Energy Markets Barely Blinked at Russia’s Mutiny. Summer Surprises May Await.

- Order Reprints

- Print Article

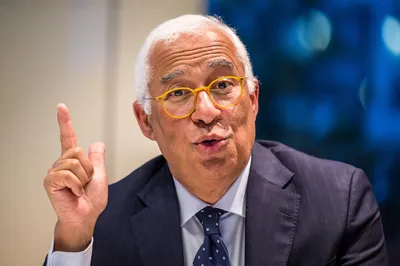

Russian Vladimir Putin has showed a rare indecisiveness in the face of an armed mutiny, writes Carolyn Kissane.

Mikhail Sputnik/Getty ImagesAbout the author: Carolyn Kissane is the associate dean of the NYU-SPS Center for Global Affairs, and the founding director of the SPS Energy, Climate Justice and Sustainability Lab.

Across energy markets, the aborted mutiny that threatened Russian President Vladimir Putin’s rule and Russia’s national security barely moved prices. What a difference a year makes. Oil and gas prices spiked last year in the early months of the war in Ukraine, with uncertainty swelling around the security of supply from Russia. Oil moved to $120 and gas prices in Europe reached historic highs.

The weekend’s events in Russia underwhelmed energy markets. Brent rose 1% in response to the potential for turmoil, and gas budged and then settled. Natural gas prices in Europe are down almost 88% below last year’s peak. A lot has to do with the market being well-supplied and a weak global economy dampening the demand outlook.

The absence of a spike suggests traders were unfazed. Of course,

The gap between the yields on the 2-year and 10-year Treasury notes is more than a percentage point, the largest since March.

Updated June 28, 2023 3:05 am ET / Original June 27, 2023 12:43 pm ET

Long readThe gap between the yields on the 2-year and 10-year Treasury notes is more than a percentage point, the largest since March.

No comments:

Post a Comment