IMF Warns Five-Year Global Growth Outlook Is Weakest Since 1990

- Georgieva cites Russian invasion, economic fragmentation

- World economy seen expanding about 3% annually for five years

The International Monetary Fund warned that its outlook for global economic growth over the next five years is the weakest in more than three decades, urging nations to avoid economic fragmentation caused by geopolitical tension and take steps to bolster productivity.

The emergency lender sees the world economy expanding about 3% over the next half decade as higher interest rates bite, Managing Director Kristalina Georgieva said in a speech in Washington Thursday. That’s the lowest medium-term growth forecast since 1990 and less than the five-year average of 3.8% from the past two decades.

For 2023, global gross domestic product will likely expand by less than 3%, she said. That’s in line with the fund’s January forecast of 2.9%.

About 90% of advanced economies will see growth slow this year as tighter monetary policy weighs on demand and slows economic activity in the US and euro area, the IMF said. It plans to release a more detailed World Economic Outlook report on April 11 as part of its Spring Meetings held together with the World Bank.

Russia’s invasion of Ukraine has worsened already tense relations between the US and China, exacerbated a global inflation crisis and is spurring hunger around the world.

“With rising geopolitical tensions, with inflation still running high, a robust recovery remains elusive,” Georgieva said. “That harms the prospects of everyone, especially for the most vulnerable people and most vulnerable countries.”

Read More: IMF Warns 2% of Global GDP at Risk as FDI Hit by US-China Split

Some emerging markets are showing strength, particularly in Asia, with India and China expected to account for half of global expansion. But low-income nations are hamstrung by weakening demand for their exports, with their per-capita income growth remaining below that of the emerging economies. Poverty and hunger that increased during the coronavirus pandemic could climb.

Despite the bleak growth outlook, high inflation means that central banks must continue to raise interest rates, as long as financial stability pressures remain limited after recent banking industry upheaval in the US and Switzerland, Georgieva said.

If the banking system becomes unstable, policymakers will face more complicated trade-offs between inflation and the safeguarding the financial system, Georgieva added. “Be vigilant and more agile than ever.”

Policymakers are set to converge on Washington for sessions focused on numerous global challenges, from unsustainable debt in developing nations to inflation to climate change.

Georgieva’s stark message comes a day after the IMF warned that geopolitical fragmentation, driven by tensions between the US and China, risks damaging the global economy, with foreign direct investment and other capital increasingly being channeled toward aligned blocs of countries.

Read More: IMF Needs Billions From Rich Nations to Help Poorest Countries

She repeated a warning from January that longer-term trade fragmentation — including restrictions on migration, capital flows and in international cooperation — could cut global gross domestic product by as much as 7% — equivalent to the combined annual output of Germany and Japan, or about $7 trillion. Interruptions to technology trade could see losses as large as 12% of GDP for some countries, Georgieva said.

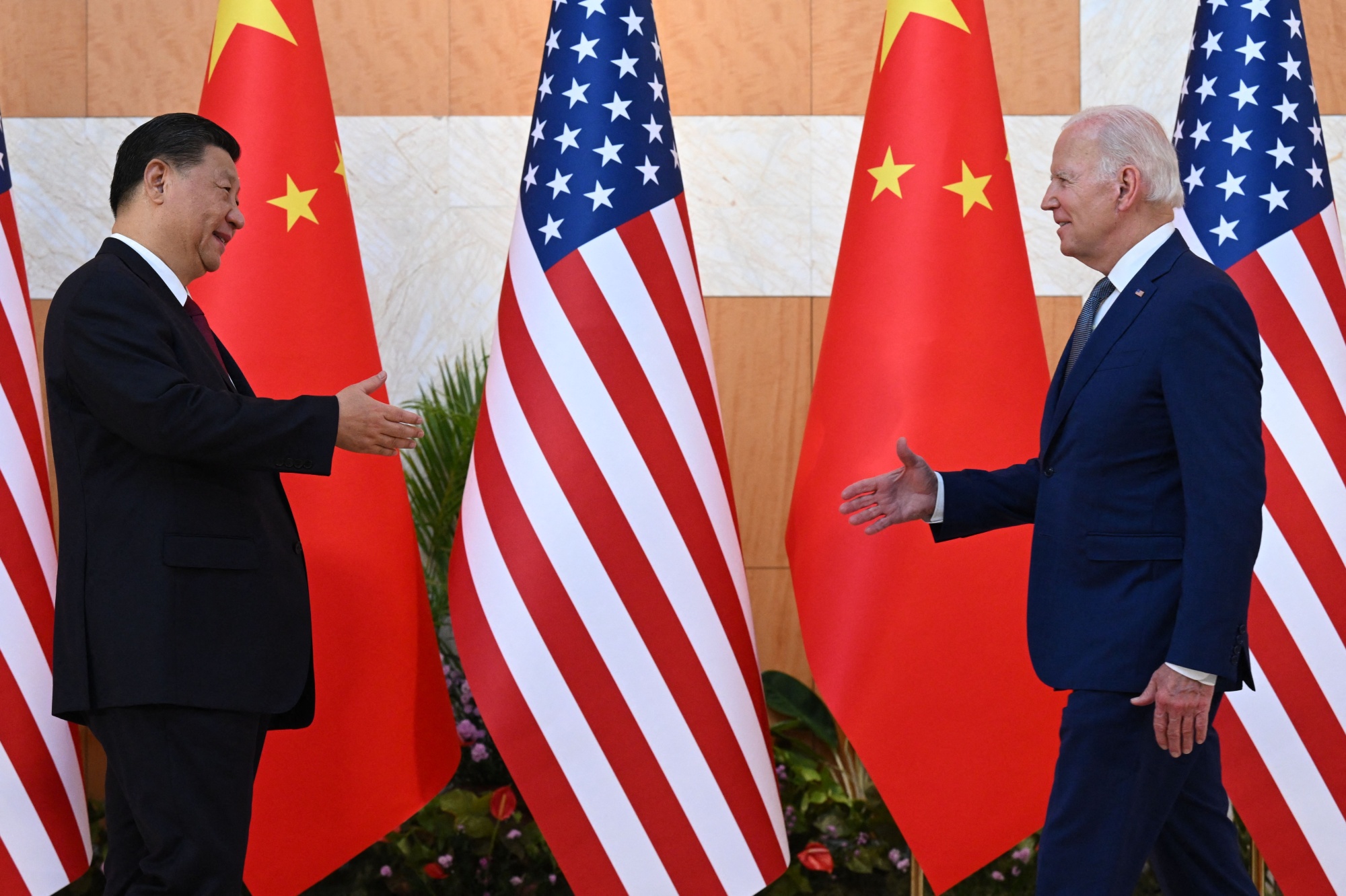

Russia’s invasion last year sent already strong inflation in many nations spiraling to its highest level in decades. Chinese President Xi Jinping’s support for the Russian leader, Vladimir Putin, including a high-profile trip to Moscow last month, drew criticism from the Biden administration and worsened the relationship between the US and China.

Relations between the world’s two largest economies have worsened in recent years. They deteriorated under former President Donald Trump, who kicked off a trade war that resulted in hundreds of billions of dollars in tit-for-tat tariffs. President Joe Biden’s administration has sustained a hard line, focused mainly on economic and national-security concerns.

Washington last year unleashed strict export controls on semiconductor technologies to China and has spent years targeting Huawei Technologies Co., a leader in telecommunications infrastructure that the US has deemed a national security threat with ties to the Chinese government.

Just last week, Beijing opened a new front in the escalating chip battle, launching a cybersecurity review of imports from America’s largest memory-chip maker, Micron Technology Inc. And on Wednesday, US House Speaker Kevin McCarthy and a bipartisan group of lawmakers met with Taiwan’s President Tsai Ing-wen in California. a visit to the US that China has protested.

Read More: McCarthy Assures Taiwan’s Tsai That Ties With US Are Strong

Amid that conflict and after the supply-chain disruptions of Covid-19, the US has encouraged nearshoring and “friend-shoring,” urging companies to move suppliers into aligned countries closer to home and particularly away from Asia and China.

Georgieva urged countries to be pragmatic about strengthening supply chains. She also repeated a call for IMF members to provide debt relief to distressed nations, and to contribute to a trust for the poorest countries that is short billions of dollars.

More from Bloomberg

US-China Split Could Hinder Foreign Investment and Lower Global GDP, IMF Warns

IMF Warns Risks From Nonbank Finance Institutions May Intensify

IMF Urges Nations to Use Fiscal Tightening to Tame Inflation

IMF Reaches Staff-Level Deal on $3.5 Billion Ivory Coast Loan

IMF Team Initiates Talks on New Funding Program For War-Wracked Ethiopia

Top Reads

China Takes Its Climate Fight to the Rooftops

by Bloomberg News

A DC Office Building Offers a Lesson in Glass and Sculpture

by Kriston Capps

Air Pollution Casts a Pall Over Booming Bangladesh Megacity

by Peter Yeung

Nickel Revolution Has Indonesia Chasing Battery Riches Tinged With Risk

by Yudith Ho and Eko Listiyorini

US Jobless Claims Get Bumped Up by Revisions for Seasonal Swings

China Restraint on Taiwan Shows Xi Has Bigger Concerns Right Now

Google and Amazon Struggle to Lay Off Workers in Europe

Apple’s $165 Billion Cash Hoard Creates M&A Mirages

Opinion

It’s Tax Season! Here Come the ‘Leech Brands’

CEOs Are Perfect Patsies for TikTok Politicians

The Nursing Workforce Needs More Men

A Medicaid Catastrophe Is Looming. It Can Be Avoided.

Walmart’s Automated Future Can’t Just Be About Profits

Listen to Today's Big Take Podcast

The Future With Hannah Fry

A Bloomberg Originals series where the mathematician explores questions about what's to come.

Can We Really Rewild the Planet? | Episode 6

Technology and AI for Social Inclusion | Episode 5

Can Nuclear Fusion Power the Future? | Episode 4

Weaponization of Data | Episode 3

Podcasts

Listen to the latest episodes from Bloomberg Podcasts

Burnbrae’s Jim Mellon Sees a Bright Future for Britain

Crash Course: Trump, Strongmen and German History Lessons

The NYC Landlord Who Says the ‘Golden Age’ of Being a Landlord Is Over

Capital Had Its Day. Now It’s Labor’s Turn, Troy’s Lyon Says

Stories for You

Top Tax Mistakes to Avoid If You Make More Than $100,000

The Final Mission for a California Military Base: Become Housing

The Gambler Who Beat Roulette

Tesla Lets Old Age Get the Best of Its Most Expensive Models

Warner Bros. Nears Deal for Harry Potter Online TV Series

Apple’s Complex, Secretive Gamble to Move Beyond China

War in Ukraine

Ukraine Latest: Macron Urges China’s Xi to Help; Ruble’s Slide

Ukraine Has Decimated Its Oligarchs But Now Fears New Ones

China Can’t Be Peace Mediator for Ukraine, Lithuania Says

Putin Says US-Russia Ties in ‘Deep Crisis,’ Blames Washington

UP NEXT

On Now

Made: Where High-End Classic Cars Go Electric- Africa+

- Storylines

- Made: $3,000 Wooden Surfboard

Bloomberg Green

Companies like Gogoro are proving that two- and three-wheelers are well suited to battery swaps, which can alleviate range anxiety.

Here’s Some Good News About the Planet for a Change

Europe’s EV Push Nearly Faltered Over Fringe Fuels That Are Years Away

The Arctic’s Peak Ice Cover Has Shrunk by an Area Larger Than Egypt

Bloomberg Businessweek

Everyone is freaking out about artificial intelligence, but the risks of disinformation, for one, are far more worrying than apocalyptic scenarios.

The Chainsmokers Are Dancing Through the Silicon Valley Downturn

Tech bros’ favorite music duo have had some flameouts in their VC side hustle. But it’s too soon to write off the band the critics love to hate.

Tough Times for Equity Offerings Bring Back the Art of Winks and Nudges

Companies can’t afford to assume there’s a strong market for new shares, so they have to prepare investors carefully.

UniCredit's Orcel Says It's Time for Banks to Be Conservative

In an interview, the CEO points to risks posed by major shifts in the global economy, geopolitics and trade.

Latest Issues

Work Shift

Fewer Than Half of US Workers Use All Their Vacation Days

Work Shift: How Dodgy Data Cloud the Future of Work

UK Bosses Try to Lure Gen Z Workers With ‘Early Finish Fridays’

Top Tax Mistakes to Avoid If You Make More Than $100,000

Crypto

Coinbase, Do Kwon, Lindsay Lohan Are All Ensnared by Widening Crypto Dragnet

The Chainsmokers Are Dancing Through the Silicon Valley Downturn

Love Island Star Joins Push to Educate Influencers About Finance

Australia Cancels License for Binance’s Derivatives Business

Equality

Tennessee Drag Ban Put On Hold by Trump-Appointed Judge

A Month After Her Very Public Firing, TAP Airline CEO Remains on the Job

English Hospitals Can’t Guarantee Safety During Doctors’ Walkout

Why Uganda’s LGBTQ Community is Under Renewed Fire

CityLab

In a Manhattan Condo, Terra Cotta Marks an Art Deco Revival

New York State Will Be Able to Pay Its Bills and Employees as Budget Talks Drag On

Texas State Bill Targets Local Tenant Protections Against Eviction

Chicago’s Transit Chief Says Crime Is Hurting Ridership Rebound

Bloomberg Wealth

Terry Smith Builds $1 Billion Fortune With Riches Outside UK

Investors Seen Pouring $1.5 Trillion More Into the Safest Money Funds, Barclays Says

BofA Urges Bankers to Take New Roles Focusing On Smaller Deals

UBS Chairman’s Top-Secret Prep Paid Off in Credit Suisse Moment

Screentime

WWE Shares Slide After $9.3 Billion Deal With Endeavor’s UFC

Will Taylor Swift or Beyoncé Have the First $1 Billion Tour?

Tensions Flare Inside NPR After Staff Layoffs and Town Halls

Watching Your Favorite Team Could Cost You More Than Netflix

Pursuits

How Two Friends Built a Hot Swiss Watch Brand in Just Five Years

Britain’s Most and Least Expensive Seaside Locations to Buy a Home

A $1,500 Pair of Featherweight Binoculars Will Make You Love Birdwatching

Google Wants You to Never Overpay for a Flight Again

Markets

Turkey Wants to Negotiate Payments to Iraq Before Oil Exports Resume

Carvana Bondholders May Score Bigger in Bankruptcy Versus Debt Swap

Loan Market Faces More Regulation as Overlooked Lawsuit Heats Up

At €200 Billion, Hermes Surfs Luxury Boom to Surpass Novartis

Zara Owner Gets Approval to Sell Russian Business to UAE’s Daher

Billionaire Saade Forges Ahead With China, Media Deals

Intilion Owner Weighs Rare IPO of Lithium Energy Unit

China Debt-Relief Delay Highlighted as IMF Withholds Zambia Cash

Politics

Japan's Army Says Helicopter Carrying 10 Crashed Into Ocean

Guptas Wanted in South Africa Seen in Switzerland, Africa Intelligence Reports

Berlusconi in ICU for Lung Infection After Leukemia Diagnosis

Contentious Chinese Ship Is Research Vehicle, South Africa Says

Technology

Vietnam Warns TikTok, Social Media Apps Over ‘Toxic’ Content

Billionaire Agarwal’s Chip Dream at Risk as Hurdles Mount

Four Asian Countries Lead in US Chip Diversification Move

Opinion

Universa's 3,126% Return Is Legit (But With an Asterisk)

Whether you believe the gaudy gains are real or not, it’s clear that some “crisis hunters” have a secret sauce that offers value to investors beyond conventional tail-risk strategies.

Will Glencore Go from Predator to Prey in Mining M&A?

With its offer to buy Teck, the world’s largest commodity trader may have also hung out a "for sale" sign visible to its only potential acquirer: BHP

The UK Stock Market Needs Another Nigel Lawson

Taxes are rising and growing increasingly complicated — things have changed for the worse since the late chancellor’s time.

Lending Slowdown Will End the Rate Hike Cycle

Signs will soon start emerging of a potential credit crunch

Paris' Failed Romance With Scooters Is a Warning

The 15-minute city is going to take things a little slower in its bid to go carless.

India’s Leaders Don’t Seem to Believe in Indians

The country’s lame attempt at a trade policy signals a lack of confidence in its ability to compete globally.

No, South Korea Is Not Ready for MSCI’s Elite Club

When the president cannot help but meddle, it’s a sure sign your market has a way to go.

AI May Be Good for Humanity But Very Bad for Warfare

An artificial intelligence arms race between China and the US could be far harder to control than nuclear proliferation was during the Cold War.

Hyperdrive

Ford Sees Only Its Electric F-150 Pickup Truck Getting Full EV Tax Break — for Now

Stellantis Will Build Electric Ram Pickup in the US

Why Europe Is Emerging as a Green Aviation Test Bed

Ford Battery Partner Eyes Expansion in Korea After Clarity on Biden’s Green Subsidies

QuickTake

Economics

Reed Recruitment Chief Executive Calls for Higher Worker Wages

Turkey Wants to Negotiate Payments to Iraq Before Oil Exports Resume

Vietnam Warns TikTok, Social Media Apps Over ‘Toxic’ Content

China Debt-Relief Delay Highlighted as IMF Withholds Zambia Cash

In Case You Missed It

More from Bloomberg

US-China Split Could Hinder Foreign Investment and Lower Global GDP, IMF Warns

IMF Warns Risks From Nonbank Finance Institutions May Intensify

IMF Urges Nations to Use Fiscal Tightening to Tame Inflation

IMF Reaches Staff-Level Deal on $3.5 Billion Ivory Coast Loan

IMF Team Initiates Talks on New Funding Program For War-Wracked Ethiopia

No comments:

Post a Comment