Government Property Lease Excise Tax (GPLET)

NOTE The original Department of Revenue GPLET database will continue to be available for reference until December 31, 2017.

OLD DATABASE: 2 Property Leases here in Mesa

Source: https://www.azdor.gov/GPLET.aspx

GPLET is a controversial development tax incentive established by Arizona in 1996. In 2015, the Auditor General reported that ‘although the Legislature enacted laws to increase GPLET revenues for counties, cities and towns, community college districts and other school districts, these changes may not increase revenues as expected… and improvements were needed to ensure GPLET is accurately calculated, collected, distributed and reported’ [Blogger emphasis]

There were very recent changes - please read more . . .

Related content on this blog site > https://mesazona.blogspot.com/2016/09/gplet-property-tax-incentive-known-as.html#!/2016/09/gplet-property-tax-incentive-known-as.html

GPLET is a controversial development tax incentive established by Arizona in 1996. In 2015, the Auditor General reported that ‘although the Legislature enacted laws to increase GPLET revenues for counties, cities and towns, community college districts and other school districts, these changes may not increase revenues as expected… and improvements were needed to ensure GPLET is accurately calculated, collected, distributed and reported’ [Blogger emphasis]

There were very recent changes - please read more . . .

Related content on this blog site > https://mesazona.blogspot.com/2016/09/gplet-property-tax-incentive-known-as.html#!/2016/09/gplet-property-tax-incentive-known-as.html

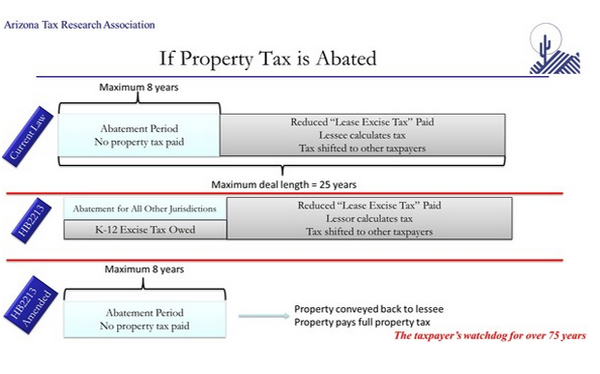

The Arizona Legislature enacted several changes to the statutes relating to the Government Property Lease Excise Tax (GPLET) in House Bill 2213 during the First Regular Session (2017). The changes were effective August 9, 2017.

> One of the changes impacts the database of GPLET properties which has been posted on the Department of Revenue’s website since 2010.

This database will be replaced by databases published by counties, cities and towns or by government lessors posting lease agreements on a county, city or town website where the government property improvement is located.

____________________________________________________________________

Government lessors will provide links to their public databases to the Department of Revenue. The Department will post links to the government lessors’ databases on its website.

>> VIEW NEW DATABASES HERE

____________________________________________________________________________

____________________________________________________________________________

NOTE The original Department of Revenue GPLET database will continue to be available for reference until December 31, 2017.

OLD DATABASE: 2 Property Leases here in Mesa

| County | City | Leased Address | Lessee Name |

| Maricopa | Mesa | 1630 W. Broadway | Crescent Crown Distributing |

| Maricopa | Mesa | 1240 E. Main | Stacy and Witbeck/Sundt |

| Maricopa | Mesa | 1240 E. Main | Valley Metro Rail, Inc. |

| Maricopa | Mesa | 51 E. Main | Benedictine University |

| Maricopa | Mesa | 225 E. Main | Benedictine University |

| Maricopa | Mesa | 120 N. Center | Mesa Convention and Visitors Bureau |

| Maricopa | Mesa | 100 N. Center | Downtown Mesa Association |

| Maricopa | Mesa | 200 S. Center | Valley Metrorail, Inc. |

| Maricopa | Mesa | 245 W. 2nd Street | Wilkes University |

| Maricopa | Mesa | Address Confidential | A New Leaf, Inc. |

| Maricopa | Mesa | 217 W. University | A New Leaf, Inc. |

| Maricopa | Mesa | Address Confidential | A New Leaf, Inc. |

| Maricopa | Mesa | Address Confidential | A New Leaf, Inc. |

| Maricopa | Mesa | 453 N. Pima | Mesa Martin Luther King Jr. Celebration, Inc. |

| Maricopa | Mesa | 170 W. University | Child Crisis Center, Inc. |

| Maricopa | Mesa | 247 N. Macdonald | East Valley Adult Resources |

| Maricopa | Mesa | 247 N. Macdonald | Oakwood Creative Care |

| Maricopa | Mesa | 45 W. University | East Valley Adult Resources |

| Maricopa | Mesa | Address Confidential | Save the Family Foundation |

| Maricopa | Mesa | 4616 E. Fighter Aces Drive | Empire Southwest LLC |

| Maricopa | Mesa | 4702 E. Fighter Aces Drive, #104 | Wings of Flight Foundation |

| Maricopa | Mesa | 4702 E. Fighter Aces Drive | Precision Heli-Support |

| Maricopa | Mesa | 4730 E. Falcon Drive | Civil Air Patrol |

| Maricopa | Mesa | 4930 E. Falcon Drive | Heliponents |

| Maricopa | Mesa | 4800 E. Falcon Drive | Boeing Company |

| Maricopa | Mesa | 4800 E. Falcon Drive | John Lewis |

| Maricopa | Mesa | 4800 E. Falcon Drive | Steve Adams |

| County | City | Leased Address | Lessee Name |

| Maricopa | Mesa | 6030 S. Kent St. | Confidential |

| Maricopa | Mesa | 6030 S. Kent St. | Confidential |

| Maricopa | Mesa | 6030 S. Kent St. | Confidential |

| Maricopa | Mesa | 6030 S. Kent St. | Confidential |

| Maricopa | Mesa | 6030 S. Kent St. | Confidential |

| Maricopa | Mesa | 6030 S. Kent St. | Confidential |

| Maricopa | Mesa | 6030 S. Kent St. | Confidential |

| Maricopa | Mesa | 6030 S. Kent St. | Confidential |

| Maricopa | Mesa | 6030 S. Kent St. | Confidential |

| Maricopa | Mesa | 6030 S. Kent St. | Confidential |

| Maricopa | Mesa | 6030 S. Kent St. | Confidential |

| Maricopa | Mesa | 6030 S. Kent St. | Confidential |

| Maricopa | Mesa | 6030 S. Kent St. | Confidential |

| Maricopa | Mesa | 6030 S. Kent St. | Confidential |

| Maricopa | Mesa | 6030 S. Kent St. | Confidential |

| Maricopa | Mesa | 6030 S. Kent St. | Confidential |

| Maricopa | Mesa | 6030 S. Kent St. | Confidential |

| Maricopa | Mesa | 6030 S. Kent St. | Confidential |

| Maricopa | Mesa | 6030 S. Kent St. | Confidential |

| Maricopa | Mesa | 6030 S. Kent St. | Confidential |

| Maricopa | Mesa | 6030 S. Kent St. | Confidential |

| Maricopa | Mesa | 6030 S. Kent St. | Confidential |

| Maricopa | Mesa | 6030 S. Kent St. | Confidential |

| Maricopa | Mesa | 6030 S. Kent St. | Confidential |

| Maricopa | Mesa | 6030 S. Kent St. | Confidential |

| Maricopa | Mesa | 6030 S. Kent St. | Confidential |

| County | City | Leased Address | Lessee Name |

| Maricopa | Mesa | 424 W. Pepper Place, Apt. C | Name withheld to protect privacy of tenant |

| Maricopa | Mesa | 424 W. Pepper Place, Apt. D | Name withheld to protect privacy of tenant |

| Maricopa | Mesa | 432 W. Pepper Place, Apt. E | Name withheld to protect privacy of tenant |

| Maricopa | Mesa | 432 W. Pepper Place, Apt. G | Name withheld to protect privacy of tenant |

__________________________________________________________________________________

GPLET Reform Bill Overwhelmingly Passes House With Amendments

| PHOENIX, Arizona – In 1996, the Government Property Lease Excise Tax (“GPLET”) was first established by the State of Arizona as a redevelopment tool to initiate development by reducing a project’s operating costs. In 2010, under the state statute, the Legislature amended GPLET laws and an excise tax rate was established for the building type of use calculated on the gross square footage of the building to replace real property taxes. The use of the excise tax cannot continue for more than twenty-five years and requires that the land and improvements be conveyed to a government entity and leased back for private use. The excise tax rate can be abated for the first eight years after a certificate of occupancy on the building is issued only for properties located within a Central Business District and a Redevelopment Area. In 2015, the Auditor General reported that ‘although the Legislature enacted laws to increase GPLET revenues for counties, cities and towns, community college districts and other school districts, these changes may not increase revenues as expected… and improvements were needed to ensure GPLET is accurately calculated, collected, distributed and reported’. See full Auditor General Report here. GPLET abatements were created to revitalize “slum and blight” areas in business districts. Deals which can exist for several decades and shift property taxes to their neighbors and pit competitive businesses against each other. GPLET is levied in lieu of property taxes when governments lease publicly-owned property to private businesses. When local governments offer property tax incentives like GPLET to developers, it deprives school districts of tax revenue. State taxpayers are forced to make up the difference through elevated payments to those school districts. The House of Representatives this week overwhelmingly voted 50-9 to pass HB 2213, a bill sponsored by Representative Vince Leach (R-11) that closes several loopholes related to the GPLET. After a stakeholder process resulted in significant changes from the underlying bill, several changes were applied based on recommendations from municipalities and developers and Arizona Tax Research Association (“ATRA”).  ________________________________________________________________________________ CROCKETT LAW GROUP http://jeffcrockettlaw.com/incentives.php Areas of Practice Economic Development Incentives Useful Links: eDocket: http://edocket.azcc.gov/ Arizona Corporation Commission: http://www.azcc.gov/ Arizona Administrative Code-Title 14 (Public Service Corporations): http://www.azsos.gov/rules/arizona-administrative-code#ID14 Arizona Revised Statutes-Title 40 (Corporation Commission): http://www.azleg.gov/ArizonaRevisedStatutes.asp?Title=40 Greater Phoenix Economic Council: http://www.gpec.org/home Jeff Crockett has been involved with economic development for many years. He serves as a member of the Board of Directors of the Greater Phoenix Economic Council, one of the region's premier economic development organizations. He is a past two-term chair and current ex officio member of the City of Mesa's Economic Development Advisory Board (EDAB), an organization which provides guidance and assistance to Mesa’s Mayor and City Council on business attraction, retention and expansion, workforce development and economic development and urban revitalization. EDAB supports Mesa's innovative HEAT initiative which emphasizes economic development in the areas of Healthcare, Education, Aerospace, Technology and Tourism. Mr. Crockett can advise clients regarding the various economic incentives offered in Arizona, including:

Crockett Law Group Jeff's practice is concentrated in the areas of public utilities regulation, water rights and planning, development and construction of utility infrastructure for master planned developments, with special emphasis on telecommunications law and renewable energy. ______________________________________________________________ This report appeared on September 12, 2017 Mesa Creates Redevelopment Zones to Reverse Blight Source: http://www.orionprop.com/topfive

In its latest efforts to redevelop land surrounding the city’s downtown core, the Mesa City Council took a significant step toward creating the East and West Redevelopment Areas that would give the city tools to attract investment to blighted areas.

The redevelopment areas will allow the city to take advantage of tax breaks and other incentives aimed at attracting investment and infill development of vacant properties to the designated areas.

At the Aug. 21 city council meeting, the council formally adopted resolutions recognizing the necessity of the redevelopment areas and approving an expansion of the Central Business District to include those areas.

The West Redevelopment Area roughly includes select land parcels surrounding Main Street west of Country Club Drive. The East Redevelopment Area includes land parcels surrounding Main Street to the east of downtown and west of Gilbert Road.

The boundaries have to be contiguous to other redevelopment areas, and the light rail corridor was used as a guide in creating the oddly shaped districts, Mesa economic development director Bill Jabjiniak said at a city council study session.

In order to qualify as an RDA, these zones must exhibit a predominance of blighted conditions, as defined by Arizona laws governing redevelopment areas.

This includes visual and non-visual blight, such as building deterioration, excessive trash, fire hazards, graffiti, restricted access, inadequately sized parcels and crime, according to project overviews prepared by the city and presented to the public. . .

According to the city’s presentation, the plan is focused on improving the quality of life for residents by encouraging reinvestment in the areas surrounding downtown and prompting infill redevelopment of vacant properties.

The redevelopment areas could result in increased property values for property owners, according to the presentation.

The adoption of redevelopment areas will give the city access to various tools to incentivize commercial redevelopment, including the Government Property Lease Excise Tax Program, also known as GPLET.

GPLET is a controversial development tax incentive established by Arizona in 1996. It allows developers to hand over ownership of a property to the city in order to temporarily replace a project’s property tax burden with a lower excise tax. GPLET also allows the city to provide an eight-year abatement of that excise tax.

In order to qualify for a GPLET, a project must be within a city’s Central Business District and a redevelopment area.

Mesa has added all four of its existing and potential RDAs to its Central Business District in order to maximize the benefits of the GPLET by making all areas eligible for the benefits of the program rather than signaling out one zone, Jabjiniak said.

As city develops the specifics of the redevelopment plans it will rely on feedback from business owners, residents and developers in order to determine the other federal, state and local development incentives to include in the plan.

|

No comments:

Post a Comment