How'd we miss this one?

The WSJ's Esther Fung last night detailed the growing phenomenon of selling malls online.That mall sales are going digital shouldn't be surprising in 2017, but check out the recent sale of Vista Ridge Mall in Odessa, Texas.

It could give pause to bottom-fishing mall/shopping-center investors.

The two-level 1.05M square-foot mall was valued at $144M in 2001.

Then e-commerce began to happen. It was appraised at $46M in June of 2016, at $34.5M in February of this year, and ultimately sold for $18.1M.

h/t Aaron Edelheit

Among interested parties:

_________________________________________________________________________________

Related content:

The Retail Apocalypse Is Demolishing Mall Investors

" . . Some of the share prices more than doubled over those years, as part of the commercial property bubble that got so huge that the Fed keeps publicly fretting about it, naming it as one of the reasons for raising interest rates, precisely to tamp down on the valuations. The Fed is worried that an implosion of these inflated commercial property values can take down the banks.Mall REITs were part of this inflated commercial property universe, and they soared with it. That entire universe is now peaking. But separately, mall REITs are also caught up in the relentless brick-and-mortar retail meltdown, as online shopping is taking over. This is a structural shift that will continue to progress. Mall owners are already trying to find a way to “repurpose” their malls. But this isn’t going to be smooth.

As so many times, Private Equity firms are in the thick of it. . .:

Read… I’m in Awe of How Fast Brick-and-Mortar Retail is Melting Down.

Brick-and-Mortar Meltdown Sinks Property Prices

By Wolf Richter, WOLFSTREET.com:

"Commercial real estate prices soared relentlessly for years after the Financial Crisis, to such a degree that the Fed has been publicly fretting about them. Why? Because US financial institutions hold nearly $4 trillion of commercial real estate loans. But the boom in most CRE sectors is over.

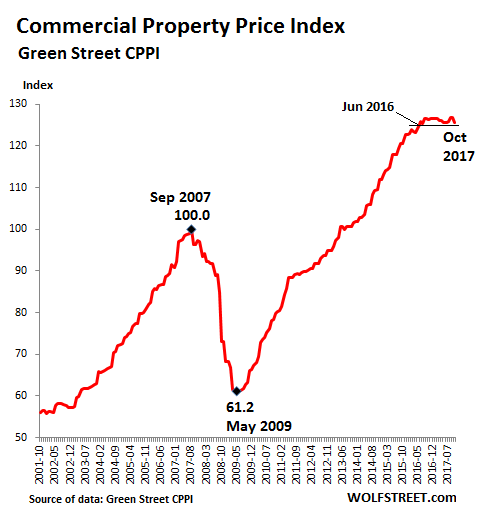

The Green Street Property Price Index – which measures values across five major property sectors – had soared 107% from May 2009 to the plateau that began late last year, and 27% from the peak of the totally crazy prior bubble that ended with such spectacular fireworks. But it has now turned around, dragged down by a plunge in prices for retail space.

The CPPI by Green Street Advisors dropped 1.1% in October from September. In terms of points, the 1.4-point decline was the largest monthly decline since March 2009. The index is now below where it had been in June 2016 . . .

This phenomenal bubble, as depicted by the chart above, has even worried the Fed because US financial institutions hold nearly $4 trillion of CRE loans, according to Boston Fed governor Eric Rosengren earlier this year. Of them, $1.2 trillion are held by smaller banks (less than $50 billion in assets). These smaller banks tends to have a loan book that is heavily concentrated on CRE loans, and these banks are less able to withstand shocks to collateral values.

Rosengren found that among the root causes of the Financial Crisis “was a significant decline in collateral values of residential and commercial real estate.”

But the CRE bubble isn’t unraveling as gently as the chart suggests. Some sectors are still surging, while others are plunging. According to the report, the index, which captures the prices at which CRE transactions are currently being negotiated and contracted, “was pushed down by falling mall valuations.”

Which sector is plunging, and which is soaring?

> Lodging took a 12% plunge that started in 2015, and it never recovered. It has remained essentially flat since, currently with a 1% gain over the beaten-down levels last year.

> The industrial sector is hot. The index jumped 10% year-over-year in October. Industrial includes warehouse space for “fulfillment centers,” as Amazon calls them. They are in hot demand, not only from Amazon, which has been leasing them around the country, but also from other logistics and retail companies

READ MORE > Zero Hedge

No comments:

Post a Comment