Dodge Momentum Index Increases in April

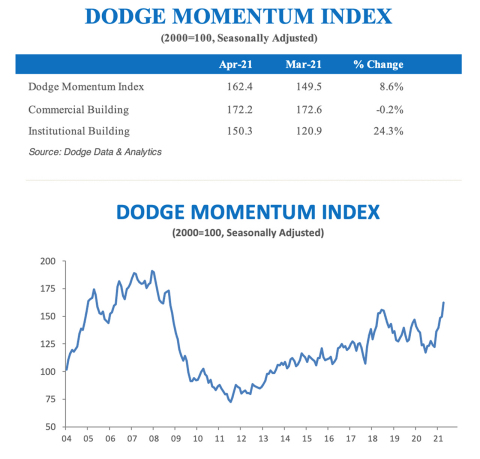

HAMILTON, N.J. The Dodge Momentum Index posted an 8.6% gain in April, climbing to 162.4 (2000=100) from the revised reading of 149.5 in March.

The Momentum Index, issued by Dodge Data & Analytics, is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year.

April’s gain marks the fifth consecutive monthly increase, and similar to February and March, was due to a large increase in institutional buildings entering the planning stage while commercial planning eased by less than one percent.

Since hitting its nine-year low in January, institutional planning has rebounded substantially, climbing 77% over the last three months. Healthcare and laboratory projects continue to dominate the sector, pushing institutional planning 50% higher on a year-over-year basis.

Conversely, the commercial component has slipped in recent months as fewer warehouse projects have entered planning, though the sector is 21% higher than in April 2020.

> Overall, the Momentum Index is 31% higher than last April, which was the first full month of COVID-19 shutdowns.

There were 13 projects with a value of $100 million or more that entered planning within April. The leading commercial projects were a $400 million mixed-use office project in San Francisco CA and a $250 million warehouse project in Mesa AZ. The leading institutional projects were the $300 million first phase of The Cove JC laboratory and education facility in Jersey City NJ and a $175 million laboratory project in Boston MA.

About Dodge Data & Analytics:

Dodge Data & Analytics is North America’s leading provider of commercial construction project data, market forecasting & analytics services and workflow integration solutions for the construction industry. Building product manufacturers, architects, engineers, contractors, and service providers leverage Dodge to identify and pursue unseen growth opportunities that help them grow their business. On a local, regional or national level, Dodge empowers its customers to better understand their markets, uncover key relationships, seize growth opportunities, and pursue specific sales opportunities with success. The company’s construction project information is the most comprehensive and verified in the industry. Dodge is leveraging its more than 125-year-old legacy of continuous innovation to help the industry meet the building challenges of the future. Learn more at www.construction.com.

Media Contact

Nicole Sullivan | AFFECT Public Relations & Social Media | +1-212-398-9680 | nsullivan@affectstrategies.com

Sarah Markfield | Dodge Data & Analytics | Content Marketing, Director | sarah.markfield@construction.com

---------------------------------------------------------------------------------------------------------------------------

Join Dodge Data & Analytics Chief Economist Richard Branch and other Dodge economists for our Mid-Year Outlook program. During this 75-minute event, Mr. Branch and his colleagues will outline the national and regional starts forecast for 2021 and 2022, respectively, across our residential, nonresidential building, and nonbuilding sectors. Highlights of this program will include those factors impacting the economic upturn now that the economy is starting to improve.

Mr. Branch and his colleagues will also be looking at some high-frequency planning data to help the industry continue on its path to recovery.

Attendees will gain an understanding of the current market situation and a macroeconomic overview. Also, Mr. Branch and his colleagues will share an outlook for commercial building, manufacturing building, institutional, building, and nonbuilding.

more

No comments:

Post a Comment