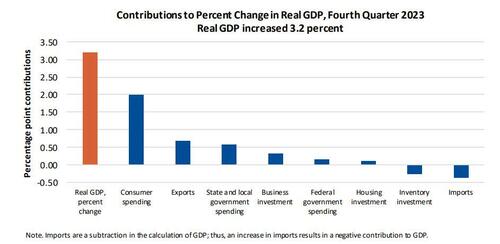

While we already know this, the BEA reported that the increase in the fourth quarter primarily reflected increases in consumer spending, exports, and state and local government spending. Imports, which are a subtraction in the calculation of GDP, increased.US GDP "Grew" $334 Billion In Q4.... That Growth Cost $834 Billion In Debt

Moments ago, two things happened: Biden's Bureau of Economic Analysis released the first revision of Q4 2023 GDP, a number which is completely irrelevant as it looks at the state of the US economy more than 2 months ago as the calendar is now just weeks away from the start of Q2 2024... and bitcoin soared above $60,000, now less than $10k away from a record high. While it may not be immediately obvious, the two events are linked. Let us explain.

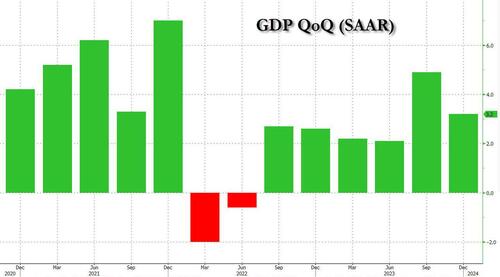

First, according to the Biden admin, in Q4 GDP rose 3.2%, a modest drop from the 3.3% reported in the first estimate one month ago, and below the 3.3% consensus estimate.

- The increase in consumer spending reflected increases in both services and goods. Within services, the leading contributors were health care, food services and accommodations, and other services (led by international travel). Within goods, the leading contributors to the increase were other nondurable goods (led by pharmaceutical products) as well as recreational goods and vehicles.

- The increase in exports reflected increases in both goods (led by petroleum) and services (led by financial services).

- The increase in state and local government spending reflected increases in both investment (led by structures) and consumption expenditures (led by compensation of employees).

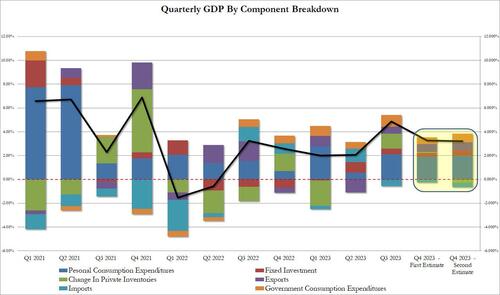

- the first being that Personal Consumption actually rose more than expected, growing a 3.0% QoQ annualized (vs 2.8% in the first estimate), and contributing 2.0% to the bottom line GDP of 3.21%, up from 1.91% in the original estimate.

- Another increase was seen in fixed investment which contributed 0.43% to the bottom line, up from the 0.31% originally estimated; finally government also saw its contribution boosted, rising to 0.73%, or about a quarter, of the final GDP.

- These improvement were offset by a notable drop in the change in private inventories which declined from an addition of 0.07% to a subtraction of -0.27%.

But what does that have to do with the bitcoin spike?

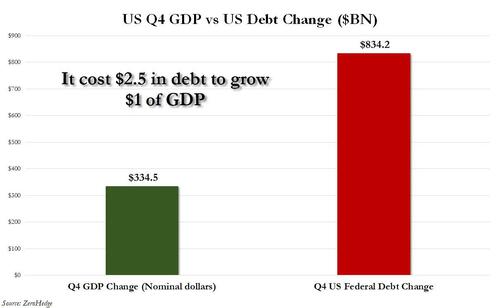

Well, a closer look at the data revealed something stunning: a quick look at the increase in nominal GDP, which rose from $27.61 trillion in Q3 to $27.94 trillion in Q4, shows that the US economy increased some $334.5 billion in absolute nominal dollar terms.

Which also brings us back full circle and explains why bitcoin is now trading at $60,000, the highest price since late 2021 and why it will not only surpass its all time high in just a few days, but why it will rise much, much higher, because the US is now well past the point of no return.

|

No comments:

Post a Comment