The subject of Opportunity Zones has been highlighted multiple times in posts on this blog starting with a rare public appearance in 2017 by yours truly in front of the City of Mesa's Economic Development Advisory Board commenting on the mystery of a massive 10-parcel low-ball grab of commercial properties on Main Street swooped-up in a monopoly buy-out by one group of what were then 'unknown and private' transactions by investors gambling on rampant real estate speculation for their own personal wealth-creation.

In a series of slow revelations that provoked public anger in public meetings in February 2018, Mesa Conservative Mormon Republican/Mega-Millionaire and Arizona State Senator Bob Worsley provided public testimony at a Mesa City Council session (accompanied by revolving-door ASU lobbyist and former U.S. Congressman Matt Salmon) that yes while holding the public trust elected to public office, he was speculating as a private investor in commercial properties risking what he said was $20 million.

In spite of what seems to most reasonable persons as the appearance of an obvious conflict-of-interest for his own personal wealth-creation while holding public office, that issue was conveniently never addressed or looked into.

The question of an ethical violation never got asked

In spite of what seems to most reasonable persons as the appearance of an obvious conflict-of-interest for his own personal wealth-creation while holding public office, that issue was conveniently never addressed or looked into.

The question of an ethical violation never got asked

However, citing 'the acerbic political climate' Worsley chose not to run again for another term in the AZ State House.

No worries there - he named another conservative Mesa Republican to fill his seat to join the cohort of Mesa Conservative Republicans that exercise control in The State House - among them Rusty Bowers, a couple of Farnsworths and other conservative Mesa Republicans elected in state legislative and congressional districts.

________________________________________________________________________

In April 2018 The U.S. Treasury and Internal Revenue Service announced 7800+ pre-designated "Opportunity Zones" across urban and rural areas in the United States, that include among others in Arizona both Phoenix and Mesa. Mesa has 11 OZones.

Blogger Note: Use THE SEARCHBOX on this site to find oodles of opinion and data.

One recent publication is this Opportunity Zone Fund Directory

Published on November 9, 2018

WASHINGTON, DC — The National Council of State Housing Agencies (NCSHA) has released a significantly expanded third edition of its Opportunity Zone Fund Directory featuring 53 Qualified Opportunity Funds (QOFs) representing nearly $15 billion in anticipated investment in designated high-poverty neighborhoods. NCSHA reviewed public information on these 53 funds and found the following for publicly-announced funds that have been formed for the purpose of attracting investment in Opportunity Zones.

Please note thatNCSHA is tracking only multi-project opportunity funds.

The Opportunity Zone Fund Directory is a compilation of Opportunity Zone funding opportunities. This resource provides descriptions and contact information for publicly-announced funds that have been formed for the purpose of attracting investment in Opportunity Zones. NCSHA is tracking only multi-project opportunity funds.

The Opportunity Zone Fund Directory is a compilation of Opportunity Zone funding opportunities. This resource provides descriptions and contact information for publicly-announced funds that have been formed for the purpose of attracting investment in Opportunity Zones. NCSHA is tracking only multi-project opportunity funds.

Last Updated: December 3, 2018

On 20 December Dan Gauthier, Rose Law Group transactional attorney handling many Opportunity Zones, commented on O-Zones wide-ranging investment potential:

“Although the early focus of Opportunity Zone investments tends to be on commercial real estate (CRE), the scope of potential investment goes far beyond CRE – the Opportunity Zone program allows for investment in new and existing businesses, infrastructure, renewable energy, and much more.”

Link > Rose Law Group Reporter

_________________________________________________________________________________

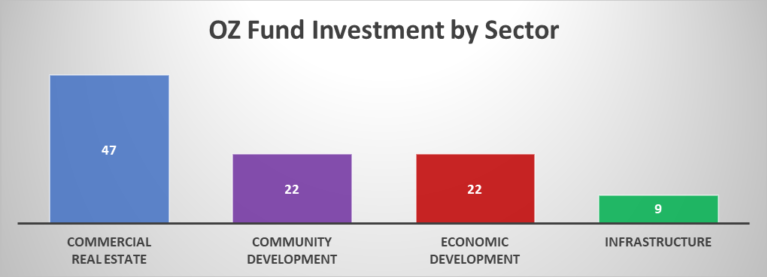

One infographic tells the story where OZone investment goes: and it also tells the story of how and where the OZone private investor monies are getting dumped here in Mesa in the neglected downtown Central Business District

1. OZ Funds Predominantly Target Commercial Real Estate Investment

________________________________________________________________________________

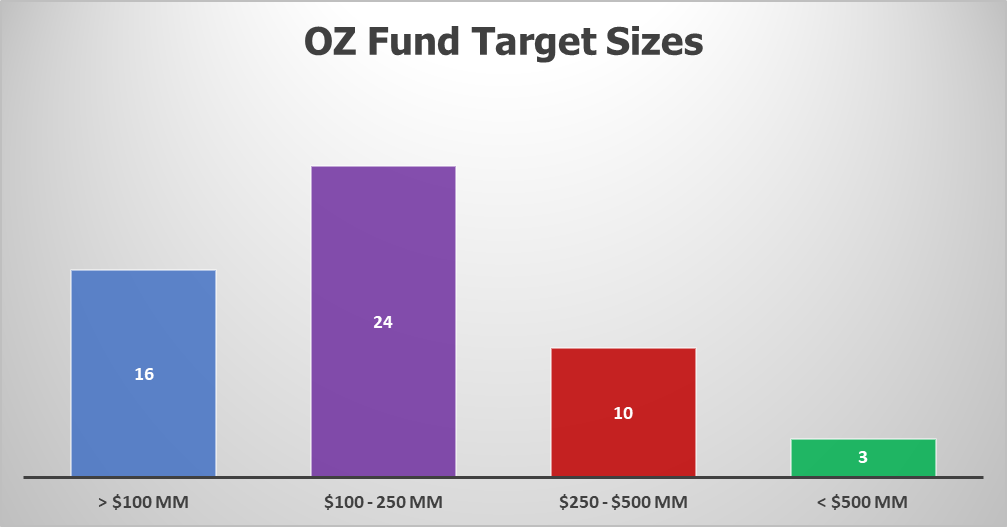

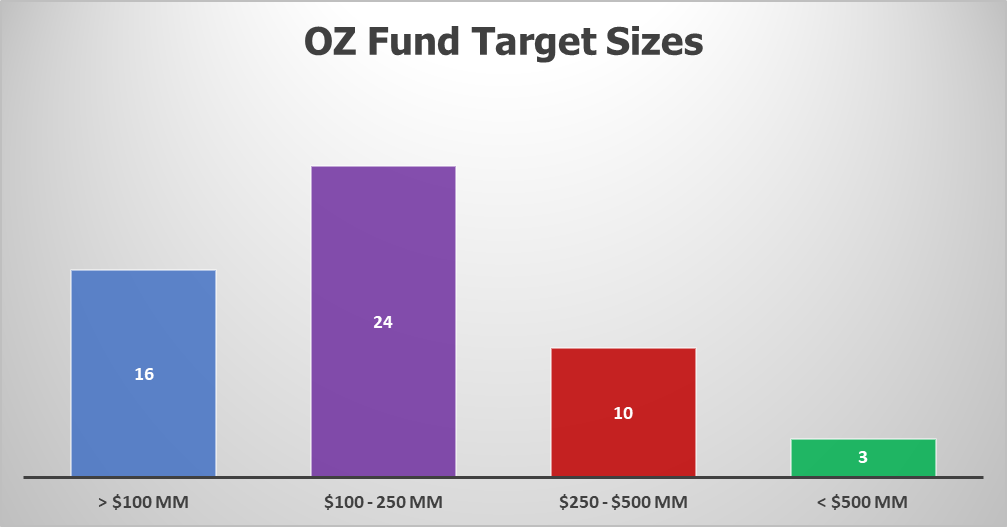

2. Target Sizes of OZ Funds Range Widely

Source: NCSHA Opportunity Zone Fund Directory

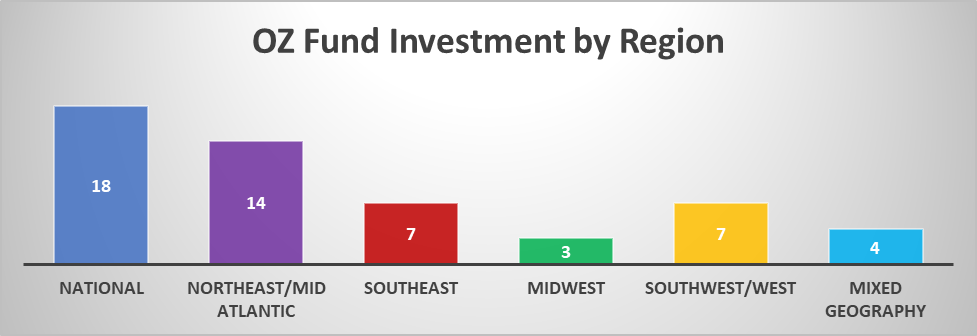

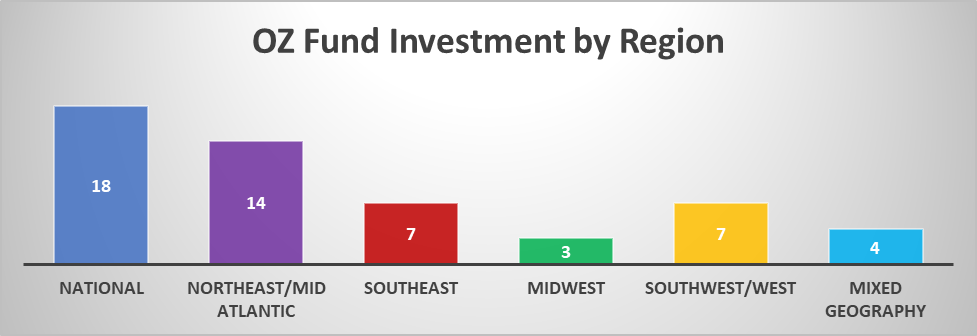

3.OZ Fund Investment Is Spread Throughout the United States

Source: NCSHA Opportunity Zone Fund Directory

“The Treasury Department’s recent release of regulations clarifying many important aspects of Opportunity Zone investing has spurred further interest in the program among fund managers,” said NCSHA Executive Director Stockton Williams. “With additional regulatory clarity that we hope is forthcoming soon, the program will be even better able to achieve its promise to revitalize rural as well as urban areas.”

____________________________

In a series of slow revelations that provoked public anger in public meetings in February 2018, Mesa Conservative Mormon Republican/Mega-Millionaire and Arizona State Senator Bob Worsley provided public testimony at a Mesa City Council session (accompanied by revolving-door ASU lobbyist and former U.S. Congressman Matt Salmon) that yes while holding the public trust elected to public office, he was speculating as a private investor in commercial properties risking what he said was $20 million.

In spite of what seems to most reasonable persons as the appearance of an obvious conflict-of-interest for his own personal wealth-creation while holding public office, that issue was conveniently never addressed or looked into.

In spite of what seems to most reasonable persons as the appearance of an obvious conflict-of-interest for his own personal wealth-creation while holding public office, that issue was conveniently never addressed or looked into.However, citing 'the acerbic political climate' Worsley chose not to run again for another term in the AZ State House.

No worries there - he named another conservative Mesa Republican to fill his seat to join the cohort of Mesa Conservative Republicans that exercise control in The State House - among them Rusty Bowers, a couple of Farnsworths and other conservative Mesa Republicans elected in state legislative and congressional districts.

________________________________________________________________________

In April 2018 The U.S. Treasury and Internal Revenue Service announced 7800+ pre-designated "Opportunity Zones" across urban and rural areas in the United States, that include among others in Arizona both Phoenix and Mesa. Mesa has 11 OZones.

Blogger Note: Use THE SEARCHBOX on this site to find oodles of opinion and data.

One recent publication is this Opportunity Zone Fund Directory

Published on November 9, 2018

WASHINGTON, DC — The National Council of State Housing Agencies (NCSHA) has released a significantly expanded third edition of its Opportunity Zone Fund Directory featuring 53 Qualified Opportunity Funds (QOFs) representing nearly $15 billion in anticipated investment in designated high-poverty neighborhoods. NCSHA reviewed public information on these 53 funds and found the following for publicly-announced funds that have been formed for the purpose of attracting investment in Opportunity Zones.

Please note thatNCSHA is tracking only multi-project opportunity funds.

The Opportunity Zone Fund Directory is a compilation of Opportunity Zone funding opportunities. This resource provides descriptions and contact information for publicly-announced funds that have been formed for the purpose of attracting investment in Opportunity Zones. NCSHA is tracking only multi-project opportunity funds.

The Opportunity Zone Fund Directory is a compilation of Opportunity Zone funding opportunities. This resource provides descriptions and contact information for publicly-announced funds that have been formed for the purpose of attracting investment in Opportunity Zones. NCSHA is tracking only multi-project opportunity funds.Last Updated: December 3, 2018

On 20 December Dan Gauthier, Rose Law Group transactional attorney handling many Opportunity Zones, commented on O-Zones wide-ranging investment potential:

“Although the early focus of Opportunity Zone investments tends to be on commercial real estate (CRE), the scope of potential investment goes far beyond CRE – the Opportunity Zone program allows for investment in new and existing businesses, infrastructure, renewable energy, and much more.”

Link > Rose Law Group Reporter

One infographic tells the story where OZone investment goes: and it also tells the story of how and where the OZone private investor monies are getting dumped here in Mesa in the neglected downtown Central Business District

1. OZ Funds Predominantly Target Commercial Real Estate Investment

________________________________________________________________________________

| Investment Focus by Sector | % of Funds Investing |

| Commercial Real Estate: Commercial, Hospitality, Mixed-Use, Multifamily Residential, or Student Housing | 89% |

| Community Development: Affordable Housing, Workforce Housing, or Community Revitalization | 42% |

| Economic Development: Economic or Small Business Development | 42% |

| Infrastructure: Infrastructure or Renewable Energy Development | 17% |

2. Target Sizes of OZ Funds Range Widely

Source: NCSHA Opportunity Zone Fund Directory

3.OZ Fund Investment Is Spread Throughout the United States

Source: NCSHA Opportunity Zone Fund Directory

“The Treasury Department’s recent release of regulations clarifying many important aspects of Opportunity Zone investing has spurred further interest in the program among fund managers,” said NCSHA Executive Director Stockton Williams. “With additional regulatory clarity that we hope is forthcoming soon, the program will be even better able to achieve its promise to revitalize rural as well as urban areas.”

____________________________

Opportunity Zone Fund Directory Overview

For complete fund details, including select fields not included in the overview, please download the full directory here.

Introducing the Caliber Tax Advantaged Opportunity Zone Fund, LP.

More Information > https://www.caliberco.com/opportunity/

Complying with the new “Opportunity Zones” section of the Tax Cuts and Jobs Act of 2017, the Fund will invest directly into a diversified portfolio of assets in qualifying zones, allowing investors to take advantage of preferential tax treatment.

Caliber Tax Advantaged Opportunity Zone Fund, LP Investment Details

$500m Equity Offering

$250k Minimum Investment

13% Target IRR

______________________

Discover Opportunity Zones

Opportunity Zones are communities that have been designated by state and federal governments where new investments aimed at improving these areas are incentivized with preferential tax benefits.

| Caliber Tax Advantaged Opportunity Zone Fund, LP | 500 Million | Arizona, Colorado, Nevada, Texas, Utah | Affordable housing, Commercial real estate, Economic development, Hospitality development, Mixed-use development, Multifamily residential, Single family residential, Student housing |

| Fund Name | Fund Size | Geographic Focus | Investment Focus |