EMBARGOED UNTIL RELEASE AT 8:30 A.M. EDT, Friday, September 29, 2017

EMBARGOED UNTIL RELEASE AT 8:30 A.M. EDT, Friday, September 29, 2017

PERSONAL INCOME AND OUTLAYS, AUGUST 2017

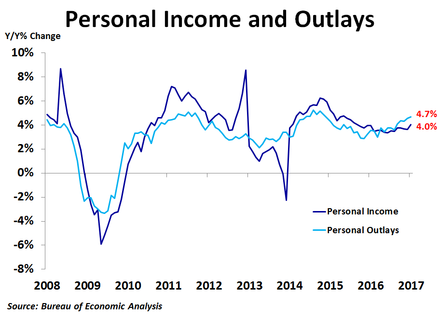

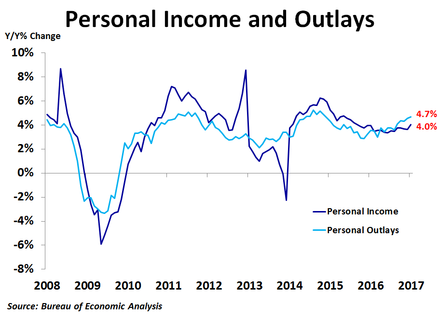

Personal income increased $28.6 billion (0.2 percent) in August according to estimates released today by the Bureau of Economic Analysis.

> Disposable personal income (DPI) increased $14.9 billion (0.1 percent) and personal consumption expenditures (PCE) increased $18.0 billion (0.1 percent).

> Real DPI decreased 0.1 percent in August and Real PCE decreased 0.1 percent.

> The PCE price index increased 0.2 percent. Excluding food and energy, the PCE price index increased 0.1 percent.

2017

Apr. May June July Aug.

Percent change from preceding month

Personal income:

Current dollars 0.1 0.3 0.0 0.3 0.2

Disposable personal income:

Current dollars 0.2 0.4 0.0 0.2 0.1

Chained (2009) dollars 0.0 0.5 0.0 0.1 -0.1

Personal consumption expenditures (PCE):

Current dollars 0.3 0.2 0.1 0.3 0.1

Chained (2009) dollars 0.1 0.3 0.1 0.2 -0.1

Price indexes:

PCE 0.2 -0.1 0.0 0.1 0.2

PCE, excluding food and energy 0.2 0.1 0.1 0.1 0.1

Price indexes: Percent change from month one year ago

PCE 1.7 1.5 1.4 1.4 1.4

PCE, excluding food and energy 1.6 1.5 1.5 1.4 1.3

> The increase in personal income in August primarily reflected an increase in government social benefits to persons and compensation of employees (table 3).

> Real PCE spending in August decreased $8.4 billion due to a decrease of $20.2 billion in spending for goods that was partially offset by a $9.2 billion increase in spending for services (table 7).

> Within goods, spending on new motor vehicles was the leading contributor to the decrease.

> Within services, healthcare spending was the leading contributor to the increase.

Detailed information on monthly real PCE spending can be found on Table 2.3.6U.

Personal outlays increased $16.8 billion in August (table 3).

Personal saving was $522.9 billion in August and the personal saving rate, personal saving as a percentage of disposable personal income, was 3.6 percent (table 1).

Updates

Estimates have been updated for April through July. The change from the preceding month for current-dollar personal income and for current-dollar and chained (2009) dollar DPI and PCE -- revised and previously published -- are shown below for June and July.

Change from preceding month

June July

Previous Revised Previous Revised Previous Revised Previous Revised

(Billions of dollars) (Percent) (Billions of dollars) (Percent)

Personal income:

Current dollars 5.2 3.3 0.0 0.0 65.6 56.1 0.4 0.3

Disposable personal income:

Current dollars 3.0 2.1 0.0 0.0 39.6 28.8 0.3 0.2

Chained (2009) dollars -2.7 -3.4 0.0 0.0 23.9 13.2 0.2 0.1

Personal consumption expenditures:

Current dollars 31.3 18.8 0.2 0.1 44.7 43.6 0.3 0.3

Chained (2009) dollars 23.0 11.8 0.2 0.1 29.3 27.2 0.2 0.2

BOX.____________________________

Hurricane Harvey

The August estimates of personal income and outlays reflect the effects of Hurricane Harvey that made landfall in southeastern Texas on August 25th.

BEA cannot separately quantify the total impact of the storm on personal income

and outlays because most of the source data used to estimate the components of personal income and outlays do not separately identify storm impacts.

> by reading the BEA blog,