Global bonds sell-off as rate cut hopes dashed

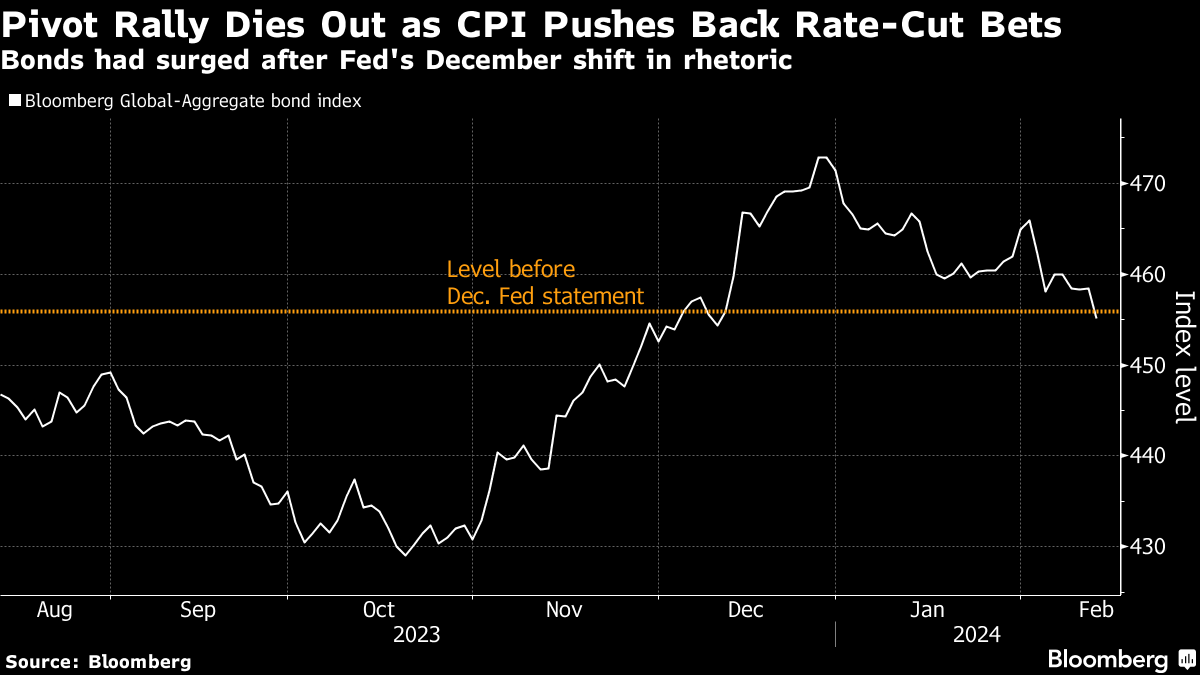

- A Bloomberg index of global debt has dropped 3.5 per cent this year, erasing all its gains since December 12, the day before the so-called dovish Fed pivot, when the central bank forecast a series of rate cuts in 2024.

- Treasury 10-year yields were at 4.31 per cent in Asian trading after surging 14 basis points in the previous session, Japan’s 10-year yield climbed as much as four basis points, while Australian 10-years were also dragged higher, up 10 basis points to 4.29 per cent, the highest in a month.

Bonds have been sold off this year as Fed chairman Jerome Powell led other central banks in watering down lofty market expectations that the US and other major economies were on the brink of cutting interest rates.

“January CPI is a game changer – the narrative that Fed disinflation provided scope for insurance cuts is clearly now on the chopping board,” said Prashant Newnaha, a senior rates strategist at TD Securities, as quoted by Bloomberg.

“There is now a real risk that price pressures begin to shift higher. The Fed can’t cut into this. This should provide momentum for further bond declines.”

- The Fed is now expected to stand pat at its March policy meeting with traders ascribing just an 8 per cent chance of a move lower.

- Fed fund futures imply three rate cuts this year, in line with the Fed’s forecasts and are fully priced for a move in July.

- Before the data, traders were betting on four reductions, starting in June, and at one stage as many as five rate cuts were priced in for the world’s largest economy in 2024.

“The mistake in the market expectation was thinking that the decline in core PCE inflation was going to be sustained, and that the level of confidence that Fed Jerome Powell would have in the inflation decline would be high,” said Barrenjoey’s Mr Lilley. “Both of those assumptions are wrong.”

Bond traders have also pushed out the likely timing of the first-rate relief by the Reserve Bank of Australia to December, from September. Last week, they had implied two cuts this year.

“By late January this year, almost three out of every four US bank research team had the Fed starting to cut rates in March,” added Mr Lilley. “They’re all moving back to June and the risk is that they have to start pushing that back out even further.”

Barrenjoey expects one US rate cut in the first half of this year and for the Fed to cut by less than 100 basis points.

“Now 10-year yields have gone up to about 4.3 per cent which is where we think interest rates need to be to bring inflation back to trend on a sustainable basis,” Mr Lilley added.

Oliver Levingston, an FX and rate strategist at Bank of America, added that the distribution of rate cut probabilities for both the Fed and the RBA now looked about right.

- “That means that for the very first time we can confidently say the entire Aussie curve will outperform US Treasuries because we don’t have the same supply pressures that they have in the US,” he said.

Elsewhere in the world, stronger than expected UK labour market data and a pickup in wages growth prompted markets to price in a small chance of a rate hike by the Bank of England in March.

And in New Zealand, traders are betting that the next move by the Reserve Bank of NZ will be a rate increase. Traders ascribe a 57 per cent chance of a hike by May.

With Bloomberg

___________________________________________________________________________________

No comments:

Post a Comment