Thursday, January 20, 2022

Wednesday, January 19, 2022

HOP TO IT

Ready?

New White Rabbit ransomware linked to FIN8 hacking group

"A new ransomware family called 'White Rabbit' appeared in the wild recently, and according to recent research findings, could be a side-operation of the FIN8 hacking group.

FIN8 is a financially motivated actor who has been spotted targeting financial organizations for several years, primarily by deploying POS malware that can steal credit card details.

A simple tool to deliver double-extortion

The first public mention of the White Rabbit ransomware was in a tweet by ransomware expert Michael Gillespie, seeking a sample of the malware.

#Ransomware Hunt: "White Rabbit" with extension ".scrypt", drops note for each encrypted file with ".scrypt.txt" with victim-specific information: https://t.co/ZjVay8A3Ch

— Michael Gillespie (@demonslay335) December 14, 2021

"Follow the White Rabbit..." pic.twitter.com/lhzHi5t1KK

In a new report by Trend Micro, researchers analyze a sample of the White Rabbit ransomware obtained during an attack on a US bank in December 2021.

The ransomware executable is a small payload, weighing in at 100 KB file, and requires a password to be entered on command line execution to decrypt the malicious payload.

A password to execute the malicious payload has been used previously by other ransomware operations, including Egregor, MegaCortex, and SamSam.

Once executed with the correct password, the ransomware will scan all folders on the device and encrypt targeted files, creating ransom notes for each file it encrypts.

For example, a file named test.txt would be encrypted as test.txt.scrypt, and a ransom note would be created named test.txt.scrypt.txt.

While encrypting a device, removable and network drives are also targeted, with Windows system folders excluded from encryption to prevent rendering the operating system unusable.

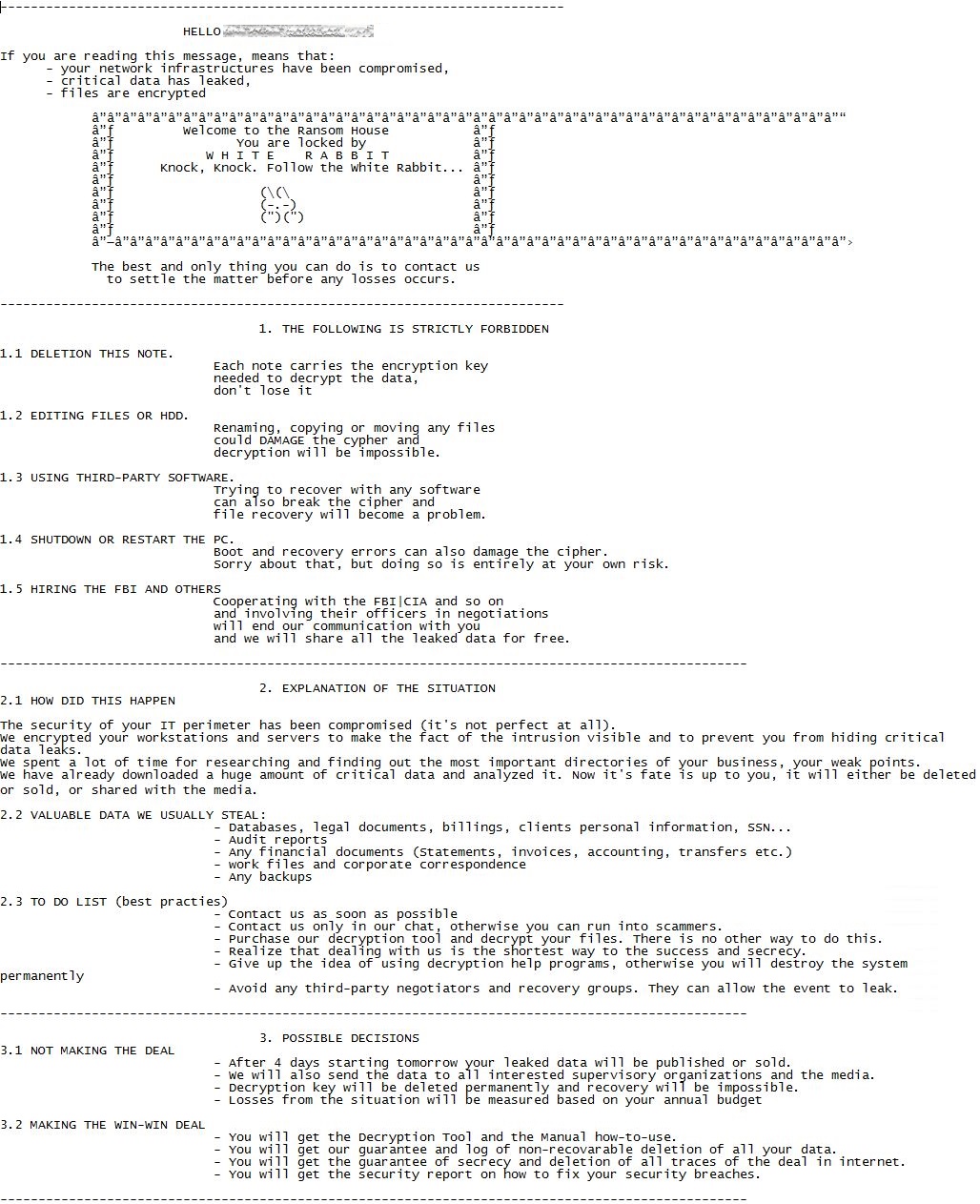

The ransom note informs the victim that their files had been exfiltrated and threatens to publish and/or sell the stolen data if the demands are not met.

The deadline for the victim to pay a ransom is set to four days, after which the actors threaten to send the stolen data to data protection authorities, leading to data breach GDPR penalties.

The evidence of the stolen files is uploaded to services such as 'paste[.]com' and 'file[.]io,' while the victim is offered a live chat communication channel with the actors on a Tor negotiation site.

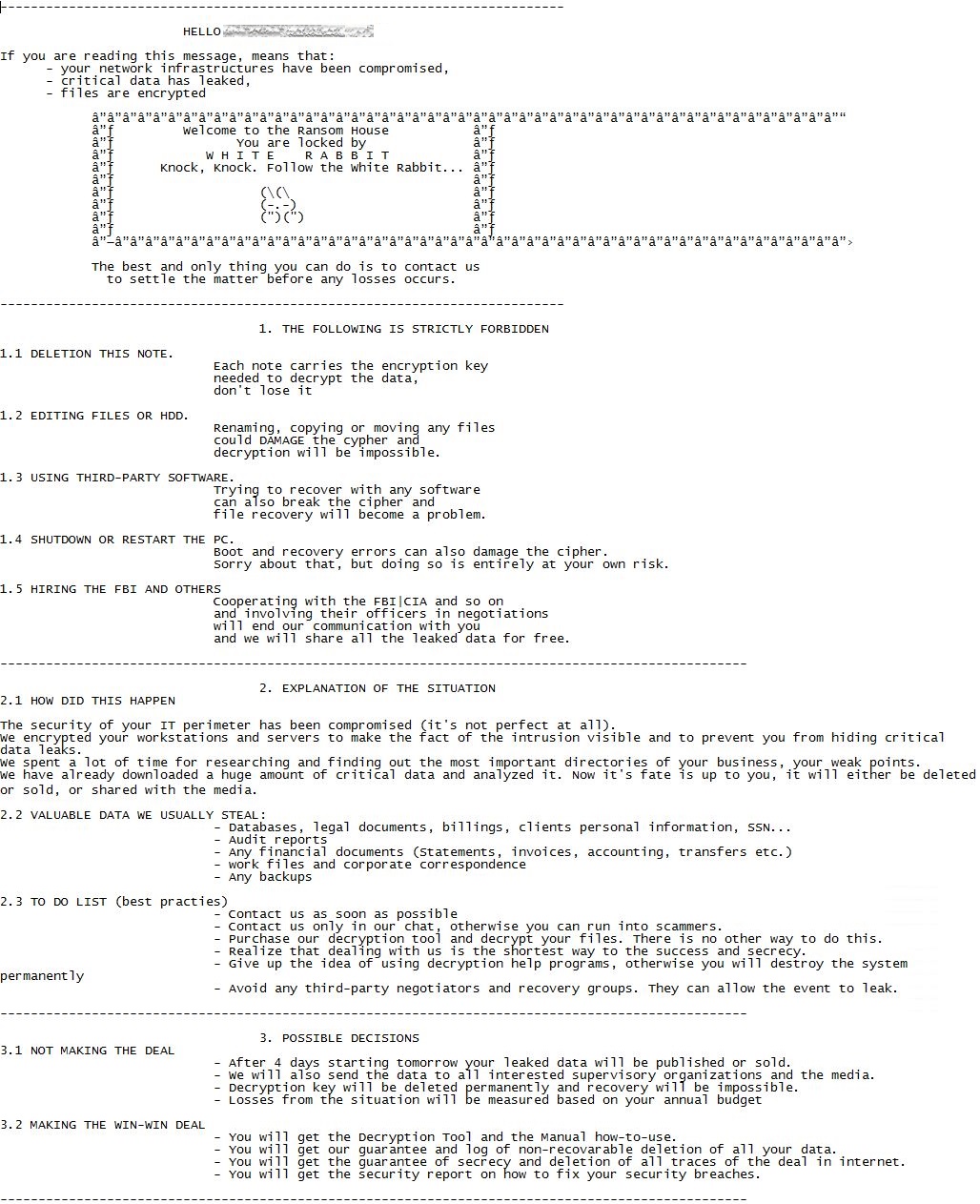

The Tor site includes a 'Main page,' used to display proof of stolen data, and a Chat section where the victim can communicate with the threat actors and negotiate a ransom demand, as shown below.

Links to FIN8

As noted in the Trend Micro report, evidence that connects FIN8 and 'White Rabbit' is found in the ransomware's deployment stage.

More specifically, the novel ransomware uses a never-before-seen version of Badhatch (aka "Sardonic"), a backdoor associated with FIN8.

Typically, these actors keep their custom backdoors to themselves and continue to develop them privately.

This finding is also confirmed by a different report on the same ransomware family undertaken by Lodestone researchers.

They too found Badhatch in 'White Rabbit' attacks, while they also noticed PowerShell artifacts similar to FIN8-associated activity from last summer.

As the Lodestone report concludes: "Lodestone identified a number of TTPs suggesting that White Rabbit, if operating independently of FIN8, has a close relationship with the more established threat group or is mimicking them."

For now, White Rabbit has limited itself to only targeting a few entities but is considered an emerging threat that could turn into a severe menace to companies in the future.

At this point, it can be contained by taking standard anti-ransomware measures like the following:

- Deploy cross-layered detection and response solutions.

- Create an incident response playbook for attack prevention and recovery.

- Conduct ransomware attack simulations to identify gaps and evaluate performance.

- Perform backups, test backups, verify backups, and keep offline backups.

Here in Mesa, AZ It's "Don't ask and Don't Tell" . . .Things about OZones Nobody wants to talk about

Senate Finance Chair to Billionaire Developers: Explain How Opportunity Zone Tax Break is Helping The Poor

There is little reason to believe that opportunity zones will deliver meaningful economic benefits to the low-income families they are ostensibly designed to benefit.

There is little reason to believe that opportunity zones will deliver meaningful economic benefits to the low-income families they are ostensibly designed to benefit. > Not only are opportunity zones based on failed trickle-down economics, but investors are incentivized to fund highly-profitable projects rather than projects more responsive to the needs of truly distressed communities, such as affordable housing.

> Additionally, regulations for opportunity zones are inadequate to hold investors accountable for making investments that actually benefit local communities

(For more information on the federal Opportunity Zones program and its shortcomings, see Opportunity Zones Bolster Investors’ Bottom Lines Rather than Economic or Racial Equity.) |

BLOGGER INSERT: First let's go back in time here in Mesa to March 2018

Here we go again! ...and here's a good question asked by https://news.impactalpha.com:

How do you ensure that wealth creation extends to the communities themselves, and not just the investors?

________________________________________________________________________________

The 90-day determination period for designating Opportunity Zones began in late December 2017 when the Opportunity Zones Program was created in the Tax Cuts and Jobs Act.

Invested capital will flow through “Opportunity Funds,” new funds and vehicles required to invest 90% of their assets in economically distressed communities. Governors must nominate areas for inclusion by March 21.

According to the Economic Innovation Group, which helped craft the law, there is probably close to $6 trillion sitting around in capital gains. . .

What will entice people to invest in Opportunity Zones?

What will entice people to invest in Opportunity Zones?

Much of that is wrapped up around unrealized capital gains -- and avoiding taxes.

According to the Economic Innovation Group, which helped craft the law, there is probably close to $6 trillion sitting around in capital gains -- money made on existing investments -- with the run-up of the stock market.

The new law envisions the creation of Opportunity Funds whose managers would look for eligible projects in the Opportunity Zones, things like new businesses, investing in existing ones, real estate projects or even infrastructure.

An investor who puts his or her existing capital gains into one of those funds gets to defer paying taxes on that gain. . .

_____________________________________________________________________________

ProPublica is a nonprofit newsroom that investigates abuses of power. Sign up to receive our biggest stories as soon as they’re published.

"The chair of the Senate Finance Committee is demanding information from several billionaire developers to determine whether they are abusing a Trump tax break that was supposed to benefit poor communities.

Citing ProPublica’s reporting on the program, Sen. Ron Wyden, D-Ore., sent letters today to Jorge Perez of Related Group, Kushner Companies and several other developers asking for details on how they are taking advantage of what’s known as the opportunity zone program.

The program, created in President Donald Trump’s 2017 tax overhaul, provides a series of tax breaks for making investments in swaths of specially designated land around the country. The program’s bipartisan advocates contended the program would funnel money into disadvantaged neighborhoods that were otherwise starved for investment.

Under the program, investors receive tax advantages. Chief among them is that any gains on projects in the zones are tax-free after a number of years.

But ProPublica and other news outlets found that investments often went to develop projects that benefit the affluent. In a series of stories in 2019, ProPublica reported that developers around the country had successfully lobbied to get favored tracts included in the opportunity zone program, at the expense of poorer areas. Several of those tracts were in well-off areas or were sites of long-planned projects that predated the tax break, suggesting that public subsidies could flow to projects that were going to happen regardless.

Now Wyden is scrutinizing the tax benefit. “I have long been concerned that the Opportunity Zone program may permit wealthy investors another opportunity to avoid billions of dollars in taxes without meaningfully benefitting the distressed communities the program was intended to help,” Wyden wrote in the letter.

Wyden’s letter zeroed in on one of the projects highlighted by ProPublica: an opportunity zone in West Palm Beach, Florida, that contains a superyacht marina owned by a major Republican political donor.

“It appears that the Opportunity Zone program is already helping subsidize luxury real estate development by wealthy developers, and in many cases will allow these investors to realize the gains on their investments completely tax-free,” Wyden wrote. “Among the investments that have reportedly qualified for these generous tax breaks, are projects that include luxury apartment buildings and hotels, high-end office towers, self-storage facilities and a ‘superyacht marina.’”

In his letter to Perez, head of a company developing the luxury condo project in the West Palm Beach zone, Wyden requested information on when the project was conceived; details of any lobbying of public officials on the opportunity zone issue; and numbers on job creation and tax benefits associated with the project.

Asked for a response back in 2019, the West Palm Beach developers said they were not motivated to seek the tax break for their own benefit and hoped to spur additional economic development for the surrounding area.

Wyden’s letters are designed to fill in details about how the program is unfolding. While some have called for its outright abolition, even supporters of the opportunity zone program have decried the lack of any reporting requirements that might allow experts to measure whether the tax breaks are achieving their stated goals.

In 2019, Wyden introduced legislation that would increase reporting requirements for opportunity zone investors and curtail the kinds of projects that would qualify for tax breaks under the program. The legislation would also remove areas that were originally designated as opportunity zones that weren’t actually poor, including well-off areas of Detroit and Baltimore that ProPublica reported on that year"

RELATED CONTENT ON THIS BLOG

The hot topic of OZones has been featured multiple times of this blog for months, as faithful readers this site know well.

The hot topic of OZones has been featured multiple times of this blog for months, as faithful readers this site know well.

However, there's always more information to put in front of your eyes all the time.

Highlighted today are two reports from 03 January 2019, backed up with inserts of streaming vids [Trump signing the Opportunities & Jobs Act on December 12, 2017] + an audio to save you time on what is a lengthy and detailed post today that also features links to what the City of Mesa has published online with an excellent aerial Map.

Tomorrow's Mesa City Council Study Session at 5:15 pm starts off with a look at the City's Annual Financial Review for the fiscal years ending June 30, 2018.

The regular meeting will be presenting and discussing various ordinances and resolutions about more proposed real estate developments downtown that are within the OZone.

The brainchild of Silicon Valley financier Sean Parker,

Opportunity Zones allow investors to obtain massive tax advantages if they invest capital gains—money made on the sale of assets like a home, a business, or a piece of art—into “distressed” areas of the country where the post-financial crisis recovery passed by.

Advocates for the program believe this could be a game-changing community development tool.

- Downtown Mesa

- the Fiesta District

- the Falcon District

- the Gateway Area [Gateway Area North and Gateway Area South]

- the Riverview District [added below]

To visit the Aerial Mesa tool and explore Mesa’s Opportunity Zones visit the links below.

__________________________________________________________________________________

DOWNTOWN MESA Link > https://aerialsphere.com/city-of-mesa/downtown-mesa/

Source:

https://www.selectmesa.com/business-environment/incentives-programs/opportunity-zones

OPPORTUNITY ZONES:

A NEW INCENTIVE FOR INVESTING IN LOW-INCOME COMMUNITIES

________________________________________________________________________________

AEROSPACE & DEFENSE NEWS ...Yes you can subscribe to these informative feeds (headlines and contracts)

| |||||||||||||||||||||||||||||||||||||||

|

NEW UTOPIA IN UTAH

They’re building a 15-minute city from scratch in the Utah desert

“One of our goals is to create what we’ve termed a one-car community.”

"In Paris, one of the first cities to champion the idea of the 15-minute city—urban planning that makes it possible to take care of most everyday errands with a short walk or bike ride—it was already fairly easy to get around without a car even before the current mayor started making changes. In a typical sprawling American suburb, it’s harder to transform streets designed for driving. But in Draper, Utah, a suburb of Salt Lake City, a new neighborhood is being designed from the ground up to help residents avoid the need for cars.

Unlike another new development under construction in suburban Phoenix, which calls itself car-free, the Utah project, called The Point, isn’t assuming that residents will give up cars completely, just that they’ll drive much less. “One of our goals is to create what we’ve termed a one-car community,” says Alan Matheson, executive director of The Point of the Mountain State Land Authority, the government agency leading the project, which is happening on state-owned land. “We know there will be those who want more than one vehicle, but we think we can design this in a way where they wouldn’t need it.”

The site, which currently houses a state prison that will be demolished this summer, is large, a little more than 600 acres. (That’s bigger than the entire country of Monaco, or about 70% of Central Park in New York City.)

It’s also the perfect size for the 15-minute city concept. “From the center to the edge is about a 10-minute walk or so, a 15-minute walk, depending on how fast you walk,” says Peter Kindel, an urban design and planning principal at Skidmore, Owings & Merrill, the global design and engineering firm that developed a framework plan to be used to build the neighborhood, which will contain 7,400 households.

The plan calls for a network of open spaces so residents can walk through car-free linear parks to different parts of the neighborhood to reach offices, schools, or stores, all built in mixed-use zones. “You can move through the whole project in the open space system and have access to almost every single parcel in the project,” Kindel says. Streets will allow cars, but will also prioritize space for bike lanes and wide sidewalks. People living in the neighborhood will be able to ride on a bus rapid-transit system to nearby cities Salt Lake City or Provo. A small shuttle, which may run autonomously, will circle through the neighborhood for those who need to quickly run an errand and don’t want to walk or bike. Mobility hubs will offer shared cars, bikes, and scooters.

A pathway will also lead through the site on a new pedestrian bridge over a freeway to a recreational trail next to the river.

On the other side of the neighborhood, it will link to hiking or biking in the mountains. “I think that’s where a lot of urban design and the future of cities is headed—this idea of ‘biomorphic urbanism,’ where people want connection to nature, and they want connection to each other,” Kindel says. “And they don’t want to spend their whole day in a car commuting.” The path that reconnects the river and mountains will also help wildlife move between the open spaces.

Because the land is owned by the state, the government went through a long process of asking the community how they wanted it to be developed. “We heard loud and clear from them that the principles of having more convenient, less car-focused development, and a little more compact and amenity-rich community, would be appealing,” says Matheson. Utah’s population has been quickly growing, and “people here are concerned about what that growth means,” he says. “How will it impact our enviable quality of life? I think increasingly, they’re open to looking at ways that we can grow more thoughtfully, that preserve the beauty of the area and improve our air quality, and that minimize traffic congestion.”

It’s likely that some residents will forego car ownership. “The idea here is that it’s an economic driver for the state to attract younger workers who are in the tech sector or the science sector, and we know that they don’t want to live in the suburbs, oftentimes, as the suburbs are currently configured,” says Kindel. “They want more urban features, they want to know their neighbors, they want to be part of a community. They don’t want to spend their day driving.”

Although the site is unique—and may be the first true 15-minute city to be built in the U.S.—he says that the ideas can be replicated in other cities. “We do think it could be a prototype for other American suburbs,” he says. “Specifically, you know, in the West, where the cities are newer, and there may be more sprawl, cities like Denver, and Dallas. In many of these cities, there’s underutilized lands, old industrial sites, that may not be 600 acres contiguous, but may be 100 acres or 200 acres. So, we do think the concept is transferable to other cities. But cities need to make a commitment to walkability, to open space, to rethinking their street design.”

NYT Columnist Thomas Friedman: “The World Will Push Back” Against Trump ...

Jan 27, 2026 #amanpourpbs From ICE's violent crackdown in Minneapolis to President ...

-

Flash News: Ukraine Intercepts Russian Kh-59 Cruise Missile Using US VAMPIRE Air Defense System Mounted on Boat. Ukrainian forces have made ...