Investors aren’t getting money back from their existing holdings, they’re hampered in their ability to put money to work in new funds or re-top existing investments,

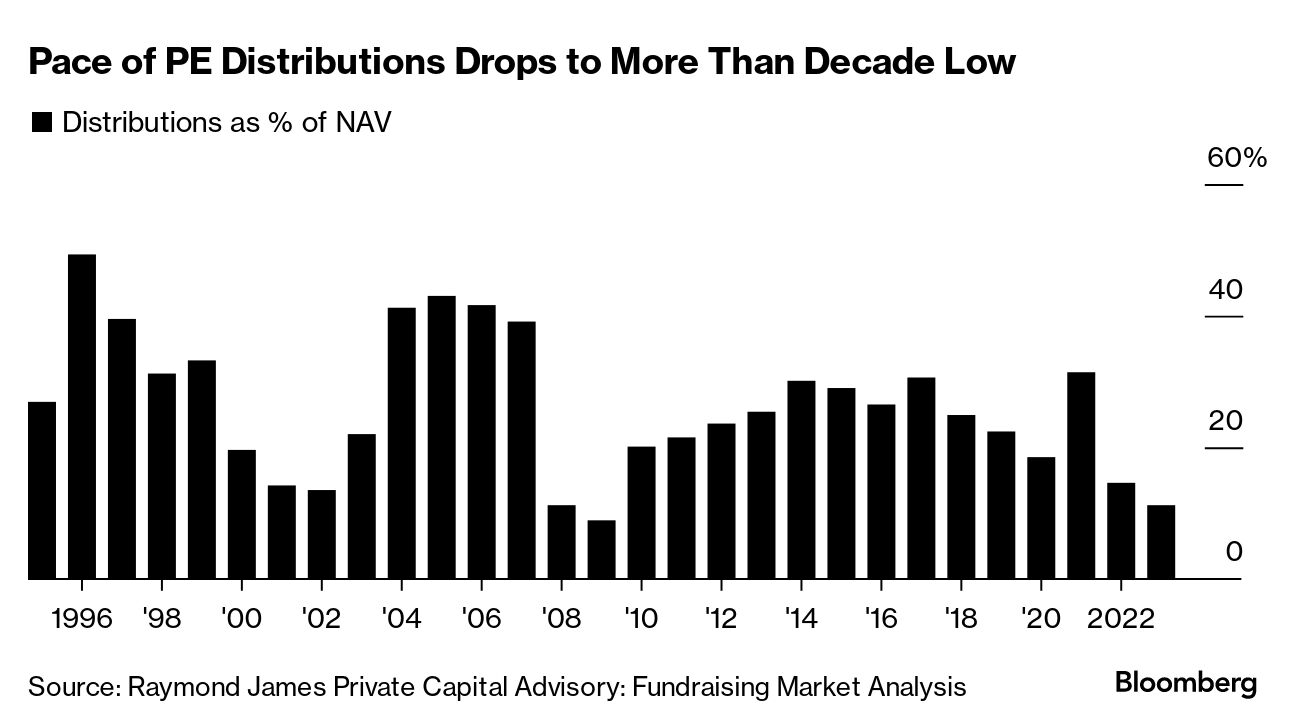

According to data from Raymond James Financial Inc., distributions to limited partners, a critical component of the private equity ecosystem, have dwindled to 11.2% of funds' net asset value. This figure marks a significant departure from the 25% median distribution rate observed over the past quarter-century.

Private Equity Returns Plunge to Global Financial Crisis Levels

(Bloomberg) -- Private equity funds last year returned the lowest amount of cash to their investors since the financial crisis 15 years ago, according to Raymond James Financial Inc., hampering buyout firms in their efforts to launch new investment vehicles.

- Distributions to so-called limited partners totaled 11.2% of funds’ net asset value, the lowest since 2009 and well below the 25% median figure across the last 25 years, according to the investment bank.

- This in turn has hampered their ability to return capital to pension and sovereign wealth funds, besides other key investors, meaning once-reliable clients are struggling to find cash to allocate new money to the asset class.

- Because investors aren’t getting money back from their existing holdings, they’re hampered in their ability to put money to work in new funds or re-top existing investments, she said.

The impact on fundraising is already visible:

- The median time to raise a new fund is now 21 months, compared with about 18 months just a couple of years ago, according to the bank’s research.

- And the number of new funds raised last year dropped 29%.

Still, the aggregate capital raised last year by buyout funds reached a record $500 billion, up 51% from 2022, driven by the biggest funds, Raymond James said.

__________________________________________________________________

__________________________________________________________________

A glut of fundraising in 2021 is also weighing on investors’ ability to commit to new funds, especially as the go-to private equity pitch of outsized returns is faltering. For years, pension funds could count on their returns from the asset class outpacing that of public markets.

Now, with global stock indexes booming once again and the private capital industry grappling with structural shifts, that math isn’t as straightforward.

Many institutional investors “are full to the gills from the 2021 private markets fundraising glut,” Jeff Boswell, head of alternative credit at money manager Ninety One, said in an interview.

Many institutional investors “are full to the gills from the 2021 private markets fundraising glut,” Jeff Boswell, head of alternative credit at money manager Ninety One, said in an interview.

Read this next: NFL Succession Crisis Forces Teams to Let Private Equity In

Private equity funds face challenges amid lowest returns since financial crisis

The median holding period for a buyout firm asset is now 5.6 years, according to Raymond James, wider than the industry norm of about 4 years.

The impact on fundraising is already visible: The median time to raise a new fund is now 21 months, compared with about 18 months just a couple of years ago, according to the bank’s research. And the number of new funds raised last year dropped 29 percent.

Private Equity Returns Plunge to Global Financial Crisis Levels

No comments:

Post a Comment