Time of essence in proposed bond refinance of Arizona sports park

"Plans for a youth sports destination in Arizona to refinance its way out of financial trouble have yet to come to fruition, and the clock appears to be ticking.

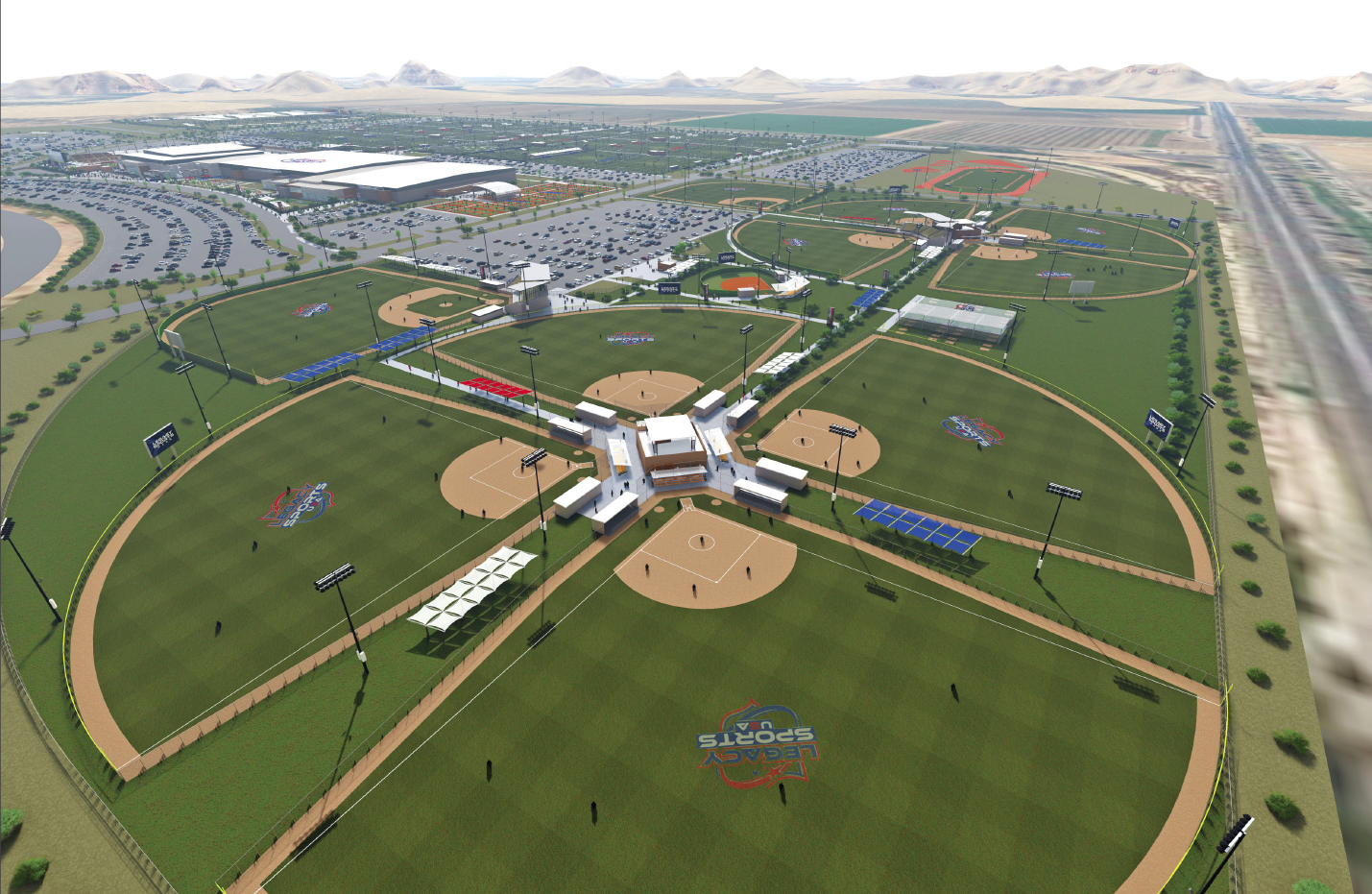

Bell Bank Park, which opened on schedule in January 2022 and publicly claims to be a smash success, with 4.3 million guests in its first year, left a trail of mechanic's liens from unpaid construction contractors and was declared to be in default by the trustee on the tax-exempt bonds used to build it.

The developers of the venue, designed as a destination for youth sports events, like soccer, volleyball and basketball travel team tournaments (it also offers competitive pickleball for an older demographic), created a nonprofit organization to qualify to issue tax-exempt bonds to finance it."

Questions of fraud, misappropriation of bond funds arise in Mesa sports park bankruptcy case

No comments:

Post a Comment