Taking on some of issues, Please Note: This column was originally published in NOT SHUTTING UP, a newsletter about the issues facing journalism and democracy >

Why There’s So Much Investigative Journalism About Utility Companies

Including our own. If you know something about a utility company you think we should be looking into, let us know.

------------------------------------------------------------------------------------------------------------------------------

" I have a confession to make. I love stories about utility companies. Always have. Always will.

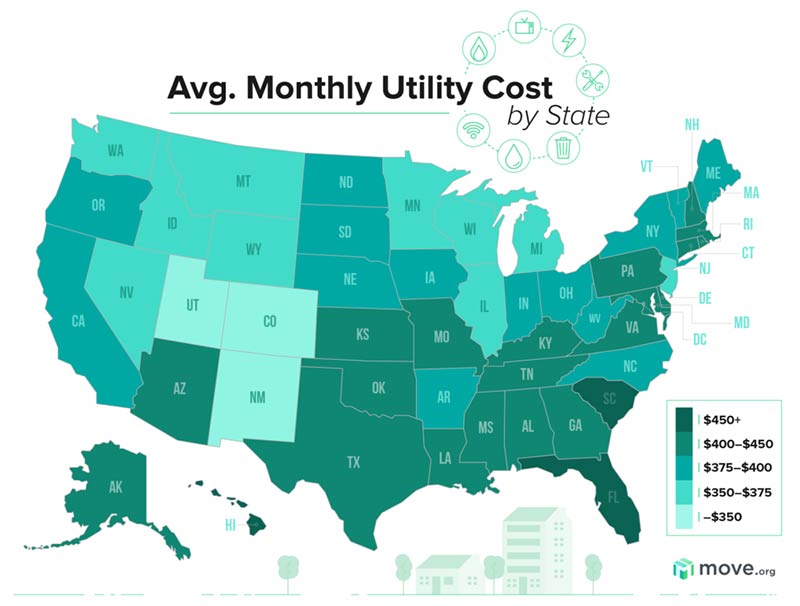

There are several reasons. First, and perhaps foremost, they check the most important box for being the focus of investigative reporting: The services they deliver – electricity and water – touch the lives of nearly everyone. And, they are almost always monopolies. When the grid fails in Texas, or the water system becomes toxic in Flint, Michigan, it’s not like customers can take their business elsewhere.

But after decades in journalism, I have to acknowledge a personal motivation: I like to tackle utility stories because of the degree of difficulty. While no investigative story is ever straightforward, cracking the complexities of power grid management, nuclear power plants or utility rate setting brings a special delight. It’s a little bit like gymnastics. Nothing wrong with brilliantly executing an A-rated move (the easiest), but when Simone Biles lands the floor exercise J move she invented, it’s something to savor. As Wilson points out, the utility has a long history of projects of dubious benefit. Right now, each of its customers is paying $4 per month on their bills for the company’s decision to build one of the last coal-fired power plants in America, a $1.8 billion investment that is used only 11% of the time.

The Times-Dispatch project was one of the proposals we supported in 2020 as part of ProPublica’s Local Reporting Network. When a member of our selection committee pointed out that Wilson had already published several quite good stories on Dominion, I replied that this was an argument for helping him do even more.

The conversation about the Dominion project goes to the heart of why investigative reporting should take aim at utilities. As you look across the injustices we expose at ProPublica, a lot of them share a theme: the tendency of government officials to become overly sympathetic to the industries they are supposed to be overseeing. The problem is known as “regulatory capture,” and we’ve documented it in a myriad of agencies.

The Trump years saw a vast expansion of regulatory capture, but it’s been a feature of both Democratic and Republican administrations for decades.

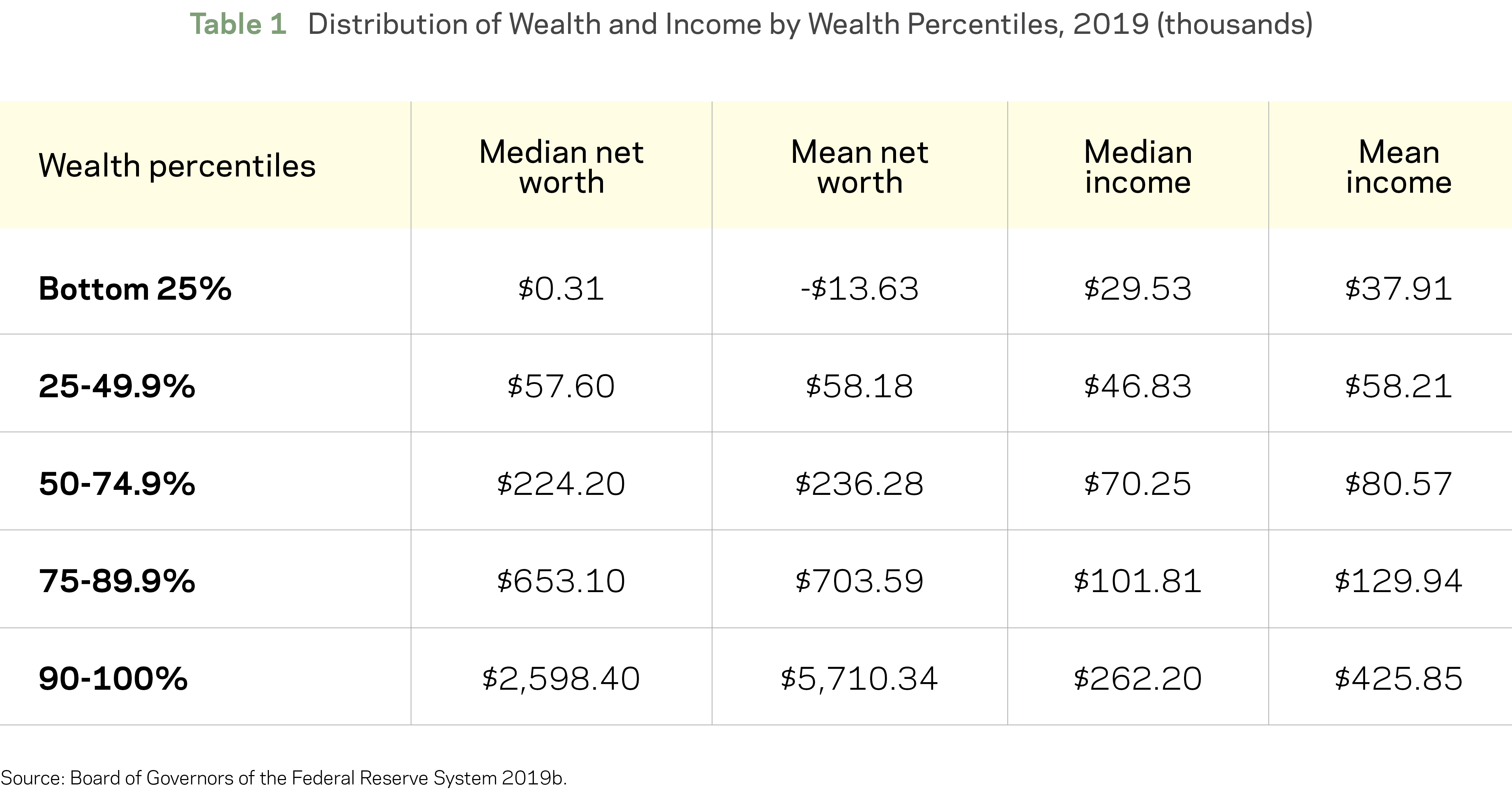

> Our reporting on the continued sales of dangerous car booster seats for children is a classic instance.Regulators had evidence for years that tougher standards were needed, yet they continued to slow-walk new rules. It has been two decades since Congress asked the Department of Transportation to set standards for side impacts involving booster seats. After years of pushback from the industry, those rules still remain unissued. Regulatory capture is ubiquitous in the arcane universe of utility oversight. Because the companies that deliver power and water are regulated monopolies, their rate of return is set by state oversight commissions.

> In Virginia, Dominion Energy is allowed to earn about a 10% return on its assets and investments. The economic justification for this goes back to the earliest days of the power business, when a jumble of companies stringing their own lines to homes eventually whittled down by competition to a single provider that could theoretically charge as much as it wanted to keep the lights on. States stepped in to protect consumers from being gouged, in some cases creating their own utility cooperatives.

It’s not a beat many reporters volunteer for.

The economic formulas used to justify rates are often opaque, even to experts. There’s a ton of jargon, and you have to work really hard to explain things in ways that connect with ordinary readers. (When was the last time you looked at an electricity bill and wanted to know more about the “GRT & other tax surcharges”?)

One of the best people I’ve ever seen at doing this work was Nigel Jaquiss, a journalist who began his career as a Wall Street oil trader for, among other places, Goldman Sachs. Unfortunately, when I was a managing editor of The Oregonian, he worked at Willamette Week, the competing weekly in Portland.

The stories about Goldschmidt won the 2005 Pulitzer Prize for investigative reporting.

Amazingly, that scoop arose from Nigel’s work on the utility beat:

> Goldschmidt, a former governor and cabinet secretary, had returned to public attention in 2003 when he led an out-of-state group that was trying to buy Portland General Electric, the company that delivered electricity to more than 750,000 people in and around downtown Portland. Willamette Week’s revelation about Goldschmidt blew up that deal.

> The Goldschmidt-led group was trying to buy PGE from Enron, the Wall Street darling that had imploded the previous year. During Enron’s bankruptcy proceedings, a tape emerged of conversations between two energy traders that made national headlines. The exchange, one of the better utility scoops of all time, was recorded as California regulators were moving to recoup some of Enron’s high charges for selling electricity to the state. Traders Kevin and Bob were bantering about the 2004 election and the problems elderly Floridians had encountered deciphering a confusingly designed “butterfly” ballot:

Kevin: So the rumor’s true? They’re [expletive] taking all the money back from you guys? All those money you guys stole from those poor grandmothers in California?

Bob: Yeah, Grandma Millie, man. But she’s the one who couldn't figure out how to [expletive] vote on the butterfly ballot.

Kevin: Yeah, now she wants her [expletive] money back for all the power you’ve charged for [expletive] $250 a megawatt-hour.

Bob: You know — you know — you know, Grandma Millie, she’s the one that Al Gore’s fighting for, you know?

More

Because it gave me a chance to catch up with one of the best reporters I’ve ever competed against, I reached out to Nigel for his perspective on why the utility beat is so fruitful.

First, he said, utility companies are an unusually rich source of public records >>>>>> They are required to disclose copious amounts of information to state regulators. Many are publicly traded, which creates Securities and Exchange Commission filings. And when they lobby state legislatures, as many do, they have to file another thick stack of paperwork describing the laws they’re hoping to change. In many states, including Oregon, any attempt to raise rates plays out in what amounts to a court hearing, replete with expert witnesses, depositions and detailed financial filings.

Perhaps most important of all, this is the rare consumer story in which the critics are sophisticated and well-funded. The biggest losers when utility rates go up are big businesses, and they hire phalanxes of lawyers to keep their energy costs low.

Because the math can be daunting, Nigel said, there aren’t a lot of reporters flocking to the beat. “I found that the experts and industry advocates are really eager to talk because hardly anyone ever calls them,” he said. “It’s a fertile hunting ground.”

Nigel added this observation from his home base in Oregon, with a bit of wistfulness:

“What just happened in Texas is going to be feeding investigative reporters for years.”

Including our own. If you know something about a utility company you think we should be looking into, let us know.