This is somewhat academic, but let's see if there are any actual and possible outcomes in what they a White Paper that can be downloaded

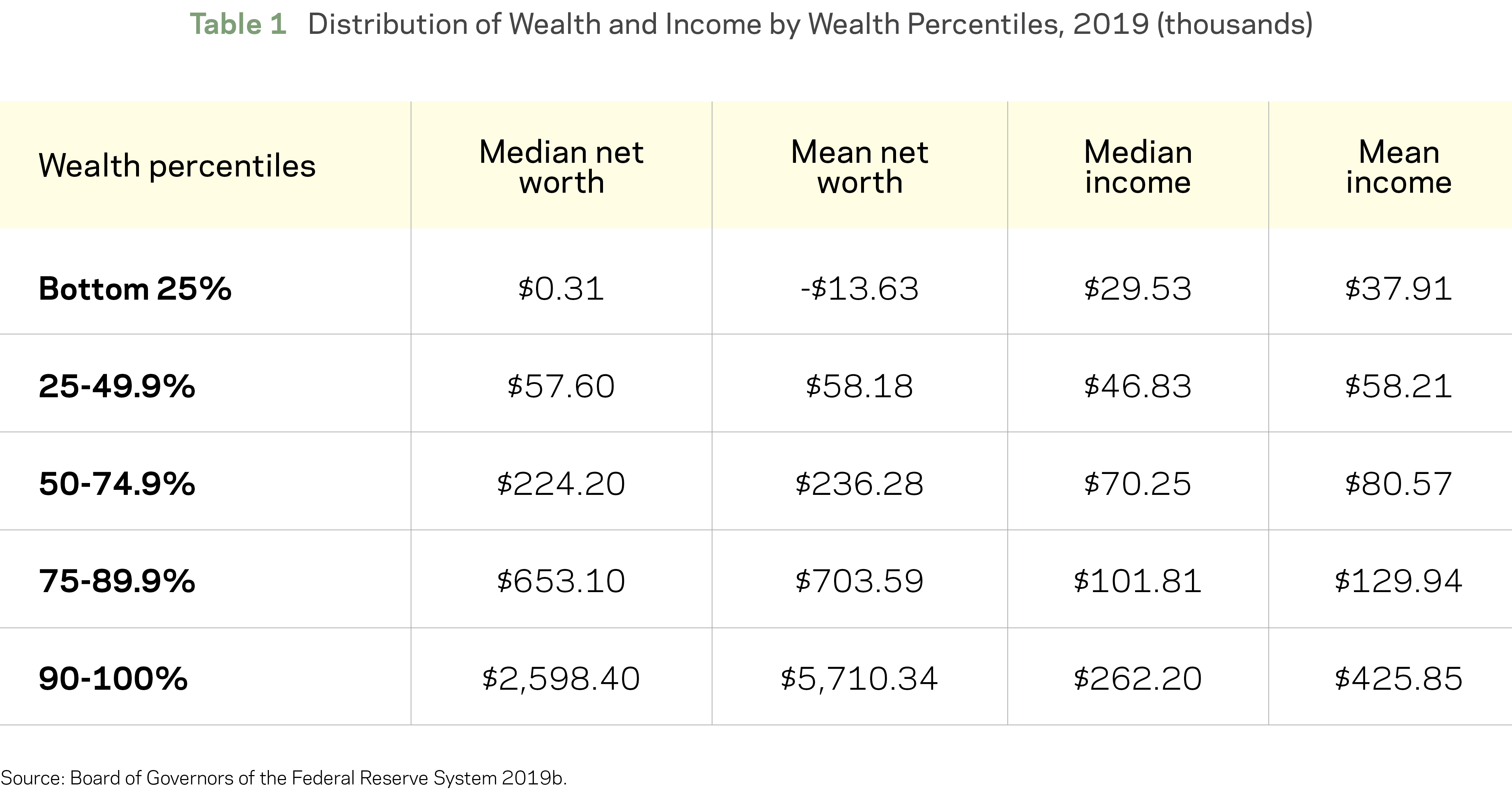

The COVID-19 recession has laid bare the reality of the lack of wealth among millions of American workers in the bottom half of the income distribution, many of whom have disproportionately lost their jobs and have no meaningful assets to fall back on. The median net worth of the bottom 50 percent of American families is $0. Without sufficient wealth or money put aside in savings, low- and moderate-income workers are forced to work into old age, since just one job loss or health crisis could spiral them into poverty. |

|

|

|

No comments:

Post a Comment