Saturday, August 02, 2025

SMOOT-HAWLEY TARIFF ACT LEGACY: historical example of the potentially negative consequences of protectionist trade policies on a global scale

The Global Impact of Trump's Tariff Surge on Equity Markets and Growth Outlook

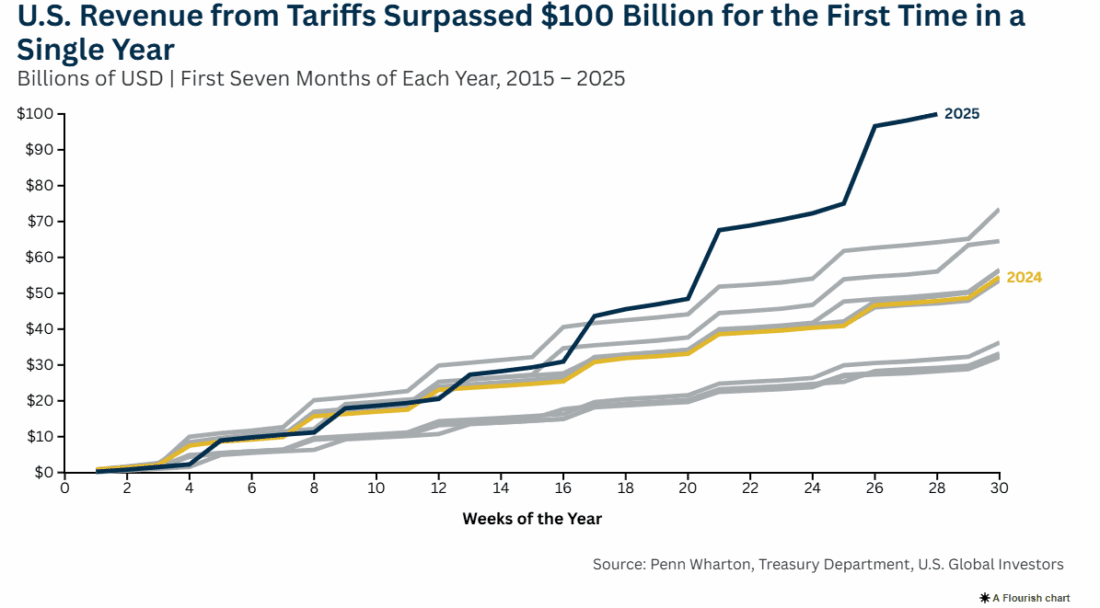

- Trump's 2017-2025 tariffs reshaped global trade, triggering retaliation and equity market volatility.

- U.S. average tariffs hit 22.5%, raising costs for automakers and destabilizing metal markets with 50% copper/aluminum tariffs.

- J.P. Morgan estimates 1% global GDP loss in 2025, with emerging markets facing sharper contractions.

- Equity markets show caution; defensive sectors outperform as tariffs disrupt supply chains and consumer spending.

- Latin America and AI sectors offer asymmetric opportunities amid trade realignments and AI-driven demand.

. As investors navigate this new era, understanding the long-term implications of these policies is critical to identifying both risks and opportunities in a world where trade barriers are no longer temporary but structural.

The 2018 steel and aluminum tariffs, the China trade war, and the 2025 universal tariff hikes have collectively pushed the U.S. average effective tariff rate to 22.5%—the highest since 1909.

- These policies, while aimed at reducing trade deficits and protecting manufacturing, have instead inflated input costs for downstream industries.

Ask Aime: Are 2025 tariffs set to disrupt supply chains further?

- China's retaliatory tariffs on American agriculture and

- Brazil's 50% tariffs on U.S. imports have created a domino effect of trade retaliation.

- .P. Morgan estimates that these policies could reduce global GDP by 1% in 2025, with spillover effects doubling that impact.

- Emerging markets, particularly China and Brazil, face sharper contractions, while the U.S. could see a 0.6% permanent drag on GDP growth.

Ask Aime: Predict how tariffs will impact U.S. auto industry?

Equity Market Volatility and Sectoral Realignments

Equity markets have mirrored the uncertainty.

- The S&P 500, a bellwether for U.S. corporate performance, has oscillated within a narrow range of 5,200–5,800 since 2025, reflecting investor caution.

- Defensive sectors like utilities and healthcare have outperformed, trading at valuations below long-term averages, while cyclical industries such as manufacturing and commodities face headwinds.

Consider

, a case study in sectoral realignment.

- While the company initially benefited from U.S. protectionism by avoiding Chinese competition, its exposure to global supply chains (e.g., lithium from Latin America, batteries from South Korea) has made it vulnerable to trade disruptions.

- Its stock price, which surged during the early stages of the tariff war, has since stabilized as investors factor in long-term risks like higher component costs and regulatory scrutiny.

The automotive sector offers another lens. Domestic automakers like Ford and

have gained short-term market share by absorbing tariff costs, but their margins remain under pressure.

- Meanwhile, global automakers, particularly those in Europe and Asia, are pivoting to new markets, with Japanese firms leveraging lower tariffs under the U.S.-Japan agreement to boost exports.

The most pressing risk lies in the erosion of global economic efficiency.

- Tariffs have forced companies to rewire supply chains, increasing costs and reducing economies of scale.

- For example, U.S. pharmaceutical firms now face potential 200% tariffs on imports, which could delay drug approvals and drive up healthcare costs.

- Similarly, the 10% universal tariff on non-NAFTA partners has reduced U.S. exports by 18.1%, with Canada's economy projected to shrink by 2.1% in the long run due to retaliatory measures.

Investors must also contend with the regressive impact of tariffs on consumer spending.

- The 2.3% average price increase from 2025 tariffs has reduced real disposable income, potentially slowing GDP growth by 0.3–0.4 percentage points.

- This dynamic is particularly concerning for equity markets, as consumer-driven sectors like retail and hospitality face weaker demand.

Opportunities in a Rewired Global Economy

Despite these risks, fragmentation creates new opportunities.

- Latin America, for instance, is emerging as a beneficiary of U.S. trade realignments.

- Countries like Brazil and Mexico, with abundant raw materials and lower production costs, are attracting capital inflows.

- J.P. Morgan forecasts that Brazil's GDP could grow by 0.3–0.5% if it diversifies exports away from the U.S.

- Similarly, Vietnam's 20% tariff increase on U.S. goods has spurred investment in alternative trade routes, positioning it as a manufacturing hub for Southeast Asia.

Technology and AI sectors also present asymmetric opportunities. While near-term volatility has pressured AI equities, the structural demand for compute power remains intact.

Firms like

and- , which supply semiconductors for AI infrastructure, continue to see robust demand as U.S. tech giants invest $315 billion in AI expansion.

- Investors who adopt a bottom-up approach, targeting companies with pricing power in the AI stack, may outperform broader indices.

Strategic Recommendations for Investors

- Diversify Beyond Traditional Assets: With U.S. Treasuries losing their role as a safe haven, investors should allocate to alternatives like gold, infrastructure, and inflation-linked bonds. Gold, for instance, has historically enhanced Sharpe ratios during periods of fiat currency instability.

- Prioritize Defensive Equities: Sectors like utilities and healthcare offer downside protection. Utilities, trading at 12x forward earnings, are undervalued relative to their defensive profile.

- Hedge Against Geopolitical Risks: Exposure to emerging markets, particularly Latin America, can offset U.S.-centric volatility. However, investors should favor minimum volatility strategies in these regions to mitigate trade-related shocks.

- Embrace Short-Duration Fixed Income: Given the Fed's delayed rate cuts and elevated inflation, short-duration bonds (3–7 years) provide a balance of yield and liquidity.

- Monitor AI and Supply Chain Trends: Active management in AI-related equities, particularly those with global supply chain resilience, can capture long-term growth.

Conclusion

The Trump-era tariff surge has left an indelible mark on global trade and equity markets.

While the immediate costs—higher prices, retaliatory tariffs, and GDP drag—are evident, the long-term impact hinges on how businesses and investors adapt.

In a fragmented world, success will belong to those who anticipate structural shifts, diversify portfolios beyond traditional benchmarks, and capitalize on asymmetric opportunities in sectors like AI and emerging markets.

As the global economy recalibrates, the key to long-term growth lies not in resisting fragmentation but in navigating it with foresight and agility.

========================================================================

- Purpose: Intended to protect American farmers and industries from foreign competition during the onset of the Great Depression by raising tariffs on imported goods.

- Impact:

- Raised import duties on a wide range of agricultural and industrial goods.

- Triggered retaliatory tariffs from other nations, leading to a significant decrease in global trade.

- Widely considered by economists to have worsened the Great Depression, according to Investopedia.

- U.S. imports decreased by 66% and exports decreased by 61% between 1929 and 1933.

- The stock market reacted negatively to its passage.

- Legacy: The Smoot-Hawley Tariff Act serves as a historical example of the potentially negative consequences of protectionist trade policies on a global scale

The Heat: U.S. Tariff Turmoil #Heat #Trump #tariffs #tradewar

On Friday, 01 Auust, Global stock markets tanked, leaving U.S. trading partners scrambling to curb economic volatility.

Trump's very bad trade deal with Europe

Date

- It also cements a new trading order where tariffs are accepted as a geopolitical cudgel.

- A 15 percent tariff accepted by the European Union is definitively better than the 30 percent threatened by Trump.

- But it is still a lot more than the status of trade before Trump's second term, when the average tariff rate between the European Union and the United States was only a few percentages.

The European Union, for example, promises to purchase $750 billion worth of American oil, gas, and nuclear fuel, partly to phase out the dependence on Russia that some member states still face.

- Many experts question the realism of such a sum, however.

- But these commitments are subject to member state competence and are up to countries and individual companies to deliver.

- The European Commission claims that these sums are more an estimation of what companies have announced already.

- This investment is non-binding and more of an intention, according to the European side, whereas the White House sees it as a promise until 2028.

- It is questionable how these investments can be measured and evaluated.

What is the direction of a free trade deal?

Ten years ago, during the administration of President Barack Obama, the European Union and the United States were negotiating a potentially very ambitious trade agreement between them, the Transatlantic Trade and Investment Partnership, TTIP.

Friday, August 01, 2025

BEA News: Gross Domestic Product by State and Personal Income by State, 3rd Quarter 2025

BEA News: Gross Domestic Product by State and Personal Income by S...

-

Flash News: Ukraine Intercepts Russian Kh-59 Cruise Missile Using US VAMPIRE Air Defense System Mounted on Boat. Ukrainian forces have made ...