Companies are desperately seeking options to deal with debt

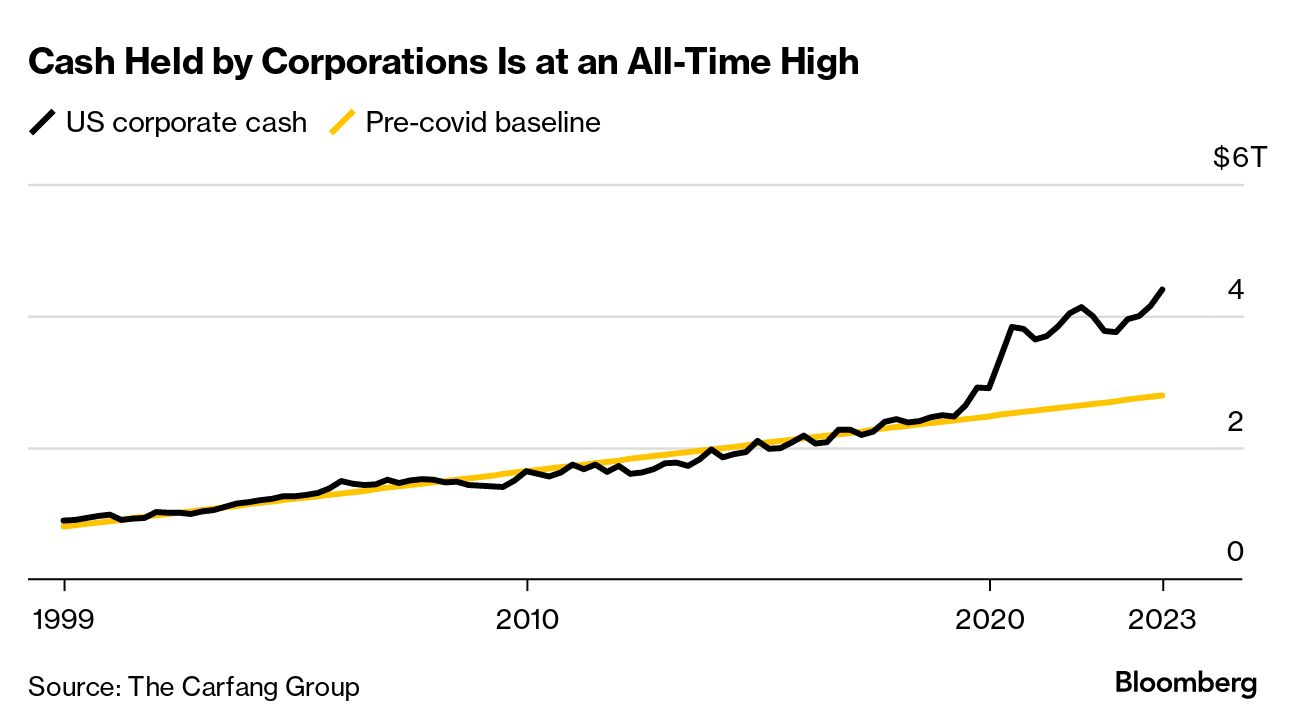

Investors are plowing billions into money-market funds by the day. Corporate treasurers are hoarding record amounts of cash. The market is digesting a glut of Treasury bills without a hiccup.

Markets start to speculate if the next Fed move is up, not down

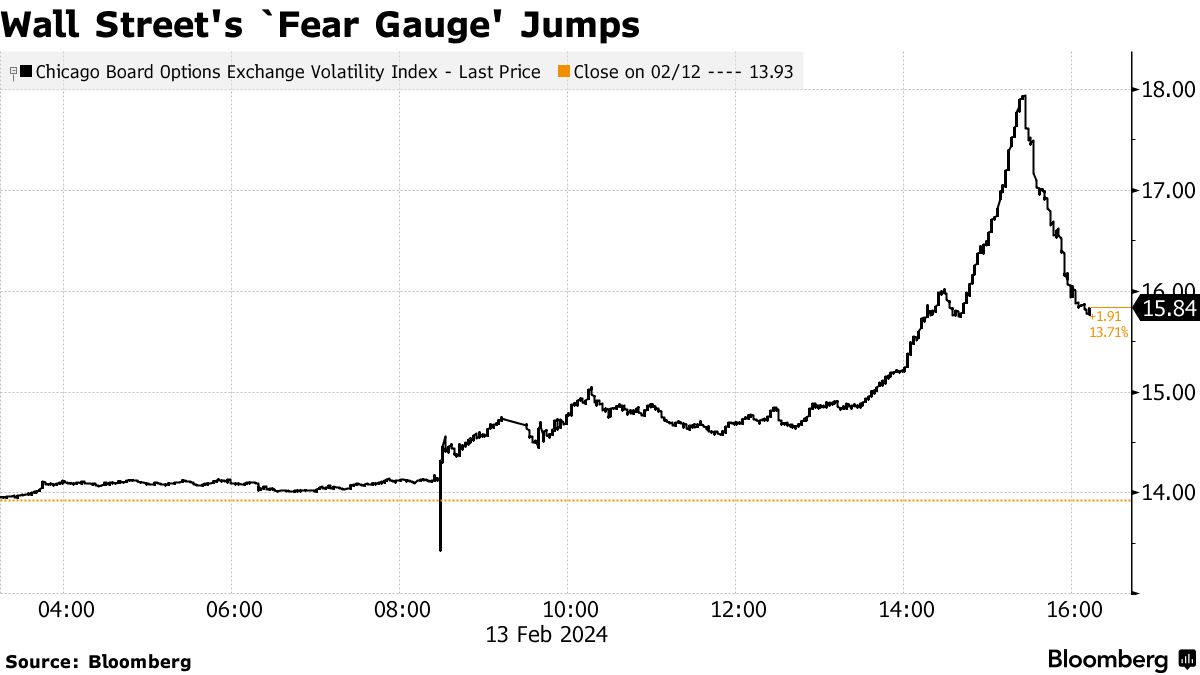

(Bloomberg) — Investors are beginning to war-game how the Federal Reserve can manage a US economy that just won’t land, with some even debating whether interest-rate hikes will be needed only weeks after a steady run of reductions appeared all but certain.

Most Read from Bloomberg

Largest Covid Vaccine Study Yet Finds Links to Health Conditions

Capital One to Buy Discover for $35 Billion in Year's Biggest Deal

Wall Street’s Moelis Bet Big on the Middle East. Now He’s Cashing In

A $6 Trillion Wall of Cash Is Holding Firm as Fed Delays Cuts

Bets on lower rates coming soon were so prevalent a few weeks ago that Fed Chair Jerome Powell publicly cautioned that policymakers were unlikely to be in position to cut as of March. Less than three weeks later, traders have not only removed March as a possibility but May also looks improbable, and even conviction about the June Fed meeting is wavering, swaps trading shows.

The latest hot debate: perhaps the next shift isn’t a cut at all. Former US Treasury Secretary Lawrence Summers on Friday voiced what a number of market participants had already been thinking: “there’s a meaningful chance” the next move is up.

Even if another hike is too hard to countenance, some Fed watchers are floating a repeat of the late-1990s: only a brief course of rate reductions that sets the stage for increases later.

“There are so many possible, plausible outcomes,” said Earl Davis, head of fixed income and money markets at BMO Global Asset Management.

Even if another hike is too hard to countenance, some Fed watchers are floating a repeat of the late-1990s: only a brief course of rate reductions that sets the stage for increases later.

“There are so many possible, plausible outcomes,” said Earl Davis, head of fixed income and money markets at BMO Global Asset Management.

- While he’s sticking with 75 basis points of cuts for 2024, he said “it’s very hard for me to say that with a high degree of confidence.”

For their part, no Fed policymaker in recent weeks has publicly suggested that further rate increases are on the table.

- Powell on Jan. 31 said “we believe that our policy rate is likely at its peak for this tightening cycle.”

- On Friday, San Francisco Fed President Mary Daly, viewed as a centrist, said 75 basis points of cuts in 2024 was a “reasonable baseline expectation.”

___________________________________________________________________________________

___________________________________________________________________________________

No comments:

Post a Comment