Supply chains have been making news again because of problems in two of the world’s most important shipping lanes: the Red Sea, where Yemen’s Houthi rebels have attacked shipping, and the Panama Canal, where low water levels are limiting the number of vessels that pass through.

Despite problems in the Red Sea and Panama Canal, shipping costs are falling

The cost of container freight rose through January, according to supply chain advisory firm Drewry.

- But in February, container shipping costs have ticked down, said Simon Heaney, Drewry’s senior manager of container research.

In other words, the trade lane that’s most affected by the Red Sea disruption.

- In large part because shipping companies are avoiding the Red Sea.

- “There’s an understanding that yes, there will be additional time in terms of transporting cargo from Asia to Europe, but the scheduling is about to adjust to cater for those additional delays,” he said.

“So when you have those smoother operations, you’re not having missed departures and loaded containers building up in the ports and then competing to get on the space of the next vessel,” Levine said.

- Neither is the extra fuel consumed traveling around Africa.

- But the added capacity takes a lot of risk and uncertainty out of shipping, which can take the edge off shipping prices.

- “Compared to how high we’ve seen them get in the last few weeks, we’re expecting them to come down,” Levine said.

“Ports have plenty of capacity and are able to more or less manage this rerouting of ships, to a large degree,” she said.

___________________________________________________________________________________

FEBRUARY 21, 2024

U.S. energy flows through Panama Canal rose slightly in January

U.S. liquefied petroleum gas (LPG) and ethane exports through the Panama Canal rose in January 2024 with a return to vessel traffic through the shipping channel as drought conditions eased. Transit volumes of LPG and ethane had fallen in late 2023 amid a historic drought at the Panama Canal.

In 2023, water levels at Gatun Lake, which supplies the water used to operate the canal’s locks, were the lowest since at least 1965, when recordkeeping began. Water conservation efforts have reduced traffic and led to longer delays at the Panama Canal, causing vessels to avoid the canal and take longer, more costly routes, in turn, elevating freight rates.

Operations

The Panama Canal offers daily booking slots that can be booked ahead of time depending on the type of vessel, with some reserved slots auctioned for a fee, used mostly by Very Large Gas Carriers (VLGCs). Auctioned slots currently have a base rate of $100,000 and are useful for short-term, spot cargos. Following an increase in water levels in November and December, the Panama Canal Authority opened more booking slots mid-December 2023 and allowed more transits and volumes to go through in January 2024 than previously planned.

At the end of July 2023, only 32 daily booking slots were made available to transit the Panama Canal, down from the normal 36. Daily booking slots were further reduced to 24 for most of November, while 22 slots per day were reserved in December and 20 slots per day in January. Although transits were scheduled to decrease to 18 per day in February, the Panama Canal Authority issued an advisory in mid-December that increased January’s transits to 24 per day. Transit slots that opened up in January allowed more VLGC voyages through the Panama Canal, increasing January 2024 LPG transit volumes by 12% and ethane transit volumes by 67% compared with December 2023.

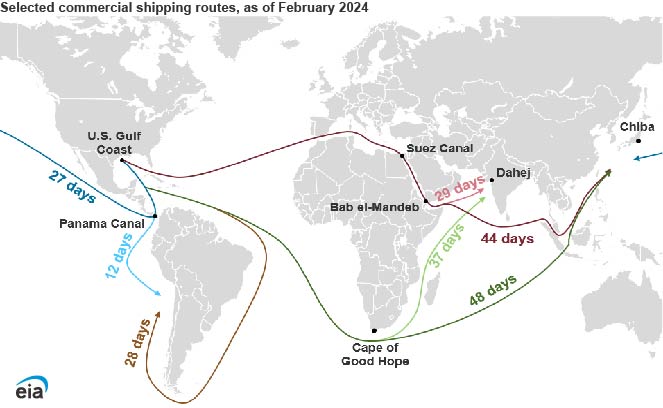

Note: Voyage time is calculated for laden Very Large Gas Carriers traveling at 14 knots without extended chokepoint delays.

Vessels and cargo

LPG includes propane, normal butane, and isobutane. In November and December 2023, 23% less U.S. LPG flowed through the Panama Canal than on average from January to October 2023. U.S. ethane flows through the Panama Canal were 73% lower. LPG and ethane together account for 63% of the U.S. petroleum product exports that cross the Panama Canal. Refined petroleum products such as gasoline, diesel, and naphtha account for most of the other petroleum products, but transit volumes for these fuels have not changed overall.

LPG typically travels on VLGCs, and ethane travels on Very Large Ethane Carriers (VLECs), which use the Neopanamax locks, a newer, larger set of locks in the Panama Canal. Similar to shipping LPG and ethane, the economics of shipping refined petroleum products—such as gasoline, diesel, and jet fuel—improve as the size of the ship and the distance traveled increase. Although VLGCs and VLECs travel mostly to countries in Asia, U.S. refined petroleum products typically travel shorter distances, mostly to the west coast of South America after transiting the Panama Canal. Smaller vessels are used for these shorter runs, and refined petroleum products mostly travel on Panamax-sized ships, which fit into the older, smaller Panamax locks. Because more slots are available at the Panama Canal for Panamax-sized ships than for Neopanamax-sized ships, more refined product (clean petroleum product) tankers can book ahead of time and secure transit slots.

Routes

Tankers carrying U.S. LPG, which typically transit the Panama Canal to destinations in East Asia, last year started traveling more frequently through the Suez Canal or around the Cape of Good Hope. Monthly U.S. LPG volumes through the Suez started increasing in August, reaching 374,000 barrels per day (b/d) in November and 179,000 b/d in December, nearly 172% more than the rest of 2023 (January to October).

A journey from the United States to Asia through the Suez Canal requires navigating the Red Sea and then the Bab el-Mandeb Strait. In mid-November, attacks on vessels by Yemen-based Houthi rebels decreased transit volumes through the Bab el-Mandeb in December and increased transit volumes around the Cape of Good Hope. In late-November and in December, shipments of U.S. LPG rose 135% around the Cape of Good Hope. Ethane tankers, which are almost exclusively VLECs en route to Asia, also shifted to routes around the Cape of Good Hope. One China-bound VLEC from the United States per month starting in August took the longer route, according to vessel tracking data. In November, 87% less U.S. ethane moved through the Suez Canal compared with monthly averages earlier in the year, a route that makes regular export runs to India.

In January 2024, LPG volumes decreased through the Suez Canal by 84% and around the Cape of Good Hope by 44% compared with December 2023. Shipments through the Suez Canal decreased more than shipments around the more risk-averse Cape of Good Hope. In contrast, LPG volumes increased in the Panama Canal in January. But in the Suez Canal, January U.S. ethane export volumes stopped because all shipments that regularly transited through the Suez Canal from the United States to India decided to use the longer Cape of Good Hope route.

As more booking slots opened in January, the number of vessels transiting the Panama Canal increased, and VLGC rates from Houston to Chiba dropped to $86 per metric ton. Benchmark VLGC rates for the U.S. Gulf Coast to Chiba, Japan, (East Asia) route reached a record high at the end of September 2023. VLGC rates on this route reached $250 per metric ton for the week ending September 29, the highest since rates were first published in 2016. By the last week of December, rates were $222 per metric ton. VLGC rates have reached record highs because of the delays at the Panama Canal and the longer distances traveled for the vessels that opted to travel on alternative routes. Further distances incur higher fuel costs. A typical VLGC spends between $27,000 to $35,000 per day on marine gas oil, but a vessel using LPG dual-fueled engines spends between $20,000 and $24,000 on LPG bunker fuel, based on average 2023 fuel prices.

Even with record delays at the Panama Canal in November and December 2023, according to Argus, water levels also increased. Weekly U.S. propane exports have also been the highest ever, averaging well over 1.7 million b/d from November 2023 to February 2024. Strong demand for U.S. LPG, especially propane, has increased volumes crossing the Panama Canal toward Asia. With record demand, January 2024 volumes transiting the Panama Canal for both LPG and ethane have increased, and VLGC rates are the lowest since 2022.

Principal contributor: Josh Eiermann

.gif)

/cloudfront-eu-central-1.images.arcpublishing.com/prisa/NVICYEXN5FGNNGINGZUKRWHQJU.JPG)

No comments:

Post a Comment