Wednesday, April 27, 2022

DOING THE RIGHT THING: LUX & VERITAS..An Elite Institution Acknowledges It “helped to perpetuate … racial oppression and exploitation”.

Intro: Harvard’s move comes following a report by a 14-member committee on the school and the legacy of slavery. Photograph: Charles Krupa/AP

Harvard devotes $100m to closing educational gap caused by slavery

President says institution has ‘helped to perpetuate racial oppression and exploitation’ as it establishes endowment fund

"Harvard University is setting aside $100m for an endowment fund and other measures to close the educational, social and economic gaps that are legacies of slavery and racism, according to an email the university’s president sent to all students, faculty and staff on Tuesday.

The email from Harvard’s president, Lawrence Bacow, included a link to a 100-page report by his university’s 14-member committee on Harvard and the legacy of slavery and acknowledged that the elite institution “helped to perpetuate … racial oppression and exploitation”.

The move comes amid a wider conversation about redressing the impacts of centuries of slavery, discrimination and racism. Some people have called for financial or other reparations.

The report laid out a history of enslaved people toiling on the campus and of the university benefiting from the slave trade and industries linked to slavery after slavery was outlawed in Massachusetts in 1783, 147 years after Harvard’s founding.

The report also documents Harvard excluding Black students and its scholars advocating racism.

While Harvard employed notable figures among abolitionists and in the civil rights movement, the report said: “The nation’s oldest institution of higher education … helped to perpetuate the era’s racial oppression and exploitation.”

The report’s authors recommended offering descendants of people enslaved at Harvard educational and other support so they “can recover their histories, tell their stories, and pursue empowering knowledge”. . .

READ MORE >> https://www.theguardian.com/education/2022/apr/26/harvard-slavery-racism-endowment-fund

GETTING GOUGED REAL GOOD: Massive Transfer of Wealth from Consumers to Investment Firms Who Reap Benefits

The Guardian’s data, . . objectively shows a massive “transfer of wealth” from consumers, who pay higher prices, to shareholders and investment firms that reap the benefits.

The Guardian’s data, . . objectively shows a massive “transfer of wealth” from consumers, who pay higher prices, to shareholders and investment firms that reap the benefits.Revealed: top US corporations raising prices on Americans even as profits surge

"As inflation shot to a new peak in March, cost increases exacted a deep toll on the economy, eating into most Americans’ wages and further imperiling the financially vulnerable. But for many of the US’s largest companies and their shareholders it has been a very different story.

One widely accepted narrative holds that companies and consumers are sharing in inflationary pain, but a Guardian analysis of top corporations’ financials and earnings calls reveals most are enjoying profit increases even as they pass on costs to customers, many of whom are struggling to afford gas, food, clothing, housing and other basics.

One widely accepted narrative holds that companies and consumers are sharing in inflationary pain, but a Guardian analysis of top corporations’ financials and earnings calls reveals most are enjoying profit increases even as they pass on costs to customers, many of whom are struggling to afford gas, food, clothing, housing and other basics.

Profits or profiteering?

The Guardian’s findings are in line with recent US commerce department data that shows corporate profit margins rose 35% during the last year and are at their highest level since 1950. Inflation, meanwhile, rose to 8.5% year over year in March. . .

CASE IN POINT: Caterpillar

Financial observers have varying takes on whether companies are “profiteering” or “price gouging”, or simply profiting. George Pearkes, an analyst at Bespoke Investment, pointed to Caterpillar, which recorded a 958% profit increase driven by volume growth and price realization between 2019 and 2021’s fourth quarters. Eliminating price increases may have dropped the company’s 2021 quarter four operating profits slightly below the $1.3bn it made in 2020.

“This isn’t price gouging … and it shows pretty concretely that there’s a lot of nuance here,” Pearkes said, adding profiteering is “not the primary driver of inflation, nor the primary driver of corporate profits”. However, he added that it’s reasonable to question whether Caterpillar should have passed on its cost increases.

The company also spent $5bn on buybacks last year, and $1.3bn for a quarter of profits is still high, Brown noted, especially in the context of American workers’ shrinking wages.

“Companies have access to massive capital,” she said. “They could have one or two years that are more painful – not even more painful, just less profitable for their investors, and they’re choosing not to.” . .

‘It’s a fix’

One industry that neatly illustrates how corporations have used the current imbalance of supply and demand to increase their profits is housing.

In recent months, the white-hot market for newly built houses shut out many Americans as average sale prices shot above $500,000. The popular explanation: inflation, supply chain squeezes and building material costs.

But another less publicized factor contributed. Two of the nation’s largest builders, PulteGroup and Lennar, intentionally kept home starts low and took other steps seemingly designed to maintain high prices by restricting supply.

“We could sell another 1,000 homes in the quarter if we wanted to without too much effort. It just doesn’t make sense to do that,” Lennar co-CEO Jon Jaffe told investors in an earnings call. Lennar’s profits are up 78%, while PulteGroup’s jumped 97%. Lennar didn’t respond to a request for comment. . .

Observers note a common thread along the supply chain: consolidation. By some estimates, Home Depot and Lowe’s control about one-third of the home improvement market, and hold even more of consumer lumber. Lennar and PulteGroup control about 11% of the home building market, though that figure is probably much higher in many metro regions, and Boise Cascade controls about one-third of the plywood market, according to a Forest Economic Advisors analysis.

“Those who have market power can raise prices above what’s considered fair market value,” Brown said. “We’re at a point in our market concentrations that we haven’t seen ever before.”

The influence of consolidation is pervasive. . .

> Concentration is particularly pronounced among commodity companies, a problem highlighted in the grain market. CPI data shows bread and cereal prices increased by 30% and 7% between 2019 and 2021’s fourth quarters, while wheat skyrocketed to an all-time high in March as war largely eliminated Ukrainian and Russian crops.

Meanwhile, four large grain producers control about 90% of the market. Among them are Archer Daniels Midland, whose profits jumped 55%, and Bunge, whose profits swung by about $280m. Three companies control 73% of the cereal market.

That level of concentration breeds higher prices, said Alex Turnbull, a commodities analyst. . .

> Just as PulteGroup kept housing starts down, oil companies have kept production low while gas topped $7 a gallon in some regions. In earnings calls across the industry, oil executives like Diamondback Energy CEO Travis Stice have promised to keep production flat in the years ahead, “putting returns and, therefore, shareholders first”. . .

>

Some companies are enacting price increases in a less direct manner: by eliminating lower-cost products. The CEO of Kohl’s said in a previous interview the store was shifting its merchandise toward higher-end brands like PVH-owned Tommy Hilfiger, where profits are up 183%, because they’re more profitable for Kohl’s.

Similarly, General Motors profits jumped 49% between the full years in 2019 and 2021 despite selling about a million fewer vehicles. The company said it focused on moving more expensive trucks and SUVs than in previous years, but it also raised prices – a Silverado can now cost over $5,000 more than it did in 2019. That includes two rounds of March price increases just weeks after GM announced record profits and margins. . .

‘Sick and tired of being ripped off’

Not everyone is raising prices. Arizona Iced Tea owner Dan Vultaggio became a populist hero in April when he declared he’d rather take a hit than push prices above 99 cents: “I don’t want to do what the bread guys and the gas guys and everybody else is doing,” Vultaggio told the Los Angeles Times. . .

In March, Senator Bernie Sanders began a push to bring back a windfall profit tax last used after the second world war, while Senator Elizabeth Warren introduced similar legislation that focused on oil companies’ profits.

“The American people are sick and tired of the unprecedented corporate greed that exists all over this country. They are sick and tired of being ripped off by corporations making record-breaking profits while working families are forced to pay outrageously high prices for gas, rent, food, and prescription drugs,” said Sanders.

Sanders may well be right, but if “sick and tired” Americans vote against the Biden administration in November, his chances of pushing for change will fall."

READ MORE DETAILS >> https://www.theguardian.com/business/2022/apr/27/inflation-corporate-america-increased-prices-profits

NOW WE KNOW

Intro:

U.S. Tested Hypersonic Missile in March But Kept Quiet to Avoid Antagonizing Russia: Report

The U.S. also cancelled a scheduled ICBM test for the second time on Friday.

"The U.S. tested a hypersonic missile in mid-March but didn’t publicize the test to avoid inflaming tensions with Russia as the country continues to decimate Ukraine with its needless war. Any confusion between the U.S. and Russia during a time of heightened world conflict runs the risk of starting a nuclear war, and the potential of destroying all life on planet Earth, something many humans who live on Earth say would be a bad thing.

The news of America’s hypersonic missile test comes from CNN, which cites an unnamed senior official with the U.S. military. The missile, reportedly fired from a B-52 somewhere on the west coast, traveled at a height of 65,000 feet and a distance of 300 miles, according to the unnamed official.

The hypersonic missile tested last month was part of Lockheed Martin’s Hypersonic Air-breathing Weapon Concept, though other major defense contractors are also working on hypersonic missiles for the U.S. in a race to match the capabilities of China and Russia. North Korea also claims to have tested a hypersonic missile, though details about that program are still unclear.

Russia even claimed to have used its Kinzhal hypersonic missile technology against Ukraine to destroy an underground weapons depot on .

If true, it would be the first known use of a hypersonic missile in war. It’s not clear if the U.S. hypersonic test occurred before or after Russia’s use of the weapon because the CNN report only cites “mid-March” without narrowing it further. . .

Hypersonic missile technology is still very much in its infancy, with many critics questioning its usefulness and the technology underlying the construction of these systems. Lockheed Martin’s Air-Launched Rapid Response Weapon failed in at least three tests during 2021, according to the Arms Control Association. But critics have never really kept enormous weapons systems from being produced, especially during a time of heightened alert.

. . .The U.S. also cancelled an ICBM test on Friday, which had already been postponed from earlier in Russia’s war against Ukraine. ICBM tests are often conducted by the U.S. throughout the year and often land near the Marshall Islands. Typically, these tests don’t get much coverage (unless North Korea does them, naturally), but holding off these tests is a big deal. If Russia interpreted a test as an actual nuclear missile heading for Moscow, Putin and his advisors would have roughly 20 minutes to decide whether to retaliate. . ."

READ MORE >> https://gizmodo.com/u-s-tested-hypersonic-missile-in-march-but-kept-quiet-1848749636

RELATED CONTENT

DoD Needs To Sharpen Hypersonics Oversight: GAO

GAO notes that efforts to defend against Russian and Chinese hypersonic missiles are much less mature than offensive efforts, with much less funding. Only 12 of 70 projects tracked by GAO related to defenses; DoD requested $207 million in 2021 for hypersonic defense, up from $157 million in 2020.

WASHINGTON: DoD must sort out roles and responsibilities for developing and buying hypersonic weapons as it has 70 related efforts scattered amongst the services, DARPA and the Office of Secretary of Defense — to avoid costly duplication and technological missteps, the Government Accountability Office says.

While hypersonic weapons are one of the US military’s top priorities, the new GAO report frets that the department has not formally laid out who decides what programs are viable and how they are prioritized. The GAO report follows a Congressional Research Service review last month, which suggested DoD needs to take a harder look at “the rationale for hypersonic weapons, their expected costs, and their implications for strategic stability and arms control.

March test ‘one of the biggest steps we've seen’ in development of new hypersonic weapons, company officials say.

That the United States is behind China and Russia in the area of hypersonic weapons is no secret. But the successful endurance test of a new jet-launched hypersonic in March is giving weapons maker Lockheed Martin hope that the United States is on track to close the gap.

Defense One last week sat down with representatives from Lockheed Martin at the company’s Skunk Works site in Palmdale, California, shortly after the Defense Department announced the successful test of a jet-launched cruise missile—the Hypersonic Air-breathing Weapon Concept, or HAWC—in March. Lockheed Martin is one of the contractors on that program, and the test coincided with the Russian use of a hypersonic missile against a Ukrainian military target in March . . ."

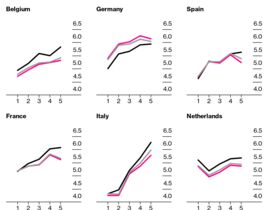

Report from Bloomberg Economics: RISING INEQUALITY WITHIN THE EUROZONE

Inequality Threatens Trust in Central Bankers, ECB Study Warns

- Inequality may affect public confidence in ECB, paper finds

- Improving understanding of ECB mandate may boost perceptions

-

Flash News: Ukraine Intercepts Russian Kh-59 Cruise Missile Using US VAMPIRE Air Defense System Mounted on Boat. Ukrainian forces have made ...