Real GDP: Percent change from preceding quarter, Q4 '20

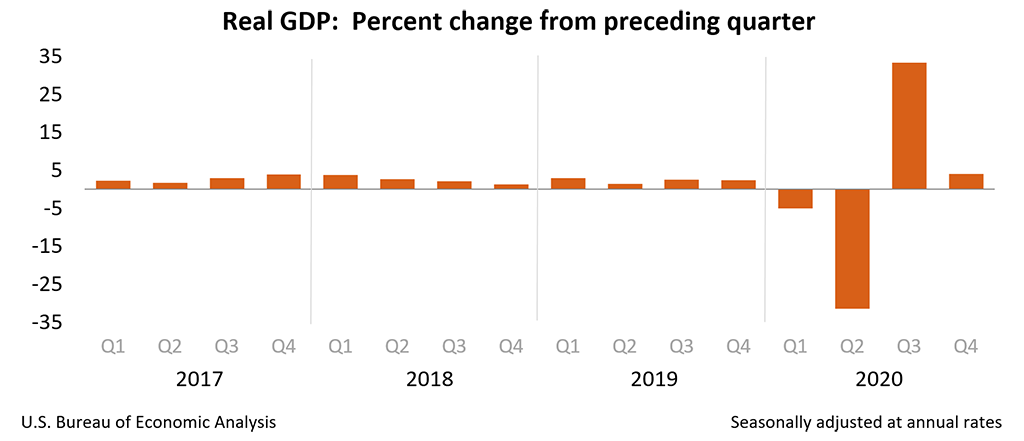

Real GDP decreased 3.5 percent in 2020 (from the 2019 annual level to the 2020 annual level), compared with an increase of 2.2 percent in 2019 (table 1).

The decrease in real GDP in 2020 reflected decreases in PCE, exports, private inventory investment, nonresidential fixed investment, and state and local government that were partly offset by increases in federal government spending and residential fixed investment. Imports decreased (table 2).

The decrease in PCE in 2020 was more than accounted for by a decrease in services (led by food services and accommodations, health care, and recreation services). The decrease in exports reflected decreases in both services (led by travel) and goods (mainly non-automotive capital goods). The decrease in private inventory investment reflected widespread decreases led by retail trade (mainly motor vehicle dealers) and wholesale trade (mainly durable goods industries). The decrease in nonresidential fixed investment reflected decreases in structures (led by mining exploration, shafts, and wells) and equipment (led by transportation equipment) that were partly offset by an increase in intellectual property products (more than accounted for by software). The decrease in state and local government spending reflected a decrease in consumption expenditures (led by compensation).

The increase in federal government spending reflected an increase in nondefense consumption expenditures (led by an increase in purchases of intermediate services that supported the processing and administration of Paycheck Protection Program loan applications by banks on behalf of the federal government). The increase in residential fixed investment primarily reflected increases in improvements as well as brokers' commissions and other ownership transfer costs.

Current-dollar GDP decreased 2.3 percent, or $500.6 billion, in 2020 to a level of $20.93 trillion, compared with an increase of 4.0 percent, or $821.3 billion, in 2019 (tables 1 and 3).

NEW RELEASE

Real gross domestic product (GDP) increased at an annual rate of 4.0 percent in the fourth quarter of 2020 (table 1), according to the "advance" estimate released by the Bureau of Economic Analysis. In the third quarter, real GDP increased 33.4 percent.

> The GDP estimate released today is based on source data that are incomplete or subject to further revision by the source agency (see "Source Data for the Advance Estimate" on page 4). > The "second" estimate for the fourth quarter, based on more complete data, will be released on February 25, 2021.

The increase in real GDP reflected increases in exports, nonresidential fixed investment, personal consumption expenditures (PCE), residential fixed investment, and private inventory investment that were partly offset by decreases in state and local government spending and federal government spending. Imports, which are a subtraction in the calculation of GDP, increased (table 2).

The increase in exports primarily reflected an increase in goods (led by industrial supplies and materials).

The increase in nonresidential fixed investment reflected increases in all components, led by equipment.

The increase in PCE was more than accounted for by spending on services (led by health care); spending on goods decreased (led by food and beverages).

The increase in residential fixed investment primarily reflected investment in new single-family housing.

The increase in private inventory investment primarily reflected increases in manufacturing and in wholesale trade that were partly offset by a decrease in retail trade.

Current‑dollar GDP increased 6.0 percent at an annual rate, or $309.2 billion, in the fourth quarter to a level of $21.48 trillion.

> In the third quarter, GDP increased 38.3 percent, or $1.65 trillion (tables 1 and 3). More information on the source data that underlie the estimates is available in the Key Source and Data Assumptions file on BEA's website.

The price index for gross domestic purchases increased 1.7 percent in the fourth quarter, compared with an increase of 3.3 percent in the third quarter (table 4). The PCE price index increased 1.5 percent, compared with an increase of 3.7 percent in the third quarter. Excluding food and energy prices, the PCE price index increased 1.4 percent, compared with an increase of 3.4 percent.

Personal Income

Current-dollar personal income decreased $339.7 billion in the fourth quarter, compared with a decrease of $541.5 billion in the third quarter.

The decrease in personal income was more than accounted for by decreases in personal current transfer receipts (notably, government social benefits related to the winding down of CARES Act pandemic relief programs) and proprietors' income that were partly offset by increases in compensation and personal income receipts on assets (table 8).

Disposable personal income decreased $372.5 billion, or 8.1 percent, in the fourth quarter, compared with a decrease of $638.9 billion, or 13.2 percent, in the third quarter.

Real disposable personal income decreased 9.5 percent, compared with a decrease of 16.3 percent.

Personal saving was $2.33 trillion in the fourth quarter, compared with $2.83 trillion in the third quarter. The personal saving rate—personal saving as a percentage of disposable personal income—was 13.4 percent in the fourth quarter, compared with 16.0 percent in the third quarter. Additional information on factors impacting quarterly personal income and saving can be found in "Effects of Selected Federal Pandemic Response Programs on Personal Income."

GDP for 2020

Real GDP decreased 3.5 percent in 2020 (from the 2019 annual level to the 2020 annual level), compared with an increase of 2.2 percent in 2019 (table 1).

The decrease in real GDP in 2020 reflected decreases in PCE, exports, private inventory investment, nonresidential fixed investment, and state and local government that were partly offset by increases in federal government spending and residential fixed investment. Imports decreased (table 2).

The decrease in PCE in 2020 was more than accounted for by a decrease in services (led by food services and accommodations, health care, and recreation services). The decrease in exports reflected decreases in both services (led by travel) and goods (mainly non-automotive capital goods). The decrease in private inventory investment reflected widespread decreases led by retail trade (mainly motor vehicle dealers) and wholesale trade (mainly durable goods industries). The decrease in nonresidential fixed investment reflected decreases in structures (led by mining exploration, shafts, and wells) and equipment (led by transportation equipment) that were partly offset by an increase in intellectual property products (more than accounted for by software). The decrease in state and local government spending reflected a decrease in consumption expenditures (led by compensation).

The increase in federal government spending reflected an increase in nondefense consumption expenditures (led by an increase in purchases of intermediate services that supported the processing and administration of Paycheck Protection Program loan applications by banks on behalf of the federal government). The increase in residential fixed investment primarily reflected increases in improvements as well as brokers' commissions and other ownership transfer costs.

Current-dollar GDP decreased 2.3 percent, or $500.6 billion, in 2020 to a level of $20.93 trillion, compared with an increase of 4.0 percent, or $821.3 billion, in 2019 (tables 1 and 3).

The price index for gross domestic purchases increased 1.2 percent in 2020, compared with an increase of 1.6 percent in 2019 (table 4). The PCE price index also increased 1.2 percent in 2020, compared with an increase of 1.5 percent. Excluding food and energy prices, the PCE price index increased 1.4 percent, compared with an increase of 1.7 percent.

Measured from the fourth quarter of 2019 to the fourth quarter of 2020, real GDP decreased 2.5 percent during the period (table 6). That compared with an increase of 2.3 percent during 2019.

The price index for gross domestic purchases, as measured from the fourth quarter of 2019 to the fourth quarter of 2020, increased 1.3 percent during 2020. That compared with an increase of 1.4 percent during 2019. The PCE price index increased 1.2 percent, compared with an increase of 1.5 percent. Excluding food and energy, the PCE price index increased 1.4 percent, compared with an increase of 1.6 percent.

Source Data for the Advance Estimate

Information on the source data and key assumptions used for unavailable source data in the advance estimate is provided in a Technical Note that is posted with the news release on BEA's website. A detailed Key Source Data and Assumptions file is also posted for each release. For information on updates to GDP, see the "Additional Information" section that follows.

* * *

Next release, February 25, 2021 at 8:30 A.M. EST

Gross Domestic Product (Second Estimate) Fourth Quarter and Year 2020

* * *

| Release Dates in 2021 | ||||

|---|---|---|---|---|

| Estimate | 2020 Q4 and Year 2020 | 2021 Q1 | 2021 Q2 | 2021 Q3 |

| Gross Domestic Product | ||||

| Advance Estimate | January 28, 2021 | April 29, 2021 | July 29, 2021 | October 28, 2021 |

| Second Estimate | February 25, 2021 | May 27, 2021 | August 26, 2021 | November 24, 2021 |

| Third Estimate | March 25, 2021 | June 24, 2021 | September 30, 2021 | December 22, 2021 |

Gross Domestic Product by Industry | March 25, 2021 | June 24, 2021 | September 30, 2021 | December 22, 2021 |

| Corporate Profits | ||||

| Preliminary Estimate | --- | May 27, 2021 | August 26, 2021 | November 24, 2021 |

| Revised Estimate | March 25, 2021 | June 24, 2021 | September 30, 2021 | December 22, 2021 |

Resources

Additional resources available atwww.bea.gov:

Definitions

Gross domestic product (GDP), or value added, is the value of the goods and services produced by the nation's economy less the value of the goods and services used up in production. GDP is also equal to the sum of personal consumption expenditures, gross private domestic investment, net exports of goods and services, and government consumption expenditures and gross investment.

Gross domestic income (GDI) is the sum of incomes earned and costs incurred in the production of GDP. In national economic accounting, GDP and GDI are conceptually equal. In practice, GDP and GDI differ because they are constructed using largely independent source data.

Gross output is the value of the goods and services produced by the nation’s economy. It is principally measured using industry sales or receipts, including sales to final users (GDP) and sales to other industries (intermediate inputs).

Current-dollar estimates are valued in the prices of the period when the transactions occurred—that is, at "market value." Also referred to as "nominal estimates" or as "current-price estimates."

Real values are inflation-adjusted estimates—that is, estimates that exclude the effects of price changes.

The gross domestic purchases price index measures the prices of final goods and services purchased by U.S. residents.

The personal consumption expenditure price index measures the prices paid for the goods and services purchased by, or on the behalf of, "persons."

Personal income is the income received by, or on behalf of, all persons from all sources: from participation as laborers in production, from owning a home or business, from the ownership of financial assets, and from government and business in the form of transfers. It includes income from domestic sources as well as the rest of world. It does not include realized or unrealized capital gains or losses.

Disposable personal income is the income available to persons for spending or saving. It is equal to personal income less personal current taxes.

Personal outlays is the sum of personal consumption expenditures, personal interest payments, and personal current transfer payments.

Personal saving is personal income less personal outlays and personal current taxes.

The personal saving rate is personal saving as a percentage of disposable personal income.

Profits from current production, referred to as corporate profits with inventory valuation adjustment (IVA) and capital consumption (CCAdj) adjustment in the National Income and Product Accounts (NIPAs), is a measure of the net income of corporations before deducting income taxes that is consistent with the value of goods and services measured in GDP.

The IVA and CCAdj are adjustments that convert inventory withdrawals and depreciation of fixed assets reported on a tax-return, historical-cost basis to the current-cost economic measures used in the national income and product accounts. Profits for domestic industries reflect profits for all corporations located within the geographic borders of the United States. The rest-of-the-world (ROW) component of profits is measured as the difference between profits received from ROW and profits paid to ROW.

For more definitions, see the Glossary: National Income and Product Accounts.

Statistical conventions

Annual-vs-quarterly rates. Quarterly seasonally adjusted values are expressed at annual rates, unless otherwise specified. This convention is used for BEA's featured, seasonally adjusted measures to facilitate comparisons with related and historical data. For details, see the FAQ "Why does BEA publish estimates at annual rates?" Quarterly not seasonally adjusted values are expressed only at quarterly rates.

Percent changes. Percent changes in quarterly seasonally adjusted series are displayed at annual rates, unless otherwise specified. For details, see the FAQ "How is average annual growth calculated?" and "Why does BEA publish percent changes in quarterly series at annual rates?" Percent changes in quarterly not seasonally adjusted values are calculated from the same quarter one year ago. All published percent changes are calculated from unrounded data.

Calendar years and quarters. Unless noted otherwise, annual and quarterly data are presented on a calendar basis.

Quantities and prices. Quantities, or "real" volume measures, and prices are expressed as index numbers with a specified reference year equal to 100 (currently 2012). Quantity and price indexes are calculated using a Fisher-chained weighted formula that incorporates weights from two adjacent periods (quarters for quarterly data and annuals for annual data). For details on the calculation of quantity and price indexes, see Chapter 4: Estimating Methods in the NIPA Handbook.

Chained-dollar values are calculated by multiplying the quantity index by the current dollar value in the reference year (2012) and then dividing by 100. Percent changes calculated from real quantity indexes and chained-dollar levels are conceptually the same; any differences are due to rounding. Chained-dollar values are not additive because the relative weights for a given period differ from those of the reference year. In tables that display chained-dollar values, a "residual" line shows the difference between the sum of detailed chained-dollar series and its corresponding aggregate.

Updates to GDP

BEA releases three vintages of the current quarterly estimate for GDP: "Advance" estimates are released near the end of the first month following the end of the quarter and are based on source data that are incomplete or subject to further revision by the source agency; "second" and "third" estimates are released near the end of the second and third months, respectively, and are based on more detailed and more comprehensive data as they become available.

The table below shows the average revisions to the quarterly percent changes in real GDP between different estimate vintages, without regard to sign.

| Vintage | Average Revision Without Regard to Sign (percentage points, annual rates) |

|---|---|

| Advance to second | 0.5 |

| Advance to third | 0.6 |

| Second to third | 0.3 |

| Note - Based on estimates from 1993 through 2019. For more information on GDP updates, see Revision Information on the BEA Website. | |

Annual and comprehensive updates are typically released in late July. Annual updates generally cover at least the 5 most recent calendar years (and their associated quarters) and incorporate newly available major annual source data as well as some changes in methods and definitions to improve the accounts. Comprehensive (or benchmark) updates are carried out at about 5-year intervals and incorporate major periodic source data, as well as major conceptual improvements.

Unlike GDP, advance current quarterly estimates of GDI and corporate profits are not released because data on domestic profits and on net interest of domestic industries are not available. For fourth quarter estimates, these data are not available until the third estimate.

GDP by industry and gross output estimates are released with the third estimate of GDP.

But video calls have something email doesn’t: eye contact. We feel more comfortable talking when our listeners’ eyes are visible because we can read their emotions and attitudes. This is especially important when we need more certainty—like when we meet a new team member or listen to a complex idea.

-----------------------------------------------------------------------------------------------------------------------------

| File #: | 21-0141 |

| Type: | Minutes | Status: | Agenda Ready |

| In control: | City Council |

| On agenda: | 2/8/2021 |

| Title: | Approval of minutes of previous meetings as written. |

| Attachments: |

| Meeting Name: | City Council | Agenda status: | Tentative |

| Meeting date/time: | 2/8/2021 5:45 PM | Minutes status: | Draft |

| Meeting location: | Virtual Platform | ||

| Published agenda: |  Agenda Agenda | Published minutes: | Not available | |

| Meeting video: |

| Attachments: |

|

BEA News: Gross Domestic Product by State and Personal Income by S...