Ukraine has paid $ 200 Million to owners of GDP-varantors

Friday, August 2, 2024, 13:06 -

Ukraine Made $200 Million Payment to Holders of GDP Warrants

On August 1, the Ministry of Finance of Ukraine paid $ 200.6 million to the owners of GDP-varantors.

Minfin reported this in response to a request from the EP.

Payment for GDP-varantors consists of two parts:

- payment for the consent of changes in conditions and interest in the amount of 130.1 million dollars,

- as well as a deferred payment amount and interest in the amount of $ 70.5 million for GDP growth in 2021 (this payment Ukraine had to pay to the owners of the warrants in 2023).

"Note that about 20% of the $ 70.5 million will be returned to Ukraine as one of the largest tool data owners," – said in Minfin.

- It adds that making a payment with the consent of changing the terms of issue of warrants (in the amount of $ 130.1 million) will allow Ukraine to buy out GDP warrants at their face value over the next 3 years.

On August 1, the Ministry of Finance of Ukraine paid $ 200.6 million to the owners of GDP-varantors.

Minfin reported this in response to a request from the EP.

Payment for GDP-varantors consists of two parts:- payment for the consent of changes in conditions and interest in the amount of 130.1 million dollars,

- as well as a deferred payment amount and interest in the amount of $ 70.5 million for GDP growth in 2021 (this payment Ukraine had to pay to the owners of the warrants in 2023).

"Note that about 20% of the $ 70.5 million will be returned to Ukraine as one of the largest tool data owners," – said in Minfin.

- It adds that making a payment with the consent of changing the terms of issue of warrants (in the amount of $ 130.1 million) will allow Ukraine to buy out GDP warrants at their face value over the next 3 years.

Ukraine Made $200 Million Payment to Holders of GDP Warrants - Bloomberg

"According to the fundamental agreements reached with the owners of Eurobonds, Ukraine undertakes to ensure fair and equal treatment of the owners of GDP warrants in any future public debt management operations, as well as to adhere to the objectives, embedded in the analysis of the IMF's debt sustainability, – added in the Ministry of Finance.

- Note that GDP-varantors – is a tool that Ukraine issued as a result of negotiations on debt restructuring in 2015.

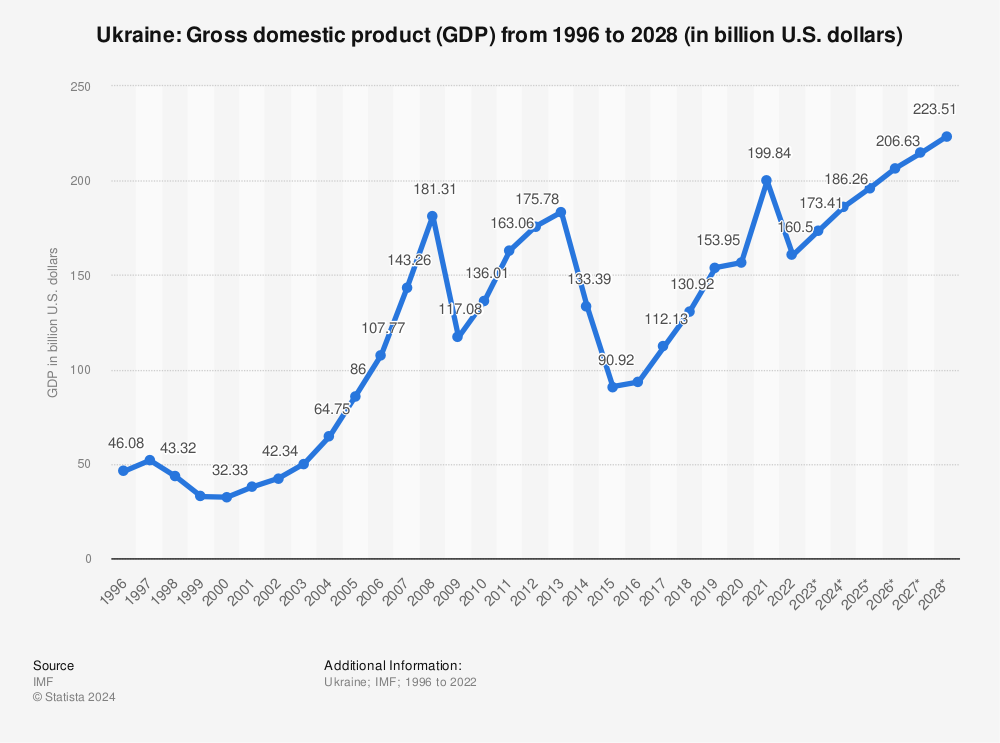

The amount of payments on GDP-varantors depends on the growth of the Ukrainian economy in the base year: the higher the growth rate – the higher the payout. The payment, which will take place in 2025, will relate to the base year 2023. At that time, the Ukrainian economy grew by 5.3% – primarily due to a low comparison base with 2022 full-scale invasion.

"According to the fundamental agreements reached with the owners of Eurobonds, Ukraine undertakes to ensure fair and equal treatment of the owners of GDP warrants in any future public debt management operations, as well as to adhere to the objectives, embedded in the analysis of the IMF's debt sustainability, – added in the Ministry of Finance.

- Note that GDP-varantors – is a tool that Ukraine issued as a result of negotiations on debt restructuring in 2015.

The amount of payments on GDP-varantors depends on the growth of the Ukrainian economy in the base year: the higher the growth rate – the higher the payout. The payment, which will take place in 2025, will relate to the base year 2023. At that time, the Ukrainian economy grew by 5.3% – primarily due to a low comparison base with 2022 full-scale invasion.

Ukraine - gross domestic product (GDP) 2029 | Statista

In the context of economic recovery, the growth rate of Ukraine's GDP may exceed 4-5% per year, which will automatically significantly increase the amount of payments on GDP-warrants. Such payments to Ukraine will have to be made by 2041.

In the context of economic recovery, the growth rate of Ukraine's GDP may exceed 4-5% per year, which will automatically significantly increase the amount of payments on GDP-warrants. Such payments to Ukraine will have to be made by 2041.

Ukraine Made $200 Million Payment to Holders of GDP Warrants - Bloomberg

The day before, Ukraine reached an agreement in principle with its creditors to carry out another restructuring of Eurobonds. At the same time, all necessary procedures are needed to complete the restructuring.

- Payment for one of the issues of Eurobonds Ukraine was to be made on August 1.

- In the future, the government has a Grace period until August 10, during which such a payment can still be made.

- Otherwise, it will be considered that Ukraine has suffered a technical default.

Read more about debt restructuring in the publication: There will be no default. How Ukraine has agreed to reduce debt by a quarter

The day before, Ukraine reached an agreement in principle with its creditors to carry out another restructuring of Eurobonds. At the same time, all necessary procedures are needed to complete the restructuring.

- Payment for one of the issues of Eurobonds Ukraine was to be made on August 1.

- In the future, the government has a Grace period until August 10, during which such a payment can still be made.

- Otherwise, it will be considered that Ukraine has suffered a technical default.

How much money does Ukraine owe, and to whom | Reuters

- "Note that about 20% of the $ 70.5 million will be returned to Ukraine as one of the largest tool data owners," – said in Minfin.

- It adds that making a payment with the consent of changing the terms of issue of warrants (in the amount of $ 130.1 million) will allow Ukraine to buy out GDP warrants at their face value over the next 3 years.

- Note that GDP-varantors – is a tool that Ukraine issued as a result of negotiations on debt restructuring in 2015.

The amount of payments on GDP-varantors depends on the growth of the Ukrainian economy in the base year: the higher the growth rate – the higher the payout. The payment, which will take place in 2025, will relate to the base year 2023. At that time, the Ukrainian economy grew by 5.3% – primarily due to a low comparison base with 2022 full-scale invasion.

In the context of economic recovery, the growth rate of Ukraine's GDP may exceed 4-5% per year, which will automatically significantly increase the amount of payments on GDP-warrants. Such payments to Ukraine will have to be made by 2041.

The day before, Ukraine reached an agreement in principle with its creditors to carry out another restructuring of Eurobonds. At the same time, all necessary procedures are needed to complete the restructuring.

Payment for one of the issues of Eurobonds Ukraine was to be made on August 1.

In the future, the government has a Grace period until August 10, during which such a payment can still be made.

Otherwise, it will be considered that Ukraine has suffered a technical default.

.gif)

No comments:

Post a Comment