This Promising REIT Has A 7.8% Covered Yield

And 12% Upside

And 12% Upside

About: Whitestone REIT (WSR)

Source: https://seekingalpha.com

____________________________________________________________________________________

Blogger Insert:

_____________________________________________________________________________________

Summary

Whitestone REIT is an interesting dividend vehicle for income investors.

The REIT has grown its portfolio, NOI and core FFO/share at a fast clip since its IPO in 2010.

Whitestone REIT's dividend stream is affordable; income investors pay just about eleven times core FFO.

Shares are undervalued and should be able to trade at ~12.5x core FFO.

Whitestone pays a $0.095/share monthly dividend. An investment in WSR yields 7.8 percent.

Whitestone REIT's dividend stream is affordable; income investors pay just about eleven times core FFO.

Shares are undervalued and should be able to trade at ~12.5x core FFO.

Whitestone pays a $0.095/share monthly dividend. An investment in WSR yields 7.8 percent.

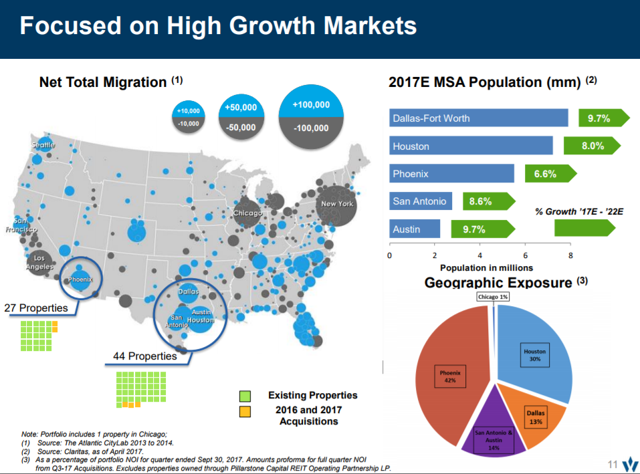

Whitestone REIT (WSR) is an underrated real estate investment trust in my opinion that has potential to increase its valuation multiple while providing income investors with a stable stream of dividend income. Whitestone REIT is active in high-growth, high-potential markets, and has robust dividend coverage stats for an eight percent yielder. An investment in Whitestone REIT comes with an attractive, covered 7.8 percent yield and monthly distribution frequency.

Whitestone REIT is a smaller, yet promising REIT in the increasingly crowded REIT sector. While most investors would consider buying large real estate investment trusts like Realty Income, Corp. (O) or National Retail Properties, Inc. (NNN), smaller REITs like Whitestone REIT make attractive value propositions, too.

Whitestone REIT - An Overview

Whitestone REIT has come a long way since its IPO in August 2010. The REIT has aggressively grown its real estate presence in the U.S. through acquisitions. At the end of the September quarter, Whitestone REIT had 72 properties comprising 6.6 million square feet in its real estate portfolio.

Whitestone REIT typically invests in markets with strong economic fundamentals, for instance above-average population growth.

Source: Whitestone REIT

No comments:

Post a Comment