| |||||||||||||||||||||||||||

|

Tuesday, February 15, 2022

VISUALIZING DATA FACTS USA: 10 facts to know this Black History Month...Plus the Record CPI Climb Last Month

Maricopa County News Update: Week of Feb. 14

Maricopa County, Arizona was established 151 years ago today and has thrived in ways few could imagine.

Maricopa County, Arizona was established 151 years ago today and has thrived in ways few could imagine.

NEWS BITESFood Bank Funds Food banks across the county are receiving upgrades to their equipment and expanding service capacity thanks to investments totaling $6 million approved by the Maricopa County Supervisors. With more Maricopa County families unsure about where they’ll get their next meal, board members felt it was essential to allocate some federal recovery funds to local food banks. Read the press release >

Black History MonthDuring the month of February we honor the struggles and triumphs of African Americans in Maricopa County and across the country. To learn more, check out Maricopa County Library District’s Featured Collections.

|

Celebrating 150 years of service and information that saves lives, |

What Exactly Do You Do?

They include: |

- Public safety, through the Sheriff’s Office which patrols unincorporated areas and staffs and operates jails

- Public health, through our Public Health, Correctional Health, and Environmental Services Departments

- Elections, through our Elections Department and Recorder’s Office

- Regulatory functions that promote community wellbeing such as air quality, food safety, and development

We also manage parks and libraries, build roads, keep track of vital records, take care of homeless pets, and provide assistance programs to individuals and families from birth to the end of life. In short, we do a

|

|

|

MARICOPA COUNTY: PM10 HIGH POLLUTION ADVISORY February 15, 2022

VIOLATIONS OF FEDERAL CLEAN AIR STANDARDS BY DUST-IN-THE-AIR

Maricopa County: Living Here is Hazardous To Your Health

"High Pollution Advisory" or "HPA" means the highest concentration of pollution may exceed the federal health standard. Active children, adults and people with lung disease such as asthma should reduce prolonged or heavy outdoor exertion. Maricopa County employers enlisted in the Travel Reduction Program are asked to activate their HPA plans on high pollution advisory days.

| ||||||||||

|

> Whose job is it anyway to ensure that Federal Clean Air Standards do not not get consistently violated here? It doesn't look like they are "Doing Their Job"!

> Whose job is it anyway to ensure that Federal Clean Air Standards do not not get consistently violated here? It doesn't look like they are "Doing Their Job"!

Unhealthy for Sensitive Groups AQI category at several monitors in the Phoenix area.

| |

|

> Regulated Businesses

Due to the expected high winds, businesses conducting dust-generating operations need to be vigilant of their dust control measures. Workers may need to cease operating, after stabilizing disturbed areas, if water application and other dust control measures prove ineffective.

Maricopa County Air Quality Department inspectors will be conducting surveillance of fugitive dust sources in the county on days that are deemed high risk for particulate matter. Sources observed violating the particulate matter standards will be issued Notices of Violation.

Transportation Coordinators

Due to unhealthy levels of particulate matter, Maricopa County Air Quality Department requests all Transportation Coordinators to email employees and activate your HPA plans. The department encourages the use of alternative modes of transportation, especially when pollution levels are expected to be on the rise.

Remind employees that they are encouraged to make more clean air. By taking small, simple steps every day, we can all make a difference. Additional tips on how to reduce air pollution can be found at www.CleanAirMakeMore.com.

PM-10 stands for particulate matter measuring 10 microns or less. State and county agencies measure PM-10 and PM-2.5 which are extremely small solid particles and liquid droplets found circulating in the air. PM, or particulate matter, comes from either combustion (cars, industry, woodburning) or dust stirred up into the air.

High levels of PM are typically created when the air is especially stagnant.

Monday, February 14, 2022

'DIGITAL DISCRIMINATION' : FCC Creating a A Task Force for EQUAL ACCESS by prohibiting deployment discrimination based on the income, racial or ethnic composition...

It's 2022 and the FCC has only just announced that it's going to take a look at the problem. Prompted by language in the recently passed infrastructure bill, the FCC has announced it's creating a task force to tackle "digital discrimination":

"Specifically, the Commission must adopt final rules to facilitate equal access to broadband service that prevents digital discrimination and promotes equal access to robust broadband internet access service by prohibiting deployment discrimination based on the income, racial or ethnic composition, and other agency determined relevant factors of a community.

Additionally, the cross-agency Task Force to Prevent Digital Discrimination will oversee the development of model policies and best practices states and local governments can adopt that ensure ISPs do not engage in digital discrimination."

FCC To Take A Closer Look At Racial Discrimination In Broadband Deployment

from the do-not-pass-go,-do-not-collect-$200 dept

"The regional monopolization of U.S. broadband comes with all manner of nasty side effects. The lack of competition at the heart of the country's monopoly and duopoly problem contributed to high prices, comically bad customer service, slow speeds, spotty coverage, annoying fees, and even privacy and net neutrality violations (since there's often no market penalty for bad behavior).

But it also results in "redlining," or when a regional monopoly simply refuses to upgrade minority neighborhoods because they deem it not profitable enough to serve.

____________________________________________________________________________

BLOGGER INSERT: 06 February 2022 (Press Release from the City of Mesa's newsroom)

PLAYING A RIFF: City of Mesa "Takes First Steps" to Bridge The Digital Divide?

Yep there's "a first time" for everything, if we want to understand any given infrastructure, we need to unfold both the political and ethical, as well as the social choices that were done throughout its development. When we talk about the work of an infrastructure, we should always talk about “relations’, not just components of a network

Yep there's "a first time" for everything, if we want to understand any given infrastructure, we need to unfold both the political and ethical, as well as the social choices that were done throughout its development. When we talk about the work of an infrastructure, we should always talk about “relations’, not just components of a network Mesa Takes First Steps to Bridge the Digital Divide

Mesa Takes First Steps to Bridge the Digital Divide

YOU CAN'T FIX A PROBLEM UNLESS YOU FIRST ACKNOWLEDGE THERE'S A PROBLEM

According to a 2021 City of Mesa household survey, 17 percent of participants didn't have internet, with affordability being the barrier preventing them from accessing the web.

According to a 2021 City of Mesa household survey, 17 percent of participants didn't have internet, with affordability being the barrier preventing them from accessing the web.  The City already plans to deploy Wi-Fi and Mobile Broadband infrastructure to the 10 square miles of qualified census tract in west Mesa that showed the greatest need for connectivity at the height of the pandemic, per Mesa Public Schools surveys.

The City already plans to deploy Wi-Fi and Mobile Broadband infrastructure to the 10 square miles of qualified census tract in west Mesa that showed the greatest need for connectivity at the height of the pandemic, per Mesa Public Schools surveys. ____________________________________________________________________________

The National Digital Inclusion Alliance has done some interesting work on this front, showing how companies like AT&T, despite billions in subsidies and tax breaks, routinely just avoids upgrading minority and low income neighborhoods to fiber. Not only that, the group has long showed how users in those neighborhoods also struggle to have their existing (older and slower) services repaired.

[...] The U.S. broadband monopoly problem has been obviously apparent for the last 20 years. 83 million currently live under a broadband monopoly, usually Comcast. You literally cannot find a single instance in the last five years where this problem was candidly acknowledged by regulators and lawmakers of either party, which kind of makes it hard to fix.

It's somehow gotten even worse during the (often justified) policy freak out surrounding "big tech." "Big telecom" has just almost completely fallen off the policy table, and even the idea of having some base levels of accountability for regional monopiles with 20 years of documented, anticompetitive behavior under their belts feels like a distant afterthought. You'll know things have changed when you see an FCC official clearly capable of acknowledging telecom monopolization and corruption are bad things. Until then we seem stuck in the age of half measures and incomplete solutions.

Filed Under: broadband, fcc, racial discrimination

CANNABIS INDUSTRY: Arizona saw more demand for cannabis than other states in the first year of legalization

Intro:

Arizona's Weed Entrepreneurs Sold $1.9 Billion of Marijuana Last Year — That's a Lot of Blunts

Katya Schwenk February 11, 2022 6:44AM

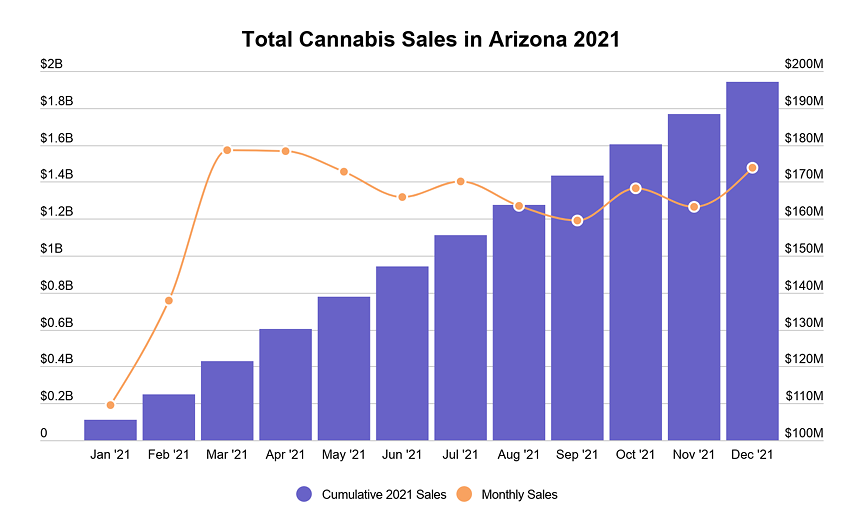

Arizona’s budding cannabis industry generated $1.9 billion in sales from marijuana products last year, far higher than the estimated $1.2 billion in marijuana sales the state tracked through taxes.

Consumer spending on cannabis — both recreational and medical — was measured by Headset, a Seattle, Washington-based market research company that specializes in studying the marijuana industry.

> Medical marijuana has been sold in Arizona since 2010 but recreational cannabis products have been sold to the general public who are at least 21 years old for the first time last year.

Arizona saw more demand for cannabis than other states in the first year of legalization — a sign of industry success, according to the report.

“The trajectory of growth for the first year of operation is very impressive," the report's author Andy Fuller said.

Nevada, for instance, just broke $1 billion in sales last year, four years after recreational cannabis was legalized in the state back in 2017.

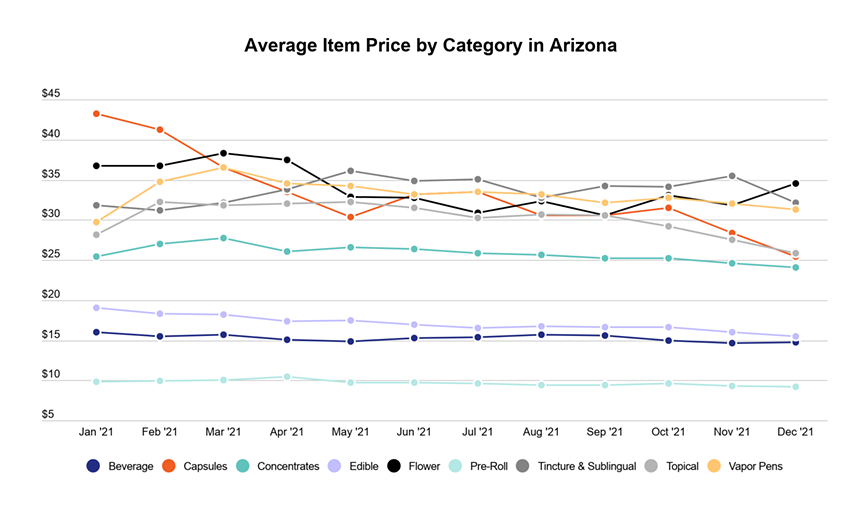

One factor could be that Arizona law allows a much wider range of products to be sold than its counterparts. Here, you can buy not just raw marijuana flower buds to smoke at home, but also a dizzying array of tinctures, THC, and CBD-infused food products, concentrates, topical creams, capsules, and even pre-rolled marijuana blunts.

Here, you can buy not just raw marijuana flower buds to smoke at home, but also a dizzying array of tinctures, THC, and CBD-infused food products, concentrates, topical creams, capsules, and even pre-rolled marijuana blunts.

Demitri Downing, a consultant and CEO of the Marijuana Industry Trade Association, called the nearly $2 billion figure a “very good indicator” for the industry in Arizona. But, he emphasized, the full scope of the cannabis market is not reflected in consumer sales.

“The economic impact of the cannabis industry as a whole is really yet to be measured,” he said. “The rest of the story is all the components.”

Downing is referring to the network of marijuana-affiliated companies that rely on an ecosystem of vendors, suppliers, transportation, manufacturing, warehouse storage, logistics, and marketing.

This doesn't include employee payroll for all the marijuana dispensary workers, warehouse associates, and even security guard contractors who check identification at the front door of retail sales locations. Analysts estimate that in other, more established markets like Colorado and California, the economic impact of the industry ranges in the tens of billions.

Headset, the market research company, looked at strictly recreational and medical consumer sales to come up with its grand total. The company says it uses a variety of point-of-sale data sources to come up with its figures.  Its sales number for Arizona is higher than the $1.2 billion in taxable cannabis sales that the Arizona Department of Revenue reported last month. The state agency has cautioned that its sales figures are still estimates.

Its sales number for Arizona is higher than the $1.2 billion in taxable cannabis sales that the Arizona Department of Revenue reported last month. The state agency has cautioned that its sales figures are still estimates.

"As we finalize January revenues, we may see additional dollars credited to taxable sales from previous months,” Department of Revenue Spokesperson Rebecca Wilder said in an email.

A spokesperson for Headset told Phoenix New Times in a statement that its research department is wary that the taxes collected so far by the state's Department of Revenue do not reflect total sales.

"As the program is new, [the state agency] is still working with providers to help them understand how much taxes are owed," said company spokesperson Morgan Hurley. "We received confirmation in June 2021 and January 2022 that the tax revenues are incomplete as collections are still ongoing, even for previous months."

[...] Purchases of flower — a broad term for dried, smokable pot — accounted for around 47 percent of sales over the course of the year.

[...] Purchases of flower — a broad term for dried, smokable pot — accounted for around 47 percent of sales over the course of the year.

But its share of the sales is slowly decreasing, according to Headset’s data analysis.

More Arizona consumers are buying vapor pens and edibles, as well. And the prices of most goods — from flower to concentrates — decreased over the course of the year, with the exception of vapes and tinctures.

Sam Richard, director of the Arizona Dispensaries Association, said in a statement that the sales numbers spotlighted “the wild success of the Arizona market.”

“I think the tax rate was well-thought-out to encourage people to participate,” he said, comparing Arizona’s regulations to those in California, which levies an additional cultivation tax on growers . .And the success of the first year of recreational cannabis has brought in big dollars to the state: Nearly $200 million in total taxes, according to the Department of Revenue, with more on the way.

It meant that Arizona had proved itself to be a "new frontier" for the cannabis industry, the report concluded."

HEIST-OF-THE-CENTURY? ...a complicated web of transactions to transfer about 25,000 of the 119,754 bitcoin stolen by hackers in 2016

‘Heist of the century’: US bitcoin case tests ability to crack down on cybercrime

Case may be first time government has brought a case not on the basis of an alleged theft, but on the couple’s alleged efforts to conceal their identities

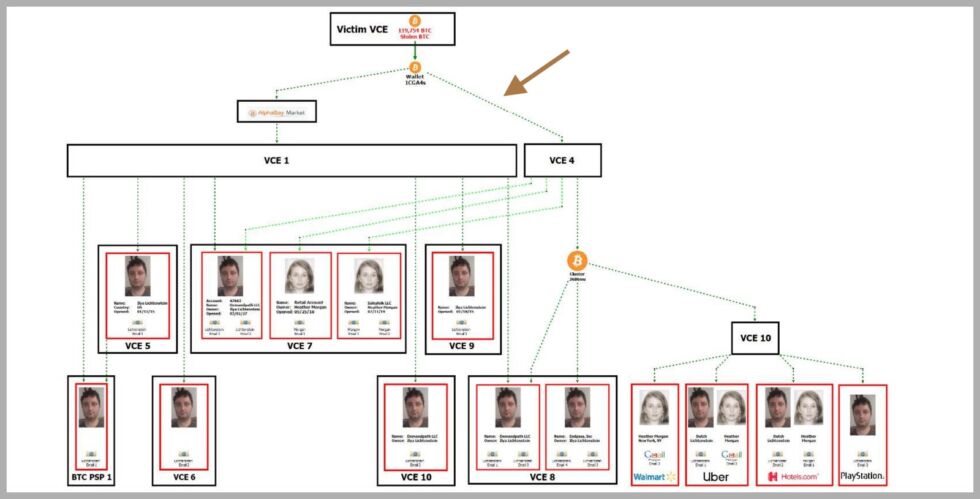

". . .According to the government’s Statement of Facts, the stolen bitcoin was “layered” and “chain-hopped” through a series of virtual wallets to the “darknet market AlphaBay” and then back, and finally on to accounts where it was converted into fiat currency, gift cards and precious metals and withdrawn as cash from bitcoin ATMs.

What may be more fascinating is that the couple at the center of what US prosecutors have described as the largest financial seizure in the history of the Department of Justice were able to utilize so little of the stolen cryptocurrency.

Authorities said more than 80% of the stolen currency remained untouched in accounts associated with the couple and money-laundering allegations against them identify only small sums, including the purchase of a $500 Walmart gift card and gift cards for Uber, Hotels.com and PlayStation. [...]

It may also test the bounds of believability as more and more colorful – and downright bizarre – details emerge of the couple at the heart of the saga which seems to lie at an unlikely nexus between the cryptocurrency, rap, self-help advice and New York eccentricity.

The couple targeted in the sting, Ilya “Dutch” Lichtenstein and Heather Morgan, a self-described “badass money maker”, were charged with conspiracy to commit money laundering and conspiracy to defraud the United States. They are currently on $5m and $3m bail, respectively, but held in custody after a judge in Washington granted an emergency request by the government to keep them detained. . ."

RELATED CONTENT

Dirty laundry —

$3.6 billion bitcoin seizure shows how hard it is to launder cryptocurrency

A “laundry list” of technical measures to cover wrongdoers' tracks didn’t work.

"On Tuesday, Ilya Lichtenstein and Heather Morgan were arrested in New York and accused of laundering a record $4.5 billion worth of stolen cryptocurrency. In the 24 hours immediately afterward, the cybersecurity world ruthlessly mocked their operational security screwups: Lichtenstein allegedly stored many of the private keys controlling those funds in a cloud-storage wallet that made them easy to seize, and Morgan flaunted her “self-made” wealth in a series of cringe-inducing rap videos on YouTube and Forbes columns.

But those gaffes have obscured the remarkable number of multi-layered technical measures that prosecutors say the couple did use to try to dead-end the trail for anyone following their money. Even more remarkable, perhaps, is that federal agents, led by IRS Criminal Investigations, managed to defeat those alleged attempts at financial anonymity on the way to recouping $3.6 billion of stolen cryptocurrency. In doing so, they demonstrated just how advanced cryptocurrency tracing has become—potentially even for coins once believed to be practically untraceable.

“What was amazing about this case is the laundry list of obfuscation techniques [Lichtenstein and Morgan allegedly] used,” says Ari Redbord, the head of legal and government affairs for TRM Labs, a cryptocurrency tracing and forensics firm. Redbord points to the couple's alleged use of "chain-hopping"—transferring funds from one cryptocurrency to another to make them more difficult to follow—including exchanging bitcoins for "privacy coins" like monero and dash, both designed to foil blockchain analysis. Court documents say the couple also allegedly moved their money through the Alphabay dark web market—the biggest of its kind at the time—in an attempt to stymie detectives.

Yet investigators seem to have found paths through all of those obstacles. "It just shows that law enforcement is not going to give up on these cases, and they’ll investigate funds for four or five years until they can follow them to a destination they can get information on," Redbord says.

GET MORE CURIOUS Hmmm...In July 2017, however—six months after the IRS says Lichtenstein moved a portion of the Bitfinex coins into AlphaBay wallets—the FBI, DEA, and Thai police arrested AlphaBay's administrator and seized its server in a data center in Lithuania. That server seizure isn't mentioned in the IRS's statement of facts

"In a 20-page "statement of facts" published alongside the Justice Department's criminal complaint against Lichtenstein and Morgan on Tuesday, IRS-CI detailed the winding and tangled routes the couple allegedly took to launder a portion of the nearly 120,000 bitcoins stolen from the cryptocurrency exchange Bitfinex in 2016. Most of those coins were moved from Bitfinex's addresses on the Bitcoin blockchain to a wallet the IRS labeled 1CGa4s, allegedly controlled by Lichtenstein. Federal investigators eventually found keys for that wallet in one of Lichtenstein's cloud storage accounts, along with logins for numerous cryptocurrency exchanges he had used.

But to get to the point of identifying Lichstenstein—along with his wife, Morgan—and locating that cloud account, IRS-CI followed two branching paths taken by 25,000 bitcoins that moved from the 1CGa4s wallet across Bitcoin's blockchain. One of those branches went into a collection of wallets hosted on AlphaBay's dark web market, designed to be impenetrable to law enforcement investigators. The other appears to have been converted into monero, a cryptocurrency designed to obfuscate the trails of funds within its blockchain by mixing up the payments of multiple monero users—both real transactions and artificially generated ones—and concealing their value. Yet somehow, the IRS says it identified Lichtenstein and Morgan by tracing both those branches of funds to a collection of cryptocurrency exchange accounts in their names, as well as in the names of three companies they owned, known as Demandpath, Endpass, and Salesfolk.

The IRS hasn't entirely spelled out how its investigators defeated those two distinct obfuscation techniques. But clues in the court document—and analysis of the case by other blockchain analysis experts—suggest some likely theories. . .

>

The IRS's explanation doesn't mention at what point the money in Lichtenstein's bitcoin wallet was converted into the monero that later appeared in those two exchange accounts. Nor, more importantly, does it say how investigators continued to follow the cryptocurrency despite Monero's features designed to thwart that tracing—a feat of crypto-tracing that has never before been documented in a criminal case.

It's possible that the IRS investigators didn't actually trace monero to draw that link, points out Matt Green, a cryptographer at Johns Hopkins University and one of the cocreators of the privacy-focused cryptocurrency zcash. They may have found other evidence of the connection in one of the defendant's records, just as they found other incriminating files in Lichtenstein's cloud storage account, though no such evidence is mentioned in the IRS's statement of facts. . .IRS Criminal Investigations declined to comment on the Bitfinex case beyond the public documents it has released, and Chainalysis declined to say whether it had been part of the investigation—much less whether it had helped the IRS to trace monero. . ."

========================================================================

-

Flash News: Ukraine Intercepts Russian Kh-59 Cruise Missile Using US VAMPIRE Air Defense System Mounted on Boat. Ukrainian forces have made ...