The Role of Inland Ports to Tackle Supply Chain Congestion

Inland ports, also known as dry ports, can help reduce supply chain congestion by providing more options for shippers to move goods:

How inland ports help with supply chain congestion | |

|---|---|

Reduce congestion at seaports | Inland ports can help relieve congestion at nearby port facilities. |

Provide more options for shippers | Inland ports provide access to multiple modes of transportation, including rail, truck, inland waterways, and airports. |

Inland ports can also help businesses gain a competitive advantage by offering the best shipping prices. Some major retailers and importers who use inland ports include Walmart and Home Depot.

:

The Role of Inland Ports to Tackle Supply Chain Congestion

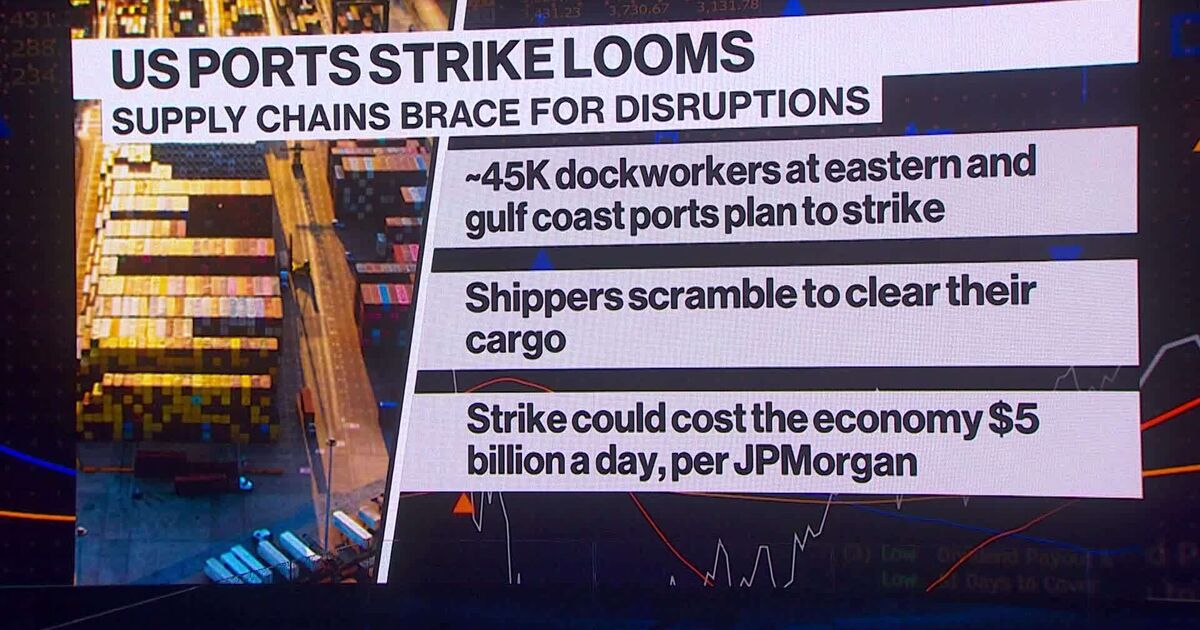

In this episode, Sal Mercogliano - a maritime historian at Campbell University (@campbelledu) and former merchant mariner - discusses the statements by International Longshoreman's Association President Harold Daggett and what a Gulf/East Coast Port strike means for the United States and the global supply chain. #supplychain #strike #labor

Support What's Going on With Shipping via: Patreon: www.patreon.com/wgowshipping Twitter: @mercoglianos Facebook: @wgowshipping Email: mercoglianosal@gmail.com ILA Union https://ilaunion.org/ US Maritime Alliance https://www.usmx.com/

A Candid Conversation With ILA President Harold J. Daggett On Wide Range of Important Topics  • A Candid Conversation With ILA Presid...

• A Candid Conversation With ILA Presid...

Container Shipping Lines Fear Port Strike Will Paralyze Half of U.S. Trade https://gcaptain.com/container-shippi...

ILA Fires Back at USMX’s Unfair Labor Practice ‘Publicity Stunt’ https://gcaptain.com/ila-fires-back-a...

Potential Impact of an International Longshoreman’s Strike https://www.mitre.org/news-insights/p...

The Role of Inland Ports to Tackle Supply Chain Congestion

January 28, 2024

Even before the pandemic hit and historically long lines of cargo ships extended beyond the horizon as they waited to unload, inland ports were viewed as part of a key strategy to help reduce congestion and the capacity crunch at coastal ports.

A 2017 article from Inbound Logistics described the potential of inland ports like this:

“As maritime seaports in North America reach capacity and seek expansion strategies, inland ports have emerged to provide a solution to increased demand on supply chain infrastructure. Though inland intermodal terminals are not a new logistics trend, the rise in the number of inland ports in the United States is providing new strategies in global trade, and relief from capacity headaches plaguing some North American deepwater container ports.”

The article noted that inland ports have been around for decades, and although Class I railroads and commercial real estate developers were the early parties showing interest, “port authorities are getting into the act by developing intermodal terminals that enhance container traffic flow in international commerce.”

In this context, inland ports aren’t viewed as competitors to maritime ports, “but as complementary solutions to relieve capacity for land-constrained port terminals.”

A 2018 Freightwaves article highlighted additional benefits offered by inland ports—which are especially important in light of the current era’s challenging dynamics: “Inland ports can give shippers more options, which can potentially lead to cheaper transport costs and faster transits. This is especially important in an industry in which a capacity crunch has given carriers the upper hand. …In particular, inland ports allow shippers to rely less on the trucking industry, which has been experiencing higher freight rates fueled by increased diesel costs, as well as the driver shortage and capacity crunch.”

With all that’s happened in the years since those articles were written, it’s no wonder inland ports are becoming more popular than ever.

What’s considered an inland port?

The Journal of Commerce describes inland ports like this: “Ordinarily located along Class 1 railroad lines and major road networks, inland ports offer intermodal transfer facilities and international trade processing and other services that may be linked to specific seaports. Distribution centers and other warehousing facilities are generally co-located with inland ports, even on site. Each emerging full-fledged inland port…functions as a hub designed to move international shipments more efficiently and effectively from maritime ports inland for distribution elsewhere.”

Global real estate firm JLL notes that inland ports are “on the rise” and that investors see a “logistics opportunity” in the dynamics involved.

Noting the important role of rail to move cargo away from ports, JLL describes the dilemma: “Large ports lack the road and warehousing infrastructure to cope with the amount of cargo they can process and those located in busy cities cannot build new road networks, so they handle increased volumes by rail.” JLL refers to railways as “rivers of steel” that take cargo to inland areas where land is both more available and more affordable.

Examples of Major Inland Ports

The following provides just a few examples of major inland ports that connect with coastal U.S. ports.

The article noted that inland ports have been around for decades, and although Class I railroads and commercial real estate developers were the early parties showing interest, “port authorities are getting into the act by developing intermodal terminals that enhance container traffic flow in international commerce.”

In this context, inland ports aren’t viewed as competitors to maritime ports, “but as complementary solutions to relieve capacity for land-constrained port terminals.”

A 2018 Freightwaves article highlighted additional benefits offered by inland ports—which are especially important in light of the current era’s challenging dynamics: “Inland ports can give shippers more options, which can potentially lead to cheaper transport costs and faster transits. This is especially important in an industry in which a capacity crunch has given carriers the upper hand. …In particular, inland ports allow shippers to rely less on the trucking industry, which has been experiencing higher freight rates fueled by increased diesel costs, as well as the driver shortage and capacity crunch.”

With all that’s happened in the years since those articles were written, it’s no wonder inland ports are becoming more popular than ever.

What’s considered an inland port?

The Journal of Commerce describes inland ports like this: “Ordinarily located along Class 1 railroad lines and major road networks, inland ports offer intermodal transfer facilities and international trade processing and other services that may be linked to specific seaports. Distribution centers and other warehousing facilities are generally co-located with inland ports, even on site. Each emerging full-fledged inland port…functions as a hub designed to move international shipments more efficiently and effectively from maritime ports inland for distribution elsewhere.”

Global real estate firm JLL notes that inland ports are “on the rise” and that investors see a “logistics opportunity” in the dynamics involved.

Noting the important role of rail to move cargo away from ports, JLL describes the dilemma: “Large ports lack the road and warehousing infrastructure to cope with the amount of cargo they can process and those located in busy cities cannot build new road networks, so they handle increased volumes by rail.” JLL refers to railways as “rivers of steel” that take cargo to inland areas where land is both more available and more affordable.

Examples of Major Inland Ports

The following provides just a few examples of major inland ports that connect with coastal U.S. ports.

Appalachian Regional Port (ARP)

Opened in 2018

Joint effort between the state of Georgia, Murray County, the Georgia Ports Authority and CSX Transportation.

Located on 42 acres in Murray Count in Northwest Georgia

Current capacity: 50,000 containers per year with 10-year development plan to double capacity

Connects with the Port of Savannah: “Exclusive CSX service on a direct, 388-mile rail route to/from Garden City Terminal

“Features easy access to Interstate 75 and U.S. 411”

Inland Port Greer

Owned and operated by the South Carolina Ports Authority (SCPA)

“Rail-served inland port facility in Upstate South Carolina”

“Extends the Port of Charleston’s reach 212 miles inland via rail”

“A dedicated Norfolk Southern train runs 6 days per week and provides overnight service in both directions.

In April of 2021 the SCPA announced plans for expansion

International Inland Port of Dallas (IIPOD)

“An intermodal and logistics district that encompasses 7,500 acres and 5 municipalities

“Direct access to three major interstate highways (I-35, I-20 & I-45)”

“The Union Pacific Dallas Intermodal Terminal in southern Dallas County provides intermodal access to the Ports of Los Angeles and Long Beach”

“Foreign Trade Zone 39 and its alternative site management framework allows for ‘usage-driven’ trade zone sites in the IIPOD area. FTZ designation may allow businesses to delay, reduce or eliminate customs duties on some import categories.”

Logistics Park Kansas City (LPKC)

“A 3,000-acre master-planned distribution and warehouse development in Edgerton, Kansas — just southwest of downtown Kansas City”

“Served by global intermodal transportation leader, BNSF Railway”

“…a world-class inland port with capacity for 17 million square feet of industrial buildings”

“14.4+ million square feet of distribution facilities”

- Connects to Southern California ports via BNSF Railway

Midwest Inland Port

“…a multi-modal transportation hub located in Decatur, Illinois that delivers both domestic and international flexibility for companies through a well-positioned transportation corridor, connecting the Midwest to the East, West and Gulf Coasts of North America”

“Direct access to 4 railroads connecting to all North American rail networks”

“Intermodal ramp with 25-minute average turn times”

“An airport equipped with a U.S. Customs Office, a Fixed-Based Operator (FBO) and runways measuring 8,400’ long and 150’ wide to handle large aircrafts”

THE INTERNMOUNTAIN WEST

Utah Inland Port Authority and the Utah Inland Port

The Utah Inland Port Authority (UIPA) has been in the news over the past year, and its approach is viewed by some as a potential model to deal with ongoing port congestion.

The UIPA says it is “not a singular place; it’s a statewide, generational logistics system,” as described in the following video.

The UIPA says that “An inland port development in Utah has been the subject of studies and countless discussions in and around the Salt Lake City area for more than 40 years. In 2018, a renewed interest spurred the state legislature to create the Utah Inland Port Authority to support the production and movement of goods in and out of Utah.”

- There has been some controversy surrounding the opening of the Utah Inland Port in Salt Lake City, but according to Transport Topics, it opened in 2019 and became “fully operational” in mid-2021.

In May of last year, the UIPA signed a deal with the Port of Oakland to “improve the flow of cargo to and from the Northern California gateway and the Utah logistics system.”

According to a press release, “The cooperative agreement focuses on reducing congestion and cost associated with goods movement through the corridor by optimizing the existing on- and near-dock rail system of the Port of Oakland to reduce dwell times and improve the speed and consistency of rail deliveries to and from Utah. UIPA will, in turn, develop transloading capacity within its jurisdiction to accept those imports and increase export capacity from Utah businesses.”

Quoted in the announcement, Jack Hedge, Executive Director of Utah Inland Port Authority described the positive impact expected: “This partnership is a huge step to establishing Utah as a transformational location in trade logistics. Working directly with the nation’s Western cargo gateways will shape new trade patterns for the Western U.S.”

Referencing the “nonstop trade surge” that showed “no signs of slowing” at the time, Port of Oakland Maritime Director Bryan Brandes said, “This collaboration with the Utah Inland Port Authority creates a path to long-term stability in the supply chain by improving fluidity and velocity as goods move inland.”

In June, the UIPA did the same with the Port of Long Beach (POLB).

Quoted in the announcement, Mario Cordero, Executive Director of the Port of Long Beach said, “This agreement is vital to the Port’s strategic goals to diversify exports and create new partnerships that will help alleviate the unprecedented cargo surge we’ve experienced since last summer. Our enhanced on-dock rail facilities will be crucial in delivering cargo to Utah while also strengthening the Port’s competitiveness and reducing emissions.”

Late last month, the UIPA hosted a meeting with logistics industry leaders to discuss the supply chain challenges that continue to plague the nation and Utah’s role in providing solutions.

According to a press release, “The cooperative agreement focuses on reducing congestion and cost associated with goods movement through the corridor by optimizing the existing on- and near-dock rail system of the Port of Oakland to reduce dwell times and improve the speed and consistency of rail deliveries to and from Utah. UIPA will, in turn, develop transloading capacity within its jurisdiction to accept those imports and increase export capacity from Utah businesses.”

Quoted in the announcement, Jack Hedge, Executive Director of Utah Inland Port Authority described the positive impact expected: “This partnership is a huge step to establishing Utah as a transformational location in trade logistics. Working directly with the nation’s Western cargo gateways will shape new trade patterns for the Western U.S.”

Referencing the “nonstop trade surge” that showed “no signs of slowing” at the time, Port of Oakland Maritime Director Bryan Brandes said, “This collaboration with the Utah Inland Port Authority creates a path to long-term stability in the supply chain by improving fluidity and velocity as goods move inland.”

In June, the UIPA did the same with the Port of Long Beach (POLB).

Quoted in the announcement, Mario Cordero, Executive Director of the Port of Long Beach said, “This agreement is vital to the Port’s strategic goals to diversify exports and create new partnerships that will help alleviate the unprecedented cargo surge we’ve experienced since last summer. Our enhanced on-dock rail facilities will be crucial in delivering cargo to Utah while also strengthening the Port’s competitiveness and reducing emissions.”

- In October of last year, the POLB, the UIPA, and Union Pacific Railroad announced “a bold initiative that brings rapid relief from existing Port congestion by optimizing rail deliveries between California and Utah.”

- Cordero also said that “A direct connection to Utah links two critical points in the supply chain and immediately reduces pressure on terminal storage, gates, chassis, and the local drayage community on the coast. Not only is this a more efficient service for importers in the Intermountain West, but it’s also a major step forward for exporters from the region.”

Late last month, the UIPA hosted a meeting with logistics industry leaders to discuss the supply chain challenges that continue to plague the nation and Utah’s role in providing solutions.

Uploaded: Sep 25, 2024

More than 45,000 workers at ports in the South and Gulf Coast may go on strike, a move that could affect the country's supply chain. CBS News' Errol Barnett reports., CBS News 24/7 is the premier ...

Uploaded: Sep 27, 2024

The east coast is bracing for a labor strike at US ports. International Labor Organization Director-General Gilbert Houngbo speaks with Bloomberg's Scarlet Fu saying " We have to be very clear that ...

No comments:

Post a Comment