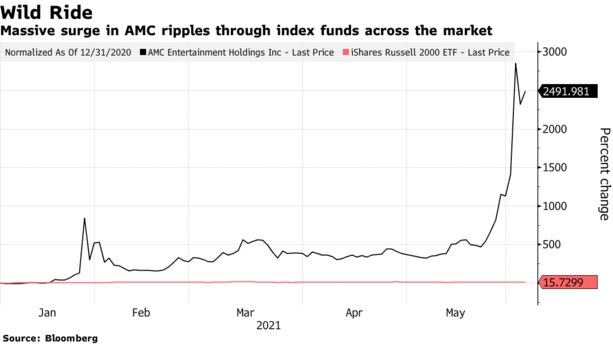

- Wild moves in meme shares are roiling the ETF market

- Scale of swings, fund plumbing lead to unintended exposures

Monday, June 07, 2021

BROADBAND UPDATE

Limited Competition Means US Broadband Prices Can Vary Drastically On The Same Block

from the do-not-pass-go,-do-not-collect-$200 dept

But live in any of the countless US markets that major broadband providers have neglected (despite decades of major subsidies, tax breaks, and the near-mystical promises surrounding mindless deregulation), and you're often facing the choice of either an apathetic telco with sluggish, neglected DSL, or, more likely, a regional cable monopoly (Charter or Comcast) that charges significantly more money thanks to regional monopolization.

Over at Stop the Cap!, Phil Dampier recently showcased how the presence or absence of competition can even result in customers having to pay up to $40 more per month for the same or sometimes slower service. Not only that, users in more competitive markets enjoy longer promotion rates (often two years rather than just one). Even the fees charged by the regional monopoly (one major way they hit consumers with dramatically higher prices than advertised) are significantly higher at homes that lack any real competition:

"Spectrum charges a hefty $199.99 compulsory installation fee for gigabit service in non-competitive neighborhoods. Where fiber competition exists, sometimes just a street away, that installation fee plummets to just $49.99."

When asked to explain itself, Charter engaged in some tap dancing:

When contacted by Ars, Charter said that "Spectrum Internet retail prices, speeds, and features are consistent in each market—regardless of the competitive environment." But "retail prices" are the standard rates customers pay after promotional rates expire. Stop the Cap showed that Charter's promotional rates vary between competitive and noncompetitive areas.

Charter told Ars that its promotional offers are affected by several factors, including "location."

Filed Under: broadband, competition, fcc, prices

Mesa Residents Feel Safe and Have a Positive Perception of Police Depart...

Front-Page Cover Art: NEW YORK DAILY NEWS Trump Transformed Into A Mocking Emoji "Faceblock"

Donald Trump Turned Into A Mocking Emoji On New York Daily News Cover

“We will evaluate external factors, including instances of violence, restrictions on peaceful assembly and other markers of civil unrest," said Nick Clegg, Facebook’s vice president of global affairs.

“If we determine that there is still a serious risk to public safety, we will extend the restriction for a set period of time and continue to re-evaluate until that risk has receded,” added Clegg, the former deputy prime minister of the United Kingdom.

Trump described the ruling as "abuse"

- Your connection to this site is secure

This is a search result, not an ad. Only ads are paid, and they'll always be labeled with "Sponsored" or "Ad."

Send feedback on this info

NEW YORK DAILY NEWS NEWSPAPER FACEBLOCK BOO ...

On Trump, Facebook Kicks the Can—Again

It’s Facebook’s house, so we shouldn’t complain too much about what it does—within the law—inside its doors. But there’s something about its new judgment and sentence of Donald Trump, banning him from the site for two years and promising to review his return based on the “risk to public safety,” that screams arbitrary and capricious as opposed to just and consistent. It’s almost as if Facebook deliberately set out to render a verdict in the Trump case that nobody would applaud. It doesn’t overtly offend anybody in the MAGA crowd or the resistance; it appeals to the soft middle that doesn’t really care about Trump, or Facebook, or Facebook’s weaseling jurisprudence.

Nick Clegg, Facebook’s vice president of global affairs and former member of Parliament, took great pride in staking that low ground in his post about the decision. “There are many people who believe it was not appropriate for a private company like Facebook to suspend an outgoing President from its platform, and many others who believe Mr. Trump should have immediately been banned for life,” he wrote. The best you can say for Clegg and the company’s decision is that it was Solomonic but only in the sense that Facebook followed through on its threat to slice the baby in half by doing just that—and doing it as a Friday news dump.

In slamming Facebook for inconsistency, we must also take care to also point out that the social media company is consistent about its inconsistencies.

> Thanks to founder and CEO Mark Zuckerberg’s governance, it practiced inconsistent enforcement of its “hate speech” guidelines and then apologized for those inconsistencies.

> It banned political ads after the November election, then reinstated them in March.

> It banned posts that contradicted Centers for Disease Control and Prevention directions and then lifted the ban.

> Don’t take my word for it: The co-chairman of Facebook’s so-called Oversight Board, appointed to review and judge Facebook’s content policy and actions, called its content-banning policies a “shambles” last month.

“Their rules are a shambles,” Michael McConnell said. “They are not transparent. They are unclear. They are internally inconsistent.”

Facebook thought it had purchased a pass from criticism when it established the Oversight Board in 2020. All the tough questions about running the site could be punted by Zuckerberg to the oversighters, leaving him little to do but trap and spend its $86 billion in annual revenues. . .

Their rules, apparently, are “kick the can two years further down the road.”

A normal company and a normal CEO would be ashamed to run its affairs in such a slipshod fashion. But Facebook and Zuckerberg are not normal. He’s the guy who habitually screws up but always apologizes dramatically when found out.

> Fast Company and other outlets have collected and cataloged his apology storms over the years.

> The privacy-invading “Beacon” feature. Zuck was sorry about that.

> Sharing unique user IDs with advertisers? So sorry.

> Calling Facebook users “dumb fucks”?

> Rejecting the argument that Facebook helped Trump win?

> The Cambridge Analytica scandal?

Sorry, sorry, sorry.

There should be a law of limitations that rations public apologies and puts those who exceed the limit into a penalty box for six months.

Sunday, June 06, 2021

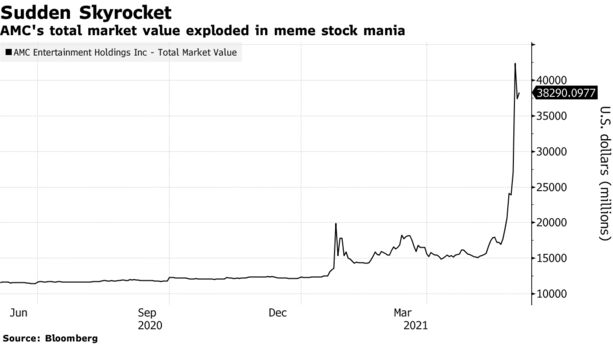

Human-Driven Craziness In $11 Trillion World of Index Funds

AMC Drama Is Exposing Risks in $11 Trillion World of Indexing

By and

“For index investing, the appeal is that human decision-making, human emotions are taken out of it,” said Tom Essaye, a former Merrill Lynch trader who founded “the Sevens Report” newsletter. . .

AMC shares currently stand at almost 10 times the level analysts see it trading a year from now: $5.25. The premium tops all Russell 3000 stocks that have enough of an analyst following to generate a price target, according to Bloomberg data, and more than double that of GameStop -- the next over-valued stock.

AMC will likely remain in many value funds until their rebalancing comes around.

“Research tells premiums such as those associated with small cap and value stocks are generally delivered by a subset of the asset class,” said Wes Crill at Dimensional Fund Advisors, a pioneer of quant investing which has $637 billion under management. “Style drift can reduce the odds of capturing the premiums when they appear.”

The obvious solution would be to rebalance more often. But that would bring more transactional costs to funds, which can be a big problem for passive vehicles charging rock-bottom fees.

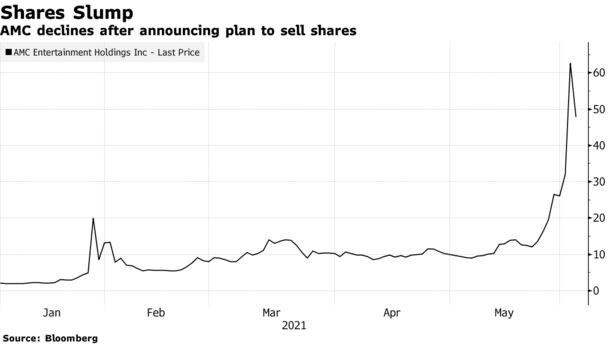

AMC Stock Sale Comes With Warning to Traders: Be Prepared to Lose It All

By and- Company said entire investment may be lost in offering

- It’s uncommon to see such a dire warning in stock sale

Investing in AMC Entertainment Holdings Inc. comes with the promise of free popcorn, special screenings -- and the chance you’ll lose all your money.

That last part is a warning the movie chain and its lawyers made in a regulatory filing on Thursday announcing its intention to sell more than 11 million shares to a market dominated by frenzied retail traders.

While companies commonly use cautionary language when making share offerings, the extent of AMC’s was uncommon. It included an acknowledgment that the stock is at the mercy of the retail mania, with fundamentals playing little role in determining valuation.

“We believe that the recent volatility and our current market prices reflect market and trading dynamics unrelated to our underlying business, or macro or industry fundamentals, and we do not know how long these dynamics will last,” AMC said in its filing Thursday. “Under the circumstances, we caution you against investing in our Class A common stock, unless you are prepared to incur the risk of losing all or a substantial portion of your investment.”

The movie-theater chain revealed that it plans to capitalize on the rally by selling up to 11.55 million shares to trim its debt load and finance future acquisitions. The tone in Thursday’s filing is starkly different than the one in its announcement a day earlier, when it said it would offer retail shareholders special perks as a reward for their loyalty.

Shares of AMC plunged more than 30% as trading kicked off on Thursday, triggering a halt. They’re are still up more than 2,000% since the beginning of the year. This would be the company’s fourth stock sale of 2021. It sold shares this week to Mudrick Capital, which flipped them on the same day for a profit.

“When a company files to sell more than 11 million shares of stock, you wouldn’t expect to see the above statement connected to the offering,” Paul Hickey, co-founder of Bespoke Investment Group, wrote in a note.

At its recent share price of around $60, AMC could raise $693 million as part of its offering, Hickey said. For perspective, AMC’s total market value at the start of 2021 was around $434 million.

-

Flash News: Ukraine Intercepts Russian Kh-59 Cruise Missile Using US VAMPIRE Air Defense System Mounted on Boat. Ukrainian forces have made ...