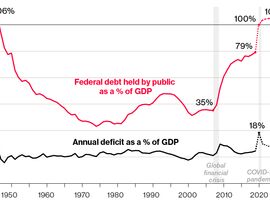

The U.S. budget deficit may quadruple this year to almost $4 trillion. Projections from the Committee for a Responsible Federal Budget (CRFB) say that by 2023 U.S. debt held by the public will surpass records set in the post-World War II years.

And these projections only include spending enacted so far—in a three-month-old crisis that has seen emergency Congressional appropriations top $2.3 trillion. Additional spending is almost certain as the coronavirus pandemic destroys millions of jobs and thousands of businesses while slashing tax revenues for local and state governments. . .

Not all the stimulus is gone for good. About 20% of the CARES Act spending, $454 billion, will be used to backstop lending from the Federal Reserve—possibly more than $4 trillion. The loans are aimed at keeping financial markets functioning, as well as helping companies and local governments survive the crisis. The loans are backstopped by capital provided by the Treasury.

If any of those loans go bad, losses will be absorbed by the backstop, but the Fed’s lending will also generate interest income. That means the central bank could end up returning more than $454 billion to the Treasury by the time the emergency lending is unwound.