Saturday, August 07, 2021

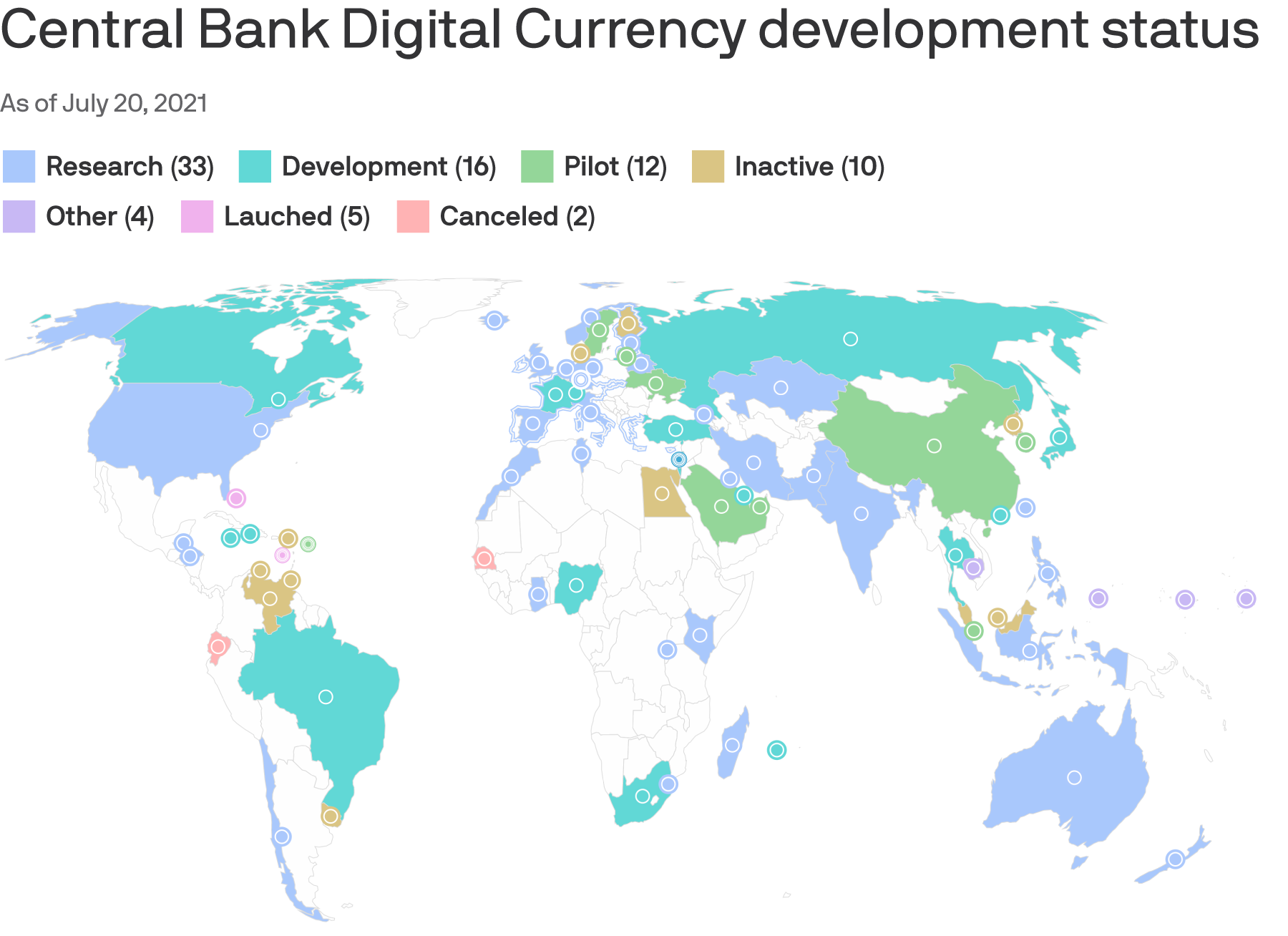

CBDC/Stable-Coins: Central Banks Realize They Need To Provide An Alternative To Money - or The Future Will Pass Them By > The World Wide Crypto Market In Different Phases of Development

- "If the U.S. doesn't help standard-set and provide guidance on issues like privacy and cybersecurity, we could be headed into a fractured digital currency ecosystem that threatens the smooth operation of international finance," Josh Lipsky, director of the Atlantic Council's GeoEconomics Center, tells Axios.

Driving the news: The Atlantic Council, a think tank that will testify at a July 27 Congressional hearing on CBDCs, gave Axios a first look at its new interactive map showing just how many world governments are now considering it.

The backstory: CBDCs are digital versions of existing currencies — legal tender issued, governed and backed by a central bank.

State of play: China is furthest along among major global powers, having launched its pilot digital yuan in April.

- A total of 16 other countries are in the pilot phase or have launched, and another 15 countries have CBDCs in development.

- The U.S. is one of 33 countries still in the research phase.

What's next: Fed chair Jerome Powell has said that the U.S. central bank won't issue a CBDC without Congressional approval.

- In response, Congressional committees have stepped up their inquiries. Tuesday's hearing is before the House Financial Services Committee and will focus on national security implications.

The bottom line: The U.S. doesn't need to create a digital dollar immediately in order to have an impact on the development of digital currencies, Lipsky says.

- But it should engage with groups like the G7 and G20 nations to set standards for security and privacy, he adds

Central Bank Digital Currency Tracker

SCROLL TO EXPLORE

What exactly is a Central Bank Digital Currency (CBDC)?

A CBDC is virtual money backed and issued by a central bank. As cryptocurrencies and stablecoins have become more popular, the world’s central banks have realized that they need to provide an alternative—or let the future of money pass them by.

81 countries (representing over 90 percent of global GDP) are now exploring a CBDC.

In our original report published in May 2020, only 35 countries were considering a CBDC.

China is racing ahead, including by allowing foreign visitors to use digital yuan if they provide passport information to the People’s Bank of China during the upcoming Winter Olympics.

Of the countries with the 4 largest central banks (the US Federal Reserve, the European Central Bank, the Bank of Japan, and the Bank of England), the United States is furthest behind.

> 5 countries have now fully launched a digital currency. The Bahamian Sand Dollar was the first CBDC to become widely available.

> 14 other countries, including major economies like Sweden and South Korea, are now in the pilot stage with their CBDCs and preparing a possible full launch.

Without new standards and international coordination, the financial system may face a significant currency exchange problem in the future.

Fri, Feb 19, 2021

What precisely will the US Treasury Department do about the rise of digital currencies? Secretary Yellen and Federal Reserve Chairman Jerome Powell should quickly harness the potential of these evolving financial tools, including a US-backed digital dollar.

Tue, Apr 20, 2021

Digital payment systems are bringing millions of unbanked and underbanked online and rapidly revolutionizing global finance.

But new technology brings new challenges. From cybersecurity to sanctions evasion to money laundering. Should more governments step in and create their own Central Bank Digital Currencies (CBDCs)? What are China’s ambitions for its digital yuan? Can a transatlantic cooperative project can set new standards on digital currencies and ensure stable and transparent cross-border payments?

Friday, August 06, 2021

On Language Again: 'The Proof is in The Pudding'

Climate contrarians predicted the world would cool—it didn’t

The anticlimate-science blogosphere’s trophy cabinet is bare.

_____________________________________________________________________________

Facebook blocks research into political ads, falsely blames FTC privacy order

FTC says Facebook privacy settlement doesn't require blocking researchers.

When Facebook disabled the accounts of New York University researchers who were investigating misinformation and political ads on the platform, the social-media giant claimed it did so to comply with a consent decree that it previously agreed to with the Federal Trade Commission. "We took these actions to stop unauthorized scraping and protect people's privacy in line with our privacy program under the FTC Order," Facebook wrote in its explanation of the account suspensions. Facebook said it "disabled the accounts, apps, Pages and platform access associated with NYU's Ad Observatory Project and its operators."

But Facebook's claim that the FTC order forced it to suspend the researchers is false, FTC Bureau of Consumer Protection Acting Director Samuel Levine wrote in a letter to Facebook CEO Mark Zuckerberg on Thursday. The FTC order did require Facebook to create a privacy program, but there was no requirement that would have forced Facebook to shut down the NYU research project. Despite that, Facebook's statement that it suspended the accounts "in line with our privacy program under the FTC Order" conveys the false message that Facebook had no choice in the matter.

Levine's three-paragraph letter to Zuckerberg said:

I write concerning Facebook's recent insinuation that its actions against an academic research project conducted by NYU's Ad Observatory were required by the company's consent decree with the Federal Trade Commission. As the company has since acknowledged, this is inaccurate. The FTC is committed to protecting the privacy of people, and efforts to shield targeted advertising practices from scrutiny run counter to that mission.

While I appreciate that Facebook has now corrected the record, I am disappointed by how your company has conducted itself in this matter. Only last week, Facebook's General Counsel, Jennifer Newstead, committed the company to "timely, transparent communication to BCP staff about significant developments." Yet the FTC received no notice that Facebook would be publicly invoking our consent decree to justify terminating academic research earlier this week.

Had you honored your commitment to contact us in advance, we would have pointed out that the consent decree does not bar Facebook from creating exceptions for good-faith research in the public interest. Indeed, the FTC supports efforts to shed light on opaque business practices, especially around surveillance-based advertising. While it is not our role to resolve individual disputes between Facebook and third parties, we hope that the company is not invoking privacy—much less the FTC consent order—as a pretext to advance other aims." . .

Researchers deny Facebook claims

When suspending the NYU researchers, Facebook said the Ad Observer browser extension "was programmed to evade our detection systems and scrape data such as usernames, ads, links to user profiles and 'Why am I seeing this ad?' information, some of which is not publicly viewable on Facebook. The extension also collected data about Facebook users who did not install it or consent to the collection."

The researchers deny this, with Edelman telling NPR, "We really don't collect anything that isn't an ad, that isn't public, and we're pretty careful about how we do it."

The Ad Observer website says the browser extension does not collect any personally identifying information. "It copies the ads you see on Facebook and YouTube, so anyone can see them in our public database," the site says. "If you want, you can enter basic demographic information about yourself in the tool to help improve our understanding of why advertisers targeted you."

This is important because . . ."

READ MORE > Jon Brodkin - Ars Technica | 8/6/2021, 12:00 PM

On Language: I Really Like a Good Turning of The Phrase 'Bite Me'

‘I’d let you bite me!’ Shark Beach With Chris Hemsworth is dangerously flirty TV

Never mind that the Hollywood star has never encountered a great white – this documentary has Thor, his perfect jawline … and flirting so full-on it could crack the camera lens

Broadcast during National Geographic’s annual Shark Fest, this is ostensibly a show about the animals – although it takes eight minutes before we get our first proper look at one. Sure, we learn how many people were killed by sharks in Australia last year. And we see champion surfer Mick Fanning describe the time a shark had a go at him in the water. But mainly we spend those eight minutes with Hemsworth. Hemsworth taking his top off. Hemsworth stroking his surfboard. Hemsworth surfing in slow motion, the salty water caressing his perfect jawline like the touch of an angel.

However, despite this clear devotion to surfing, Hemsworth has never actually encountered a shark. But that doesn’t matter, because he claims to “feel their presence”. While some might query whether this is enough of a justification for a documentary – I think I felt the presence of a bat in a beer garden once, but nobody is clamouring for an hour-long show called Bat Pub With Stuart Heritage – it doesn’t really matter. You’re watching this because it’s got Thor in it.

If you do happen to be watching for sharks, though, you may well come away disappointed. There isn’t a huge amount of new information here. You don’t have to be an expert to know that the climate crisis is altering shark migration patterns, or that shark nets erected at beaches kill plenty of non-shark marine life, or that the shark population has massively decreased. You could get all of that from any boilerplate shark documentary. You could get it from a YouTube video.

To his credit, though, Hemsworth is a bright and engaging host, letting his evident enthusiasm buoy up his lack of expertise. Plus, there’s a short sequence here that I would have happily watched much more of, featuring Valerie Taylor, one of the world’s most qualified shark experts. Now 85, Taylor was the first person ever to photograph a great white without the aid of a cage. She has made documentaries about sharks, campaigned tirelessly for the protection of the animals and shot the real-life shark footage used in Jaws. She is a magnificent, accomplished professional. However, put her near Hemsworth and she flirts harder than any human being on Earth.

Hemsworth and Taylor only have a couple of chats, but every second they are onscreen together is magical. She bats her eyelashes and stumbles over her words, grabs his biceps and strokes his back. The onslaught is so full-on that Hemsworth can’t help but fall under her spell. “I’d let you bite me,” he blushes at one point. It’s fantastic. . .

-

Flash News: Ukraine Intercepts Russian Kh-59 Cruise Missile Using US VAMPIRE Air Defense System Mounted on Boat. Ukrainian forces have made ...