Top U.S. Regional Economic Predictions For 2023

Summary

- A mild recession is coming in the US. Unemployment and migration trends are shifting. How will these factors play out across different states and regions?

- In 2022, 28 states registered a record low unemployment rate, as demographic trends and pandemic-related disruptions continued to suppress the labor force.

- Inflation will fall most rapidly in the Midwest, while the slowdown in price growth will be more gradual in the Northeast and West.

simoncarter

A mild recession is coming in the US. Unemployment and migration trends are shifting. How will these factors play out across different states and regions?

Here are our top regional economic predictions for 2023:

1. US states will fall into recession.

The US will enter a mild recession over the first half of 2023, and most states will follow. This downturn will have less of a regional theme than past ones given its mild nature and the main drivers precipitating it, which are more broadly based.

✓ The housing correction will have a high degree of regional variance, with the previously booming West incurring the deepest home price declines and thus most related economic damage, especially Arizona, California, Colorado, Nevada, and Utah.

Industry structure will also help shape the regional narrative. The energy industry, for example, will outperform this year, giving the major energy-producing states — Alaska, New Mexico, North Dakota, Oklahoma, Texas, and Wyoming — relatively better economic outlooks.

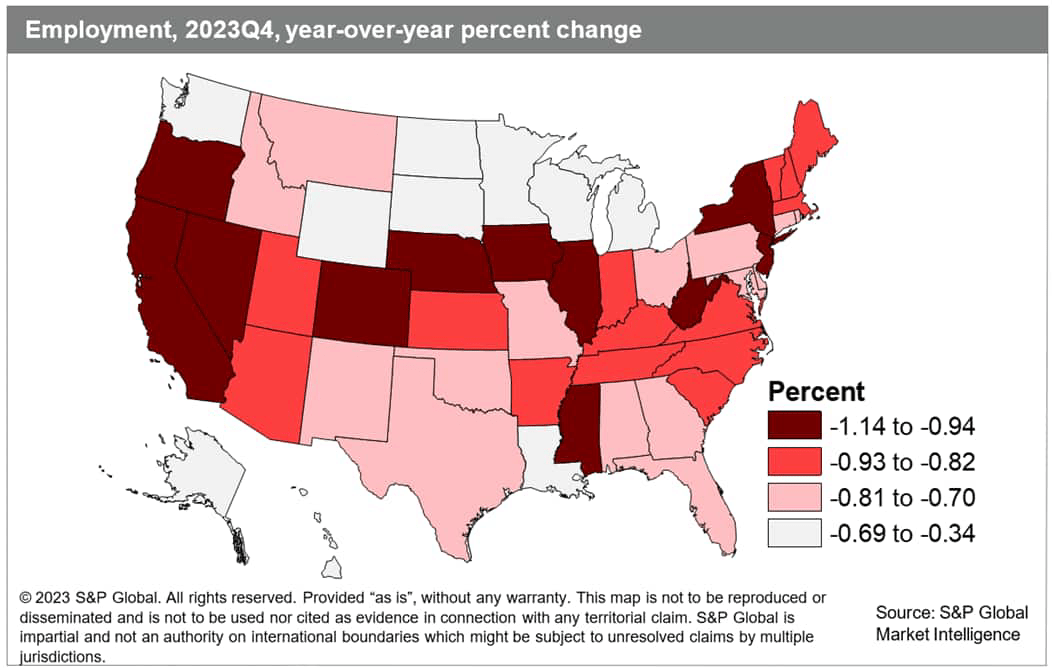

2. It will be a long road back to pre-pandemic employment levels for 20 states.

As of December 2022, employment in 26 states exceeded their February 2020 levels. The remaining states have a difficult road ahead.

✓ Four states — Oklahoma, Iowa, Massachusetts, and New Mexico — have current deficits at or below 0.5% that could recover over the next month or two if trends continue apace. Another group of states — Delaware, Kansas, Minnesota, Pennsylvania, and Wisconsin — can see light at the end of the tunnel, although their recoveries will halt as the recession takes hold.

A dozen other states had little or no shot of fully recovering in 2023 even under good economic conditions given how deep their current deficits are, including Alaska, Hawaii, Louisiana, New York, North Dakota, and Vermont.

All told, 20 states will not have fully recovered by the time the next recession hits, many of them concentrated in the Northeast and Midwest.

3. The unemployment rate will rise in every state.

In 2022, 28 states registered a record low unemployment rate, as demographic trends and pandemic-related disruptions continued to suppress the labor force. This labor tightness will ease somewhat in 2023, as layoffs pick up and more firms implement hiring freezes.

Every state will see its unemployment rate rise, and by the end of 2023, the unemployment rate will be close to or above 5.0% in every region, with the highest rates in the West and Northeast.

4. Pandemic-fueled disruptions to state population growth will settle down as the upcoming recession approaches.

The high rate of inter-state moves in 2021 and 2022 reflected the combination of large differences in costs of living across states, increased job mobility afforded by remote work, and low mortgage interest rates. The broader economic slowdown in 2023 will be an obstacle for potential movers, making it more difficult to land a position in a new locale as firms curtail hiring.

The state of the housing market is another challenge. Current homeowners face a tougher decision swapping into a new home at a much higher mortgage rate at a time when home prices remain elevated and affordability low.

The record inflows to the South and outflows from the Northeast will soften over 2023, even if they remain above pre-pandemic norms. Out West, California will see outmigration continue to soften from elevated levels, and in-migration to the Mountain region will be well below what was seen over the 2020-21 highs.

5. Home prices will contract across all four Census regions.

Weakness in the housing market began to emerge over the latter half of 2022 as rapid increases in mortgage rates combined with a significant lack of affordability. Prices have already started to fall and will continue to tumble through 2023. An impending recession, elevated mortgage rates, and an increase in housing inventory from resolving construction delays will all weigh on home price growth.

While all regions will see home prices fall, the West will experience the deepest peak-to-trough decline with prices plunging by over 10% (seasonally adjusted). Prices in the other three Census regions will fall in the range of 6-8% from their 2022 peak.

6. The recent deceleration in headline CPI inflation will continue in 2023.

Inflation will fall most rapidly in the Midwest, while the slowdown in price growth will be more gradual in the Northeast and West.

The Midwest will see the lowest year-over-year inflation rate of the four Census regions by the fourth quarter of 2023. Midwestern states are more car-dependent given their relatively low population densities, so the topline price levels of their respective Consumer Price Index (CPI) baskets are more sensitive to changes in gas prices and automobiles. Recent data show declines in energy and agricultural commodity prices pushing headline CPI inflation down more than two percentage points below its peak through December 2022.

Services price growth is expected to moderate only slightly in 2023, largely due to persistently elevated levels of rent inflation. This will keep overall CPI inflation more elevated in the Northeast and West regions, which have the highest levels of renters among the four Census regions.

7. Regions will see modest real income growth, with the West lagging.

Real personal income growth has been especially volatile since the pandemic began. Fiscal stimulus led to periods of incredible growth over 2020 and 2021, and the levels fell back when the stimulus measures ended, with 2022 representing a down year. Growth will accelerate in 2023 but remain modest overall.

A tepid outlook for employment will hold down wage disbursements, with elevated inflation pushing down real growth rates as well. By the fourth quarter of 2023, real personal income will be up in year-over-year terms in all regions, yet still below 2% — a lackluster increase.

The West will lag the three other regions due in part to a deeper downturn this year, in addition to stimulus checks that began circulation in California during the fourth quarter of 2022, which will exaggerate the slowdown in late 2023.

8. Manufacturing activity will lose steam.

The manufacturing sector is likely already in recession, and conditions will get worse before they get better. The dollar's strength and weak global growth will hurt goods exports. Weaker homebuilding will spill into supplier industries and upstream energy spending will not be as robust as last year.

Manufacturing employment will decline in 2023, and the impact will be felt most across states that rely most heavily on the manufacturing sector, including Alabama, Indiana, Iowa, Kentucky, Michigan, Ohio, and Wisconsin.

On the bright side, a recovery from the semiconductor shortage will help boost auto production and provide some offset from broader weakness in the industrial sector.

X

No comments:

Post a Comment