Market Extra

S&P 500 exits longest bear market since 1948. What stock-market history says about what happens next.

The S&P 500 on Thursday closed above the threshold that marked its exit from the longest bear market since 1948.

Here are some key stats from Dow Jones Market Data:

- The S&P 500 SPX,

+0.62% had been in bear-market territory for 248 trading days; the longest bear market since the 484 trading days ending on May 15, 1948. - Excluding this most recent bear market, the average bear market lasts 142 trading days.

- It took 164 trading days from the bear-market low to exit; the longest period from bear-market low to exiting a bear market since the 191 trading day period ending July 25, 1958.

- Excluding this bear market, the average bear-market low to bear-market exit is 61 trading days.

- The index fell 25.43% from its recent high to its bear-market low, on a closing basis.

- The index is still 10.5% off from its record close of 4796.56, set on Jan. 3, 2022.

Under the criteria used by Dow Jones Market Data and many other market watchers, a 20% rise from a recent low signals the start of a bull market while a 20% fall signals the start of a bear market. That means the market is always in either a bull or bear market. Also, the market doesn’t hop into and out of either a bull or bear each time it crosses the threshold again. It takes another 10% or 20% move in the opposite direction to change the status.

So what does history say about what happens next?

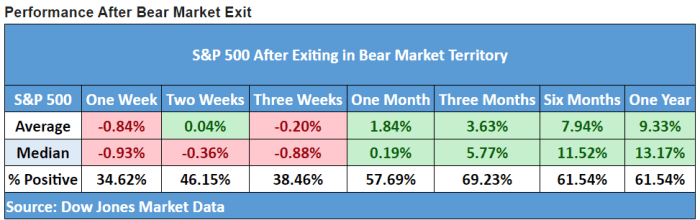

A look by Dow Jones Market Data at median and average performance following past bear-market exits, based on data stretching back to 1929, is largely positive for periods from one month to a year (see table below).

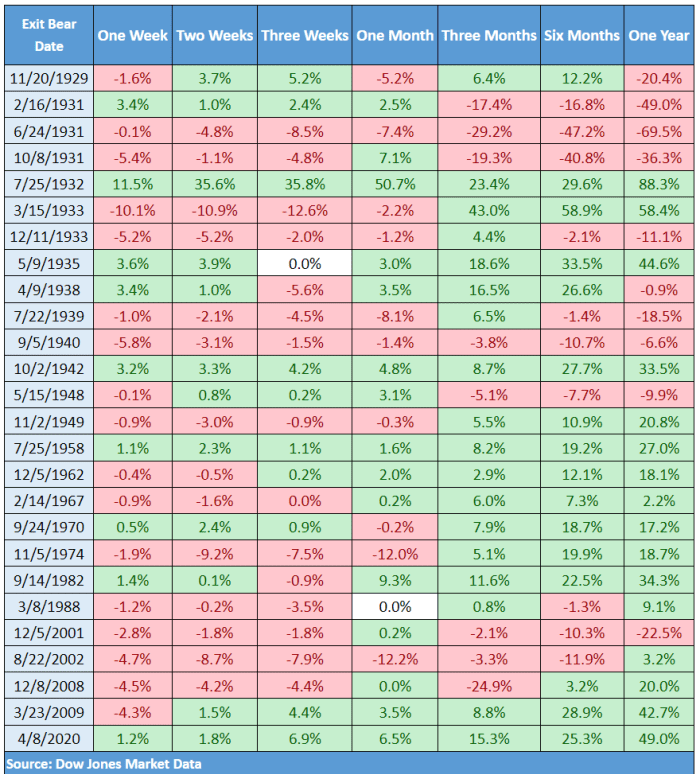

But there’s a lot of variability. Here’s a closer look at what happened after each exit:

The table shows that bear exits usually — but not always — lead to durable bull markets.

In One Chart: Why stock-market bulls must beware of ‘bogus bear-market bottoms’

As noted earlier by Sam Stovall, chief investment strategist at CFRA, of the 14 bear markets since WWII, only two — 2000-’02 and 2007-’09 –– produced exits that saw the S&P 500 quickly slump back into a bear market by declining more than 20%.

See: Big Tech’s added bulk in S&P 500 in 2023 outweighs index’s energy sector, DataTrek says

Stocks were boosted Thursday after a rise in first-time jobless claims appeared to reinforce expectations the Federal Reserve will leave rates unchanged when it meets next week.

The S&P 500 rose 26.41 points, or 0.6%, to close at 4,293.93, its highest close since Aug. 16.

The Nasdaq Composite COMP,

The Nasdaq exited a bear market on May 8, while the Dow exited its bear on Nov. 30.

Read Next

Barron's: These 2 Energy Stocks Could Get a Boost From Falling Prices

Oil producers Devon Energy and Marathon Oil stand to gain as their operational costs ease, says Citigroup.

More On MarketWatch

- Why U.S. stock-market investors were rattled by the Bank of Canada’s surprise rate hike

- Get ready for higher beef prices this summer. Here’s why.

- Barron's: Tesla Stock Rises Again. It’s About the Cybertruck This Time, Mostly.

- A deluge of Treasury bill issuance is coming. How it could impact stocks and the broader market

About the Author

William Watts is MarketWatch markets editor. In addition to managing markets coverage, he writes about stocks, bonds, currencies and commodities, including oil. He also writes about global macro issues and trading strategies. During his time at MarketWatch, Watts has served in key roles in the Frankfurt, London, New York and Washington, D.C., newsrooms.

No comments:

Post a Comment