Attorney General Merrick Garland Remarks on Redlining and Lending Discrimination

Attorney General Merrick Garland and Assistant Attorney General Kristen Clarke deliver remarks at the Justice Department in Washington, D.C. on a new initiative to combat redlining and lending discrimination

Trustmark Bank to pay $5 million 'redlining' fine

- While 50 percent of census tracts in the Memphis area are majority-Black and Hispanic, only four of Trustmark’s 25 branches were located in majority-Black and Hispanic communities, the complaint alleged.

- Trustmark also allegedly did not assign any mortgage loan officers to its four branches in majority-Black and Hispanic communities, ensure broad access to home loans in those areas, nor advertise mortgages in those areas.

- Trustmark’s peer banks in the Memphis area allegedly received 2.5 times as many mortgage applications from majority-Black and Hispanic communities, which federal officials cited as proof of the company’s discouraging actions.

“Trustmark purposely excluded and discriminated against Black and Hispanic communities” said CFPB Director Rohit Chopra.

“The federal government will be working to rid the market of racist business practices, including those by discriminatory algorithms.”

Under the consent order, Trustmark will pay $5 million to settle allegations it violated the Fair Housing Act and Equal Credit Opportunity Act, which ban racial discrimination in housing and credit transactions, respectively.

The OCC also penalized Trustmark for allegedly violating the Community Reinvestment Act, which requires banks to meet the credit needs of underserved areas within its customer range.

Duration: 1:14

Posted: Jun 12, 2020

'Hotlanta' is even more sweltering in these neighborhoods due to a racist 20th-century policy

Updated 7:09 PM ET, Sat October 2, 2021

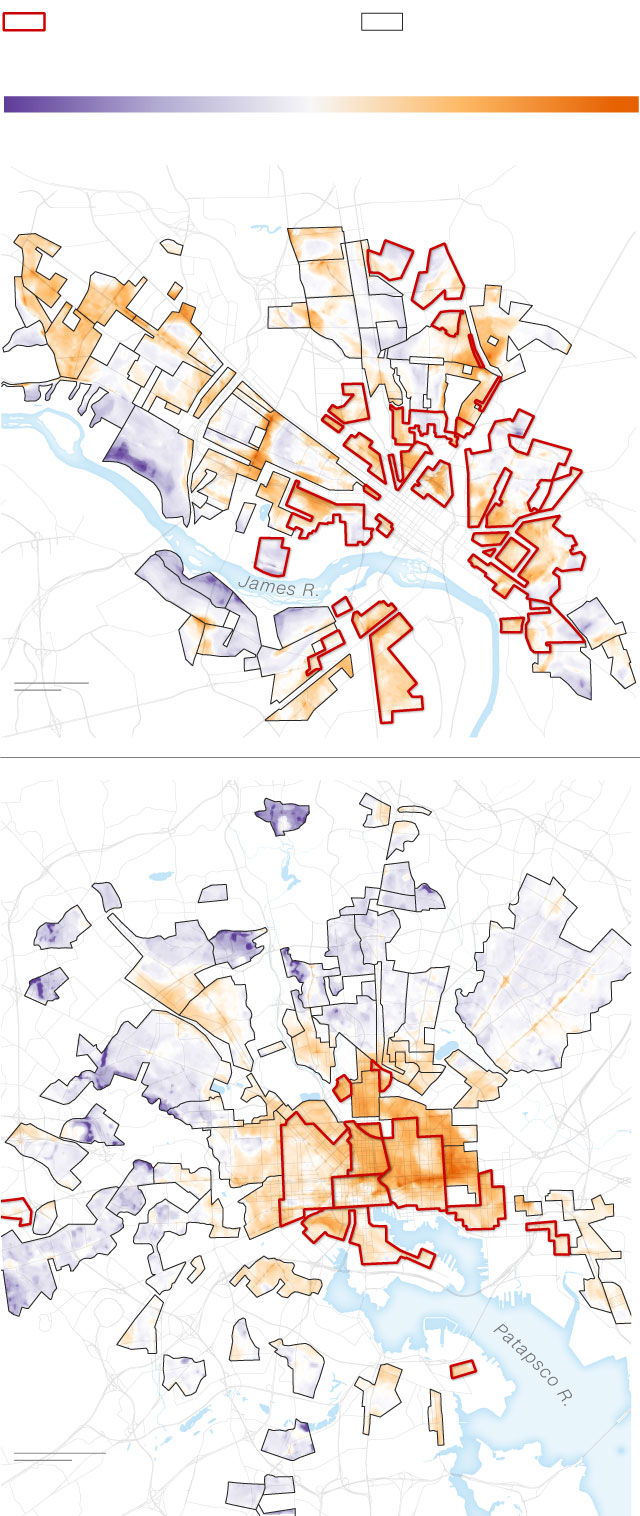

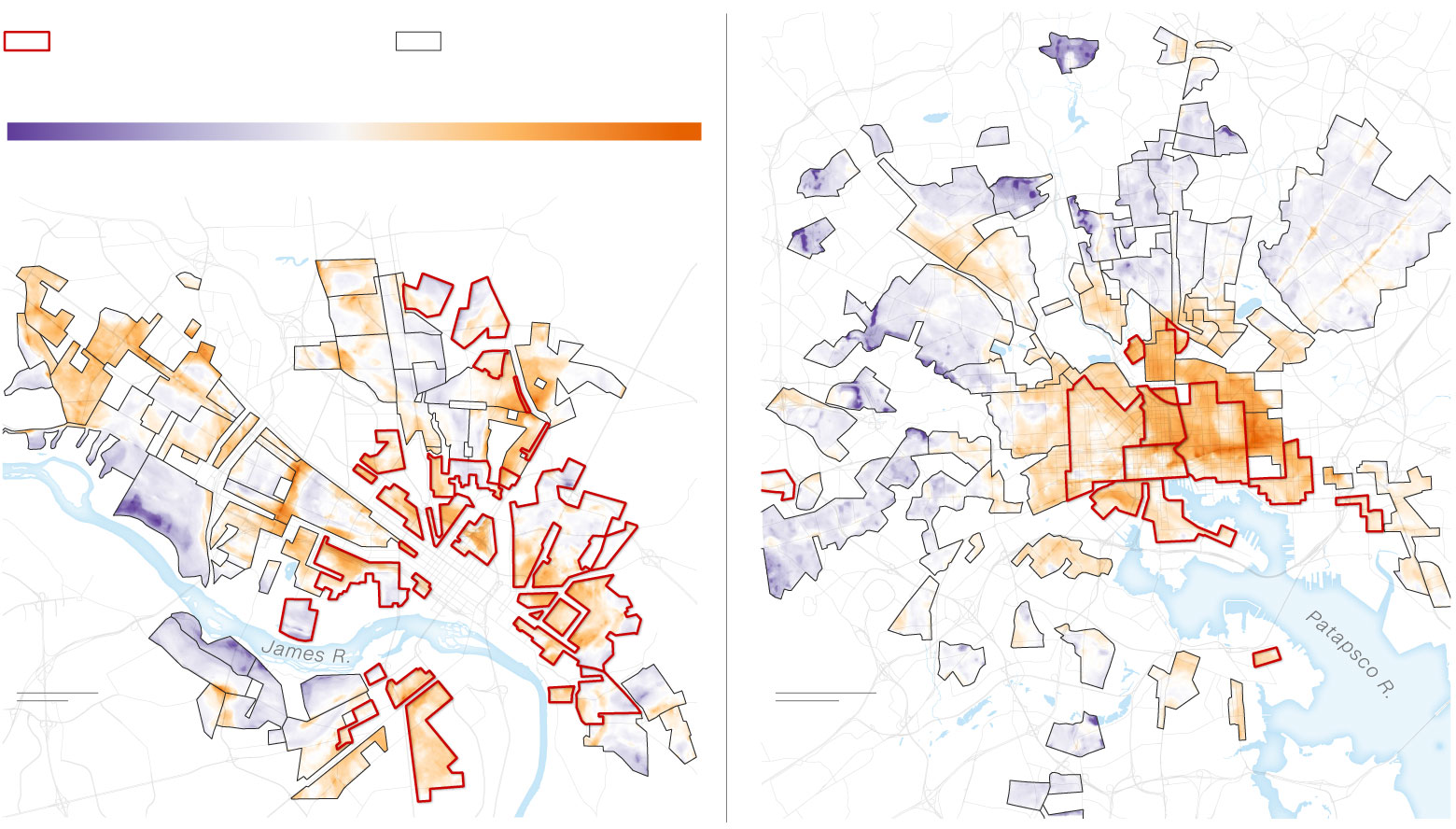

Hotter temperatures disproportionately affect redlined districts

In many urban areas, the hottest parts of the city tend to be in areas that were historically “redlined,” meaning banks and mortgage lenders considered it risky to invest in those neighborhoods. Two examples are Richmond, VA, and Baltimore.

Historical redlined districts

Non-redlined districts

Temperature relative to average

Cooler

Warmer

Richmond, VA

Downtown

1 mile

1 km

Baltimore, MD

Downtown

1 mile

1 km

Historical redlined districts

Non-redlined districts

Temperature relative to average

Cooler

Warmer

Richmond, VA

Downtown

1 mile

1 km

Baltimore, MD

Downtown

1 mile

1 km

Baltimore, MD

Historical redlined districts

Historical redlined districts

Non-redlined districts

Non-redlined districts

Temperature relative to average

Temperature relative to average

Cooler

Cooler

Warmer

Warmer

Richmond, VA

Downtown

Downtown

1 mile

1 mile

1 km

1 km

No comments:

Post a Comment