Watch: Premium Notices, Missed Pay Mark Next Phase of US Shutdown

Coming Soon: New Podcast

Listen, Watch and Catch Up

Most Active US Stocks

Your News

Watch: Premium Notices, Missed Pay Mark Next Phase of US Shutdown

Choose up to 12 topics to see the latest stories on your homepage.

Recommended

Regions

Sectors

The White House is considering invoking the Insurrection Act as officials ramp up federal law enforcement action in US cities, Vice President JD Vance said.

The 1807 statute would allow President Donald Trump to deploy active-duty military personnel; the government has already sent National Guard troops to Democratic-run cities with the stated aim of protecting immigration agents from protests.

Courts have blocked some of those deployments, but analysts say the legal setbacks could push Trump to take a more aggressive route and invoke the act.

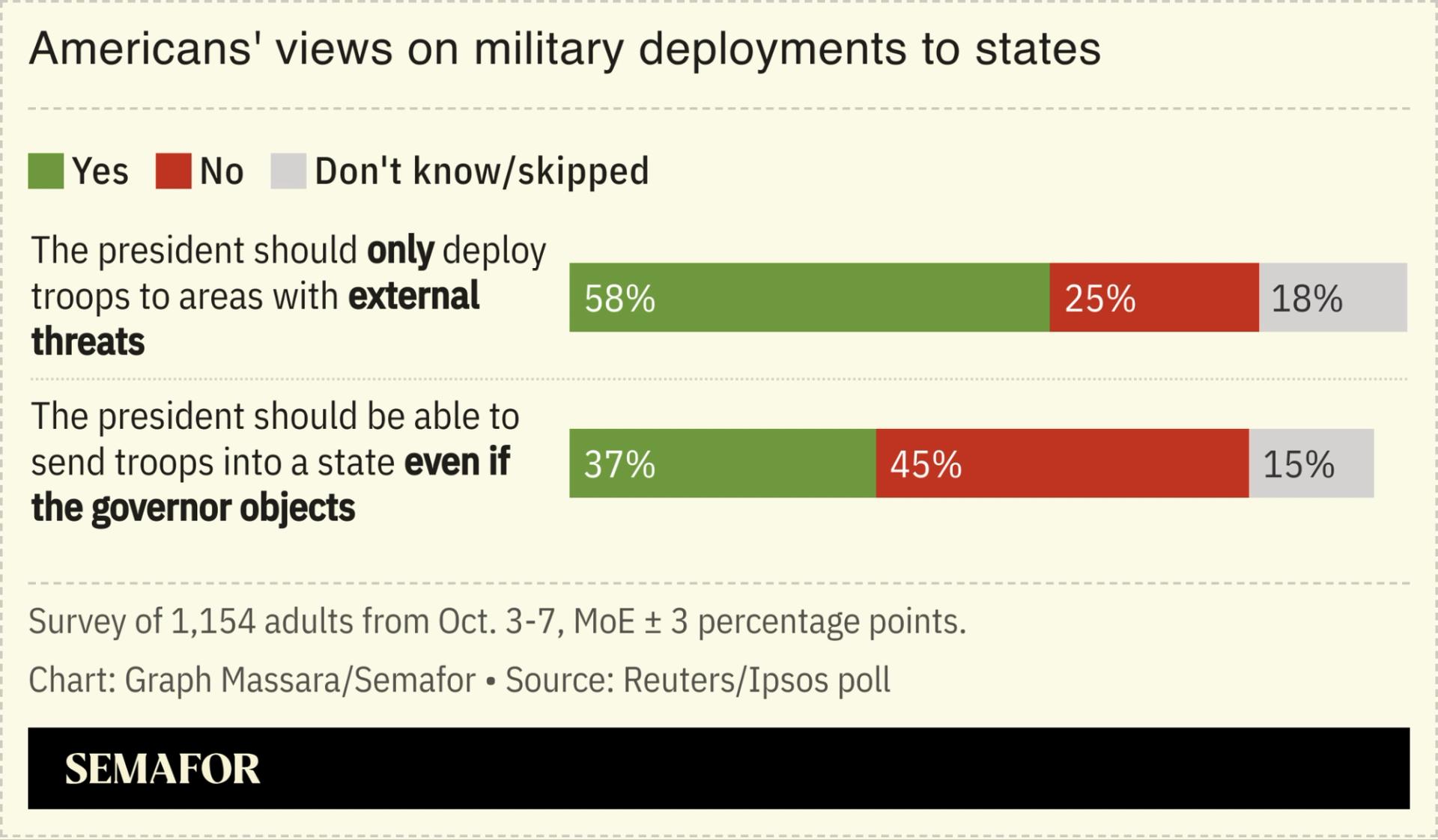

Top Trump adviser Stephen Miller has called the unfavorable court rulings a “legal insurrection,” but polls show that most Americans oppose using active troops in US cities.

Quick Read

When Howard Marks speaks, Wall Street listens. On October 13, 2025, Marks—co-founder of Oaktree Capital and legendary author of market memos cherished by Warren Buffett—marked his 35th anniversary as a voice of caution and insight. As the world’s financial markets tremble under the weight of trade wars, technology mania, and record-breaking commodities, Marks’ warnings have never felt more urgent.

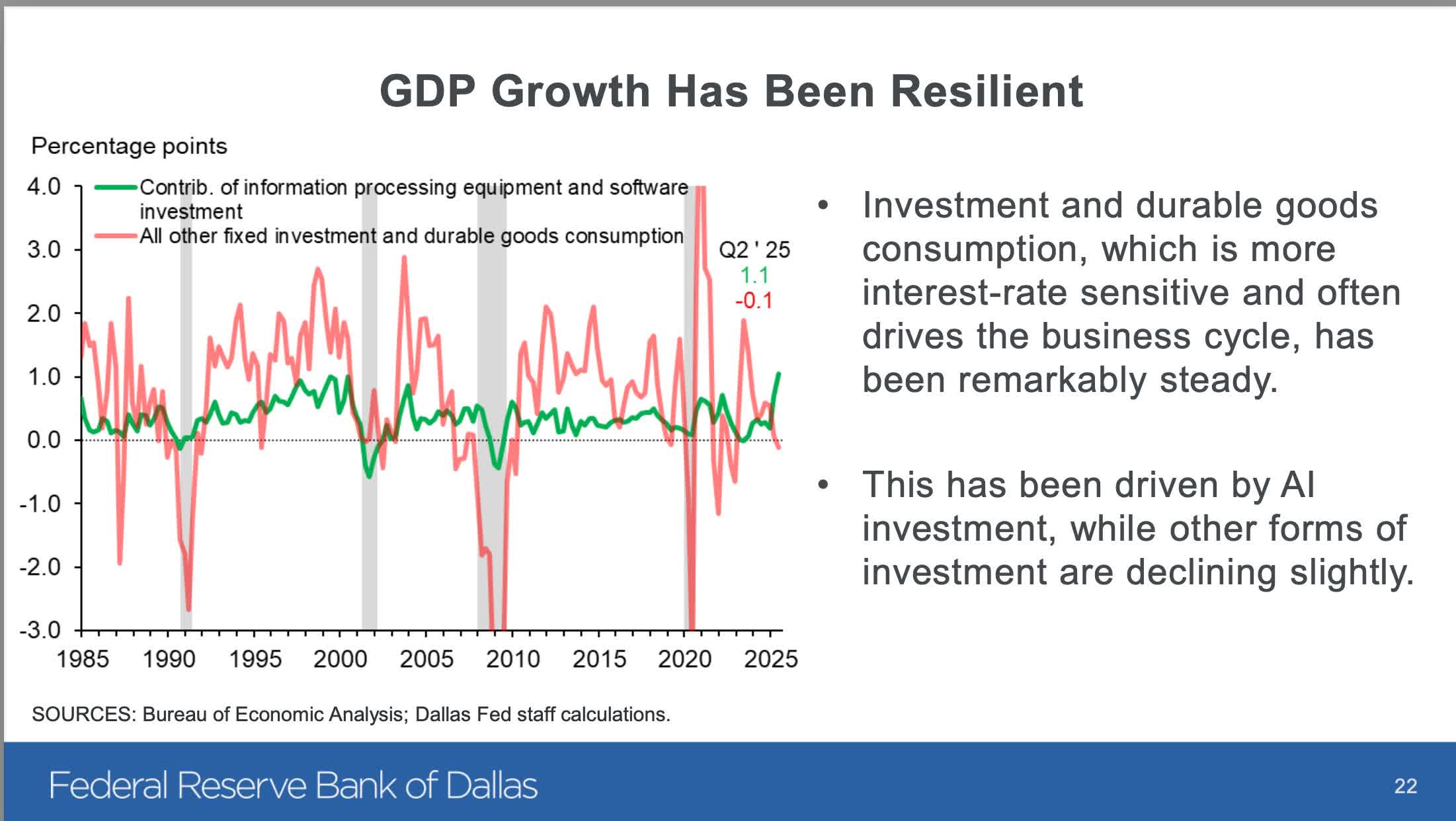

The AI wave crested in late September with Nvidia’s announcement of a $100 billion investment in OpenAI, sending its shares to new highs. Similar surges followed across the tech sector, as investors scrambled for a piece of the future. Yet, beneath the surface, cracks are showing. According to Reuters and TS2.tech, trillions are being poured into AI, but MIT research finds that 95% of companies have yet to see meaningful returns from these investments. JPMorgan data reveals that periods of sky-high valuations often lead to disappointing long-term results.

Marks draws a parallel to the dot-com era. Back then, the internet was sure to change the world—it did—but most of the companies riding that wave vanished. “The thrill of the new thing and fear of missing out are powerful forces,” Marks observed in a recent podcast. Today’s AI euphoria, he says, could easily tip into mania, especially as investors start believing there’s “no price too high” for the next big thing.

Institutional and retail investors are beginning to filter out hype from substance. Charles Schwab’s Joe Mazzola notes that clients now focus on companies with proven AI revenue streams, such as Nvidia, Oracle, and Palantir, while scaling back on names like AMD and Broadcom. Private equity titan Orlando Bravo and FG Nexus CEO Maja Vujinovic echo these concerns, urging investors to prioritize real-world utility over speculative dreams.

and retail investors are beginning to filter out hype from substance. Charles Schwab’s Joe Mazzola notes that clients now focus on companies with proven AI revenue streams, such as Nvidia, Oracle, and Palantir, while scaling back on names like AMD and Broadcom. Private equity titan Orlando Bravo and FG Nexus CEO Maja Vujinovic echo these concerns, urging investors to prioritize real-world utility over speculative dreams.

Just as AI fever reached its peak, geopolitics threw cold water on the rally. On October 10, President Trump’s sudden announcement of 100% tariffs on Chinese imports triggered a global sell-off. The S&P 500 plunged 2.7%, and the Nasdaq lost 3.6%—the worst single-day drop since April. Tech giants were hit hardest, with AMD and Qualcomm sliding about 7%. Chinese tech firms, including Alibaba and Baidu, fell as well.

With risk rising, investors rushed into safe havens. Gold soared to a record $4,096.35 per ounce, up 56% year-to-date, and silver reached $52. Commodities analysts at Saxo Bank and CPM Group note that such spikes reflect deep unease about the world’s direction. Bank of America now predicts gold could reach $5,000 by 2026, while Societe Generale forecasts silver at $65 within the same period.

Meanwhile, StoneX Group—an under-the-radar Chicago financial-services firm—has quietly gained momentum. StoneX provides market access for commodities, securities, and FX, and has expanded through acquisitions. Its stock, SNEX, is near all-time highs, driven by increased trading fees as market volatility surges. According to CNBC and GuruFocus, StoneX’s diversified exposure makes it a rare winner in turbulent times.

For three and a half decades, Marks’ memos have shaped how investors think about cycles, risk, and psychology. Buffett himself has handed them out to protégés, a testament to their enduring relevance. This year, as Marks reflects on his career, he’s blunt: market psychology repeats, and the ingredients for bubbles never really change. Unbridled optimism, rich valuations, and “fear of missing out” can override rational analysis.

Marks remains pragmatic. In a recent CNBC interview, he stated, “Expensive and going down tomorrow are not synonymous.” He cautioned that while AI valuations are elevated, mania hasn’t taken hold—yet. The true mark of a bubble, he says, is psychological excess: “For a company in this sector, there’s no such thing as a price too high. I don’t detect that level of mania at this time, so I have not put the bubble label on this incident.”

Still, he warns against complacency. The market’s rally “rests largely on future promises,” and without real earnings to support these prices, a correction could be painful. Investors should temper their euphoria and recall that history is littered with examples of cycles ending badly for those who ignore the signs.

So what’s an investor to do? Experts urge balance and prudence. Diversifying into commodities, maintaining liquidity, and sizing positions carefully in big tech or AI names are now popular strategies. Some recommend profit-taking on recent winners or setting stop-losses as volatility spikes.

The outlook is mixed. If the U.S. Federal Reserve begins cutting rates in 2026 as futures markets expect, stocks could rally anew. But if inflation persists, risk assets may struggle. Major banks advise rotating from overvalued growth stocks into value or cyclicals, and keeping an eye on macro data.

In the words of Warren Buffett: “The market is a weighing machine.” Quality and fundamentals matter, even when momentum feels irresistible.

As Mateusz Kaczmarek of TS2.tech summarizes, the AI-driven rally has lifted markets but also provoked caution from regulators and analysts. Long-term returns will depend on how technology and global dynamics evolve. For now, even the most optimistic voices—Marks included—are urging restraint.

Howard Marks’ legacy is his ability to recognize patterns others miss. Today, his balanced perspective offers a vital reminder: markets reward discipline, not blind faith. As AI’s promise and peril collide with global uncertainty, investors would do well to heed the lessons of history and proceed with caution.

Image Credit: cnbc.com