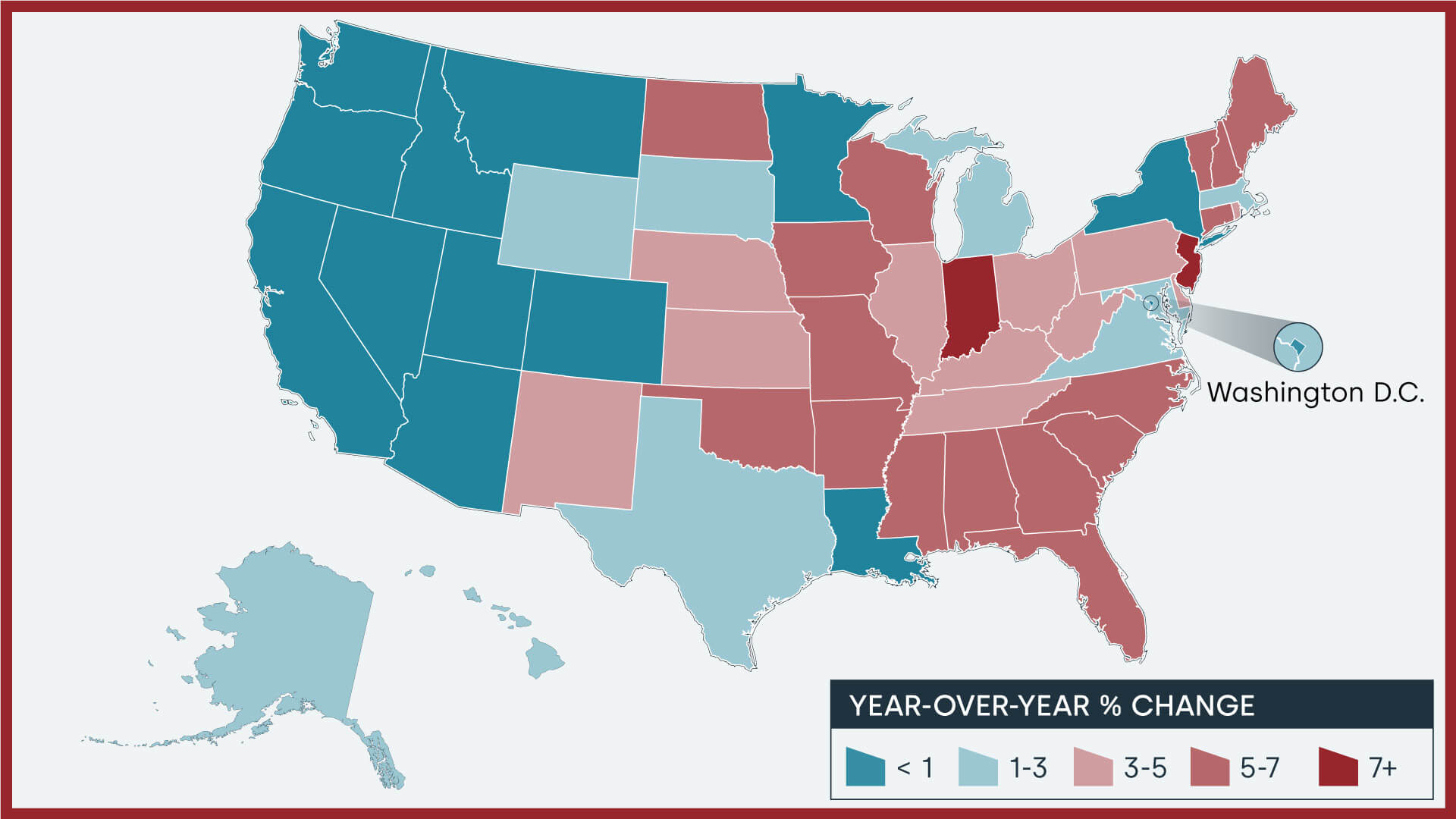

- Washington (-7.7%),

- Idaho (-5.9%),

- Utah (-4.9%),

- Nevada (-4.5%),

- California (-3.6%),

- Arizona (-2.6%),

- Oregon (-2.6%),

- Colorado (-2.1%),

- Montana (-1.1%) and

- New York (-1.1%).

Housing shortage keeps pressure on home prices – CoreLogi

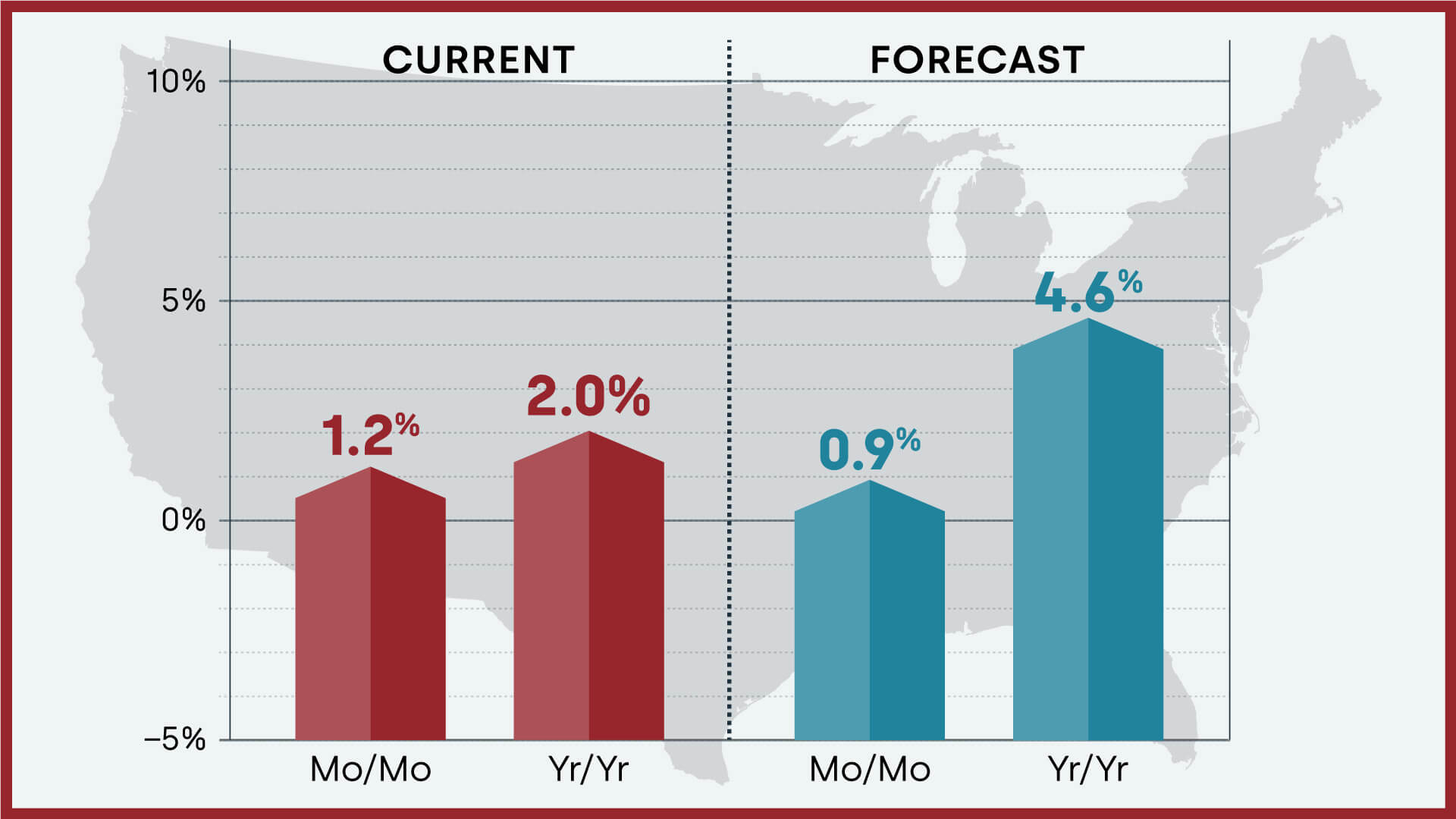

CoreLogic’s home price index (HPI) posted a 2% annual increase in April, marking the sixth month of single-digit gains.

CoreLogic said that while home prices continued to grow for the 135th month, the single-digit increase reflects the market slowdown seen in the past year. Month over month, prices rose by 1.2% from March.

“Numerous economic concerns are contributing to buyer reluctance, including mortgage rate volatility and the related uncertainty surrounding the recent debt-ceiling debate,” CoreLogic wrote in its HPI report. “That said, a continued shortage of homes for sale could keep pressure on housing prices over the next 12 months.”

Annual home price appreciation is expected to decelerate further in 2023 before regaining steam to 4.6% by April 2024.

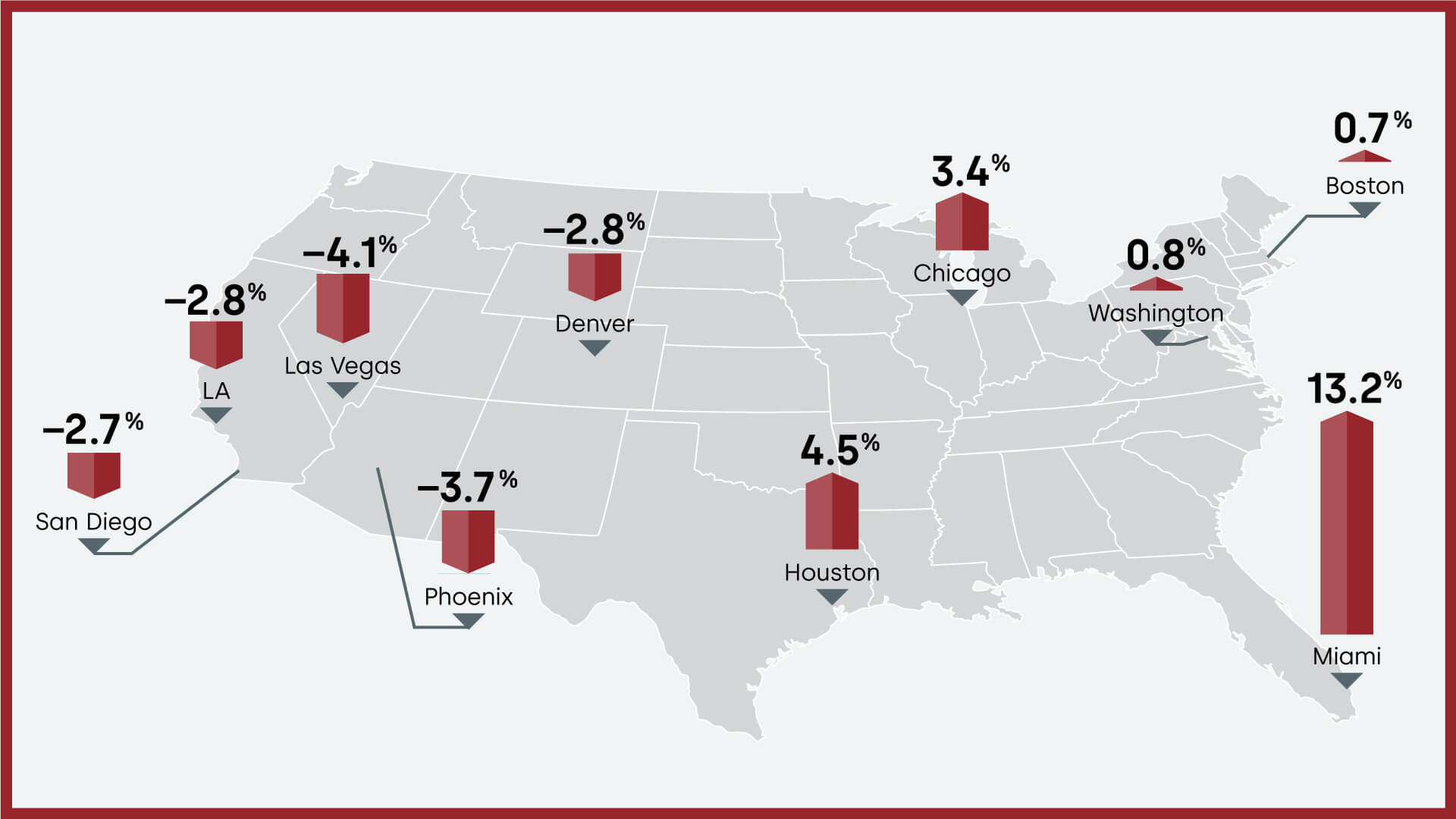

Miami saw the highest year-over-year home price gain of 13.2%, followed by Atlanta with 4.8%. Among states, Indiana and New Jersey registered the highest increase, at 7.3% and 7.1%, respectively.

On the other hand, 10 states posted annual losses, including Washington (-7.7%), Idaho (-5.9%), Utah (-4.9%), Nevada (-4.5%), California (-3.6%), Arizona (-2.6%), Oregon (-2.6%), Colorado (-2.1%), Montana (-1.1%) and New York (-1.1%).

51 US cities expected to see the highest home-price increases and 5 at risk of falling in the next 12 months — plus where mortgage rates could be by year-end — according to a housing economist

- The economist Selma Hepp says home prices in some areas are rising because of limited inventory.

- Areas that saw price declines during the pandemic are expected to make a comeback, she said.

- Anaheim, California; Seattle; and Sacramento, California; topped the list of Metropolitan areas.

But it's not necessarily because buyers are back in droves. High mortgage rates have kept would-be sellers locked into their current properties, making inventory tight and raising demand for the little that's on the market, Selma Hepp, the chief economist at CoreLogic, said.

- The data is taken from CoreLogic's HPI, which measures the year-over-year changes in single-family-home values based on data from more than 400 US cities.

- The index changes are based on repeat sales of the same properties.

Metropolitan area | HPI YOY% | Forecasted YOY% |

Anaheim-Santa Ana-Irvine CA Metropolitan Division | -0.73 | 10.3161 |

Seattle-Bellevue-Everett WA Metropolitan Division | -10.38 | 10.0377 |

Sacramento--Roseville--Arden-Arcade CA Metropolitan Statistical Area | -6.96 | 9.9691 |

Oakland-Hayward-Berkeley CA Metropolitan Division | -10.09 | 9.8245 |

Portland-Vancouver-Hillsboro OR-WA Metropolitan Statistical Area | -4.58 | 8.2212 |

Riverside-San Bernardino-Ontario CA Metropolitan Statistical Area | -1.48 | 8.1907 |

San Diego-Carlsbad CA Metropolitan Statistical Area | -2.68 | 7.9938 |

Denver-Aurora-Lakewood CO Metropolitan Statistical Area | -2.84 | 7.7273 |

Jacksonville FL Metropolitan Statistical Area | 5.05 | 6.7077 |

Las Vegas-Henderson-Paradise NV Metropolitan Statistical Area | -4.1 | 6.614 |

Tampa-St. Petersburg-Clearwater FL Metropolitan Statistical Area | 4.69 | 6.3685 |

Newark NJ-PA Metropolitan Division | 6.59 | 6.1793 |

Orlando-Kissimmee-Sanford FL Metropolitan Statistical Area | 6.69 | 6.1298 |

Los Angeles-Long Beach-Glendale CA Metropolitan Division | -2.82 | 6.042 |

West Palm Beach-Boca Raton-Delray Beach FL Metropolitan Division | 6.63 | 6.0164 |

Cambridge-Newton-Framingham MA Metropolitan Division | 0.5 | 5.9048 |

Nassau County-Suffolk County NY Metropolitan Division | -0.65 | 5.7747 |

Baltimore-Columbia-Towson MD Metropolitan Statistical Area | 3.68 | 5.7685 |

Fort Lauderdale-Pompano Beach-Deerfield Beach FL Metropolitan Division | 7.43 | 5.5688 |

Boston MA Metropolitan Division | 0.67 | 5.4016 |

Phoenix-Mesa-Scottsdale AZ Metropolitan Statistical Area | -3.71 | 5.264 |

Miami-Miami Beach-Kendall FL Metropolitan Division | 13.17 | 5.1563 |

Montgomery County-Bucks County-Chester County PA Metropolitan Division | 5.29 | 5.1486 |

Washington-Arlington-Alexandria DC-VA-MD-WV Metropolitan Division | 0.81 | 4.9793 |

Atlanta-Sandy Springs-Roswell GA Metropolitan Statistical Area | 4.82 | 4.9643 |

Minneapolis-St. Paul-Bloomington MN-WI Metropolitan Statistical Area | -0.12 | 4.9623 |

Nashville-Davidson--Murfreesboro--Franklin TN Metropolitan Statistical Area | 1.38 | 4.7932 |

Virginia Beach-Norfolk-Newport News VA-NC Metropolitan Statistical Area | 6.84 | 4.7326 |

Detroit-Dearborn-Livonia MI Metropolitan Division | 2.64 | 4.307 |

Charlotte-Concord-Gastonia NC-SC Metropolitan Statistical Area | 4.68 | 4.218 |

Milwaukee-Waukesha-West Allis WI Metropolitan Statistical Area | 6.15 | 4.0918 |

Philadelphia PA Metropolitan Division | 1.69 | 4.0543 |

St. Louis MO-IL Metropolitan Statistical Area | 4.17 | 3.644 |

Kansas City MO-KS Metropolitan Statistical Area | 4.97 | 3.5144 |

Providence-Warwick RI-MA Metropolitan Statistical Area | 3.15 | 3.4637 |

Chicago-Naperville-Arlington Heights IL Metropolitan Division | 3.36 | 3.4629 |

Richmond VA Metropolitan Statistical Area | 3.81 | 3.1682 |

Cincinnati OH-KY-IN Metropolitan Statistical Area | 6.07 | 3.0565 |

Pittsburgh PA Metropolitan Statistical Area | 0.97 | 2.9902 |

Warren-Troy-Farmington Hills MI Metropolitan Division | 2.03 | 2.9774 |

Oklahoma City OK Metropolitan Statistical Area | 4.87 | 2.9635 |

Cleveland-Elyria OH Metropolitan Statistical Area | 4.09 | 2.7892 |

San Antonio-New Braunfels TX Metropolitan Statistical Area | 1.8 | 2.4221 |

New York-Jersey City-White Plains NY-NJ Metropolitan Division | 0.78 | 2.3719 |

Austin-Round Rock TX Metropolitan Statistical Area | -6.88 | 2.3515 |

Columbus OH Metropolitan Statistical Area | 4.62 | 2.3468 |

Houston-The Woodlands-Sugar Land TX Metropolitan Statistical Area | 4.5 | 2.2728 |

Indianapolis-Carmel-Anderson IN Metropolitan Statistical Area | 6.44 | 1.9631 |

Fort Worth-Arlington TX Metropolitan Division | 1.04 | 1.5919 |

Dallas-Plano-Irving TX Metropolitan Division | 2.15 | 1.2522 |

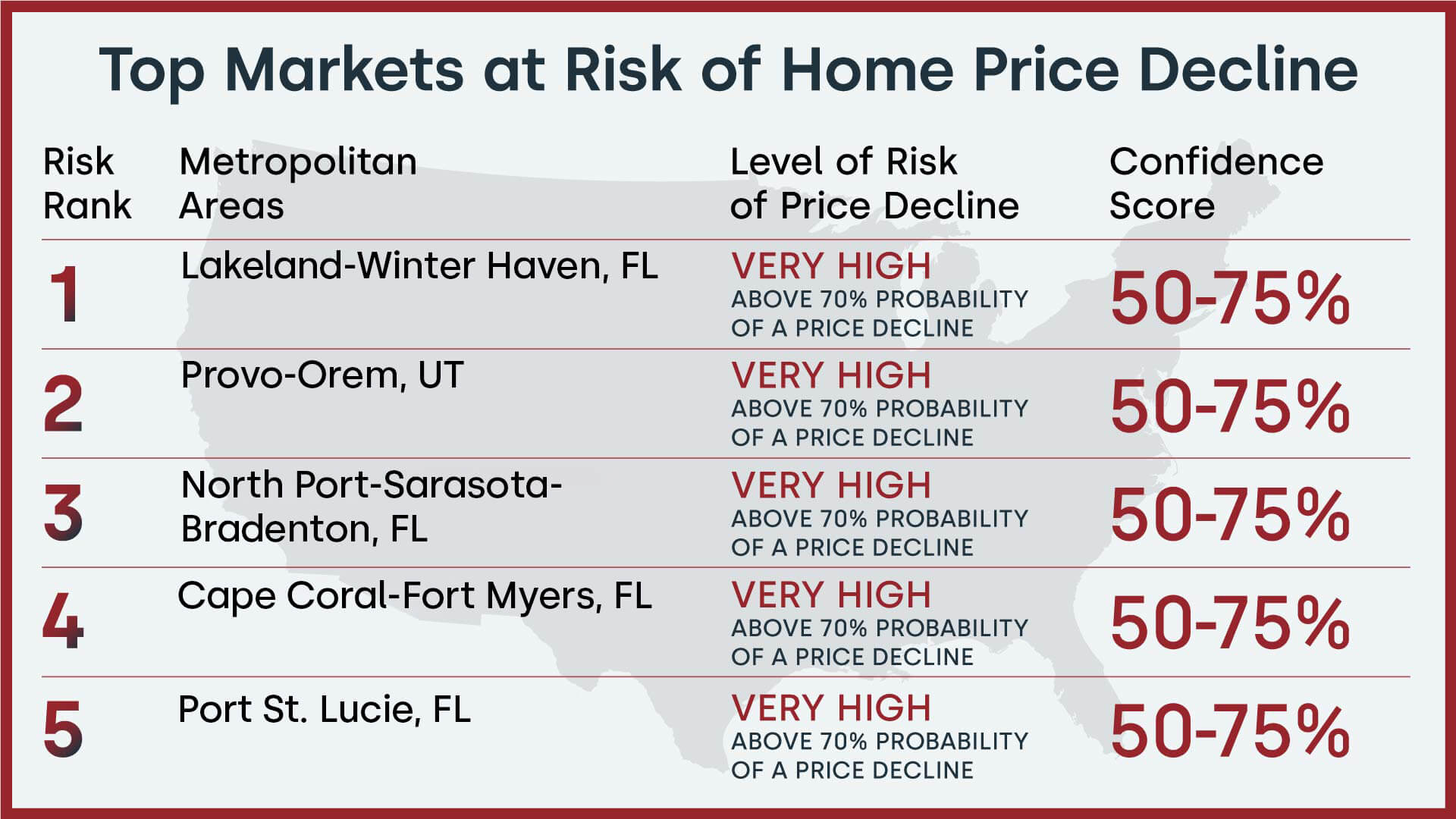

The metropolitan areas listed below have the highest probability of seeing price declines in the next 12 months.

"In these markets, when we look at how much prices exceed local incomes, it has been substantial. And that increases the vulnerability for price declines going forward," Hepp said.

Finally, while mortgage rates can be difficult to predict, Hepp said that we had likely peaked for the year. CoreLogic expects that mortgage rates will gradually decline for the remainder of the year to about 5.8% if inflation rates continue to decline, she said."

>

No comments:

Post a Comment