on the night before christmas all through new york streets

nasty critters were stirring making humans their eats

with few masks few vaxes so few people cared

that almost all Americans slept unprepared

for coughing sneezing and stupid brain fog

too tired to stop starting a long covid slog

2020 All Over Again?

New York and New Jersey have fallen to infection by the XBB covid family, the most-contagious and antibody-conquering virus yet.

XBB’s most evil spawn, XBB 1.5, pole-vaulted the variant from 20% share-of-cases in those two states to over 50% in just two weeks.

Quick Takeover Mimics 2020 Invasion

XBB 1.5 turned the former covid champions into also-rans. At 22.1% and 19.9%, BQ1 and BQ1.1 lost a combined 20.5% in the two weeks December 10-24. XBB 1.5 also squeezed all nine other variants in CDC Region 2 into smaller shares, relegating pre-BQ champ BA5 down to a paltry 3.7%.

That is some strong stuff. And I predict 1.5 will mushroom in the United States the same way D614G did in 2020, and will go worldwide after gaining huge strength from the antibody resistance of its F486P mutation.

But it won’t be Santa Claus asking 1.5 to guide his sleigh, it’ll be the grinch.

Shades of D614G

The speed and magnitude of the XBB invasion resembles the 2020 covid attack by the D614G variant, which ravaged the East Coast before marching south and west with a relentless infection that killed over 350,000 Americans.

On May 8, 2020, I quoted a Los Alamos National Laboratory report: “The mutation Spike D614G is of urgent concern; after beginning to spread in Europe in early February, when introduced to new regions it repeatedly and rapidly becomes the dominant form. Also, we present evidence of recombination between locally circulating strains, indicative of multiple strain infections.”

XBB 1.5 has all that, on steroids.

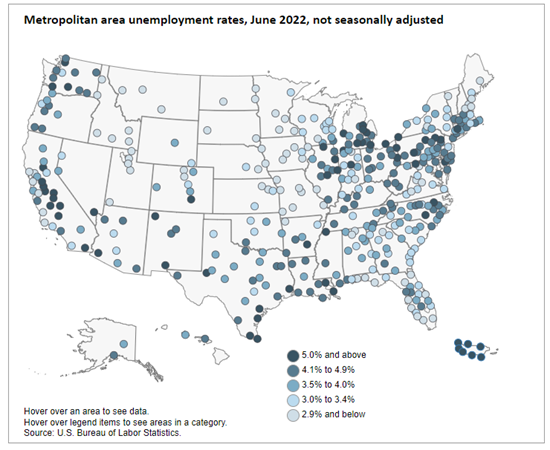

On May 23, 2020, this map showed U.S. counties with high covid rates:

Colored red for “voted Trump” in 2016 and blue for “voted Clinton,” it shows the path of D614G from New York / New Jersey south to Florida and west to Louisiana. The West Coast got the original Wuhan version, plus some skip-over D614G via airplane from the East (as did Chicago).

Thirty-one months and two weeks later, the “pie” charts on the CDC region map below show XBB infection (purple slices) highest in the northeast, spreading down the East Coast and branching west.

XBB’s taking much the same path D614G did in 2020. Again, with some skip-over via airplane.

Nationally, XBB is now 18.3% of all cases in the United States. That’s up 630% in just the past four weeks.

In the Northeast, XBB is is over 50%, but on the West Coast it’s as low as 5.6%, and 4.1% in Texas. But 4.2% is where XBB was nationally for the week ended December 3. It jumped to 7.1% by Dec. 10, 11.2% at Dec. 17, and now 18.3% on Christmas Eve.

With its firm foothold everywhere in the U.S., I predict

a near-total XBB 1.5 grip on the nation by February 3, 2023.

Will XBB 1.5 Be Worse Than Previous Covids?

-

(1) We have the September 2022 vaccines, but only 14.6% of Americans have gotten them.

- (2) We have antibodies and immunities in us already, but they are out-of-date, worn-out, and weak.

- (3) We had monoclonal and other treatments, but almost all are useless now, except Paxlovid, the pills you start taking within five days of first covid symptoms.

- (4) We have plenty of masks, but very few use them.

- (5) Hospitals have lots of PPE, but nurses and doctors are overworked and stressed by flu, RSV and other diseases.

- (6) Original XBB was extremely antibody-resistant, and XBB 1.5 is even more elusive, like a stealth bomber, so it figures to hit harder and spread throughout your body more quickly.

So yes, it sure looks bad, especially for all ages in the Long Covid category. Because without vaccine, it’s easier for the most-contagious-ever covid to prosper and spread in your body like metastasizing cancer, and because XBB 1.5 is so impervious to monoclonal treatments, it’s harder to get rid of, hence Long Covid.

1.5 ducks the punches your antibodies and “immunities” blindly throw, because they can’t see it. 1.5 then infects you cell-by-cell, making about 1,000,000 copies of itself in each cell, and soon overwhelms your defenses with sheer (insanely large) numbers. Bad and very bad things happen to you, some of them for a very long time.

Hospitalizations are already up in high-XBB areas. Death rate changes uncertain, but in numbers of actual cases and with Long Covid wrecking lives, brains, and careers, XBB 1.5 is on track to inflict the most destruction of any covid mutant yet.

XBB 1.5 looks like the Balrog of covids, and thanks to Republican refusal to fund medical preparedness and research—we’re not ready for it.

P.S.: My advice: Do what you can to protect yourself ASAP: mask, gloves, shot, distance, disinfect, and make a plan for Paxlovid, the sooner you take it after symptoms, the better.

And spread the word. Please forward this freely.

LINKS:

< https://covid.cdc.gov/covid-data-tracker/#variant-proportions >

< https://www.dailykos.com/stories/2020/5/23/1947089/-Red-State-Covid-Boom-Two-Brutal-Graphics >

< https://www.cdc.gov/nchs/pressroom/podcasts/2022/20220107/20220107.htm >

< https://www.dailykos.com/stories/2020/5/8/1943685/-States-Open-To-Super-Coronavirus >

.jpg)

.jpg)

.png)

.jpg)

.jpg)

.jpg)

.jpg)

![A local resident repairs a broken window in an apartment building which was partially destroyed by a Russian strike in Kyiv on December 31, 2022 [Genya Savilov/AFP]](https://www.aljazeera.com/wp-content/uploads/2023/01/000_336C2LL.jpg?resize=270%2C180&quality=80)

![Rescuers work at an area heavily damaged by a Russian missile raid in Mykolaiv, Ukraine, on December 31, 2022 [Oleksandr Ratushniak/Reuters]](https://www.aljazeera.com/wp-content/uploads/2023/01/2022-12-31T181854Z_503602818_RC24HY90A1BD_RTRMADP_3_UKRAINE-CRISIS-MYKOLAIV.jpg?resize=270%2C180&quality=80)