Let's start with a report featured earlier on this blog when Phoenix Downtown-Mesa was #7, then scroll down to a more recent update

The Top 10 Opportunity Zones in the US

Ref: Fundrise.com/blog

1. Oakland: West Oakland, Uptown, Jingletown, and Coliseum Industrial

2. Los Angeles: Downtown and South Los Angeles

3. San Jose: Market Almaden, Washington Guadalupe, East Northside, Jackson Taylor, and Mayfair

4. San Diego: Golden Hill, South Park, and Barrio Logan

5. Seattle: Beacon Hill and the International District

6. Opportunity Zones in Portland: Pearl District and Central Eastside

7. Phoenix: Downtown, Tempe, Chandler and Mesa

8. Nashville: East Bank, Five Points, 12 South, and Edgehill

9. Atlanta: Bankhead, Grove Park, and English Avenue

10. New York City: Brooklyn

"Much has been reported on the creation of Opportunity Zones and even more on their tax advantages, but, less has been written about the specific Opportunity Zones that are now found in all 50 states and US territories. Although there are more than 8,700 designated census tracts in the Opportunity Zone program, some offer more potential for immediate positive impact for both investors and residents than others. Here we take a look at Opportunity Zone areas in major metropolitan markets with the most promising near-term growth potential.

What Makes them Promising?

Opportunity Zones were designed to encourage private investment generally in economically distressed, low-income census tracts through capital gains tax incentives. Under the Opportunity Zone program, up to 25% of census tracts that met income requirements of the Opportunity Zone program were eligible to be nominated as Opportunity Zones. Additionally, up to 5% of census tracts that didn’t meet income requirements of the Opportunity Zone program, but satisfied other qualifications, were also eligible to be nominated as Opportunity Zones.

The end result: 57% of all neighborhoods in America were up for consideration as Opportunity Zones, and more than 8,700 census tracts are now designated as Opportunity Zones according to the Brookings Institute.The expansive reach of the Opportunity Zone program throughout the country now offers many new tax-advantaged options for investors and entrepreneurs to explore diverse Opportunity Zone investment options intended to benefit these distressed communities. With many Opportunity Zones based in or adjacent to growing neighborhoods, in our view, here are the top 10 Opportunity Zones in the country with more immediate growth potential.

#7. Phoenix: Downtown, Tempe, Chandler and Mesa

In 2017, it added roughly 66 people per day to its city. Phoenix is a growing job and an expanding college center. Many of its neighborhoods experiencing or poised to experience high growth are now in or near Opportunity Zones.

Downtown Phoenix is home to new college campuses of Arizona State University and the University of Arizona.

Arizona State University’s Downtown Phoenix campus now has more than 10,000 students enrolled and both schools expect higher future enrollment numbers.

The surrounding areas will likely receive demand for greater businesses and housing options within walking distance of the campuses.

A new light rail extension running down Central Avenue is also set to connect Downtown Phoenix to northern neighborhoods, which will offer a convenient option for commuters.

Phoenix Opportunity Zones are likely to benefit from growth in industries in and near the city.

Major job centers, such as Mesa, Chandler, and Tempe also have Opportunity Zone census tracts running through them. Apple and State Farm are currently among the largest employers with more than 1,000 employees in the Phoenix area, but the tech sector is growing. Intel alone is expected to add 3,000 jobs in Chandler, AZ.

Phoenix is home to billionaire GoDaddy Founder, Bob Parsons, who is active in real estate in Phoenix as well.

Excerpts for this post are taken from Forbes that was published last week

The Best Performing Opportunity Zones

For Real Estate Investors

by Amy Dobson

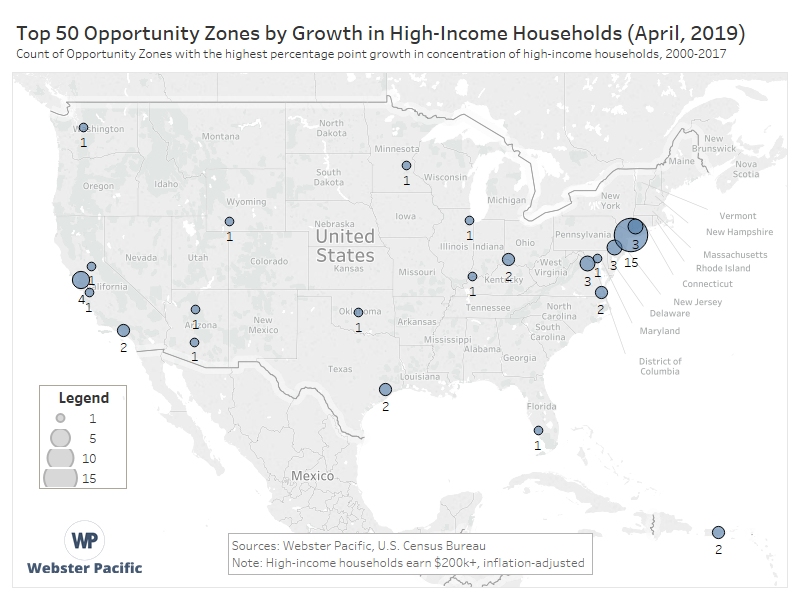

Out of the country's 8,700 Opportunity Zones created as part of the 2017 Tax Cuts and Jobs Act, 22 of them have seen the number of households with an income over $200,000 grow by at least ten percentage points, according to a study released last week by analytics firm Webster Pacific.

The study, "Wind at Your Back: Finding the Top 50 Opportunity Zones for Real Estate Investment," looked at the increased presence of high-income households between the years 2000 and 2017 to determine where economic appreciation was already taking place before the tax cuts were implemented. As they state in their report, "our analysis of real estate values has shown that incomes and wealth correlate strongly with real estate value," so the measurement of increased household wealth at the very upper tier is a strong proxy measurement for determining where real estate value has also increased . . .The study focused on households earning $200,000 or higher since that is the top income tier in the decennial census questionnaire.

__________________________________________________________________________________

Download the full report via this link.

***REPORT EXCERPT***

Finding the Top 50 Opportunity Zones for Real Estate Investment

To better understand an investment strategy in Opportunity Zones, Webster Pacific examined various data related to each zone in the United States and Puerto Rico. Our objective was to identify which Opportunity Zones represent places where the value of a property investment would most likely continue to increase. To that end, our analysis of real estate values has shown that incomes and wealth correlate strongly with real estate value. We therefore asked the following question: “Of all 8,700 Opportunity Zones, where are incomes and wealth already growing the most?”

To answer this, we calculated the growth in the percentage of households earning $200,000 or more in each of the 8,700 Opportunity Zones. (The growth is measured between 2000 and 2017 and is adjusted for inflation. We excluded any tracts that were recently created, tracts whose boundaries were significantly altered, or tracts with fewer than 100 households. A similar methodology was used in one of our earlier studies, released in an article by Bloomberg[2].) We then found the fifty Opportunity Zones with the highest wealth growth and mapped them in Tableau by metropolitan area.

***Download the full report via this link.

_________________________________________________________________________

Advancing Development Finance Knowledge, Networks & Innovation

CDFA is the go-to resource for development finance headlines, news and other resources. With dozens of targeted newsletters and other offerings, our efforts represent the largest dedicated online reference of development finance headlines and news in the world. Click below to learn more about our vast resources.

RECENT HEADLINES

_________________________________________________________________________________

_________________________________________________________________________________

2018 Arizona Opportunity Zones & Opportunity Funds Speakers

Terry Benelli, Concurrent Session B4: Social Utility Projects

Thursday September 27 2:45 - 4:00 PM

Executive Director

Local Initiatives Support Corporation

After studying Political Science at Arizona State University Terry became involved in with community development organizations as the area leader of the Building a Healthier Mesa effort. Terry is an entrepreneur who has started three businesses, which are going concerns. The combination of community work and entrepreneurship lead her to Neighborhood Economic Development Corporation where she served as Executive Director for eight years. At LISC Phoenix, where Terry is now the Executive Director, she continues her leadership role in the Community Development Financial Institution (CDFI) arena.

In 2014 Terry was unanimously appointed to the Mesa, AZ City Council to fill an interim position. Terry currently serves on the San Francisco Federal Reserve Community Advisory Council and Maricopa Integrated Health System’s Governing Council and the City of Phoenix Land Reuse Strategy committee. As a Fellow of the Flinn-Brown Civic Leadership she continually strengthens her skills to address Arizona’s long-term issues with special interest in equitable urban economic development strategies.

Thursday September 27 2:45 - 4:00 PM

Executive Director

Local Initiatives Support Corporation

After studying Political Science at Arizona State University Terry became involved in with community development organizations as the area leader of the Building a Healthier Mesa effort. Terry is an entrepreneur who has started three businesses, which are going concerns. The combination of community work and entrepreneurship lead her to Neighborhood Economic Development Corporation where she served as Executive Director for eight years. At LISC Phoenix, where Terry is now the Executive Director, she continues her leadership role in the Community Development Financial Institution (CDFI) arena.

In 2014 Terry was unanimously appointed to the Mesa, AZ City Council to fill an interim position. Terry currently serves on the San Francisco Federal Reserve Community Advisory Council and Maricopa Integrated Health System’s Governing Council and the City of Phoenix Land Reuse Strategy committee. As a Fellow of the Flinn-Brown Civic Leadership she continually strengthens her skills to address Arizona’s long-term issues with special interest in equitable urban economic development strategies.

_________________________________________________________________________________

_________________________________________________________________________________