Connecting state and local government leaders

The finding comes even as cities and states have raised the minimum wage over the past few years.

Even though many states and cities have increased minimum wages over the last few years, it’s still not sufficient to relieve the increasing financial stress many renters face. Nearly half of all workers in the U.S. are not making enough to comfortably afford a one-bedroom apartment, according to a new report.

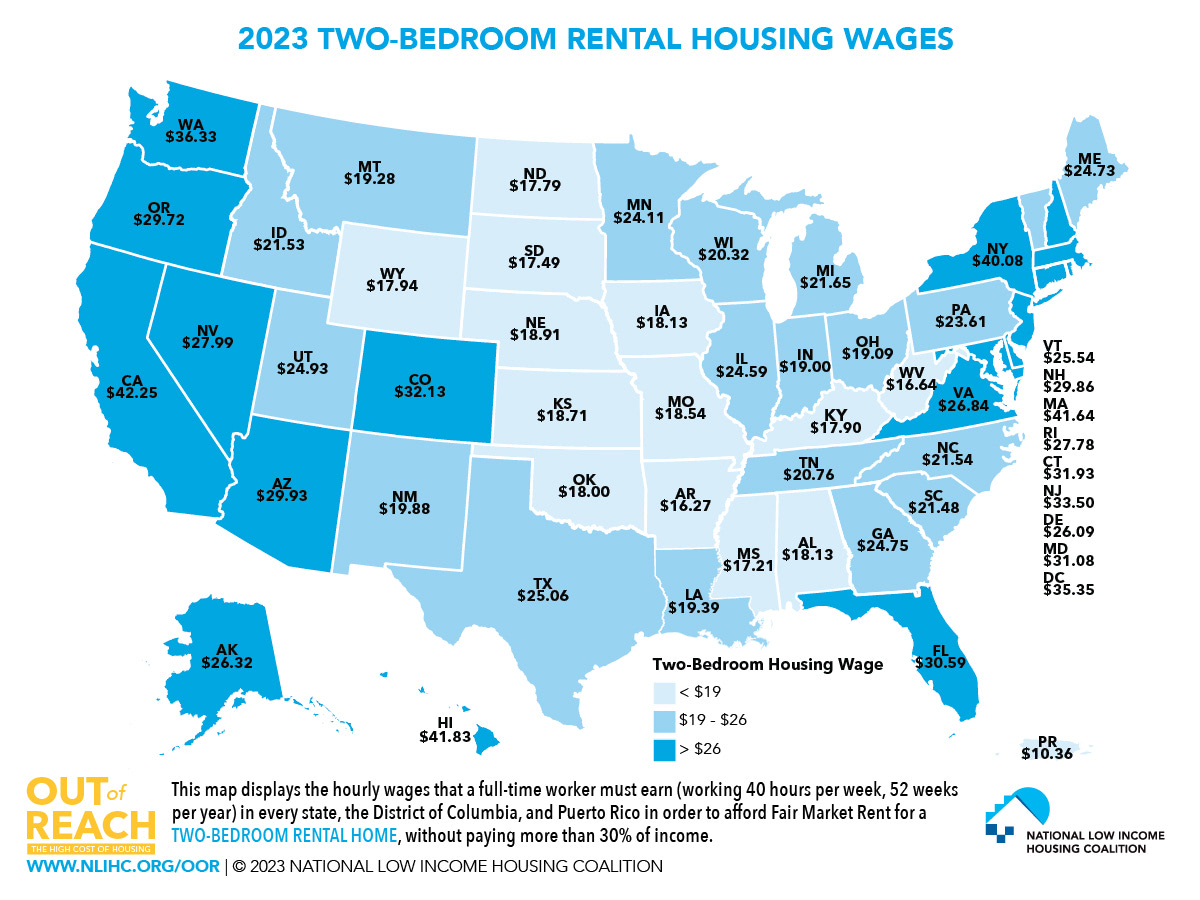

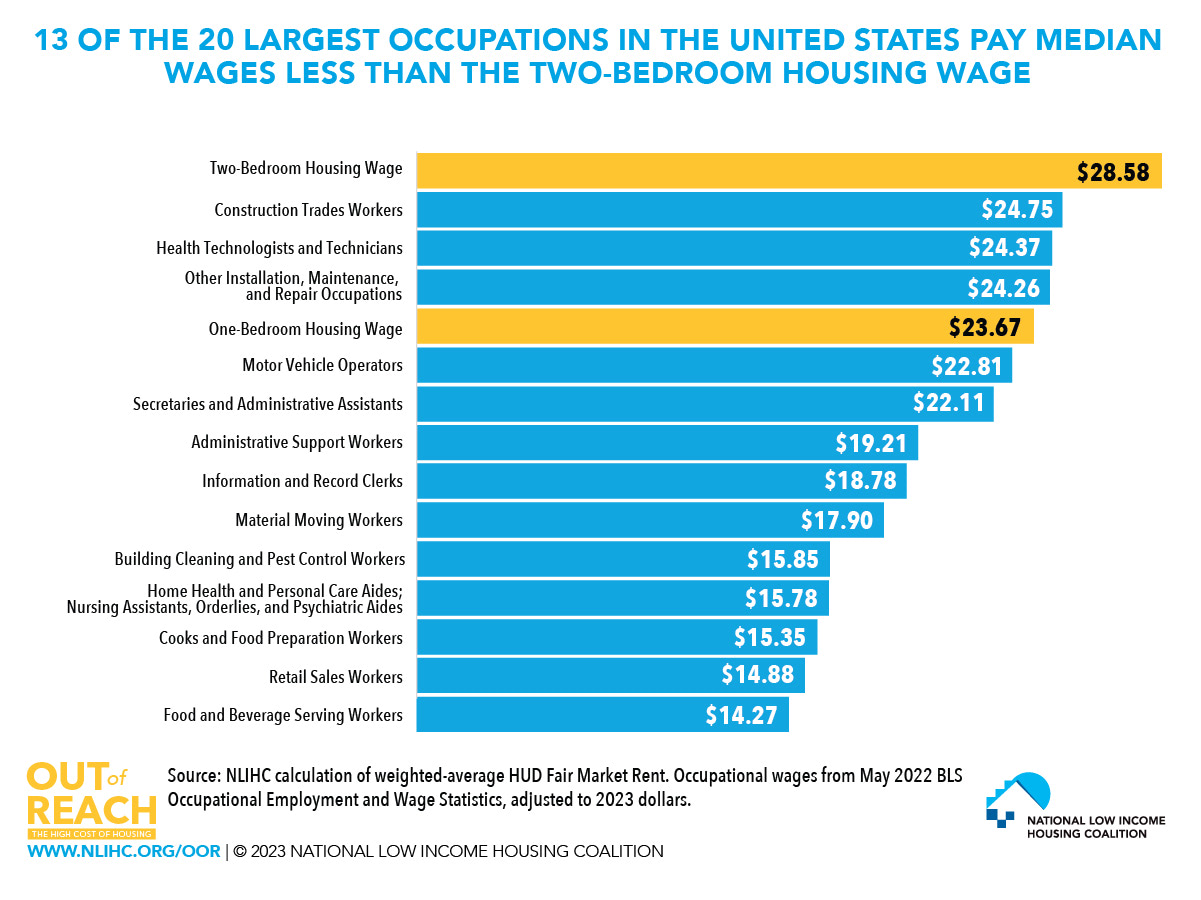

On average, a person working full time needs to make $23.67 an hour to afford a one-bedroom apartment or $28.58 an hour for a two-bedroom apartment, according to the National Low Income Housing Coalition’s annual Out of Reach report. It’s the latest to show just how unaffordable housing is for minimum-wage workers, a point the report has made for several years.

In only 7% of counties nationwide can a full-time minimum-wage worker afford a one-bedroom apartment at fair market rent. All of those counties are located in states with minimum wages higher than the $7.25 hourly federal mandate, a rate that was established in 2009 and still applies to seven states. Currently, 30 states and Washington, D.C., have minimum wages ranging between $10 and $16 an hour, and 47 localities have increased their minimum wages to surpass their respective state’s.

It’s an encouraging trend, the reports’ researchers said on a media call Wednesday, but those increases don’t address the lack of affordable housing nationwide, especially as rents jumped an average of 25% in 2021 and 2022.

“This is partly an income problem,” said Andrew Aurand, the report’s lead researcher, “but it really is a housing problem. We need to ensure that there's adequate affordable housing.”

Take San Francisco. Next month, the city’s minimum wage will increase from $16.99 an hour to $18.07. But the report found that the housing wage for the city is $61.31 an hour. (The report defines a “housing wage” as the hourly wage necessary to afford a modest apartment without spending more than 30% of a worker’s income.)

The state of California clocks in with the highest housing wage in the country at $42.28 an hour for a two-bedroom rental. The state’s current minimum wage is $15.50, and a person earning that rate would have to work 109 hours a week to afford a fair market rent apartment.

At the other end of the spectrum is Arkansas, where the housing wage for a two-bedroom fair market apartment is $16.27 an hour. The minimum wage in the state is $11. Aurand notes that in states and cities with lower costs of living, wages are often lower. As a result, he says, the wage gap still burdens many renters.

The report lists the housing wage for every state and hundreds of metropolitan areas, and compares those figures to average renters’ wages and minimum wages.

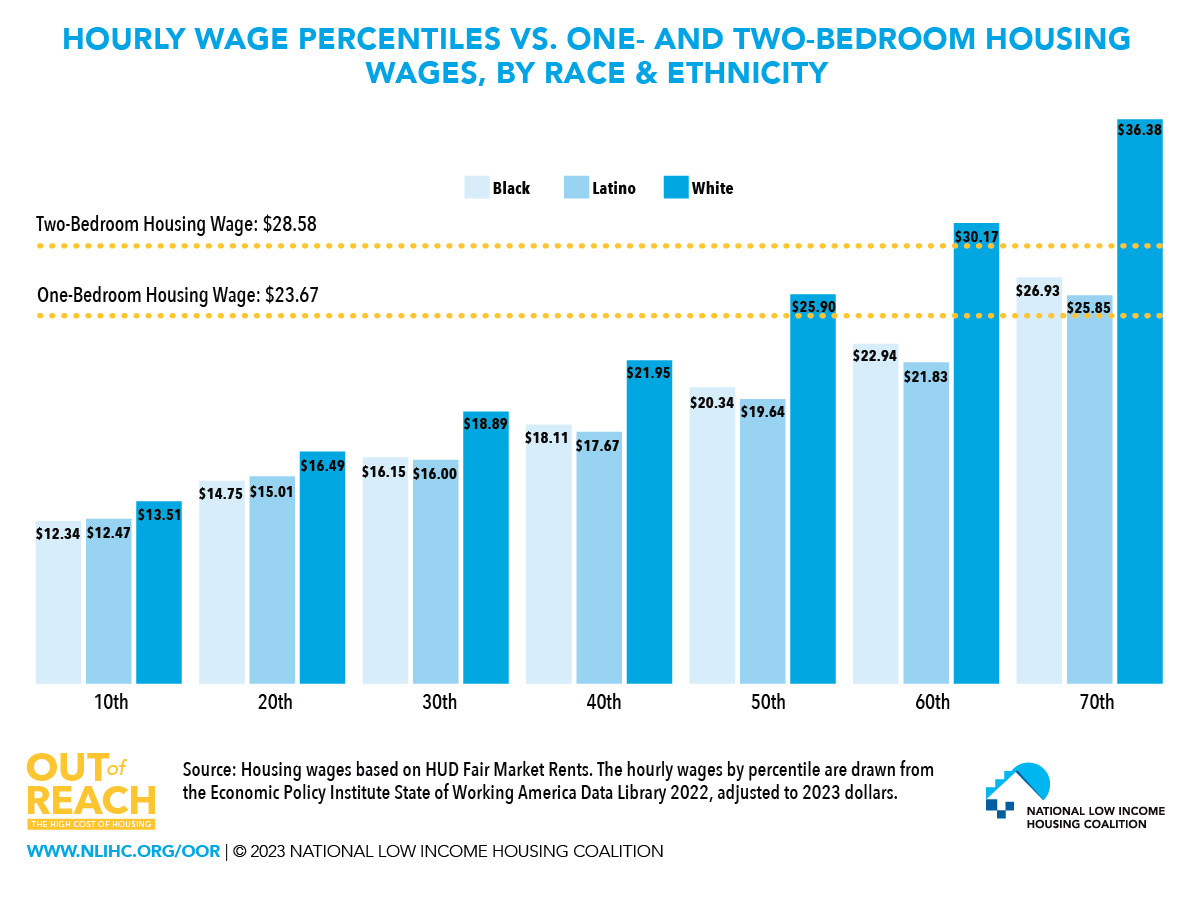

The gap between income and housing costs is especially large for renters of color. The study found that nationally the median wage for a full-time white worker is enough to cover the costs of a one-bedroom apartment, but the same can’t be said for Black and Latino workers.

Even workers who make more than the minimum wage are cost burdened by rent. Almost 50% of workers make less than the average wage necessary to afford a one-bedroom apartment. Accounting for about one-third of the country’s workforce, 10 of the 20 most common jobs—including positions in the food and retail industries, administrative roles, and nursing and health aides—pay median wages that are below the $23.67 “housing wage.”

The coalition’s CEO and president, Diane Yentel, noted on Wednesday’s call that rising rents directly lead to increases in homelessness. According to the U.S. Government Accountability Office, a $100 median monthly increase in rent leads to a 9% increase in homelessness. As pandemic programs like the eviction moratorium and emergency rental assistance end, eviction filings are returning or surpassing pre-pandemic levels in some parts of the country, the report notes.

Published Wednesday, the reports comes as Congress has agreed in the debt ceiling bill to a spending freeze that will likely slash funding for housing initiatives. But states and cities will not be able to close the gap between incomes and housing costs without funneling more money toward the National Housing Trust Fund, expanding housing vouchers and creating a permanent emergency rental assistance program.

“While communities are successfully rehousing individual people every day, they cannot stem the tide of people falling newly into homelessness, or who are on the cusp, due to a lack of homes affordable and available to the lowest income people and woefully inadequate federal funding for solutions,” Yentel said.

NEXT STORY: Feds Give States More Flexibility in Medicaid Redeterminations

No comments:

Post a Comment