Time to take another look at a phrase of frequent focus here:

Water is the most precious commodity here in the desert . . .

In the best of financial negotiations and outcomes, rights to groundwater can be bought and sold at the highest prices when entitlements to lands change hands for rampant real estate developments that depend on delivering a public natural resource -water - for private investments and profits.

That applies closely to the Non-Stop Suburban Sprawl here in Mesa along the Inner Loops and Outer Loops expanding beyond The Outer Fringes of The East Valley.

Your MesaZona blogger was reminded of that by a new report by Bryan Walsh in Axios .

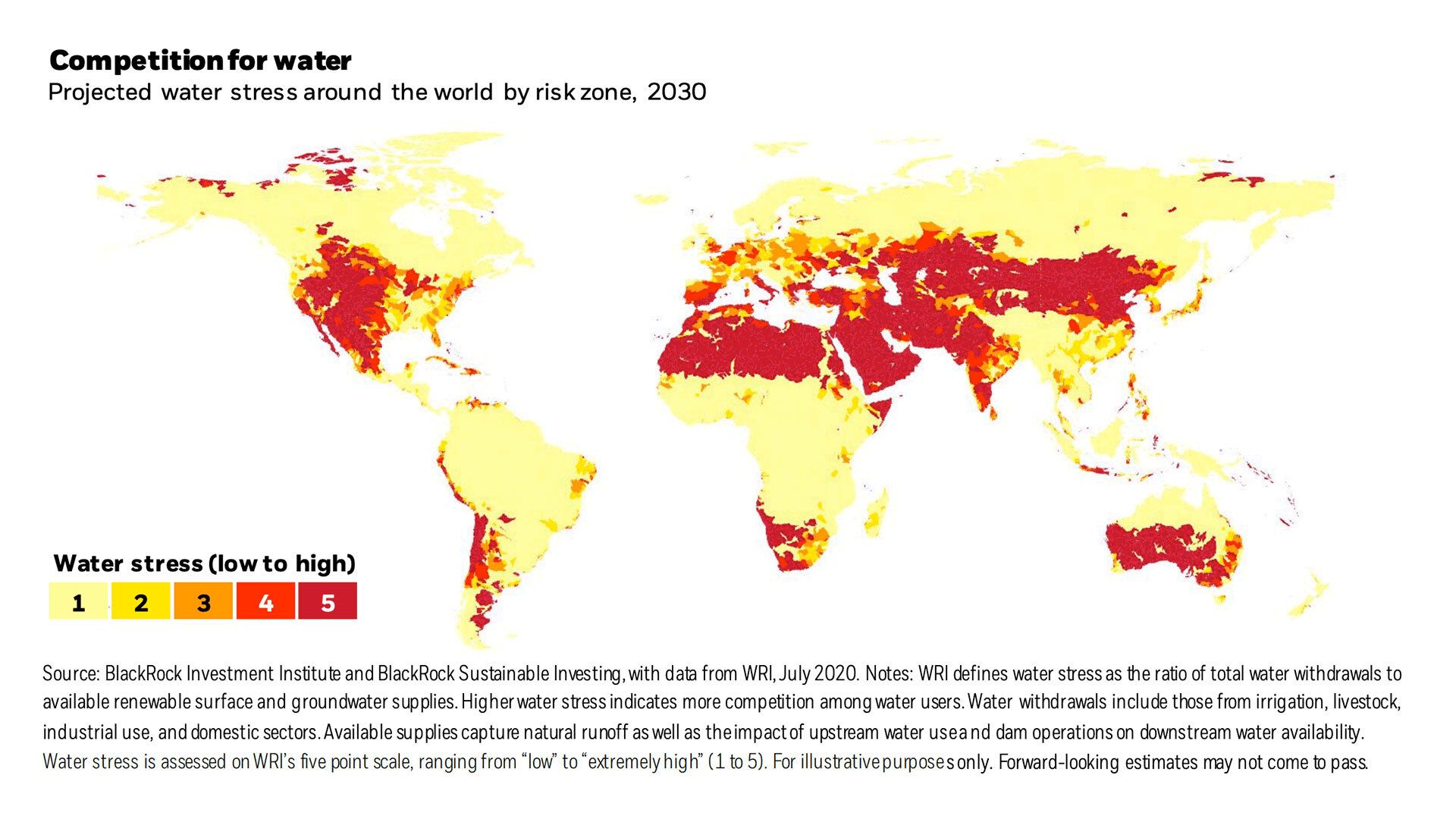

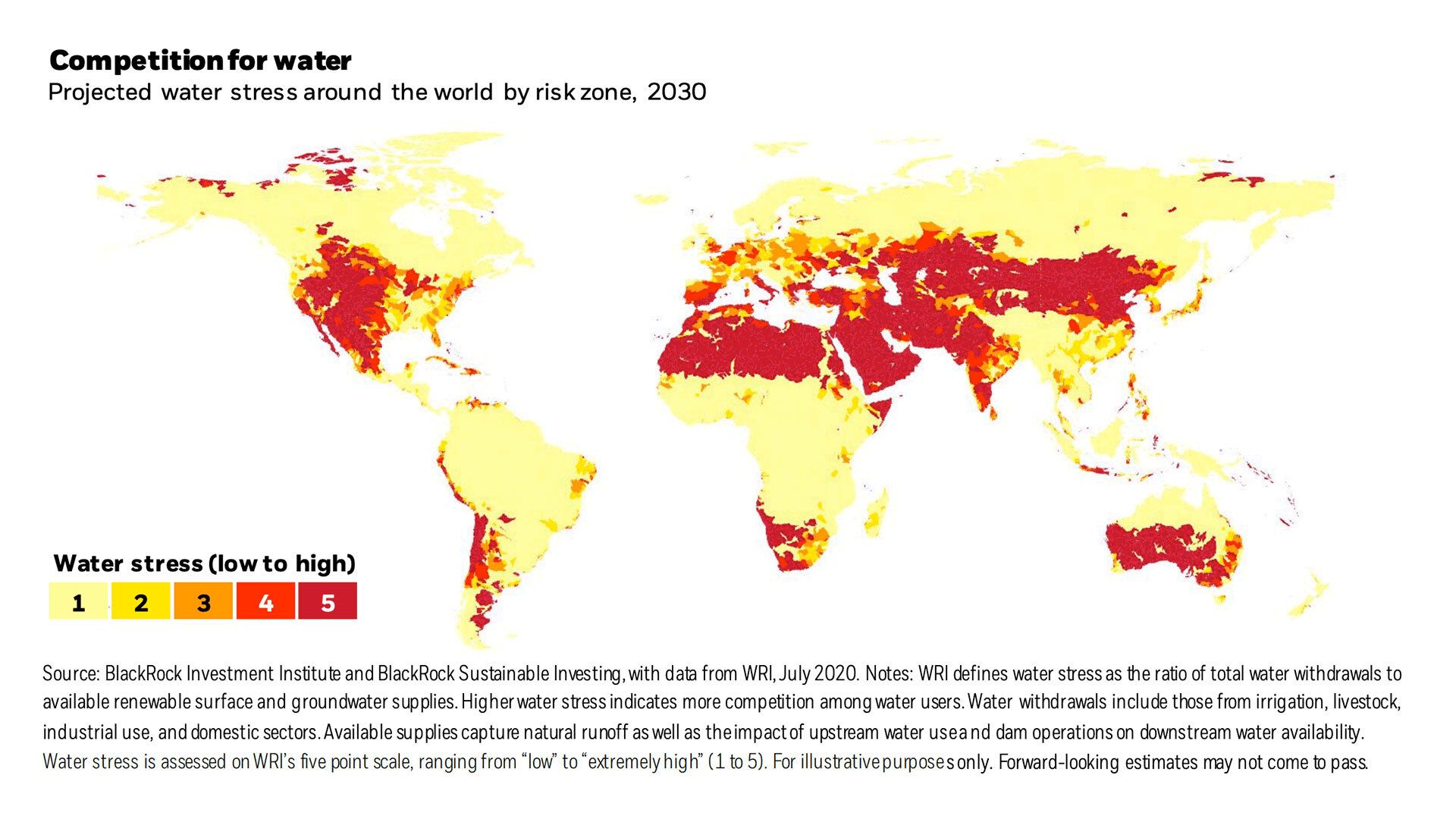

Roughly 60% of real estate investment trust (REIT) properties are projected to experience high water-stress by 2030 — more than double the number today, according to a report that Axios had early access to from the asset management firm BlackRock.

The bottom line: From billionaire investors down to individual citizens, we need to prepare now for the financial effects of a drier future.

_________________________________________________________________________Water use is also a good proxy for stewardship at both the national and corporate level, says Brian Deese, BlackRock's global head of sustainable investing.

"If you're using water well, you're usually doing other things efficiently, too."

_________________________________________________________________________

_________________________________________________________________________

Roughly two-thirds of U.S. REIT properties are projected to be in high-risk water zones, double the proportion today. This includes most of the country west of the Mississippi.

According to World Bank estimates, global water infrastructure costs are expected to rise fourfold by 2030, to $150 billion a year.

__________________________________________________________________________________

"Worldwide, pools of private capital, including private equity and private debt, as well as unlisted real-estate and hedge-fund assets, grew by 44% in the five years to the end of 2019, . . . A different way to capture the scale of the private party is to look at the quartet of Wall Street firms that specialise in managing private investments for clients — Apollo, Blackstone, Carlyle and KKR.

The Economist | Jan 30th 2020

EXIT: from low-productivity “sunset” firms

Water is the most precious commodity here in the desert . . .

In the best of financial negotiations and outcomes, rights to groundwater can be bought and sold at the highest prices when entitlements to lands change hands for rampant real estate developments that depend on delivering a public natural resource -water - for private investments and profits.

That applies closely to the Non-Stop Suburban Sprawl here in Mesa along the Inner Loops and Outer Loops expanding beyond The Outer Fringes of The East Valley.

Your MesaZona blogger was reminded of that by a new report by Bryan Walsh in Axios .

Roughly 60% of real estate investment trust (REIT) properties are projected to experience high water-stress by 2030 — more than double the number today, according to a report that Axios had early access to from the asset management firm BlackRock.

The bottom line: From billionaire investors down to individual citizens, we need to prepare now for the financial effects of a drier future.

_________________________________________________________________________Water use is also a good proxy for stewardship at both the national and corporate level, says Brian Deese, BlackRock's global head of sustainable investing.

"If you're using water well, you're usually doing other things efficiently, too."

_________________________________________________________________________

_________________________________________________________________________

The deepening financial risk of water scarcity

Why it matters: Climate change is set to exacerbate water scarcity in much of the world. Investors who fail to price in the cost of adapting to water stress risk being left high and dry.

Details: Water stress occurs when need for water exceeds supply, due to a combination of population growth and urbanization — which increases demand — and the effects of climate change, which can alter the distribution of water supplies.

BlackRock used the distribution of REITs to identify where investors will feel the pain of water stress.

RELATED CONTENT ON THIS BLOG

1

Needless to say some people "trust" more than others, but what the heck let's just scan the open skies to see what's on the radar screens. As they say there's a lot of opportunities out there. Let's see if your MesaZona blogger can hit on just one - right here in Mesa: DuPont Fabros Technologies

As of 2017, there are several pure-play data center REITs listed on U.S. stock exchanges, including the industry's two largest companies, Equinix(NASDAQ:EQIX) and Digital Realty Trust(NYSE:DLR).

Here's why data center REITs could be a smart addition to your portfolio, and a little information about each of the options.

6 Great Data Center REITs For 2017

First some background and context.

The need for data centers is growing, and these REITs could be a smart way to invest in it

The need for data centers is growing, and these REITs could be a smart way to invest in it

Matthew Frankel Mar 13, 2017 at 12:03PM

Data centers are a relatively new and growing form of real estate to invest in. As of 2017, there are several pure-play data center REITs listed on U.S. stock exchanges, including the industry's two largest companies, Equinix(NASDAQ:EQIX) and Digital Realty Trust(NYSE:DLR).

Here's why data center REITs could be a smart addition to your portfolio, and a little information about each of the options.

| Company | Symbol | Market Cap | Recent Share Price | Dividend Yield |

|---|---|---|---|---|

| Equinix | EQIX | $26.9 Billion | $376.01 | 2.13% |

| Digital Realty Trust | DLR | $16.6 Billion | $103.98 | 3.58% |

| CyrusOne | CONE | $4.2 Billion | $48.20 | 3.49% |

| QTS Realty Trust | QTS | $2.3 Billion | $48.76 | 3.20% |

| DuPont Fabros Technology | DFT | $3.7 Billion | $47.43 | 4.22% |

| CoreSite Realty | COR | $2.9 Billion | $86.51 | 3.70% |

PLEASE NOTE: Chart is author's own.

Market cap, share prices, and dividend yields are current as of 3/10/17.

________________________________________________________________

Related content:

The Retail Apocalypse Is Demolishing Mall Investors

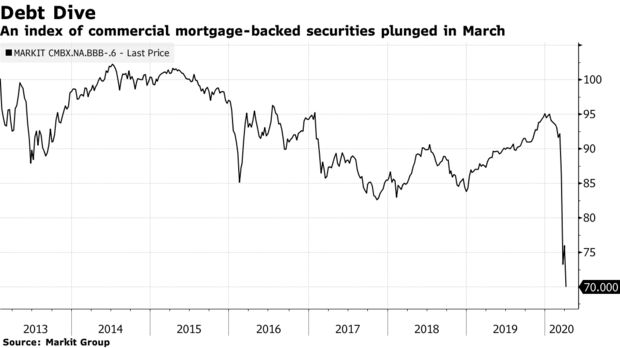

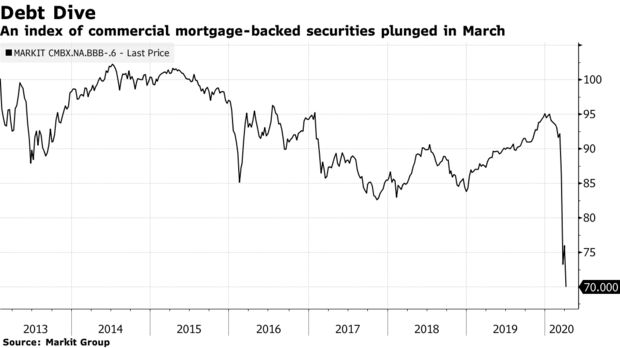

" . . Some of the share prices more than doubled over those years, as part of the commercial property bubble that got so huge that the Fed keeps publicly fretting about it, naming it as one of the reasons for raising interest rates, precisely to tamp down on the valuations. The Fed is worried that an implosion of these inflated commercial property values can take down the banks.

Mall REITs were part of this inflated commercial property universe, and they soared with it. That entire universe is now peaking. But separately, mall REITs are also caught up in the relentless brick-and-mortar retail meltdown, as online shopping is taking over. This is a structural shift that will continue to progress. Mall owners are already trying to find a way to “repurpose” their malls. But this isn’t going to be smooth.

As so many times, Private Equity firms are in the thick of it. . .:

Read… I’m in Awe of How Fast Brick-and-Mortar Retail is Melting Down.

Mall REITs were part of this inflated commercial property universe, and they soared with it. That entire universe is now peaking. But separately, mall REITs are also caught up in the relentless brick-and-mortar retail meltdown, as online shopping is taking over. This is a structural shift that will continue to progress. Mall owners are already trying to find a way to “repurpose” their malls. But this isn’t going to be smooth.

As so many times, Private Equity firms are in the thick of it. . .:

Read… I’m in Awe of How Fast Brick-and-Mortar Retail is Melting Down.

2

"The market for mortgage-backed securities was in free fall, with fear running rampant and banks seizing collateral.

So Tom Barrack, the chairman of real estate investment trust Colony Capital Inc., published an 1,800-word plea for the Federal Reserve to buy bonds backed by homes, cars and other assets and for banks to halt margin calls.

That was last Saturday. In the week since, three top investors in the sector have engaged restructuring advisers, two others sold $7 billion of debt at a discount and publicly traded mortgage REITs in the U.S. lost more than $12 billion of market value, bringing total declines this year to at least $50 billion.

The carnage shows no signs of abating. Prominent asset managers including Blackstone Group Inc., TPG and Apollo Global Management Inc. have been sucked into the vortex wrought by the coronavirus pandemic, with their associated mortgage REITs losing more than two-thirds of their value on average so far in 2020.

05 April 2020

Something old posted on this blog Dec 2017and something new and recent just yesterday from Bloomberg News (excerpts)

After $50 Billion of Losses, No One Comes to Save the Mortgage Market

Many publicly traded U.S. REITs have lost most of their value

Starwood Capital, JPMorgan among those in hunt for bargains

3

26 March 2020

The World Needs Warehouses Now, and Blackstone’s Got Them

OK . . but do read more [the valuations are now in question]

Before the coronavirus crisis, private equity made a big bet on logistics facilities.

By Noah Buhayar

@NBuhayarMore stories by Noah Buhayar

_________________________________________________________________

CAUTION INSERT 1

"Venture capital (VC), another part of the private universe, is feverish. SoftBank’s Vision Fund, a $100bn private-capital vehicle backed by Saudi Arabia’s sovereign-wealth fund, has funnelled cash into fashionable, unlisted startups. Other institutions have vied with it to write big cheques for Silicon Valley’s brightest new stars.

Already some of these bets have gone awry. . .

"The flood of capital into private markets ultimately rests on the belief that they will outperform public ones. There is evidence for this—in the past the best-run private-capital managers have beaten the returns from public markets, even after generous fees. And there are grounds to believe that this was no statistical fluke. Private capital, say its boosters, reduces “agency costs”. These arise wherever somebody (the principal) delegates a task to somebody else (the agent) and their interests conflict. Consider the public markets—no one has a big enough stake to make it worthwhile to monitor firms, which as a result get complacent or indulge in short-term earnings management to the detriment of the long term. Private capital, which is closely held in a few hands, is supposed to get around such agency problems.

Yet every investment craze is liable to overreach, blindness to risk and misallocated capital. Recent converts to the private world, dazzled by the historical returns, may not fully appreciate the hazards . . "

_________________________________________________________________

CAUTION INSERT 2

Asset Management: PRIVATE CAPITAL/PRIVATE DEBT MARKETS > Buy-Outs & Property

"Worldwide, pools of private capital, including private equity and private debt, as well as unlisted real-estate and hedge-fund assets, grew by 44% in the five years to the end of 2019, . . . A different way to capture the scale of the private party is to look at the quartet of Wall Street firms that specialise in managing private investments for clients — Apollo, Blackstone, Carlyle and KKR.

__________________________________________________________

BLOGGER NOTE: What appears in this post are selected snippets taken from

Everyone now believes that private markets are better than public ones

The Economist | Jan 30th 2020

EXIT: from low-productivity “sunset” firms

ENTRY: into more productive “sunrise” firms.

_________________________________________________________________

"Their total managed assets have risen by 76% in the past five years, to $1.3trn.

They have long specialised in buy-outs and property.

More recently they have grown in private-debt markets, too—in total their funds’ credit holdings have hit $470bn

MORE > https://mesazona.blogspot.com/2020/02

_________________________________________________________________BLOGGER INSERT: They sure did

Here's an earlier post from this blog

MesaZona > Table of Contents : Here's The Menu. Enjoy

03 June 2019

Press Release Jun 02, 2019 https://www.blackstone.com/media

Blackstone to Buy U.S. Logistics Assets from GLP for $18.7 Billion

Deal will be the largest-ever private real estate transaction globally

Singapore and New York – GLP and Blackstone today announced that they have entered into an agreement for Blackstone to acquire assets from three of GLP’s U.S. funds for a purchase price of $18.7 billion.

__________________________________________________________Blackstone Bets on E-Commerce With $18.7 Billion Logistics Deal

Updated on

In context from https://www.bloomberg.com/news

Blackstone Group LP is doubling down on the future of online shopping, agreeing to buy $18.7 billion of U.S. logistics assets from Singapore’s GLP Pte in what it says is the world’s biggest private-equity real estate deal.Blackstone will gain 179 million square feet of warehouse assets, greatly expanding the size of its U.S. industrial footprint, the New York-based company said in a statement late Sunday

This overall transaction totals 179 million square feet of urban, infill logistics assets, nearly doubling the size of Blackstone’s existing U.S. industrial footprint.

Blackstone Real Estate’s global opportunistic BREP strategy will acquire 115 million square feet for $13.4 billion and its income-oriented non-listed REIT, Blackstone Real Estate Income Trust (BREIT), will acquire 64 million square feet for $5.3 billion.

Ken Caplan, Global Co-Head of Blackstone Real Estate, commented: “Logistics is our highest conviction global investment theme today, and we look forward to building on our existing portfolio to meet the growing e-commerce demand. Our global scale and ability to leverage differentiated investment strategies allowed us to provide a one-stop solution for GLP’s high quality portfolio.”

Alan Yang, Chief Investment Officer of GLP, said: “GLP was able to leverage our deep operating expertise and global insights in the logistics sector within four years to build and grow an exceptional portfolio. We are proud of the business our team built and are confident it will continue to flourish under Blackstone’s leadership. We are looking forward to expanding our footprint in the United States to continue to seize key opportunities in the U.S. market.”

___________________________________________________________

Press Release Jun 02, 2019 https://www.blackstone.com/media

Blackstone to Buy U.S. Logistics Assets from GLP for $18.7 Billion

Deal will be the largest-ever private real estate transaction globally

Singapore and New York – GLP and Blackstone today announced that they have entered into an agreement for Blackstone to acquire assets from three of GLP’s U.S. funds for a purchase price of $18.7 billion.

__________________________________________________________Blackstone Bets on E-Commerce With $18.7 Billion Logistics Deal

Updated on

In context from https://www.bloomberg.com/news

Blackstone Group LP is doubling down on the future of online shopping, agreeing to buy $18.7 billion of U.S. logistics assets from Singapore’s GLP Pte in what it says is the world’s biggest private-equity real estate deal.Blackstone will gain 179 million square feet of warehouse assets, greatly expanding the size of its U.S. industrial footprint, the New York-based company said in a statement late Sunday

This overall transaction totals 179 million square feet of urban, infill logistics assets, nearly doubling the size of Blackstone’s existing U.S. industrial footprint.

Blackstone Real Estate’s global opportunistic BREP strategy will acquire 115 million square feet for $13.4 billion and its income-oriented non-listed REIT, Blackstone Real Estate Income Trust (BREIT), will acquire 64 million square feet for $5.3 billion.

Ken Caplan, Global Co-Head of Blackstone Real Estate, commented: “Logistics is our highest conviction global investment theme today, and we look forward to building on our existing portfolio to meet the growing e-commerce demand. Our global scale and ability to leverage differentiated investment strategies allowed us to provide a one-stop solution for GLP’s high quality portfolio.”

Alan Yang, Chief Investment Officer of GLP, said: “GLP was able to leverage our deep operating expertise and global insights in the logistics sector within four years to build and grow an exceptional portfolio. We are proud of the business our team built and are confident it will continue to flourish under Blackstone’s leadership. We are looking forward to expanding our footprint in the United States to continue to seize key opportunities in the U.S. market.”

___________________________________________________________