Rate Hikes Echo Around the World as Inflation Proves Unrelenting

US Treasury Secretary Yellen Sees Lower US Recession Risk, Says Consumer Slowdown Needed

(Bloomberg) -- Treasury Secretary Janet Yellen sees diminishing risk for the US to fall into recession, and suggested that a slowdown in consumer spending may be the price to pay for finishing the campaign to contain inflation.

On the chance of a recession, Yellen said “my odds of it, if anything, have gone down — because look at the resilience of the labor market, and inflation is coming down.” She spoke in an interview with Bloomberg News Thursday.

Spending Slowdown

- “I’m not going to say it’s not a risk, because the Fed is tightening policy,” she said, alluding to the Federal Reserve’s 10 interest-rate hikes since March 2022, with potentially more to come.

Spending Slowdown

- “We probably need to see some slowdown in spending in order to get inflation” under control, Yellen said in reference to consumption.

- The core measure of price increases, which strips out food and energy, “is quite high,” she said.

The 2% Debate

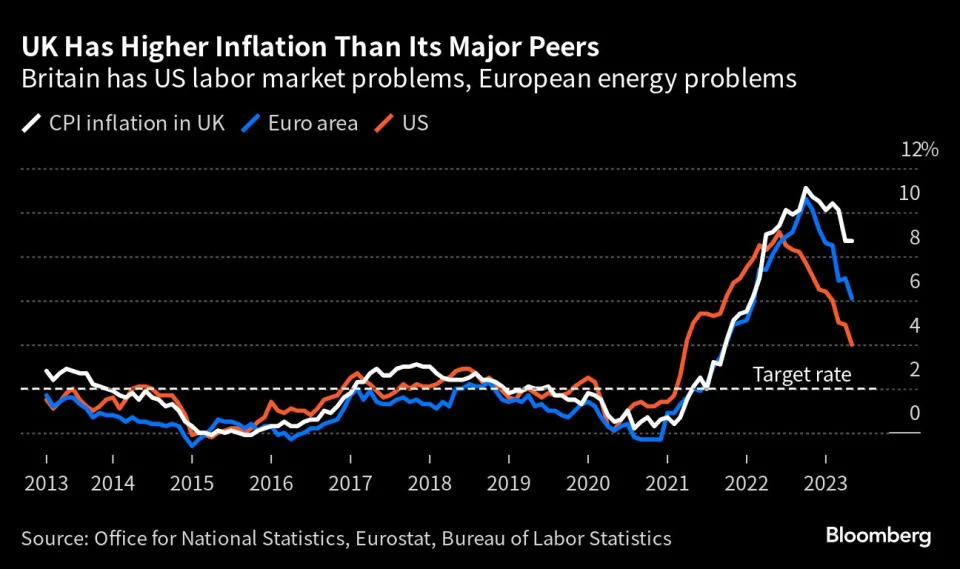

As for a debate among some economists about whether the Fed ought to raise its inflation target from the 2% rate that was adopted during a time of weak growth and investment, Yellen indicated that such a discussion isn’t appropriate at a time when policymakers are battling to contain a price surge.

“We could have lovely debate for what the inflation target would be,” Yellen said. “But this is not the time for that debate.”

Fed Chair Jerome Powell has rejected the idea of entertaining a change to the 2% target — sentiment he reiterated before Congress this week.

Yellen was speaking in Paris on the sidelines of a summit organized by French President Emmanuel Macron on reforming global development-lending architecture — an issue that’s been a priority for the US administration. . ."

Story continues about China >

As for a debate among some economists about whether the Fed ought to raise its inflation target from the 2% rate that was adopted during a time of weak growth and investment, Yellen indicated that such a discussion isn’t appropriate at a time when policymakers are battling to contain a price surge.

“We could have lovely debate for what the inflation target would be,” Yellen said. “But this is not the time for that debate.”

Fed Chair Jerome Powell has rejected the idea of entertaining a change to the 2% target — sentiment he reiterated before Congress this week.

Yellen was speaking in Paris on the sidelines of a summit organized by French President Emmanuel Macron on reforming global development-lending architecture — an issue that’s been a priority for the US administration. . ."

Story continues about China >

June 23 (Reuters) - U.S. stock index futures fell on Friday as investor sentiment remained

damp due to the hawkish interest-rate outlook of Federal Reserve Chair Jerome Powell in his two-day congressional testimony.

"The ever-present tug of war between bears and bulls seems to be at an impasse, with markets relatively steady over the week as investors weigh up the Fed's next move after comments from Powell suggest hikes are far from over," said Matt Britzman, equity analyst at Hargreaves Lansdown.

"Investors should strap in for rates to go higher than they want, for longer than they'd like."

- Appearing before the Senate Banking Committee, Powell reiterated his view that more rate hikes are likely in the months ahead.

"The ever-present tug of war between bears and bulls seems to be at an impasse, with markets relatively steady over the week as investors weigh up the Fed's next move after comments from Powell suggest hikes are far from over," said Matt Britzman, equity analyst at Hargreaves Lansdown.

"Investors should strap in for rates to go higher than they want, for longer than they'd like."

- Bond markets are still pricing in one more rate hike of 25 basis points in July, according to CME Group's FedWatch tool, as opposed to two more as suggested by Powell.

- Richmond Fed President Tom Barkin said he remains unconvinced that inflation is on a steady path downward, but would not prejudge what the Fed should do at its July 25-26 meeting.

"The latest data aggravated fears about a potential recession, which has further dampened risk appetite," a note from Deutsche Bank said.

No comments:

Post a Comment