Following The Law-of-One-Thing-Leads-To-Another, let"see one example starting on in Kansas that ended up in Texas. ALL ABOUT RELIGION ✓. ✓

Florida Schools Freeze Book Donations, Purchases In Wake Of Censoring Law

Book donations and purchases have been halted in at least one Florida school district for the remainder of 2022 in the wake of a new state law that requires books to be pre-approved by state-certified media specialists, who aren’t currently available

Texas School District Decides To Just Ban All Books Flagged For Review… Including The Bible

from the this-should-go-well dept

If you’re not familiar with the story and history behind the Church of the Flying Spaghetti Monster, then go read up on it, because it’s a great story. For you lazy bums out there, I’ll summarize it thusly. A 24-year old in Oregon got sick of religious types in Kansas trying to inject the teaching of intelligent design in public education institutions under the guise of “teaching the debate” or “equal time” with, well, actual science. As a result, he created a spoof religion centering on a monster made of pasta that uses his noodley appendages to do all kinds of things in our world, including changing carbon dating results so as to hide the actual age of the world and universe. He then argued for “equal time” for this religion in Kansas, stating that if it was good enough for Christians, it was good enough for “Pastafarians”.

Why do I bring this up? Well, because it’s always interesting to see

those who would inject their own personal beliefs into public

institutions of learning have their arguments turned right around on

them in ways that were . . .

The bible, in most of its iterations, has plenty to say about violence, sexuality, and all other matters of personal morality. Much like many of the other books the community and government flagged for removal. But somehow I doubt that those in favor of pulling books on gender as a subject matter also wanted the Bible pulled for the same reason. Call me crazy, but I think I’m on fairly solid ground here.

And, so, in the interest of banning books they don’t like, it sure seems like a fair number of the religious have gotten their own sacred text banned. And, to be clear: that sucks! It is a terrible thing that students cannot study a religious text while in school, assuming that studying is secular in nature.

But it also sucks that they can’t study gender issues, LGBTQ+ matters, and the like. So, maybe we just stop banning books now?

Filed Under: book banning, challenged books, culture, dallas, diary of anne frank, libraries, the bible

Companies: keller isd

✓✓

Exploring Pastafarianism And The Church Of The Flying Spaghetti Monster

The Church of the Flying Spaghetti Monster has some weird rituals, but the founding of Pastafarianism might be the most interesting part.

“I’d really rather you didn’t build multimillion-dollar synagogues/churches/temples/mosques/shrines to [His] Noodly Goodness when the money could be better spent ending poverty, curing diseases, living in peace, loving with passion and lowering the cost of cable.”

Thus begins the “Eight I’d Really Rather You Didn’ts,” the code by which people known as Pastafarians live. Pastafarians are, of course, the devout followers of the Church of the Flying Spaghetti Monster, a very real, very legitimate religious organization.

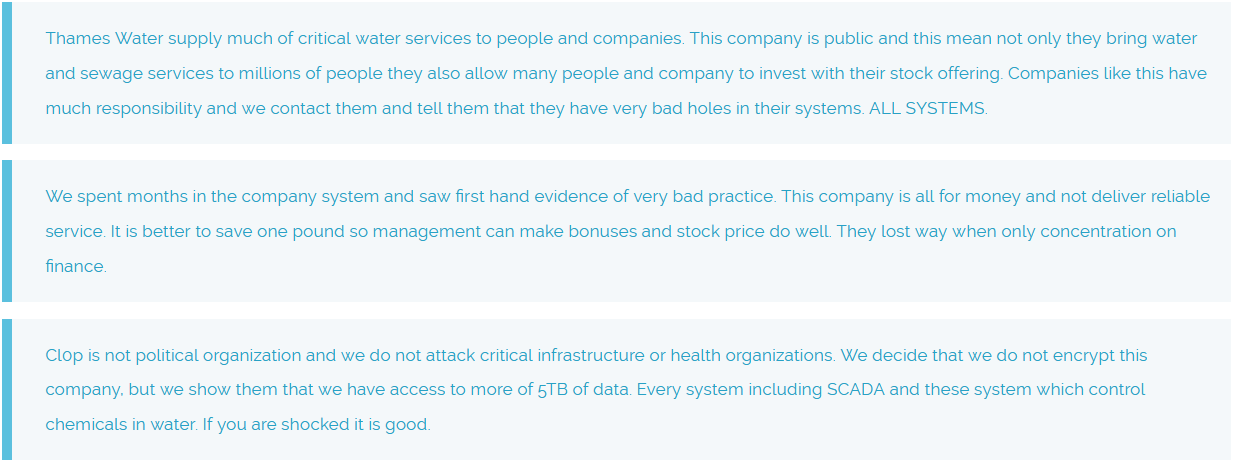

Wikimedia CommonsTouched By His Noodly Appendage, a parody of The Creation of Adam.

Founded in 2005 by 24-year-old Bobby Henderson, the initial goal of the Church of the Flying Spaghetti Monster was to prove to the Kansas State Board of Education that creationism should not be taught in public schools.

In an open letter to the board, Henderson satirized creationism by offering his own belief system. He claimed that whenever a scientist carbon-dated something a supernatural deity known as His Noodly Goodness, a ball of spaghetti with two giant meatballs and eyes, is there “changing the results with His Noodly Appendage.”

His point, no matter how frivolous it sounded, was that evolution and intelligent design should be given equal time in science classrooms.

“I think we can all look forward to the time when these three theories are given equal time in our science classrooms across the country, and eventually the world; one-third time for Intelligent Design, one-third time for Flying Spaghetti Monsterism, and one-third time for logical conjecture based on overwhelming observable evidence,” the letter read.

When the letter gained no immediate response from the board, Henderson put it online where it effectively blew up. As it became an internet phenomenon, board members began sending their responses, which were for the most part, in his corner.

Before long, Pastafarianism and the Flying Spaghetti Monster had become symbols for the movement against teaching intelligent design in classrooms. Just a few months after his letter went viral, a book publisher reached out to Henderson, offering him an $80,000 advance to write a gospel. In March of 2006, The Gospel of the Flying Spaghetti Monster was published.

Wikimedia CommonsThe gospel, along with the religions iconography, a play on the Christian fish symbol.

The Gospel of the Flying Spaghetti Monster, like other religious texts, outlines the tenets of Pastafarianism, though usually in a way that satirizes Christian religion. There is a creation myth, a description of holidays and beliefs, a concept of the afterlife, and of course, several delicious pasta puns.

The creation story begins with the creation of the universe, just 5000 years ago, by an invisible and undetectable Flying Spaghetti Monster. On the first day, he separated water from the heavens. On the second day, getting tired of swimming and flying, he created land – most notably the beer volcano, the central fixture in the Pastafarian afterlife.

After indulging in his beer volcano a little too much, the Flying Spaghetti Monster drunkenly created more seas, more land, Man, Woman, and the Olive Garden of Eden.

Wikimedia CommonsCaptain Mosey receiving the commandments.

After creating his delicious world, The Flying Spaghetti Monster decided that his people, named Pastafarians after His Noodly Goodness, needed a set of guidelines by which to live to reach the afterlife. An afterlife that he highly encouraged attempting to reach, as it includes access to the beer volcano, as well as a stripper factory. The Pastafarian version of hell is pretty much the same, though the beer is flat and the strippers have STDs.

So, to receive these guidelines, Mosey the Pirate Captain (because Pastafarians most notably started out as pirates), traveled up to Mount Salsa, where he was given the “Ten I’d Really Rather You Didn’ts.” Unfortunately, two of the 10 were dropped on the way down, so ten became eight. The dropping of these two rules is, allegedly, what caused Pastafarians’ “flimsy moral standards.”

Holidays in Pastafarianism are also covered in the gospel, which decrees every Friday a holy day and the birthday of the man who created instant Ramen noodles a religious holiday.

Despite the utter ridiculousness of the Church of the Flying Spaghetti Monster as a whole, the religion has received actual recognition as a religion. There are hundreds of thousands of followers worldwide, mostly centralized in Europe and North America and almost entirely opponents of intelligent design.

In 2007, talks about the Flying Spaghetti Monster were offered at the American Academy of Religions annual gathering, which analyzed Pastafarianism’s basis for functioning as a religion. A panel was also offered to discuss the merits of the religion.

Pastafarianism and the Church of the Flying Spaghetti Monster are often brought up in religious disputes, especially when the disputes regard the teaching of intelligent design. It has succeeded in halting efforts to teach creationism over evolution in several states, including Florida.

Wikimedia CommonsPastafarians wearing colanders as hats.

Since 2015, Pastafarian rights are also recognized.

A Pastafarian minister in Minnesota won the right to officiate weddings after he complained that not allowing him to do so would be considered discrimination against atheists.

Official individual recognition has also been allowed by the government. In official identification photos, such as a driver’s license, Pastafarians retain the right to wear an upside-down colander as a hat, and military members can list “FSM” for “Flying Spaghetti Monster” as their religion on their dog tags.

Though there have been critics of his work over the years, Henderson believes that his original intent still shines through to all who join Pastafarianism. The organization started out as a way to show that religion shouldn’t interfere in government, and indeed, it has been used to prove the point again and again.

Quite obviously an explanation is on order: "I touched his noodly appendage"

✓

✓

<meta charset="utf-8"></meta>[#image: /photos/57e17740bf7e91497a10e1e0]||||||Photograph courtesy of Niko Alm/BBC="">

Victory has arrived for both believers in the Flying Spaghetti Monster and wearers of kitchen equipment worldwide.

After a battle with Austrian authorities, Niko Alm won the right to wear a colander on his head in his driver's license photo. As a Pastafarian, he argued that the holey hat was "religious headgear," and it is now officially recognized as such.

<meta charset="utf-8"></meta>Photograph courtesy of Niko Alm/<meta charset="utf-8"></meta>BBC

This triumph comes after Alm's initial request three years ago to be pictured with the sacred pasta strainer prompted officials to require a doctor's note confirming that he was "psychologically fit" to operate a motor vehicle.

He is now moving to get Pastafarianism listed as an officially recognized faith in his homeland.

For those unfamiliar, Pastafarianism is areligion (well ok, a parody of religion) based on the worshipof the Flying Spaghetti Monster, a mystical, pasta-tentacled being madeof spaghetti and meatballs. It was founded as satirical protest againstthe Kansas Board of Education's decision to allow intelligent design tobe taught in schools. The original Pastafarian, Bobby Henderson, demanded theteachings of the Gospel of the FSM be given equal play in classrooms

.jpg)

.jpg)

.png)

.png)

.jpg)

.gif)

.jpg)

.jpg)

0

0