Thursday, May 04, 2023

Urbanism: Not Just a Big City Thing!

China issues report on U.S. CIA's cyberattacks on other countries

China issues report on U.S. CIA's cyberattacks on other countries

/CFP

The Chinese authorities released a report on Thursday to reveal the cyberattacks conducted by U.S. intelligent agency toward other countries over the years.

China's National Computer Virus Emergency Response Center and Chinese cybersecurity company Qihoo 360 Technology Co. Ltd. jointly released an investigation report on the U.S. Central Intelligence Agency's (CIA) cyberattacks against other countries and the consequences it led.

The cybersecurity firm Qihoo 360 discovered an unknown cyberattack organization in 2020 which carried out a slew of cyberattacks toward China and other countries by utilizing cyber tools related to CIA.

Such cyberattacks can be traced back to the year of 2011, and continue to this day. The targets of such espionage actions expand to fields such as countries' key information infrastructure, aerospace sector, scientific research institutes, petroleum industry, tech companies as well as government agencies.

The report unveils that the CIA took advantages of zero-day vulnerability, including a number of backdoors and vulnerabilities that haven't been disclosed to the public. This was done to set up "zombie" networks to initiate springboard attacks by stages, targeting web servers, terminals, routers, as well as industrial control devices. The zero-day vulnerability are software loopholes that are discovered by attackers before the vendor has become aware of them.

In the joint investigation, the team captured a plethora of malware such as Trojan programs and plug-ins related to the CIA. All the cyberattacking weapons were strictly standardized, processed and underwent professional software engineering management, which only the CIA abides by these standards and specifications to develop cyberattack weapons.

The investigation also found that the CIA's cyberattackes cover all networks which enables the CIA to easily steal sensitive data of other countries at any time.

Read more: U.S. hacked China 10,000 times, stole 140GB of critical data

The U.S. National Security Agency conducted over 10,000 malicious cyberattacks on China in recent years, a report said on Monday. /CFP

The U.S. National Security Agency (NSA) conducted over 10,000 cyberattacks against China in recent years and is suspected to have stolen 140 gigabytes of valuable data, according to a joint investigation report released on Monday by China's National Computer Virus Emergency Response Center (CVERC) and internet security company Qihoo 360 Technology Co. Ltd.

New China's Lithography Machine FINALLY Made official | China to Lead Se...

Within hours of the Federal Reserve’s latest policy decision, traders and commentators alike had started to challenge Chair Jerome Powell’s assessment of the economy.

Pushback Against Powell’s Prognosis Comes Almost Immediately

Within hours of the Federal Reserve’s latest policy decision, traders and commentators alike had started to challenge Chair Jerome Powell’s …

Pushback against Powell’s prognosis comes almost immediately

Within hours of the Federal Reserve’s latest policy decision, traders and commentators alike had started to challenge Chair Jerome Powell’s assessment of the economy.

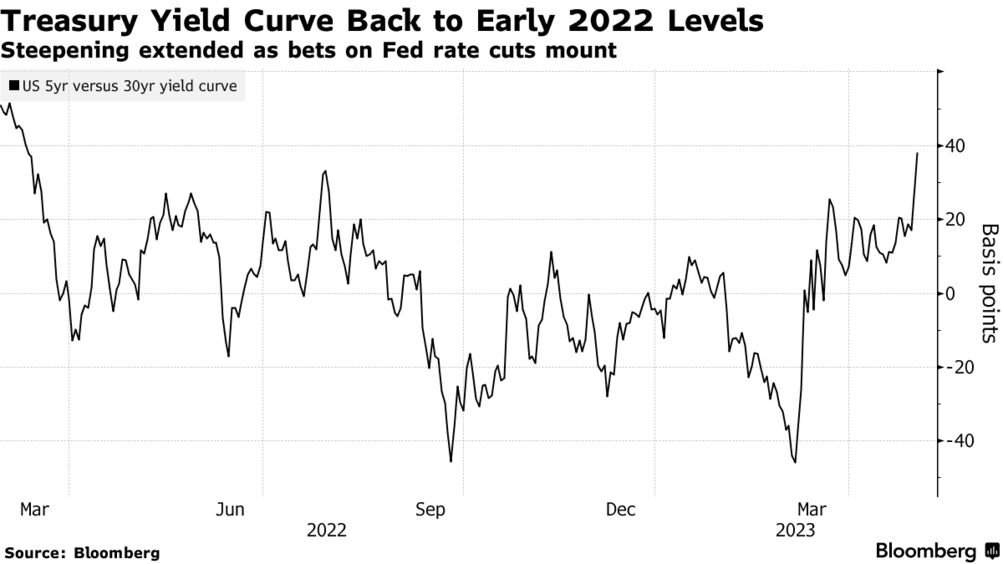

The bond market waved off the prospect that Powell might have one more hike up his sleeve, instead adding to bets the US central bank’s next move will be to cut its benchmark interest rate. A slide in crude oil prices indicated mounting concern over a recession that the Fed chair said could be avoided. And financial stocks tumbled anew even after Powell had seen a line being drawn under US bank turmoil.

DoubleLine Capital’s Jeffrey Gundlach told CNBC there’s an increased likelihood of a recession and the Fed likely won’t lift interest rates again following its latest increase. Meanwhile, over at the Milken Institute Global Conference, talk among the panelists suggested a consensus view that a contraction is inevitable.

WTI crude sank 4.3 percent Wednesday, reflecting concerns about weakening economic growth in major economies. It tumbled as much as 7.2 percent in a chaotic market open Thursday before recovering.

“Our view is for a technical recession, when is the question mark,” said Lindsay Rosner, multi-sector portfolio manager at PGIM Fixed Income. “If Powell just laid out the framework they are operating under is one of modest growth, not recession, it would suggest they need to change their course if they see a recession. That is why we believe they will have to cut.”

To be fair to Powell, he did hint Wednesday’s interest-rate increase, which took the benchmark rate above 5 percent, could be the last one in a cycle that’s lifted borrowing costs from near-zero levels last year. While the Fed chief said there was strong support for raising rates by 25 basis points this week, he suggested officials may pause their tightening campaign in June.

Powell also acknowledged that the pace of bank lending has slowed. And US economic data, while pointing to a slowdown in the labor market, don’t yet signal a recession is on hand.

Rapid response

But news moves fast and traders are wont to anticipate rather than wait to see how things pan out.

Treasuries surged Wednesday as investors reinforced bets that Fed rates will be lower by the end of this year, despite Powell’s insistence that the central bank’s inflation outlook doesn’t support easier policy. By the end of the day even swap contracts for June were pointing to the effective fed funds rate being lower.

Meantime, a Bloomberg News report that PacWest Bancorp was considering its strategic options redoubled concern that turmoil among smaller US banks would claim more victims and tighten credit conditions.

Four US banks have collapsed since early March, including First Republic Bank, which federal regulators seized this week. Powell called the resolution of First Republic an “important step toward drawing a line” under bank turmoil.

Yet the PacWest report triggered a fresh selloff in financial stocks in after-market trading.

“The market will be looking for signs that credit tightening is starting to impact activity and labor market data,” said Vassili Serebriakov, FX and macro strategist at UBS Securities in New York. “Since the Fed hinted at a pause today, any weakness in the data would reinforce the view that the tightening cycle is over.”

Powell said Wednesday it’s possible the US could experience what he hopes would be a mild recession, but “the case of avoiding a recession is in my view more likely than that of having a recession.” Wage increases have been moving down, and job openings have declined but have not been accompanied by rising unemployment, he said.

But at the Milken conference attendees expressed concerns. Guggenheim Capital Chairman Alan Schwartz told Bloomberg Television he’s worried about the effects of credit tightening and how far banks will have to pull back. Jenny Johnson, chief executive officer at Franklin Templeton, also pointed to the stress in the banking system caused by the pace of Fed hikes and the possibility of further retrenchment as a result.

Gundlach, DoubleLine Capital’s co-founder, cited the cumulative rate increases by the Fed since March 2022 and credit contraction for reasons he’s “turning more bearish at this point in time.” The Fed likely won’t lift interest rates again following its latest increase, he said. “Recessionary odds are pretty darn high right now.”

With assistance from Matthew Boesler, Rob Verdonck, Michael Mackenzie, Brandon Sapienza, Stacey Shick and Matthew Burgess / Bloomberg

NASA Awards Contracts for NOAA Coronagraph CME Studies

NASA awards contracts for NOAA coronagraph studies

LONG BEACH, Calif. – NASA selected five organizations to conduct studies of coronagraphs to fly on National Oceanic and Atmospheric Administration’s future space weather satellites.

Johns Hopkins Applied Physics Lab, EO Vista, the University of Colorado Laboratory for Atmospheric and Space Physics, Raytheon Intelligence & Space and Southwest Research Institute won $800,000 contracts to perform definition-phase studies of the coronagraph destined for the NOAA Space Weather Next Lagrange 1 mission. The eight-month contracts include $400,000 options to continue the coronagraph studies for an additional four months.

With information derived from the studies, NOAA plans to establish requirements for the coronagraph, which the agency plans to launch on the Space Weather Next Lagrange 1 mission. The coronagraphs are designed to supply NOAA with imagery of the sun’s corona. The imagery helps forecasters detect and characterize coronal mass ejections.

NASA plans to award coronagraph development contracts on behalf of NOAA in 2024.

Space Weather Next Lagrange 1 is a successor to the Space Weather Follow-On mission that is scheduled to travel to Lagrange 1 in 2025 on NASA’s Interstellar Mapping and Acceleration probe.

The Space Weather Next program was established to ensure NOAA has a continual supply of solar imagery and data into the 2030s.

In its 2024 budget request, NOAA is asking Congress to provide $225 million for the Space Weather Next program, an increase of $73.4 million from the $151.6 million appropriated in 2023.

-

Flash News: Ukraine Intercepts Russian Kh-59 Cruise Missile Using US VAMPIRE Air Defense System Mounted on Boat. Ukrainian forces have made ...