From the Crunch Network

Unicorns gorge as investors dish up bigger rounds, more capital

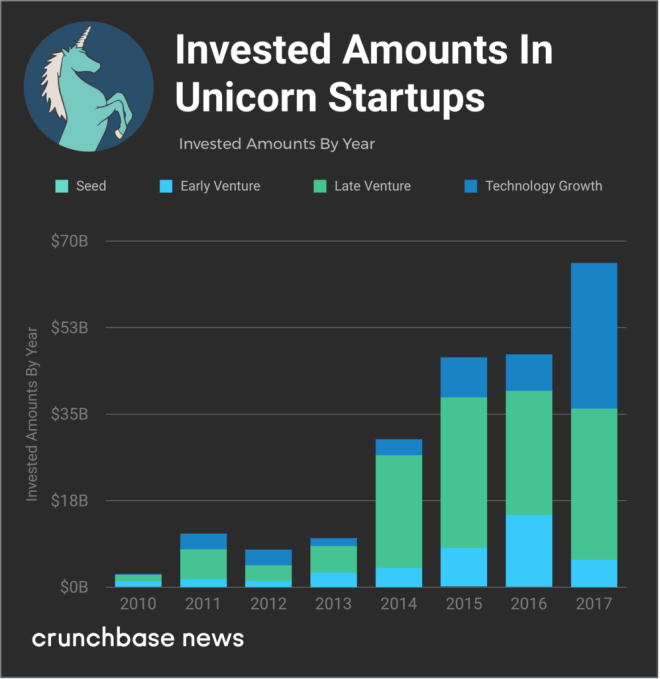

Globally, a staggering $66 billion went into unicorn companies in 2017, up 39 percent year-over-year, according to an analysis of Crunchbase data. The ride-hailing space was the single largest recipient of investor dollars, with several rivals in the space raising billions. Investors also poured copious sums into co-working, consumer internet and augmented reality.

"Newcomers also joined the unicorn club for the first time in 2017, albeit at a slightly slower pace than the preceding two years. For all of 2017, 60 new startups were added to the unicorn list. This compares to 66 newly minted unicorns in 2016 and the record-setting 2015 with 99 newcomers.

Below, we break down the leading locations for new and existing unicorns, top sectors for investment capital, exits and a few other trends affecting the space. . .

Geographic breakdown

The vast majority of unicorns are headquartered in either the U.S. or China, and that’s also the case for newcomers to the Unicorn Leaderboard.

- online education provider VIPKID

- cryptocurrency buying and selling platform Coinbase.

Sectors

Unicorn investors showed a particularly strong appetite, however, for companies in a handful of sectors.

Ridesharing, in particular, had a strong funding year, with companies in the space taking more than 10 percent of all unicorn investment.

Bike-sharing was also big. Two new entrants onto the unicorn list came from that space: Ofo and Mobike.

Other recipients of really substantial funding rounds, even by unicorn standards, include U.S. co-working giant WeWork and China-based consumer internet players Toutiao and Koubei.

Exiting the board

So a lot of unicorns are raising big rounds. But is there any sign members of the group will eventually produce returns for investors?Overall, 2017 provided some modestly positive news for unicorn exit watchers.

- Fifteen venture-funded companies with private valuations of a billion dollars or more went public last year, more than double 2016 levels and the highest total since Crunchbase began tracking the asset class.

- Unicorn IPOs weren’t just more common in 2017. Performance was often quite good, too. Many of last year’s newly public companies sustained market caps far higher than their last private valuations.

Averages point to more exits ahead

For the 45 unicorn companies that have gone public, the average time to go public has been 26 months after first being valued at $1 billion. For the 25 companies that have been acquired, the average time to get acquired is 24 months after first being valued at $1 billion.

No comments:

Post a Comment