- Netanyahu says those warning against entering Rafah ‘are basically saying lose the war’

- Netanyahu defends Gaza response: ‘I think we’re doing the right thing’

US Warns Israel It Needs an Endgame to the War

The task got more complicated on Friday, when Israel’s credit rating was downgraded for the first time ever.

Israel, just downgraded, readies bond spree to pay for war against Hamas

- But it’s also set to sell more foreign-currency bonds, especially via privately negotiated deals.

Analysts in the private sector agree.

The burden will fall largely on a domestic market that authorities usually tap for about 80% of their financing needs, reducing their reliance on volatile foreign capital flows. . .

Since the conflict began, Israel has not issued foreign-currency bonds in public markets. And it’s in no rush to do so, according to the officials.

- Those have been arranged by banks such as Goldman Sachs Group Inc. and Deutsche Bank AG.

Israel carried out at least four such deals in January, including three top-ups of existing euro-denominated securities and a rare bond in Brazilian real that will be repaid in US dollars. In total, they netted about $1.7 billion in proceeds, as part of foreign borrowing that could exceed $10 billion in 2024.

Domestic issuance in the first two months of this year is projected to total the equivalent of more than $9 billion, a 350% rise from the same period last year.

Zabezhinsky, the economist at Meitav in Tel Aviv, said Israel will need 125 billion shekels to finance the 2024 budget deficit and about 85 billion shekels to refinance maturing debt.

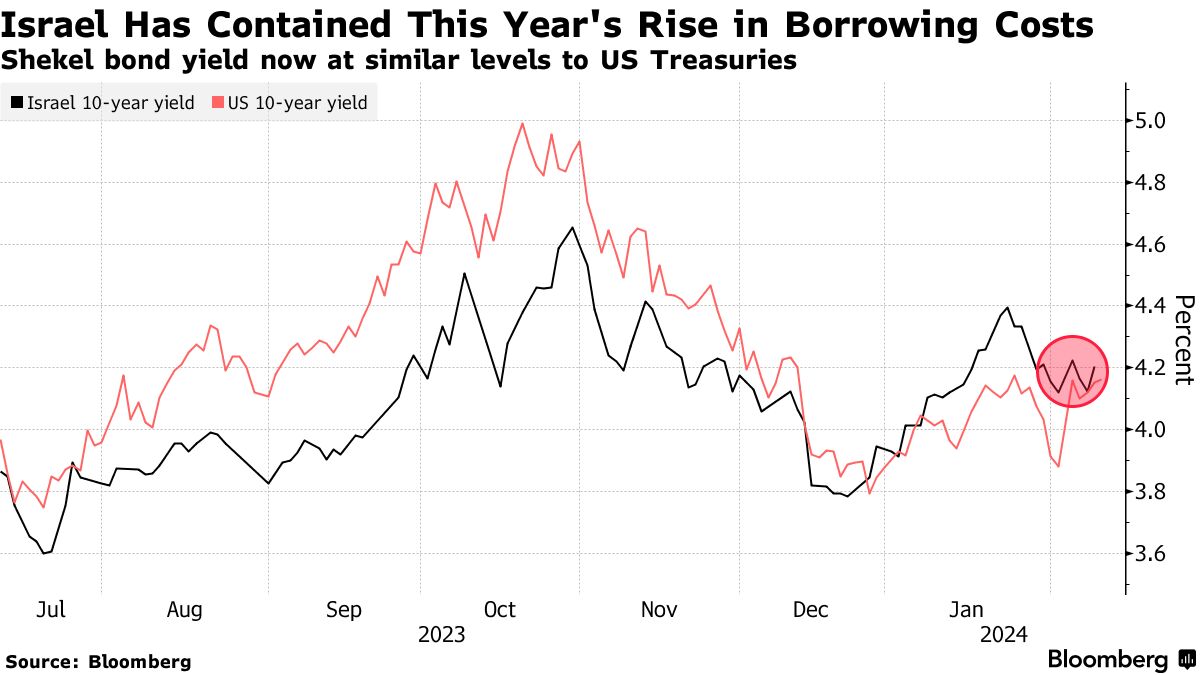

Israeli markets have stabilized after the turmoil unleashed in the first weeks of the conflict and the shekel’s now stronger than its level at the outbreak. Policymakers even cut interest rates last month.

Still, the government has a tall task ahead in paying for a war bill the central bank estimates will come to almost $70 billion — more than 10% of annual GDP — over 2023-2025. . .

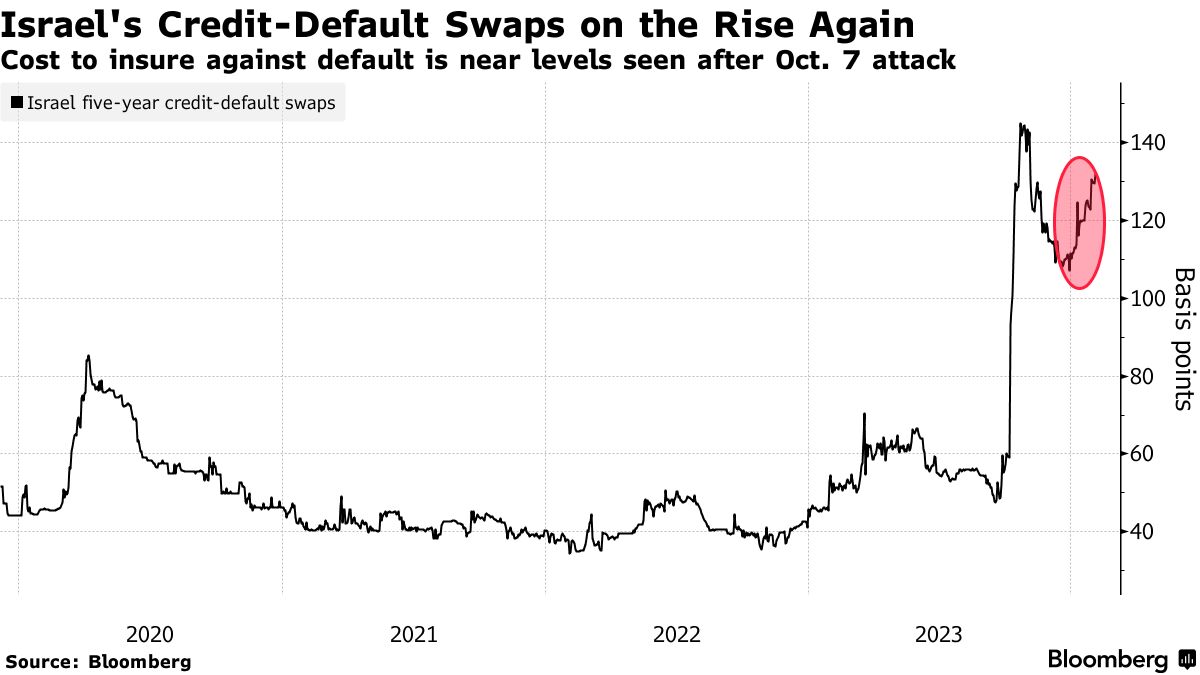

Still, the cost of insuring against an Israeli default — as measured by credit default swaps — is now higher than that for lower-rated sovereigns such as Mexico and Indonesia, indicating some investors are nervous.

Israeli Prime Minister Benjamin Netanyahu insists they shouldn’t be.

“The Israeli economy is strong,” he said in response to Moody’s decision, issuing a rare statement on the Jewish sabbath. “The rating downgrade is not connected to the economy, it is entirely due to the fact that we are in a war. The rating will rise back the moment we win the war.”

> READ-AND-SEE MORE

No comments:

Post a Comment