Ukraine has officially started debt restructuring

Launch of Exchange Offer and Consent Solicitation

- Holders of sovereign government bonds of Ukraine received the right to participate in the exchange in order to obtain new securities.

- It is noted that the restructuring should end by August 27.

Amendment to Launch Announcement

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN OR INTO, OR TO ANY PERSON LOCATED OR RESIDENT IN, ANY JURISDICTION WHERE IT IS UNLAWFUL TO RELEASE, PUBLISH OR DISTRIBUTE THIS ANNOUNCEMENT OR THE MEMORANDUM (AS DEFINED BELOW).

12 August 2024

Ukraine seeks bondholder approval for wartime debt restructuring

- The consent solicitation also seeks bondholder sign-off on the rework of state-owned road agency Ukravtodor's $700-million bond, under the same terms as the government's debt, raising the total outstanding value of the included bonds to $20.5 billion.

DEAL DURING WARTIME

Rating Action Commentary

Fitch Downgrades Ukraine to 'RD'

Tue 13 Aug, 2024 - 5:01 PM ET

Related Content:

Ukraine - Rating Action Report

Fitch Ratings - London - 13 Aug 2024: Fitch Ratings has downgraded Ukraine's Long-Term Foreign-Currency (LTFC) Issuer Default Rating (IDR) to 'RD' from 'C'. Fitch typically does not assign Outlooks to sovereigns with a rating of 'CCC+' or below.

Fitch has also downgraded the rating on the 2026 USD750 million Eurobond to 'D' from 'C' and affirmed the other foreign-currency bonds at 'C.'

Under applicable credit rating agency (CRA) regulations, the publication of sovereign reviews is subject to restrictions and must take place according to a published schedule, except where it is necessary for CRAs to deviate from this schedule in order to comply with the CRAs' obligation to issue credit ratings based on all available and relevant information and disclose credit ratings in a timely manner. Fitch interprets these provisions as allowing us to publish a rating review in situations where there is a material change in the creditworthiness of the issuer that we believe makes it inappropriate for us to wait until the next scheduled review date to update the rating or Outlook/Watch status. The next scheduled review date for Fitch's rating on Ukraine is 6 December 2024, but Fitch believes that developments in the country warrant such a deviation from the calendar and our rationale for this is set out in the first part (High weight factors) of the Key Rating Drivers section below.

Fitch has withdrawn the issue ratings of Ukraine's foreign-currency bonds as they are no longer considered to be relevant to the agency's coverage.

Key Rating Drivers

The downgrade reflects the following key rating drivers and their relative weights:

High

Default on Eurobond: The downgrade of Ukraine's LTFC IDR to 'RD' follows the expiration of the 10-day grace period for the 2026 USD750 million Eurobond coupon payment due on 1 August. This marks an event of default under Fitch's criteria with respect to the sovereign's IDR as well as the individual issue rating of the affected security. On 18 July, the Ukrainian parliament approved legislation that allows the government to temporarily suspend payments on state and state-guaranteed external commercial debt until a restructuring agreement with external commercial debt creditors is completed.

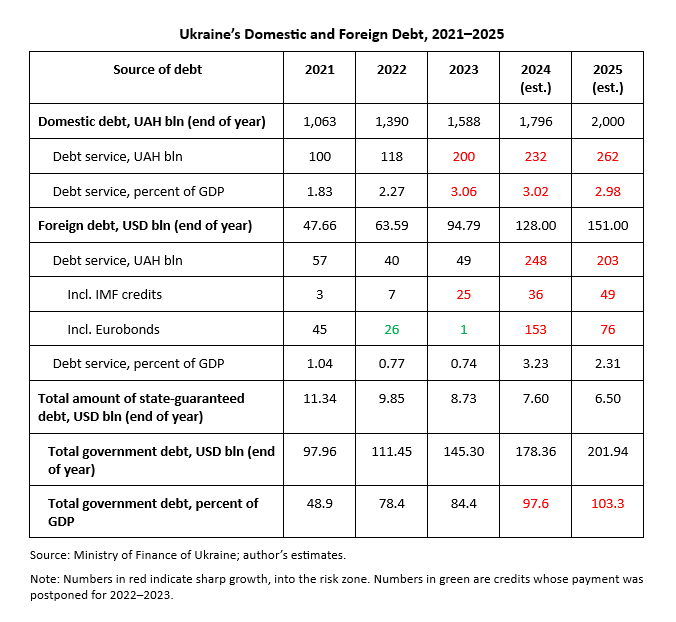

Distressed Debt Exchange Announced: On 9 August, the government formally launched a consent solicitation to restructure its outstanding USD19.7 billion sovereign Eurobonds and USD0.7 billion state-guaranteed Ukravtodor bonds. In Fitch's view, the exchange offer constitutes a distressed debt exchange (DDE) under its sovereign rating criteria, as it involves a material reduction in terms, including reductions in principal amount and interest, and extension of maturities.

Ukraine's ratings also reflect the following rating drivers:

'CCC-' LTLC IDR Affirmed: The higher rating for local-currency (LC) debt reflects our expectation that Ukraine will continue to service its LC debt and that LC debt will be excluded from a restructuring agreement with external commercial creditors, partly because only 2.2% of it is held by non-residents, compared with 41.4% held by National Bank of Ukraine and 42% by domestic banks (mostly state-owned banks).

This ownership structure would limit the benefits to Ukraine from any LC debt restructuring by creating potential fiscal costs (including bank re-capitalisation). In addition, such a restructuring could create risks for financial sector stability and impair the development of the domestic debt market.

ESG - Governance: Ukraine has an ESG Relevance Score (RS) of '5' for both Political Stability and Rights and for the Rule of Law, Institutional and Regulatory Quality and Control of Corruption. Theses scores reflect the high weight that the World Bank Governance Indicators (WBGI) have in our proprietary Sovereign Rating Model. Ukraine has a low WBGI ranking at the 29th percentile, reflecting the Russian-Ukrainian conflict, weak institutional capacity, uneven application of the rule of law and a high level of corruption.

ESG - Creditors Rights: Ukraine has an ESG Relevance Score of '5' for creditor rights given Ukraine's 2022 deferral of external debt payments and the renewed default this year.

ESG - International Relations and Trade: Ukraine has an ESG Relevance Score of '5' given the impact of the war with Russia on all aspects of Ukraine's sovereign credit profile.

RATING SENSITIVITIES

Factors that Could, Individually or Collectively, Lead to Negative Rating Action/Downgrade

-The LTLC IDR would be downgraded to 'CC' on increased signs of a probable default event on LC debt, for example, from severe liquidity stress and reduced capacity of the government to access financing.

Factors that Could, Individually or Collectively, Lead to Positive Rating Action/Upgrade

- Completion of the external commercial debt restructuring that Fitch judges to have normalised relations with external commercial debt creditors. Fitch would then upgrade Ukraine's LTFC IDR to a level appropriate for its debt service payment prospects on a forward-looking basis.

-The LTLC IDR would be upgraded on reduced risk of liquidity stress, potentially due to more predictable sources of official financing, greater confidence in the ability of the domestic market to roll over government debt, and/or lower expenditure needs.

Sovereign Rating Model (SRM) and Qualitative Overlay (QO)

Fitch's proprietary SRM assigns Ukraine a score equivalent to a rating of 'CCC+' on the LTFC IDR scale. However, in accordance with its rating criteria, Fitch's sovereign rating committee has not utilised the SRM and QO to explain the ratings in this instance. Ratings of 'CCC+' and below are instead guided by the rating definitions.

Fitch's SRM is the agency's proprietary multiple regression rating model that employs 18 variables based on three-year centred averages, including one year of forecasts, to produce a score equivalent to a LT FC IDR. Fitch's QO is a forward-looking qualitative framework designed to allow for adjustment to the SRM output to assign the final rating, reflecting factors within our criteria that are not fully quantifiable and/or not fully reflected in the SRM.

Country Ceiling

The Country Ceiling for Ukraine is 'B-'. For sovereigns rated 'CCC+' and below, Fitch assumes a starting point of 'CCC+' for determining the Country Ceiling. Fitch's Country Ceiling Model produced a starting point uplift of zero notches. Fitch's rating committee applied a +1 notch qualitative adjustment to this, under the Balance of Payments Restrictions pillar, reflecting that the imposition of capital and exchange controls since Russia's invasion of Ukraine has not prevented some private sector entities from converting local currency into foreign currency and transferring the proceeds to non-resident creditors to service debt payments.

Fitch does not assign Country Ceilings below 'CCC+', and only assigns a Country Ceiling of 'CCC+' in the event that transfer and convertibility risk has materialised and is affecting the vast majority of economic sectors and asset classes.

REFERENCES FOR SUBSTANTIALLY MATERIAL SOURCE CITED AS KEY DRIVER OF RATING

The principal sources of information used in the analysis are described in the Applicable Criteria.

ESG Considerations

Ukraine has an ESG Relevance Score of '5' for Political Stability and Rights as World Bank Governance Indicators have the highest weight in Fitch's SRM and are therefore highly relevant to the rating and a key rating driver with a high weight. As Ukraine has a percentile rank below 50 for the respective Governance Indicator, this has a negative impact on the credit profile.

Ukraine has an ESG Relevance Score of '5' for Rule of Law, Institutional & Regulatory Quality and Control of Corruption as World Bank Governance Indicators have the highest weight in Fitch's SRM and are therefore highly relevant to the rating and are a key rating driver with a high weight. As Ukraine has a percentile rank below 50 for the respective Governance Indicators, this has a negative impact on the credit profile.

Ukraine has an ESG Relevance Score of '5' for Creditor Rights as willingness to service and repay debt is relevant to the rating and is a key rating driver for Ukraine. As Ukraine deferred external debt payments in 2022, which Fitch deemed as a distressed debt exchange, and as Ukraine has missed a Eurobond coupon payment in August 2024, this has a negative impact on the credit profile.

Ukraine has an ESG Relevance Score of '4'for Human Rights and Political Freedoms as the Voice and Accountability pillar of the World Bank Governance Indicators is relevant to the rating and a rating driver. As Ukraine has a percentile rank below 50 for the respective Governance Indicator, this has a negative impact on the credit profile.

Ukraine has an ESG Relevance Score of '5' for International Relations and Trade, reflecting the detrimental impact of the conflict with Russia on all aspects of its creditworthiness with a negative impact on the credit profile.

The highest level of ESG credit relevance is a score of '3', unless otherwise disclosed in this section. A score of '3' means ESG issues are credit-neutral or have only a minimal credit impact on the entity, either due to their nature or the way in which they are being managed by the entity. Fitch's ESG Relevance Scores are not inputs in the rating process; they are an observation on the relevance and materiality of ESG factors in the rating decision. For more information on Fitch's ESG Relevance Scores, visit www.fitchratings.com/topics/esg/products#esg-relevance-scores.

>>

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN OR INTO, OR TO ANY PERSON LOCATED OR RESIDENT IN, ANY JURISDICTION WHERE IT IS UNLAWFUL TO RELEASE, PUBLISH OR DISTRIBUTE THIS ANNOUNCEMENT OR THE MEMORANDUM (AS DEFINED BELOW).

9 August 2024

Ukraine

represented by the Ministry of Finance of Ukraine

launch of aN EXCHANGE OFFER AND consent solicitation in respect of EXISTING notes

Ukraine, represented by the Ministry of Finance of Ukraine (the "Issuer" or "Ukraine") is pleased to announce the launch of:

1. an exchange offer (the "Exchange Offer") to the holders of the following outstanding securities issued by Ukraine (the "Existing Sovereign Notes") and the State Agency for Restoration and Development of Infrastructure ("Ukravtodor") (the "Ukravtodor Guaranteed Existing Notes") (each a "Series" and together, the "Existing Notes"), and

2. together with Ukravtodor, the launch of a consent solicitation (the "Consent Solicitation") in relation to the Existing Sovereign Notes and the Ukravtodor Guaranteed Existing Notes to solicit consents to approve certain written resolutions upon the terms and subject to the conditions set forth in the Exchange Offer and Consent Solicitation Memorandum dated 9 August 2024 (the "Memorandum") (the Exchange Offer and Consent Solicitation, together, the "Invitation").

The Invitation is made on the terms and subject to the conditions set forth in the Memorandum, which will be made available to Holders on or about the date of this announcement from the Exchange and Consent Website: https://projects.sodali.com/Ukraine, subject to eligibility confirmation and registration, or by contacting Sodali & Co (the "Information, Tabulation and Exchange Agent"). Terms used in this announcement but not defined herein have the respective meanings given to them in the Memorandum.

--- Reference: London Stock Exchange News

REFERENCES

.png)

No comments:

Post a Comment