Banks Always Backed Fossil Fuel Over Green Projects—Until This Year

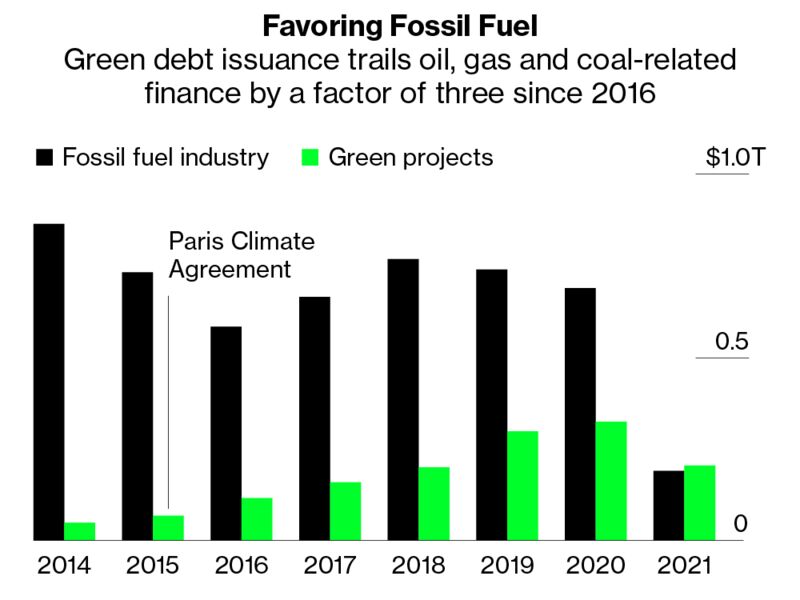

After pouring trillions into oil, gas and coal since the Paris Agreement, banks are on pace in 2021 to commit more financing to climate-friendly projects.

U.S. banks dominate this dirty corner of the debt markets. JPMorgan Chase ranks as the leading financier to energy companies, having helped extend more than $256 billion of bonds and loans since the start of 2016 in return for fees of about $900 million. Citigroup, Bank of America and Wells Fargo are the next largest advisers to corporate emitters, based on fees earned.

Fossil Fuel Pays

Banks took $16.6 billion in fees tied to energy sector loans and bonds since Paris vs. $7.4 billion for green debt

Source: Bloomberg League Tables

To measure the involvement of each bank, Bloomberg Green examined the bonds and syndicated loans underwritten for companies that produce or extract oil, natural gas and coal. Those figures are assessed against the debt by each bank arranged on behalf of corporate and government issuers for climate or environmental projects. These climate-friendly projects had to be deemed eligible for green bonds by lenders and investors.

There are weaknesses in the dataset. For example, it’s possible some portion of a loan to an oil company might have been used on a clean-energy project. Bloomberg only started tracking fees that banks earn from extending loans in 2018, so fees from 2016 and 2017 might be undercounted.

But the overall picture from the data is clear: Banks have overwhelmingly focused on fossil fuel in recent years, and also that balance is beginning to change. As both the biggest U.S. bank and leading financier of fossil fuel, JPMorgan is a bellwether of the climate-focused shift now underway. The Wall Street giant has assisted in more underwriting for green bonds and loans so far in 2021 than the funding it’s arranged for fossil-fuel companies. That reversal over less than half a year might also reflect a temporary drop in financing needs by the energy industry.

Greening of the Big Banks

Financing for oil, gas and coal compared to green debt

Note: Includes top five largest lenders to fossil fuel industry since 2016

Source: Bloomberg League Tables

The biggest Western oil companies—Exxon Mobil, Chevron, BP, Royal Dutch Shell, Total, Eni and Equinor—have issued $13 billion of debt in 2021, down from $60 billion in the same period last year. The early stages of the pandemic saw these companies sell bonds to boost liquidity as oil prices fell below $20 a barrel, said Paul Vickars, a senior credit analyst at Bloomberg Intelligence. “I don’t expect to see any new net issuance for the rest of 2021,” he said.

But what's happening in the financial markets adds to signs that politicians and business leaders are finally getting serious about climate change. There have been recent net-zero pledges from China, Japan and South Korea, the three biggest economies in Asia, and the election of U.S. President Joe Biden has resulted in more focus on climate issues than expected. Banks are moving to echo these global commitments: JPMorgan, Citigroup and Bank of America are leading a group of U.S. banks that have pledged to facilitate at least $4 trillion of sustainable and climate-friendly deals over the next decade.

From a profit and loss standpoint, industry executives now have proof they can make money participating in the transition away from fossil fuels. Banks are earning fees of about 0.6% for underwriting green bonds and loans, according to Bloomberg data, six basis points more than similar deals for energy companies.

The sums needed to fund the transition to a low-carbon future are vast. Analysts at S&P Global cite estimates of $3 trillion in annual investments if the world hopes to limit warming to 2 degrees Celsius by 2050, as set out in the Paris Agreement. That means total investment in clean technologies and energy efficiency needs to increase by roughly a factor of five by the middle of the century, compared to 2015 levels.

None of this will happen without capital markets. Investment bankers will have to throw lopsided support behind green projects, just as they have long done for the old fossil-fuel economy.

Fossil vs. Green Finance at Top 30 Banks

All figures since 2016, after the signing of the Paris Agreement. Click on column heads to sort 👆

Source: Bloomberg League Tables

—With assistance by Chris Cannon

No comments:

Post a Comment