FIRST THIS NEW HEADLINE STORY:

Uploaded: Jul 29, 2025

Foreign Secretary David Lammy speaks

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Watch: Bessent: ‘Very Constructive’ Tone of US-China Trade Talks

Watch: Deadly Spree in Manhattan Spawns Evening of Fear in NYC

Listen, Watch and Catch Up

Bloomberg News Now

Listen to the latest: US-China Talking Tariff Truce, Russia Faces Secondary Tariffs

Subscriber Only

Get the Industrial Strength newsletter.

Your News

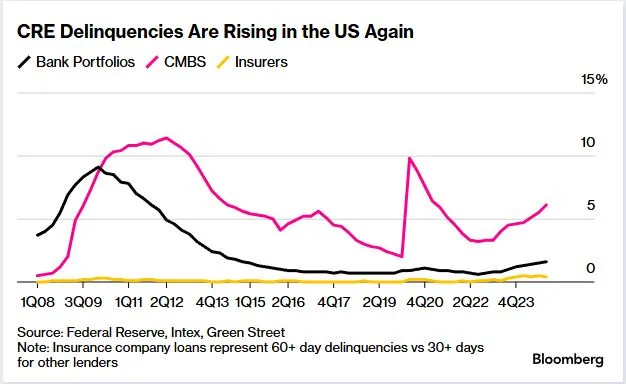

CMBS-Linked Loans Worth $23 Billion Are Gripped by Paralysis Thinking

Putting it all together

More

than $23 billion in delinquent commercial mortgage loans bundled into

bonds (CMBS) are facing a state of "suspended animation" as borrowers

are unable or unwilling to repay or refinance, according to data

analytics firm Trepp

. This paralysis stems from a combination of factors:

- Maturity Walls and Refinancing Challenges: Many of these loans, originated at low interest rates, are now maturing in a dramatically higher interest rate environment, making refinancing difficult and expensive.

- Declining Property Values: Post-pandemic shifts, like remote work, have reduced demand for office spaces and some retail properties, leading to declines in property values, making it harder to secure new financing at favorable terms.

- Borrower Hesitation and "Extend and Pretend": Some borrowers are choosing to neither refinance nor repay, essentially treading water, possibly waiting for potential interest rate cuts from the Federal Reserve, according to Bloomberg.

This situation has led to:

- Growing Delinquencies: Unresolved loans now account for three-quarters of all delinquent CMBS loans, up from 42% in early 2022.

- Bottlenecks in Capital Flow: This inability to resolve loans creates blockages in the normal flow of capital within the commercial real estate market, says Rachel Szymanski, Trepp's chief economist.

- Distress Levels Approaching Financial Crisis Levels

Prognosis

No comments:

Post a Comment