Journalists Want Respect From PR Pros

"More than 80 percent of the journalists surveyed in a new study say that they still depend on PR professionals for news. However, more than half (53%) say that the information they receive is often inaccurate.

The 2021 PR Media Report, conducted by Global Results Communications, polled 1,026 journalists between March and May of this year, asking them how they view PR practitioners. More than 80% of the journalists surveyed in a new study say that they still depend on PR professionals for news.

The 2021 PR Media Report, conducted by Global Results Communications, polled 1,026 journalists between March and May of this year, asking them how they view PR practitioners. More than 80% of the journalists surveyed in a new study say that they still depend on PR professionals for news.

However, more than half say that the information they receive is often inaccurate.

> A large majority of respondents value the relationship between journalists and PR pros. Only 10% said that their relationships with PR professionals were “not important.” Close to two-thirds (62%) said the relationship was an important one, and over a quarter (28%) called PR people “a core resource.”

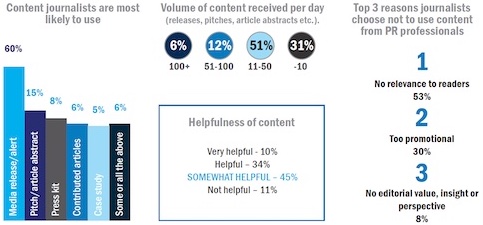

When it comes to what kind of content journalists are most likely to use, the media release is number-one by a long shot, with 60% of respondents citing it as the top source. Such content as pitches/article abstracts (15%), press kits (8 %) and contributed articles (6%) lagged considerably behind.

> Opinions about the helpfulness of content received from PR pros vary considerably. While only 11% label such content as “not helpful,” an even smaller number (10%) rank it as “very helpful.” Most respondents landed somewhere in the middle, with 34% ranking the content they receive as “helpful” and 45% as “somewhat helpful.”

> Respondents were also asked how many pieces of content they receive per day. More than half (51%) said the daily total was somewhere between 11 and 50, and 31% received 10 or less. On the other end, 6% said that get more than 100 pieces of content per day, with 12% getting between 51 and 100.

> The main reason for a piece of content to not be used, respondents said, was that it had “no relevance to readers,” which was cited by 53 percent. About a third (30%) said they steer clear of content that they deem “too promotional,” and 8% said they had turned down content that had “no editorial value, insight or perspective.”

> What respondents want is “respect/understanding of what journalists need.” Almost half (45%) said that was the quality they most appreciate in a PR professional. However, more than half (56%) also said that was the area most in need of improvement.

“Overwhelmingly, members of the media want relevance and mutual respect,” said GRC founder and CEO Valerie Christopherson. “As the landscape of news dramatically changes, there no doubt, it is time for PR to change, too.”

Category: PR Research

========================================================================

ADDED INFORMATION

ADDED INFORMATION

Top PR Firms - 2021 Rankings

1. Edelman, New York - $840M

2. Real Chemistry, San Fran. - $360.2M

3. APCO Worldwide, D.C. - $142.9M

4. Finn Partners, New York - $108.8M

5. ICR, New York - $105.9M

6. Ruder Finn, New York - $87.7M

7. Zeno Group, New York - $85.9M

8. Prosek Partners, New York- $61.9M

9. Hotwire, New York - $41.7M

10. MWWPR, New York - $38.8M

Top PR Firms - 2021 Firm Rankings

PR firms with Major U.S. Operations (ranked by worldwide fees)

O'Dwyer's has been conducting its PR firm rankings for 52 years. PR firms have distinctive financials. At least half of income is used for staff pay. Our rankings measure counseling and media contact services, not advertising or production expenses.

PR Firms by Specialty

Agriculture | Automotive/Transportation | Beauty/Fashion/Lifestyle | Education | Energy | Entertainment/Cultural | Env./Sustain./Greentech/PA | Financial PR/IR | Food & Beverage | Healthcare | Home Furnishings | Industrial | Non-Profits | Professional Svcs. | Purpose/CSR | Real Estate Fin. & Dev. | Sports | Technology | Travel & Economic Dev.

PR Firms by City/Region

Atlanta | Chicago | Connecticut | Boston | Florida | Los Angeles | Miami | Midwest | New York & NJ | Pennsylvania | San Francisco | Southeast | Texas | Wash., D.C. | West

Past Rankings

2020 | 2019 | 2018 | 2017 | 2016

Sort By: Firm | 2020 Net Fees | % Change from '19

| # | Firm | City, State | FT Emp. | '20 Net Fees | % Chg. from '19 | |

|---|---|---|---|---|---|---|

1 | Edelman | New York, NY | 5,143 | $840,022,000 | -5.8 | |

2 | Real Chemistry | San Francisco, CA | 1,350 | $360,187,000 | 61.0 | |

3 | APCO Worldwide | Washington, DC | 799 | $142,960,000 | 1.0 | |

4 | Finn Partners | New York, NY | 745 | $108,897,000 | -8.7 | |

5 | ICR | New York, NY | 260 | $105,955,111 | 20.0 | |

6 | Ruder Finn Inc. | New York, NY | 732 | $87,775,000 | 13.0 | |

7 | Zeno Group | New York, NY | 513 | $85,994,010 | 8.5 | |

8 | Prosek Partners | New York, NY | 209 | $61,950,000 | 13.2 | |

9 | Hotwire | New York, NY | 253 | $41,748,611 | 2.0 | |

10 | MWWPR | New York, NY | 160 | $38,878,161 | -9.0 | |

11 | 5W Public Relations | New York, NY | 169 | $38,092,948 | 12.6 | |

12 | imre, LLC | Baltimore, MD | 185 | $36,739,100 | 10.2 | |

13 | Padilla | Minneapolis, MN | 165 | $35,862,295 | -4.0 | |

14 | Kivvit | Chicago, IL | 123 | $34,069,946 | 3.0 | |

15 | French | West | Vaughan | Raleigh, NC | 122 | $33,159,488 | 2.7 | |

16 | Spectrum | Washington, DC | 120 | $32,900,000 | 0.0 | |

17 | Hunter | New York, NY | 161 | $31,600,000 | 30.0 | |

18 | Evoke KYNE | New York, NY | 139 | $30,984,000 | 24.0 | |

19 | Crosby | Annapolis, MD | 99 | $29,092,172 | 18.6 | |

20 | Coyne PR | Parsippany, NJ | 139 | $28,000,000 | -13.0 | |

21 | G&S Business Communications | New York, NY | 142 | $25,111,105 | -18.0 | |

22 | Fahlgren Mortine (includes TURNER) | Columbus, OH | 165 | $24,991,200 | -15.0 | |

23 | Highwire PR | San Francisco, CA | 87 | $24,163,050 | 23.3 | |

24 | Citizen Relations | Los Angeles, CA | 152 | $23,410,631 | -7.4 | |

25 | PAN Communications | Boston, MA | 148 | $23,359,021 | 4.6 | |

26 | Havas Formula | New York, NY | 118 | $22,673,654 | -11.5 | |

27 | Matter Communications | Boston, MA | 167 | $22,540,000 | -2.7 | |

28 | Jackson Spalding | Atlanta, GA | 103 | $20,902,415 | -15.4 | |

29 | Walker Sands | Chicago, IL | 129 | $20,169,584 | 7.1 | |

30 | Taylor | New York, NY | 86 | $19,700,000 | -2.0 | |

31 | Inkhouse | Waltham, MA | 111 | $19,182,393 | -4.9 | |

32 | Regan Communications Group | Boston, MA | 101 | $18,157,434 | -4.2 | |

33 | LaunchSquad | San Francisco, CA | 103 | $16,376,510 | -12.0 | |

34 | Zimmerman Agency | Tallahassee, FL | 46 | $15,400,000 | 0.0 | |

35 | Hoffman Agency, The | San Jose, CA | 34 | $15,115,000 | 1.0 | |

36 | JPA Health | Washington, DC | 64 | $14,818,927 | 44.0 | |

37 | Bravo Group, Inc. | Harrisburg, PA | 70 | $14,562,475 | 0.0 | |

38 | M Booth Health | New York, NY | 43 | $14,433,794 | -12.0 | |

39 | Bliss Group, The | New York, NY | 57 | $14,221,393 | 28.9 | |

40 | Lambert | Grand Rapids, MI | 74 | $13,650,000 | 29.1 | |

41 | Marathon Strategies | New York, NY | 40 | $13,504,883 | 15.0 | |

42 | rbb Communications | Miami, FL | 78 | $13,091,113 | -7.0 | |

43 | JeffreyGroup | Miami, FL | 233 | $12,448,292 | -6.0 | |

44 | Vested | New York, NY | 30 | $12,409,000 | 18.0 | |

45 | Racepoint Global | Boston, MA | 57 | $11,912,000 | -35.0 | |

46 | Davies | Santa Barbara, CA | 34 | $11,750,000 | 4.7 | |

47 | Gregory FCA | Ardmore, PA | 79 | $10,780,275 | -5.0 | |

48 | MP&F Strategic Communications | Nashville, TN | 66 | $9,931,133 | 4.8 | |

49 | Moore, Inc. | Tallahassee, FL | 38 | $9,452,995 | 7.0 | |

50 | Development Counsellors Int'l (DCI) | New York, NY | 55 | $9,410,923 | -5.7 | |

51 | J Public Relations | New York, NY | 53 | $9,119,000 | -20.3 | |

52 | Clarity | New York, NY | 65 | $9,035,115 | 47.0 | |

53 | 360PR+ | Boston, MA | 49 | $8,575,221 | -17.0 | |

54 | Peppercomm | New York, NY | 27 | $8,312,989 | -7.3 | |

55 | MMGY NJF | New York, NY | 39 | $8,203,073 | -23.0 | |

56 | Greentarget Global LLC | Chicago, IL | 37 | $8,184,000 | -6.6 | |

57 | Sam Brown Inc. | Wayne, PA | 51 | $8,001,820 | 26.2 | |

58 | Stanton | New York, NY | 26 | $7,572,300 | 9.1 | |

59 | Merritt Group | McLean, VA | 35 | $7,542,661 | 0.0 | |

60 | Lou Hammond Group | New York, NY | 40 | $7,350,509 | -9.0 | |

61 | Pierpont Communications | Houston, TX | 32 | $6,802,560 | -2.0 | |

62 | Bospar | San Francisco, CA | 37 | $6,632,137 | 16.5 | |

63 | McCabe Message Partners | Washington, DC | 39 | $6,407,087 | 10.7 | |

64 | Dukas Linden Public Relations | New York, NY | 24 | $6,396,315 | 1.1 | |

65 | Rasky Partners, Inc. | Boston, MA | 22 | $5,902,120 | -19.0 | |

66 | Berk Communications | New York, NY | 24 | $5,707,363 | 32.5 | |

67 | Singer Associates Public Relations, Inc. | San Francisco, CA | 19 | $5,682,442 | 4.0 | |

68 | Infinite Global | New York, NY | 29 | $5,609,950 | -5.9 | |

69 | Touchdown PR | Austin, TX | 12 | $5,600,633 | 14.7 | |

70 | 720 Strategies | Washington, DC | 18 | $5,281,963 | 40.0 | |

71 | Lumina Communications | San Jose, CA | 27 | $5,204,425 | 13.0 | |

72 | Tunheim | Minneapolis, MN | 22 | $5,170,757 | 4.3 | |

73 | SourceCode Communications | New York, NY | 27 | $5,168,512 | 52.0 | |

74 | Raffetto Herman Strategic Communications | Seattle, WA | 28 | $5,119,092 | 64.0 | |

75 | Trevelino/Keller | Atlanta, GA | 30 | $4,886,767 | 10.0 | |

76 | Public Communications Inc. | Chicago, IL | 36 | $4,804,411 | 13.7 | |

77 | LaVoie Health Science | Boston, MA | 17 | $4,459,686 | 36.0 | |

78 | MCS Healthcare Public Relations | Bedminster, NJ | 17 | $4,405,889 | 1.0 | |

79 | L.C. Williams & Associates | Chicago, IL | 18 | $4,206,450 | -11.0 | |

80 | BackBay Communications | Boston, MA | 16 | $4,086,462 | 11.0 | |

81 | Standing Partnership | St. Louis, MO | 17 | $3,970,006 | 9.4 | |

82 | March Communications | Boston, MA | 23 | $3,869,104 | -17.0 | |

83 | TruePoint Communications | Dallas, TX | 28 | $3,726,153 | 20.0 | |

84 | Champion Management Group | Dallas, TX | 20 | $3,691,386 | 3.2 | |

85 | Idea Grove | Dallas, TX | 28 | $3,577,000 | 7.2 | |

86 | Fish Consulting | Fort Lauderdale, FL | 23 | $3,473,116 | -7.1 | |

87 | Brownstein Group | Philadelphia, PA | 15 | $3,442,304 | 1.0 | |

88 | BoardroomPR | Ft. Lauderdale, FL | 17 | $3,400,000 | 13.0 | |

89 | CashmanKatz | Glastonbury, CT | 24 | $3,325,000 | 4.5 | |

90 | Caliber Corporate Advisors | New York, NY | 16 | $3,270,780 | 11.0 | |

91 | Serendipit | Phoenix, AZ | 29 | $3,070,461 | 20.0 | |

92 | Lovell Communications | Nashville, TN | 17 | $3,066,369 | 3.8 | |

93 | Crenshaw Communications | New York, NY | 15 | $3,061,499 | 0.0 | |

94 | ARPR | Atlanta, GA | 17 | $3,022,086 | 14.9 | |

95 | Hawkins Int'l Public Relations | New York, NY | 22 | $2,991,360 | -49.0 | |

96 | IW Group, Inc. | West Hollywood, CA | 10 | $2,985,370 | 0.0 | |

97 | Cerrell Associates | Los Angeles, CA | 15 | $2,918,614 | -19.8 | |

98 | Zapwater Communications, Inc. | Chicago, IL | 23 | $2,900,376 | -14.0 | |

99 | Brandware | Atlanta, GA | 13 | $2,820,232 | 1.0 | |

100 | Ehrhardt Group, The | New Orleans, LA | 17 | $2,806,267 | 4.0 | |

101 | Hewes Communications | New York, NY | 7 | $2,705,723 | -2.0 | |

102 | BLAZE | Santa Monica, CA | 12 | $2,559,300 | 0.0 | |

103 | Hodges Partnership, The | Richmond, VA | 16 | $2,537,332 | 19.6 | |

104 | Lansons Intermarket | New York, NY | 13 | $2,473,605 | NA | |

105 | Montieth & Company | New York, NY | 13 | $2,357,623 | 20.4 | |

106 | SPM Communications | Dallas, TX | 16 | $2,236,134 | -3.3 | |

107 | Beehive Strategic Communication | St. Paul, MN | 10 | $2,234,463 | -35.0 | |

108 | Landis Communications | San Francisco, CA | 7 | $2,100,062 | 2.0 | |

109 | Bellmont Partners | Minneapolis, MN | 13 | $2,070,753 | 3.0 | |

110 | Ripp Media/Public Relations, Inc. | New York, NY | 7 | $2,000,000 | -25.0 | |

111 | Stanton Communications | Washington, DC | 10 | $1,977,988 | -1.0 | |

112 | O'Malley Hansen Communications | Chicago, IL | 10 | $1,935,060 | -11.3 | |

113 | FrazierHeiby | Columbus, OH | 14 | $1,779,362 | 0.0 | |

114 | Butler Associates, LLC | New York, NY | 8 | $1,547,713 | 4.7 | |

115 | AMP3 Public Relations | New York, NY | 8 | $1,442,023 | 26.4 | |

116 | Buchanan Public Relations | Bryn Mawr, PA | 7 | $1,293,586 | -17.0 | |

117 | Buttonwood Communications Group | New York, NY | 8 | $1,291,188 | 6.5 | |

118 | WordWrite Communications LLC | Pittsburgh, PA | 8 | $1,247,312 | -19.7 | |

119 | Marketing Maven Public Relations | Camarillo, CA | 9 | $1,218,152 | 1.4 | |

120 | Hemsworth Communications | Ft. Lauderdale, FL | 16 | $1,148,669 | -35.7 | |

121 | Akrete | Evanston, IL | 5 | $1,133,507 | -26.0 | |

122 | Pineapple Public Relations | Chamblee, GA | 8 | $1,089,067 | -18.5 | |

123 | Rosica Communications | Fair Lawn, NJ | 5 | $973,955 | 4.0 | |

124 | Perry Communications Group, Inc. | Sacramento, CA | 8 | $960,053 | -25.3 | |

125 | CommCentric Solutions, Inc. | Tampa, Fl | 7 | $897,706 | 0.0 | |

126 | Agency Ten22 | Cumming, GA | 4 | $867,365 | 7.9 | |

127 | Bob Gold & Associates | Redondo Beach, CA | 8 | $823,443 | -22.9 | |

128 | Hoyt Organization Inc., The | Torrance, CA | 6 | $810,000 | -26.0 | |

129 | BizCom Associates | Plano, TX | 9 | $772,511 | 1.0 | |

130 | Bianchi Public Relations | Troy, MI | 4 | $772,147 | -1.0 | |

131 | Violet PR | Montclair, NJ | 4 | $699,370 | 0.0 | |

132 | Lawlor Media Group | New York, NY | 7 | $673,552 | -20.0 | |

133 | Stuntman PR | New York, NY | 4 | $616,208 | -3.5 | |

134 | Feintuch Communications | New York, NY | 3 | $575,314 | 17.9 | |

135 | Pugh & Tiller PR, LLC | Annapolis, MD | 3 | $494,706 | NA | |

136 | Judge Public Relations, LLC | Tampa, FL | 3 | $474,942 | -12.4 | |

137 | Press Record Communications | New York, NY | 1 | $248,977 | 204.1 |

The firms ranked above have satisfied the O'Dwyer ranking rules – supporting fee and employee totals with income tax and W-3 forms and providing a current account list. O'Dwyer's rankings should be regarded as an expression of our judgment of a firm's standing within the industry, and are not warranted to comply with any specific objective standards.

Become an O'Dwyer's Ranked PR Firm

Complete list of firms, both ranked and un-ranked, which you can research on odwyerpr.com

Profiles of Top Independent PR Firms, O'Dwyer's Magazine - May 2021

O'Dwyer's magazine, now in its 35th year, is the #1 publication for PR and marketing communications pros. The magazine has been in full text on LexisNexis since 1989--the only PR magazine on LN.

Each month, a different area of PR is examined. Issues include practice-area specific feature stories as well as profiles of PR firms with strengths in the focus area of the month. The agency profiles constitute the ideal starting point for companies beginning their search for PR counsel. Areas examined include technology, healthcare, financial, travel and fashion to name a few. Consult our editorial calendar for more information.